1. Weekly News

Israel

Israel's Avocado Industry Thrives Despite Challenges

Israel's avocado harvest is booming, with a 67% year-over-year (YoY) increase, reaching an expected 250 thousand tons in 2024, up from 150 thousand tons in 2023. Planet Israel, a leading agricultural organization, attributes this growth to expanding plantations and higher per capita consumption. Despite challenges from the ongoing conflict, including labor shortages and restricted access to orchards, the industry has managed to mobilize thousands of volunteers to assist with the harvest. Over the past 20 years, avocado cultivation in Israel has grown from 4 thousand hectares (ha) to 14.3 thousand ha. The most popular varieties are Hass, which accounts for 62% of the growth, and green varieties like Ettinger and Pinkerton, making up 38% of the crop. About 50% of Israel's avocados are exported, mainly to Europe, which accounts for 25% to 30% of the total export.

Mexico

US Resumes Avocado Imports from Michoacán Amid Enhanced Security Measures

Avocado exports from Michoacán to the United States (US) are set to resume in W27 following the implementation of stringent security measures. The US temporarily halted imports from the Mexican region in mid-May due to attacks on personnel from the US Animal and Plant Health Inspection Service (APHIS). The Governor announced the full reactivation of avocado exports starting on July 10, 2024, facilitated through 80 authorized packaging facilities. Enhanced security protocols are in place to safeguard agricultural inspectors and ensure uninterrupted exports. The reopening coincides with the peak shipping season, bolstered by the deployment of Michoacán Auxiliary Police to accompany United States Department of Agriculture (USDA) APHIS inspectors, with 1.7 thousand officers dedicated to protecting US employees.

Peru

Peru's Avocado Exports Surge to the US

Peru has witnessed a remarkable surge in avocado exports to the US, with shipments reaching nearly 75 thousand metric tons (mt) valued at over USD 145 million in 2023. Since their introduction to the US market in 2006, Peruvian avocado exports have steadily increased in volume and value. The organic segment of these exports also saw significant growth, reaching USD 11.3 million in 2023. This expansion underscores the growing demand in the US for fresh, nutritious, and sustainably sourced produce, with 122 thousand mt valued at USD 270 million exported in 2022 alone.

Rwanda

Rwandan Farmers Advocate for Improved Seed Varieties to Enhance Avocado Exports

Local farmers in Huye District, Rwanda, call for improved seed varieties to enhance avocado production, aiming to make the district a primary exporter. The Liberal Party, campaigning in the Southern Province, emphasized the importance of avocado cultivation, particularly for women's development. Avocados, which were once not valued much, are now in high demand for export, especially the Hass variety. The party promises to help farmers by improving agriculture, raising living standards, and reducing poverty with modern farming methods.

Vietnam

Low Prices and Crop Shifts Impact Vietnam's Avocado Harvest

As Vietnam's avocado harvesting season approaches, many orchard owners neglect their crops, letting them fall naturally or removing trees to plant alternatives. Despite high yields, low buying prices have discouraged farmers, ranging from USD 0.098 to 0.12 per kilogram (VND 2,500 to VND 3,000/kg). Some are switching to other crops, like coffee trees. The Department of Agriculture and Rural Development of Lâm Đồng Province reports over 8 thousand hectares (ha) of avocado trees, mainly the 034 variety. Efforts are underway to promote sustainable avocado consumption and develop markets, including finding potential buyers and distribution channels in major cities.

2. Weekly Pricing

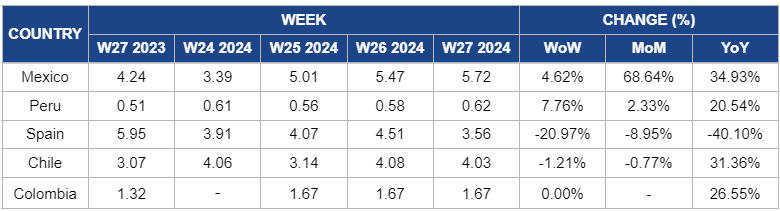

Weekly Avocado Pricing Important Exporters (USD/kg)

* All countries are looking at the pricing of Hass avocado

Yearly Change in Avocado Pricing Important Exporters (W27 2023 to W27 2024)

* All countries are looking at the pricing of Hass avocado

* Blank spaces on the graph signify data unavailability stemming from factors like missing data, supply unavailability, or seasonality

Mexico

The wholesale prices of avocados in Mexico increased by 4.62% week-over-week (WoW) to USD 5.72/kg in W27, up from USD 5.47/kg in W26. Moreover, there is a significant 68.64% month-on-month (MoM) increase. This stability during the low season is due to ongoing supply constraints exacerbated by interruptions in exports from Michoacán to the US due to security incidents. Despite these challenges, efforts to resume certifications and shipments are underway, tightening supply and increasing prices.

Peru

In W27, avocado prices increased by 7.76% WoW to USD 0.62/kg, up from USD 0.58/kg in W26. Moreover, there is a 2.33% MoM increase and a 20.54% YoY increase. This rise can be due to the ongoing high season for avocados in Peru, which typically sees increased supply as harvest volumes peak, meeting seasonal demand surges. Despite the MoM decrease in the previous month due to surplus supply, the YoY increase reflects sustained market demand and consistent export activities to crucial markets like Europe.

Spain

In Spain, avocado prices decreased by 20.97% WoW to USD 3.56/kg in W27, compared to USD 4.51/kg in W26. Additionally, there is an 8.95% MoM decrease and a 40.10% YoY decrease. This week's significant price drop is due to an increase in supply as the new harvest begins, easing the previous shortage seen during the off-season. The MoM and YoY decreases reflect the higher prices that were sustained during the off-season and the impact of improved supply chain efficiencies this year. Despite the recent drop, prices are expected to stabilize as the market adjusts to the new supply levels.

Chile

Avocado prices in Chile decreased slightly by 1.21% WoW to USD 4.03/kg in W27, compared to USD 4.08/kg in W26. There is a minimal change in MoM compared to a significant 31.36% YoY increase. This slight weekly decrease is typical during the off-season in Chile, where reduced harvesting and supply adjustments lead to minor price fluctuations despite strong annual growth driven by ongoing demand trends and favorable export conditions to international markets.

Colombia

In Colombia, avocado prices have remained steady at USD 1.67/kg in W27. Moreover, there is a notable 26.55% MoM increase. This stability amid the off-season in July reflects balanced supply and demand dynamics, with local market conditions adapting to seasonal variations. The MoM increase indicates temporary factors influencing price movements, such as logistical adjustments or short-term fluctuations in export demand, amidst Colombia's strategic position as a significant avocado supplier in global markets.

4. Actionable Recommendations

Revitalizing Vietnam's Avocado Market for Sustainable Growth and Farmer Support

To combat low buying prices and farmer discouragement, the Department of Agriculture and Rural Development of Lâm Đồng Province should implement a market development strategy to enhance avocado value through branding, secure distribution channels in major cities, and promote sustainable consumption. Providing training and support for farmers to adopt better cultivation practices and exploring value-added products can also boost profitability and interest in avocado farming.

Strengthening Israel's Avocado Industry Amidst Challenges

Mobilize volunteers to overcome labor shortages and ensure the timely harvest of Israel's booming avocado crop, expected to reach 250 thousand tons in 2024. Focus on maintaining access to orchards despite ongoing conflict. Expand export channels to Europe, which currently accounts for 25% to 30% of exports, leveraging the popularity of Hass and green varieties like Ettinger and Pinkerton.

Enhance Avocado Production with Improved Seed Varieties

Local farmers in Huye District, Rwanda, should focus on adopting improved seed varieties to boost avocado production. Emphasize the cultivation of the high-demand Hass variety to position the district as a primary exporter. Support from the Liberal Party will aid in modernizing agriculture, raising living standards, and reducing poverty, especially among women, through advanced farming techniques.

Sources: Tridge, Tradecouncil, Newtimes, En Sggp, Freshplaza, MXfruit, Fruitnet