1. Weekly News

Austria

Austria Faces Early Harvest and Lower Grape Volumes in 2024

Austria is experiencing an unusually early grape harvest in 2024, with wine production expected to decrease by about 15% from 2023, reaching around 2 million hectoliters (hL). This drop is due to challenging weather conditions, including late frosts and coulure during blossoming, which affected grape formation. While warm weather has sped up ripening, some regions like Thermenregion, Kamptal, and Wachau suffered frost damage. Despite the reduced yields, producers anticipate a denser, fully ripe vintage, especially for red wines. The early harvest is intended to balance the sugar-to-acid ratio for a well-rounded and harmonious vintage.

France

French Grape Harvest Projected to Decline by 18% in 2024

According to the Ministry of Agriculture, France's 2024 grape harvest is expected to decrease by 18% year-on-year (YoY), totaling 39.3 million hL. The decline is mainly due to cool and humid weather during the flowering period. This anticipated harvest would be slightly below the challenging 2021 harvest and 11% less than the average for the 2019 to 2023 period. Significant reductions are anticipated in regions such as Jura with a 71% reduction, Charentes with a 35% decline, and the Loire Valley with a 30% decrease. In comparison, Champagne is expected to see a 16% drop.

Greece

Grape Production in Greece Faces Major Setbacks Due to Weather and Disease

According to Greece's Central Cooperative Union of Wine Products (KEOSOE), Greek grape production in 2024 has been severely impacted by a second consecutive year of poor harvests. Downy mildew from 2023, combined with drought and high temperatures, has reduced yields in major wine-growing regions such as Tyrnavos, Nemea, and Heraklion. The mildew led to a shortage of reproductive buds, while the heat affected fruit set and ripening, leaving many grapes dehydrated and underweight. Although the remaining grapes are of high quality, low yields have raised concerns about sufficient wine production. Increased imports from Italy and rising prices have not fully offset grower losses, with young winegrowers in Eastern Attica particularly struggling and some abandoning their vineyards due to unprofitability.

Italy

Italy's Organic Seedless Grape Production Continues to Rise

Italy remains a significant player in global seedless grape production, especially in the organic sector, with 150 thousand tons cultivated primarily in Puglia, Sicily, and Basilicata. Puglia alone produces 60% of Italy's organic seedless grapes. European demand for these grapes is growing by 5 to 7% annually due to the quality and environmental impact, including reduced lower carbon dioxide (CO₂) emissions, compared to conventional production. The organic harvest began early in 2024, featuring varieties like Sugraone and Autumn Crisp, underscoring Italy’s leadership in sustainable grape production.

Peru

Peu's Table Grape Exports Expected to Rise 25.4% in 2024/25 Season

According to the Peruvian Association of Table Grape Producers and Exporters (Provid), Peru is expected to export 78.7 million 8.2-kilogram(kg) boxes of table grapes during the 2024/25 season, a 25.4% YoY increase from the previous season's 62.7 million 8.2-kg boxes. This growth is due to a rise in production in Peru's northern coastal region, which faced climate-related issues last season. Major export markets include the United States (US), Europe, Latin America, and China. The Ica region accounts for nearly half of Peru’s grape acreage, followed by Piura with 37%. Provid will release further forecasts in Oct-24 and Dec-24 to help stakeholders navigate the season.

Spain

Catalonia's Grape Harvest Expected to Drop Due to Drought

Due to severe drought conditions, Unió de Pagesos, a Catalan farmers' union advocating for agricultural interests, warns that Catalonia's grape harvest could fall by up to 40% in 2024. Regions like Penedès, Camp de Tarragona, and DO Terra Alta are seeing significantly lower yields, ranging from 1.5 thousand kg per hectare (ha) to 5 thousand kg/ha. While recent rains have improved the Parellada harvest, Macabeo production is expected to decrease by 31%, and Xarel·lo yields are also substantially reduced. Despite higher grape prices, profitability remains a concern as growers need USD 4,900/ha (EUR 4,500/ha) to cover costs. Additional challenges include mildew, heat stress, and pest infestations, leading to lower harvest volumes and reduced alcohol content in the grapes.

2. Weekly Pricing

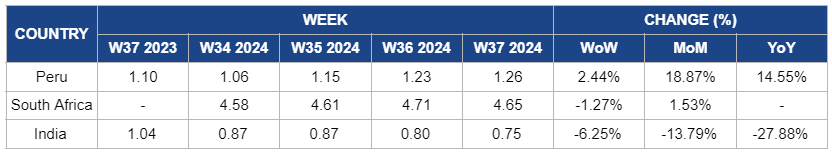

Weekly Grape Pricing Important Exporters (USD/kg)

* Varieties: Chile (Thompson Seedless), Peru (Grape Italia), and India (Green Grape)

Yearly Change in Grape Pricing Important Exporters (W37 2023 to W37 2024)

* Varieties: Chile (Thompson Seedless), Peru (Grape Italia), South Africa (White Seedless), and India (Green Grape)

* Blank spaces on the graph signify data unavailability stemming from factors like supply unavailability, missing data, or seasonality

Peru

Peruvian grape prices increased by 2.44% week-on-week (WoW) to USD 1.26/kg in W37, up from USD 1.23/kg in W36. This rise is also reflected in a 18.8% month-on-month (MoM) increase and a 14.55% YoY surge. The continued price growth is driven by Peru's robust position as the world's leading grape exporter, with strong global demand and an extended growing season. Despite increased competition from emerging producers such as China and India, Peru's established export channels and consistent product quality have sustained the upward momentum in grape prices.

South Africa

South Africa's grape prices declined by 1.2% WoW to USD 4.65/kg in W37, down from USD 4.71/kg in W36. Despite this slight decrease, the prices remain relatively stable due to the continued benefits of improved vineyard management practices. However, the high investment costs associated with these technologies have contributed to maintaining elevated price levels. The slight WoW decline may be due to a temporary easing in demand following the price peaks observed in previous weeks.

India

In W37, India's grape prices declined by 6.25% WoW to USD 0.75/kg, following the previous week's trend. This marks a 13.90% MoM and a 27.88% YoY decline. An abundant supply primarily drives the ongoing price drop despite challenging weather conditions. The increased cultivation efforts have contributed to a surplus in the market, further pressuring prices downward. However, heatwaves and insufficient rainfall impact production quality, though supply remains strong enough to keep prices low.

3. Actionable Recommendations

Enhance Drought Resilience in Catalonia's Vineyards

Vineyard managers should implement drought-resistant practices to combat the projected drop in Catalonia's grape harvest due to severe drought. They should optimize water usage through drip irrigation and soil moisture management. They should adopt drought-tolerant grape varieties like Garnacha and Tempranillo and improve vineyard mulching to retain soil moisture. They should also address pest infestations and mildew with integrated pest management techniques. Vineyard managers should prioritize these steps to protect yield and profitability amid current challenges.

Mitigate the Impact of Reduced Grape Harvest in France

Grape growers should focus on enhancing weather resilience to address the projected 18% decrease in France's grape harvest for 2024. Implementing targeted climate adaptation strategies, such as improving drainage and selecting more resistant grape varieties like Pinot Meunier and Chardonnay, will help mitigate future risks. Additionally, investing in advanced weather forecasting tools can better prepare for adverse conditions. Vineyard managers should prioritize these measures to safeguard yield and quality in light of the current challenges.

Improve Vineyard Resilience to Combat Poor Harvests in Greece

To address the ongoing challenges in Greece's grape production, growers should focus on mitigating downy mildew and heat stress. Implement preventive measures such as applying targeted fungicides to combat mildew and adjusting vineyard management practices to reduce heat stress, including shade nets and optimized irrigation. Investing in heat-resistant grape varieties and improving soil health through organic amendments can also help. These steps should be prioritized by growers to stabilize yields and improve profitability in light of recent difficulties.

Sources: Tridge, Freshplaza, Eastfruit, Agrotypos, Foodmate, Agrodigital, Harpers, MXfruit, Agrodiario