1. Weekly News

Brazil

Dwarf Banana Prices Surge in Bahia, Brazil Amid Supply Shortage

In W38, dwarf banana prices in Bom Jesus da Lapa, Bahia, surged due to a significant decrease in supply coupled with strong demand for high-quality local fruit. According to data from Hortifrúti/Cepea, top-quality dwarf bananas were sold at an average price of USD 0.49 per kilogram (BRL 2.67/kg) from September 9 to 13, 2024, marking a 10% week-on-week (WoW) increase.

Cameroon

Cameroon Becomes 13th Largest Banana Exporter Amid Declining Exports

In a recent report conducted by the Competitiveness Committee, Cameroon ranked as the 13th largest banana exporter in 2023, a drop of three positions due to a 10% year-on-year (YoY) export decrease, which reduced its global market share from 2.3% to 1.8%. The European market remains Cameroon's primary destination for banana exports, with Belgium receiving 69.3% of the total, followed by France at 16.2% and the United Kingdom (UK) at 12.5%. The French-based Compagnie Fruitère de Marseille, through its subsidiaries Société des Plantations du Haut Penja (PHP) and Compagnie des Bananes de Mondoni (CDBM), dominates over 70% of the country's banana exports. Despite facing increased competition from South America, Cameroon's banana sector continues to benefit from the presence of this major player in the market.

Malawi

Malawi's Banana Industry Recovers from BBTV

Banana farmers in Malawi are making significant strides in recovering from the banana bunchy top virus (BBTV), a disease that has severely impacted local banana varieties for over a decade. This virus, which spread across 16 African countries, led to substantial crop losses and jeopardized the livelihoods of nearly 200 thousand farmers by 2016. In response, efforts by the Food and Agriculture Organization of the United Nations (FAO) and the Malawi government have revitalized the industry. Farmers are now adopting BBTV-resistant banana varieties and implementing effective disease management strategies, such as isolating new plantations and removing infected plants.

However, the recovery is challenging, as farmers face competition from cheaper, lower-quality bananas imported from Tanzania and Mozambique. Despite these obstacles, initiatives like the School Banana Orchard Establishment program, supported by the Chinese government, aim to bolster banana cultivation in Malawi and facilitate the industry's resurgence.

Thailand

Rising Prices and Declining Production of Kluay Hom Thong Bananas in Thailand

In Thailand, the price of kluay hom thong bananas, commonly referred to as golden bananas, surged to USD 0.89/kg (THB 30/kg) due to increased demand and diminished supply caused by drought conditions. Production sharply declined in the Bang Kaew district of Phatthalung province, a region renowned for banana cultivation. This year's harvest is expected to reach only 32 thousand tons, a significant drop from last year's 120 thousand tons. Farmers have experienced income increases despite this decline, earning USD 8.50 per 100 bananas (THB 278 per 100 bananas) in 2023. However, Thailand's golden bananas, primarily exported to Japan, China, and Cambodia, face challenges in meeting Japan's stringent quality standards, which hampers export opportunities.

2. Weekly Pricing

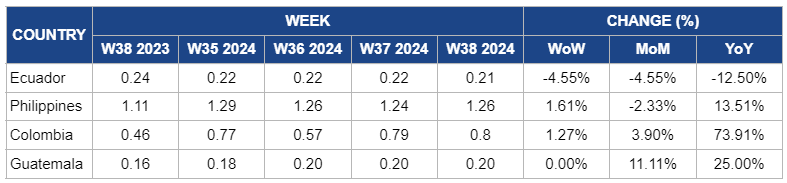

Weekly Banana Pricing Important Exporters (USD/kg)

* Varieties: Ecuador and the Philippines (overall banana average), Colombia (uraba), and Guatemala (criollo)

Yearly Change in Banana Pricing Important Exporters (W38 2023 to W38 2024)

* Varieties: Ecuador and the Philippines (overall banana average), Colombia (uraba), and Guatemala (criollo)

* Blank spaces on the graph signify data unavailability stemming from factors like missing data, supply unavailability, or seasonality

Ecuador

In W38, Ecuador's banana prices decreased by 4.55% WoW and month-on-month (MoM) to USD 0.21/kg, with a 12.50% YoY decline. This price drops can be due to weakened demand in some key markets, where purchasing activity slowed due to economic pressures and trade disruptions. Despite ongoing production challenges from drought, Moko disease, and power cuts, these factors have not yet led to significant supply shortages. Consequently, the subdued market demand offset the anticipated price rise from lower production, resulting in the observed price decrease.

Philippines

In the Philippines, banana prices increased slightly by 1.61% WoW to USD 1.26/kg in W38, with a 13.51% YoY rise. This is due to continued recovery efforts following earlier weather disruptions, which helped stabilize production, though ongoing supply limitations still support higher prices compared to last year. However, prices saw a 2.33% MoM decrease due to temporary improvements in supply as the rainy weather in W38 enhanced crop yields, easing some of the production challenges from previous months.

Colombia

Banana prices in Colombia increased slightly by 1.27% WoW in W38, reflecting a 3.90% MoM increase. Additionally, there was a significant YoY rise of 73.91%. This upward price trend is primarily driven by persistent rains disrupting harvesting activities in the Urabá region, resulting in supply challenges. The adverse weather conditions have hindered production levels, prompting increased prices as demand remains robust in domestic and international markets.

Guatemala

Guatemala's banana prices in W38 remained steady at USD 0.20/kg since W36, reflecting an 11.11% MoM and 25% YoY increase due to sustained strong demand for Guatemalan bananas amidst significant rainfall and thunderstorms in the region. The consistent pricing indicates the market's reliance on Guatemalan exports as a stable supply source, particularly given other key exporting regions' production challenges. The ongoing demand helped maintain price stability, even in adverse weather conditions.

3. Actionable Recommendations

Implement Contingency Plans for Weather-Related Disruptions

Banana producers in Colombia should develop and implement contingency plans to mitigate adverse weather impacts on harvesting activities. This includes investing in efficient drainage systems to prevent waterlogging and utilizing protective coverings to safeguard crops from excessive rainfall. Producers can maintain consistent supply levels by enhancing resilience against weather disruptions, thereby stabilizing prices and meeting robust demand in both domestic and international markets. Additionally, regular communication with buyers about potential supply challenges can help manage expectations and maintain strong market relationships.

Strengthen Quality and Branding of BBTV-Free Bananas in Malawi to Compete with Imports

Banana farmers in Malawi should focus on enhancing the quality and branding of their BBTV-free banana varieties to compete effectively against cheaper imports from Tanzania and Mozambique. This can be achieved through targeted marketing campaigns highlighting local bananas' superior quality and health benefits. Additionally, farmers should consider forming cooperatives to leverage collective bargaining power, reduce costs, and improve access to larger markets. Engaging in training programs on best practices in production and marketing will further empower farmers to increase their profitability and sustain the industry's recovery.

Enhance Supply Chain Management for Dwarf Banana Production in Bom Jesus da Lapa

Dwarf banana producers in Bom Jesus da Lapa should enhance their supply chain management to align production with market demand better. This involves closely monitoring market trends and consumer preferences to anticipate demand fluctuations and adjust planting schedules accordingly. Additionally, implementing improved storage and transportation practices will help maintain quality and reduce losses during peak demand periods. By optimizing these processes, producers can maximize profitability and ensure a more stable market presence.

Sources: Tridge, Freshplaza, MXfruit, Portal Do Agronegocio, Kasetkaoklai, Khabarhub, Daijiworld, Business in Cameroon, VOA, etail News Asia