.jpg)

1. Weekly News

Nepal

Nepal's Rice Production Surges, Challenges Persist

According to the Nepal Ministry of Agriculture and Livestock Development, rice production in this fiscal year reached 5.72 million metric tons (mmt), marking a 4.37% year-on-year (YoY) increase. This growth is due to the expanded use of improved rice varieties, adequate supply of fertilizers, and sufficient rainfall during the planting season. However, despite these gains, challenges such as land occupation, urbanization, and wasteland impacted food production negatively. Over the past decade, approximately 250 thousand hectares (ha) of arable land were lost. As of W26, domestic rice production falls short of meeting actual consumption by 7.1 mmt annually, necessitating the import of an average of 1.7 mmt of rice each year. To ensure food security and sustainability, addressing these challenges will be crucial for growth momentum in rice production in the coming years.

Philippines

Philippines Boosts Rice Procurement Amid Strong Global Production Forecasts

In the first six months of 2024, the Philippines purchased more than 168 thousand metric tons (mt) of rice, enoughsufficient for four days of emergency rice consumption. The National Food Authority (NFA) exceeded its paddy rice procurement target for the first half of 2024, purchasing 3.37 million 50-kilogram (kg) bags (168,262 mt). Despite large purchases at high prices, the NFA still has about USD 204 million allocated for rice procurement this year. As of June 6, 2024, the country's rice imports reached over 2.17 mmt, with Vietnam being the largest supplier (1.59 mmt), followed by Thailand (339,670 mt), Pakistan (148,618 mt), and India (21,345 mt). The Food and Agricultural Organisation (FAO) forecasts world rice production for the 2024/25 crop year to increase by 0.9% YoY to a record 534.9 mmt, with Asia accounting for most of the increase. Bangladesh, India, and the Philippines achieved record production levels due to improved growing conditions and strong government support, while expanded rice acreage is expected to boost production in Cambodia, Nepal, and Pakistan.

South Korea

South Korea Faces Decline in Rice Cultivation Area Amid Policy Shifts

South Korea plans to decrease its rice cultivation area by up to 16 thousand ha in 2024, between 683 and 689 thousand ha, below the optimal cultivation area. This reduction is part of broader agricultural policies focusing on diversifying crop cultivation and managing rice production more efficiently. Measures include implementing a strategic crop direct payment system, utilizing local government budgets, and converting farmland for other purposes. As a result of these initiatives, rice production could fall by over 50 thousand mt compared to previous levels, reflecting a strategic shift in South Korea's agricultural landscape towards sustainability and diversification.

Vietnam

Vietnam Expands Rice Exports to Philippines Amid Tax Reduction

Vietnam exported 1.44 mmt of rice to the Philippines as of May 23, representing a substantial portion of the Philippines' total rice imports. The reduction in rice import taxes from 35% to 15%, effective Aug-24 until Aug-28, is expected to enhance opportunities for Vietnamese rice in the Philippine market later in the year. This move is part of the Philippine government's efforts to address inflation, particularly in essential commodities like rice, which has seen significant price increases contributing to the Consumer Price Index (CPI). Vietnam's trade office in the Philippines reports that the country remains Vietnam's largest rice buyer, accounting for over 80% of Vietnam's total rice exports to the Philippines. This bilateral trade relationship underscores Vietnam's pivotal role in supplying rice to meet the Philippines' substantial demand for the grain.

2. Weekly Pricing

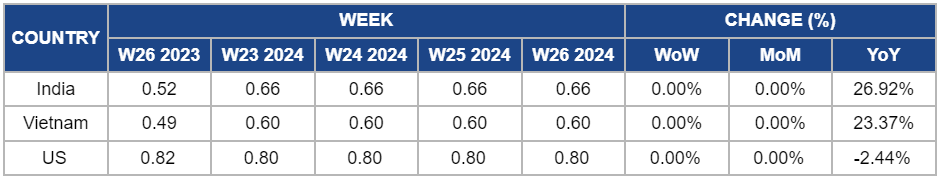

Weekly Rice Pricing Important Exporters (USD/kg)

Yearly Change in Rice Pricing Important Exporters (W26 2023 to W26 2024)

India

In W26, wholesale rice prices in India remained steady at USD 0.66/kg but surged by 26.92% YoY. This significant increase is due to the government's decision to raise the minimum support prices for paddy, which is expected to push up export prices for Indian rice. Despite the price hike, Indian rice remains competitively priced compared to other origins. According to a Mumbai trader, these higher prices will incentivize farmers to boost production in India, the world's second-largest rice-producing country. This increased production could lead the government to reconsider its ban on certain rice exports.

Vietnam

In W26, Vietnamese rice prices held steady at USD 0.60/kg, unchanged from the previous week but reflecting a significant 23.37% YoY increase. This is due to projections of a 1.4% YoY decrease in Vietnam's rice output for the 2023/24 crop year, totaling 27.8 mmt. According to the FAO, rice exporters in Southeast Asia, including Vietnam, are expected to face challenges in 2024. Despite this, Vietnam's rice harvest and yield increased in the first six months of 2024, leading to increased exports in both volume and value due to high prices. The Ministry of Agriculture and Rural Development reported that Vietnam harvested crops on 3.48 million ha of paddy fields, a growth of 0.5% YoY, with an average yield of 67.1 mt/ha, up 0.7 mt/ha. The total rice output was 23.3 mmt, up 1.6% YoY. In the first half of the year, Vietnam exported 4.68 mmt of rice, earning USD 2.98 billion, with a 10.4% YoY increase in volume and a 32% surge in value due to high export prices.

United States

In the United States (US), the wholesale price of milled white long rice remained stable at USD 0.80/kg, reflecting a modest 2.44% YoY decrease. Arkansas, the top rice-producing state, cultivated over 1.4 million acres of rice in 2023, achieving an average yield of approximately 168 bushels per acre. However, a slight production decrease is anticipated in 2024 as some farmers consider rotating crops, opting for corn or soybeans instead of rice. Weather conditions, particularly droughts during dry summers, significantly influence yield, and the high costs associated with irrigation pose additional challenges for farmers, especially during periods of water scarcity.

3. Actionable Recommendations

Optimizing Crop Rotation and Managing Water Resources

The US should encourage crop rotation practices to maintain soil health and optimize production. Investing in efficient irrigation systems and drought-resistant rice varieties can help manage water scarcity issues. Financial support and incentives for farmers rotating crops can ensure sustainable agricultural practices. Countries with similar landscapes, such as Australia and Brazil, can implement these strategies to enhance rice production and manage water resources effectively. By addressing these recommendations, these countries can enhance rice production capabilities, ensure food security, and navigate the challenges posed by climate change and market dynamics.

Stabilizing Rice Prices and Boosting Production

India should focus on stabilizing rice prices by ensuring a balanced supply-demand ratio. Increasing the minimum support price for paddy can incentivize farmers to produce more. Lifting export bans selectively can help manage domestic supply while capitalizing on global market opportunities. Countries with large rice production and export capacities, such as Pakistan and Bangladesh, can adopt similar measures to stabilize prices and boost production.

Leveraging Trade Opportunities and Improving Production

Vietnam should benefit from reduced import taxes in the Philippines to boost its rice exports. Enhancing trade relationships and exploring new markets can further increase export revenues. Moreover, investing in high-yield rice varieties and improving agricultural practices can help sustain production levels despite climatic challenges. Rice-exporting countries facing similar challenges, like Thailand and Myanmar, can adopt these strategies to enhance their market presence and production efficiency.

Sources: Agriculture, Foodmate, WTOCenter, Nongmin