European Suppliers Look to Asia for Growth Amidst Adverse Weather Conditions and Shifting Consumer Preferences

Consumer Adaptation to Rising Olive Oil Prices in Spain

Olive oil is a highly-valued item as it is a staple in many European cuisines. Emphasizing its high prices, media outlets report it as a 'luxury item' and 'liquid gold.' While the high prices triggered lower consumption and sluggish demand for olive oil, many European consumers are reluctant to switch to a cheaper substitute. Instead, many consumers have opted to move down the category as extra virgin olive oil buyers move down to purchase virgin olive oil, virgin olive oil buyers move down to purchase olive oil, and olive oil buyers move down to purchase lower-grade olive oil.

In a 2023 study by the University of Jaén, sales of olive pomace oil, the lowest olive oil grade, increased by 86%. In addition, larger bottles are being sold less, and smaller packaged olive oil is in higher demand.

Expanding Olive Oil Markets in East Asia

Even though there is a strong market in Europe due to Europeans' preference for olive oil, diversifying into overseas markets remains a viable strategy for European suppliers.

The increasing middle class, consumers' willingness to pay more for quality European olive oil, and increased interest in health in East Asia make it an attractive market for European olive oil suppliers. According to the Observatory of Economic Complexity (OEC), South Korea, China, and Japan make up the world's 8th, 15th, and 23rd largest olive oil importers, with a significant portion sourced primarily from Spain and Italy.

South Korean Olive Oil Brands Overview

Representative National Olive Oil Brands

Below are the most representative olive oil products from key brands in South Korea. These products were selected based on the highest reviews found on SSG.com, an e-commerce platform from South Korea’s largest offline retailer, E-Mart.

Although many South Korean olive oil brands indicate that the product has been manufactured and packaged within the country, most emphasize its Spanish origins on their packaging. Tridge observed that major national brands Haepyo, Fontana, and Beksul, along with two private label (PB) brands, Peacock and Homeplus Signature, prominently emphasized their Spanish origins. Their packaging includes phrases like 'From Spain' and 'Product of Spain,' along with images of the Spanish flag.

In addition to emphasizing Spanish origins, Tridge observed that Spanish original equipment manufacturers (OEMs) and other companies manufacture olive oil outside of South Korea. These include Beksul's Extra Virgin Olive Oil Spray, manufactured by Aceites Abril S.L, and Fontana's Extra Virgin Olive Oil, manufactured by Jose Morales SL. These brands are from some of the largest food conglomerates in the country, CJ CheilJedang and Sempio, respectively.

Ranking of National Olive Oil Brands

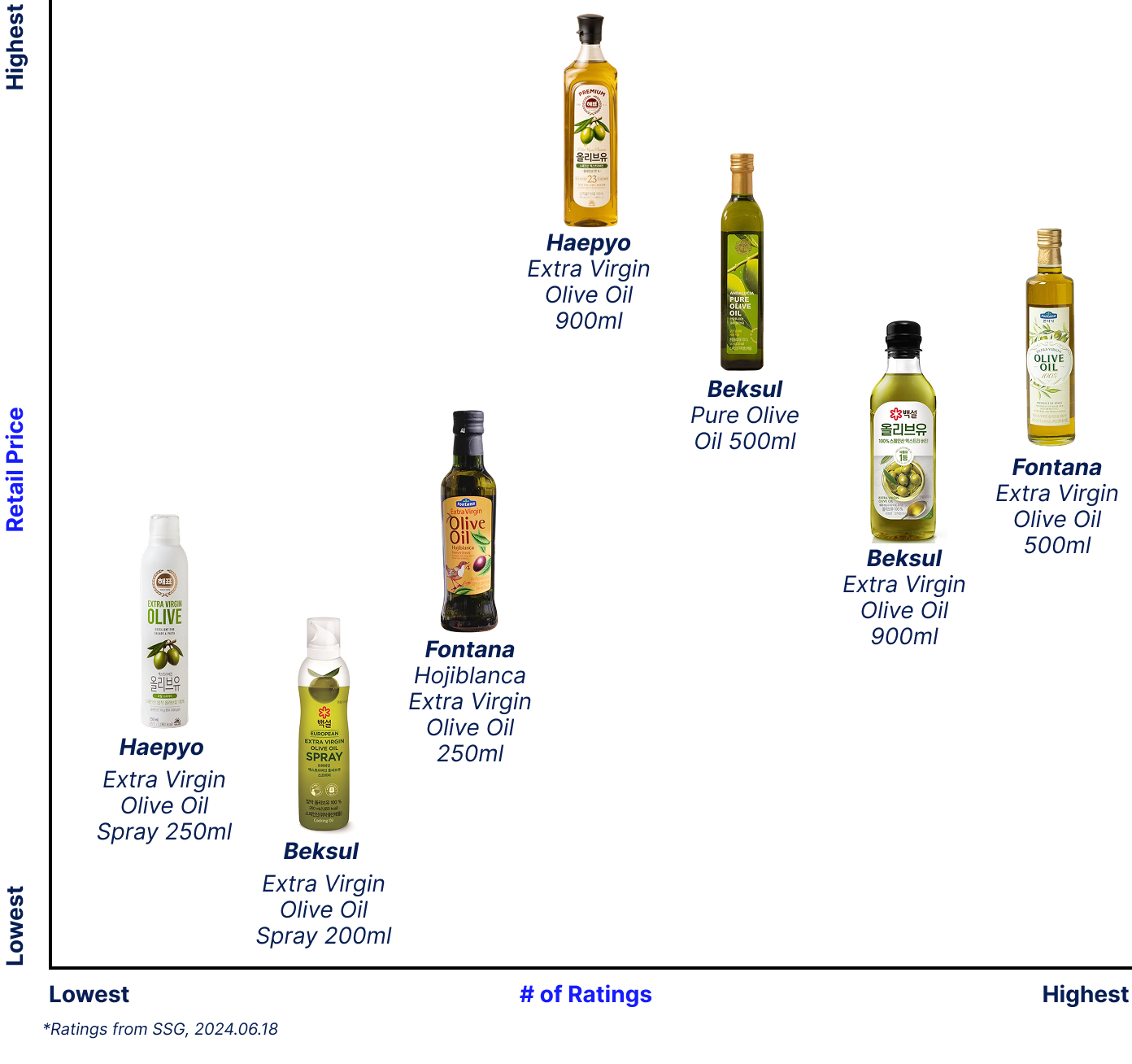

Based on the assumption that ratings correlate with sales and popularity, the diagram below illustrates the relative price points and popularity of the seven most sought-after items on ssg.com.

The two bottom products with the lowest retail prices and the lowest number of ratings are Haepyo Extra Virgin Olive Oil Spray 250ml and Beksul Extra Virgin Olive Oil Spray 200, priced at KRW 10,980 (USD 7.96), and KRW 8,200 (USD 5.94), respectively. However, as they are in a spray form, they are not the most conventional way of using olive oil, thus explaining their lower popularity.

In addition, Fontana Extra Virgin Olive Oil 500ml is the most popular and the third-highest priced out of the five bottled olive oils, with a retail price of KRW 19,800 (USD 14.30).

Leading Olive Oil Imports in South Korea

In terms of imports, below are the three top products with the highest number of ratings in South Korea’s three largest offline retail stores: E-Mart, Homeplus, and Lotte Mart.

E-Mart and Lotte Mart import olive oil directly in partnership with the brands, Coosur and Basso, while Homeplus's olive oil is sourced from Divella, imported by YOUNG IN Corporation.

The Role of Private Label Olive Oils in South Korea

Due to the rising popularity of olive oils in South Korea, E-Mart and Homeplus are also offering private-label olive oils. Yet, judging by the manufacturers indicated on the packaging, there is an overlap between national and private-label brands.

Private Label & National Brand Comparison

Peacock's private label Extra Virgin Olive Oil is manufactured by the Spanish OEM MIGASA ENVASADO S.L.U., which also produces for Beksul. Despite sharing the same manufacturer, known for producing a variety of olive oils (extra virgin, virgin, olive oil, olive pomace oil) and other edible oils, Peacock's product is priced 33.3% lower than the domestic brand.

Private Label and Overseas Brand Comparison

Spanish national brand Borges produces olive oil for the private-label brand Homeplus Signature. Yet, as seen in the case above, there is a 51.1% price difference between the two products with Homeplus Signature priced at KRW 19,800 (USD 14.35) and Borges priced at KRW 33,400 (USD 2.42). The steeper-than-usual price difference between PB and non-PB olive oil and Homeplus’s promotion of Borges as the manufacturer on the shopping page explains the high review number of 2,980 (Jun-24), which ranks them #4 in the review count and its current ‘Temporarily out-of-stock’ status.

Market Expansion Strategies for European Olive Oil Suppliers

South Korea relies on olive oil imports, resulting in significantly higher prices compared to an average bottle in Spain. Yet, as is the case for other East Asian countries, due to increased health-conscious consumers, there is a high demand for high-quality olive oil. Therefore, South Korea's favorable perception of Spanish olive oils makes the country an interesting market for Spanish suppliers to enter.

Japan and China share similarities with South Korea in their preference for high-quality European olive oil. However, suppliers must understand the Asian market, an overview of key brands dominating the market, and consumers to capture the market. For instance, although there is more interest in incorporating olive oil into Chinese cooking, many Chinese consumers purchase high-quality premium olive oil during holidays as gifts to loved ones. Thus, packaging and marketing must be highly considered in order to penetrate the Chinese market. Unlike South Korea, many domestic brands in Japan import olive oil from a wide range of countries, including Italy, Greece, and Australia. Suppliers must understand each market's key differences and nuances for higher accuracy and success in market penetration.