Malaysian palm oil prices continue to increase amid tight supplies and low production

Malaysia the, world’s second-biggest palm oil exporter, saw prices touch $1,300/MT in October 2021, starting a new season with a new record. This is $145/MT or 12.4% more than in September 2021. In comparison with October 2020, prices have increased by 75%.

Source: Malaysian Palm Oil Board

COVID slows palm fruit harvesting

There are many fundamental factors that have been supporting the Malaysian palm oil market in the past 1.5 years. However, the cumulative effect of these factors was brightly seen in September-October when a shortage of labor force due to COVID hindered harvesting on the palm oil plantations at the seasonal production peak. Since there are no automatic harvesting machines, the sector relies heavily on a manual workforce, most of which comes from abroad. According to the officials of the Malaysian Palm Oil Board, the industry has been missing at least 75,000 workers to do the harvesting since 2020. As collecting fruits is done by foreign workers and COVID has caused border closures and a series of lockdowns, attracting highly skilled workers into Malaysia has become complicated.

Given the mentioned issues, the forecast for Malaysia’s palm oil output in 2021 has been lowered from 19.7 million tons to 18 million tons.

Source: Malaysian Palm Oil Board

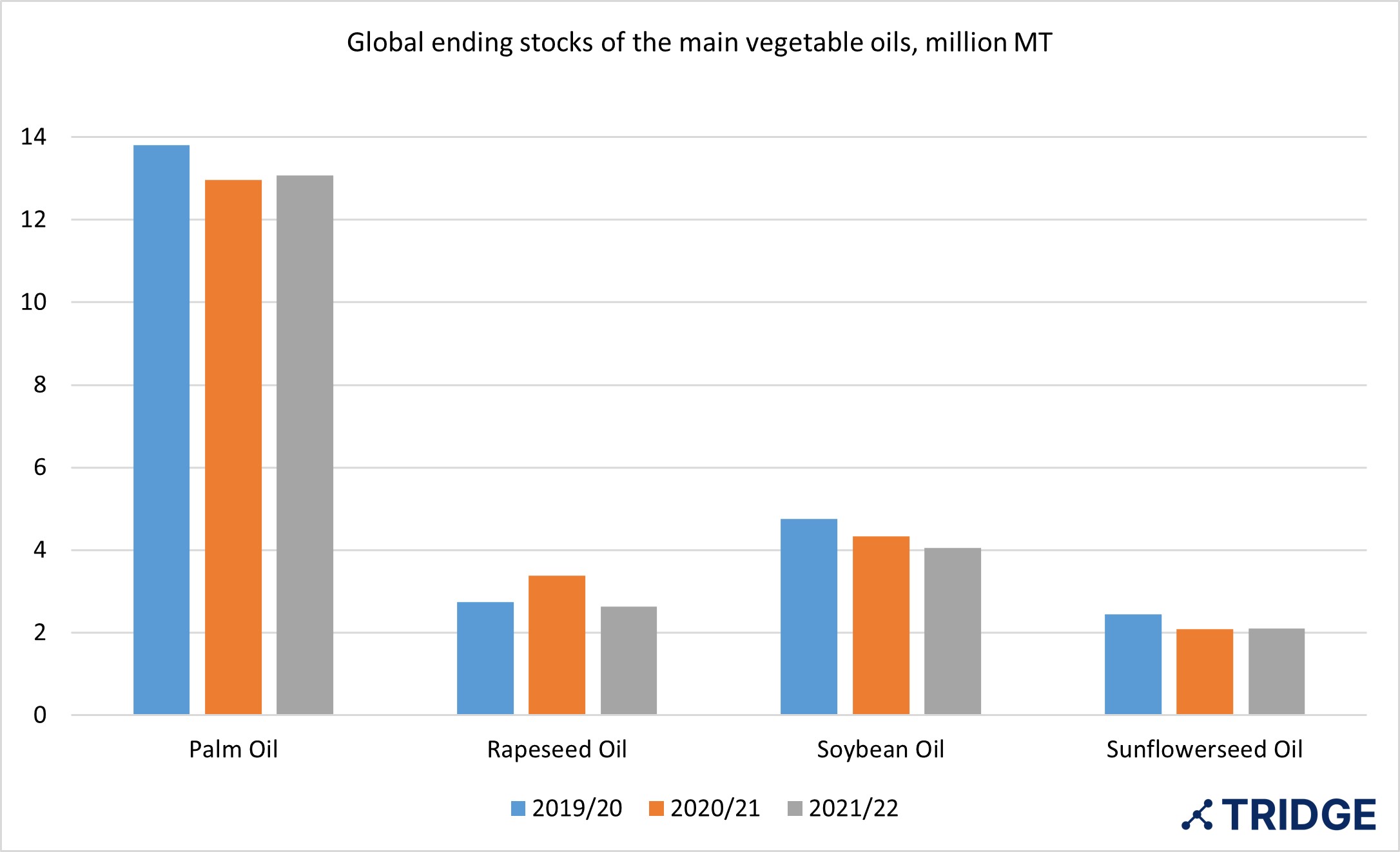

Tight vegetable oil supplies in the world

Vegetable oil shortage on the global scale has been supporting palm oil prices in the past two seasons. Higher domestic consumption around the world, especially in India and China, has been keeping the demand for cooking oil at a high level. Yet the demand is not just driven by higher per capita consumption, but also by population growth.

Source: FAS USDA

Crude oil prices influence Malaysian palm oil prices

As palm oil is also used to add to the premise of biodiesel, the price for this edible oil is strongly influenced by crude oil futures fluctuations. The demand for fossil fuels has been increasing in 2021 with many countries around the world starting to resume economic activities after numerous lockdowns. This has also been reflected in the palm oil values. The sharpest in price growth was observed in September-October 2021.

Source:International Monetary Fund

The use of palm oil as a blend of biofuel has been increasing in Indonesia and Malaysia in the last 10 years. Indonesia, for example, applies a program B30, which means that the diesel sold in the country must include 30% of the palm-oil-based blend. Malaysia intends to use 20% of this bend in diesel from December 2021.

However, the EU, one of the biggest importers of palm oil, may decrease the import of this commodity in 2021, given new environmental regulations. According to USDA, palm oil used in the EU is projected to decrease from 2.65 million tons in 2021 to 2.63 million tons in 2020. Some EU member states plan to phase out the use of palm oil for diesel production by 2030, due to the concerns that palm plantations cause massive deforestation in the main producing regions.

Sources:

IMF International Monetary Fund

thestar.com.my Malaysia targets full rollout of B20 biodiesel plan by end-2022

S&P Global EU palm oil use for biodiesel to fall in 2021 on cost concerns: USDA

Nasdaq Germany to end palm oil use in biofuels from 2023 - ministry

Nasdaq Malaysia's palm oil board cuts 2021 production outlook

The Edge Markets MPOC: Oil palm plantations in dire need of foreign workers

Nasdaq VEGOILS-Palm oil climbs 2% to record high of over 5,200 ringgit

Bloomberg The World’s Most Consumed Edible Oil Is Facing a Supply Crunch

FAS USDA Oilseed report, November 2021