In W6 in the palm oil landscape, some of the most relevant trends included:

- Following B40 in 2024, Indonesia aims to increase palm oil content in biodiesel to B50 by 2026 to reduce diesel imports, enhance energy self-sufficiency, and boost demand.

- Indonesia is tightening oil palm plantation permit regulations, requiring 20% land allocation to smallholders and increasing to 30% for extensions to ensure broader participation.

- Malaysia is addressing labor shortages in palm oil plantations, ensuring sufficient labor, and enforcing ILO-compliant recruitment practices.

- Pakistan faces supply chain disruptions with 300,000 mt of palm oil stranded at Port Qasim, causing price hikes and halting shipments from Indonesia and Malaysia ahead of Ramadan.

- Uzbekistan is introducing new testing requirements for palm oil products and tightening regulations amid a decline in palm oil imports, despite extended duty exemptions for manufacturers.

1. Weekly News

Indonesia

Indonesia Advances Biodiesel Program With B50 Target by 2026

Indonesia remains committed to increasing the palm oil content in its biodiesel mandate, aiming for a B50 blend by 2026. This follows the implementation of the B40 mandate in early 2024, which increased palm oil content in biodiesel to 40%. The policy aligns with the Indonesian President's goal of energy self-sufficiency and reducing diesel imports. In 2024, Indonesia produced 13.15 million kiloliters (kl) of biodiesel, surpassing its target of 11.3 million kl and saving USD 9.33 billion in foreign exchange. With the B40 mandate, biodiesel production is expected to reach 15.6 million kl in 2025, reducing diesel imports further. A government team has been deployed to monitor B40 distribution, ensuring compliance with the 40% palm oil content requirement.

Indonesia Tightens Palm Oil Land Regulations While Expanding Biodiesel Mandate

Indonesia is tightening regulations on right-to-cultivate (HGU) permits for oil palm plantations, requiring companies to allocate 20% of their land to local smallholders before permit extensions. This requirement will increase to 30% for additional extensions aimed to ensure broader smallholder participation. Authorities are also strengthening supervision to prevent corporate-controlled cooperatives from benefiting instead of independent farmers. Meanwhile, Indonesia continues expanding its palm oil sector, with the government increasing the biodiesel mandate to 40% in 2024 and targeting 50% by 2025. While Indonesia's President supports plantation expansion for energy self-sufficiency, environmental groups warn of deforestation risks.

Malaysia

Malaysia Focuses on Labor Availability and Sustainability in Palm Oil Production

Malaysia is prioritizing labor availability in oil palm plantations to maintain stable production as the world's second-largest palm oil producer, according to the Minister of Plantation and Commodities. He emphasized that palm oil prices are dictated by supply and demand, highlighting the need for a sufficient workforce to maximize output. The government is working with the Home Ministry and Labour Department to ensure foreign worker recruitment aligns with International Labour Organization (ILO) standards, including measures to combat forced labor. Additionally, plantation companies must obtain Malaysian Sustainable Palm Oil (MSPO) certification to ensure compliance with labor and sustainability criteria.

Pakistan

Pakistan Faces Cooking Oil Shortage Ahead of Ramadan Due to Customs Delays

Pakistan faces a potential shortage of cooking oil and ghee during Ramadan due to delays in customs clearance at Port Qasim, where 300,000 metric tons (mt) of palm oil remain stranded. The newly implemented faceless customs system has disrupted the clearance process, leading to increased demurrage charges and rising cooking oil prices. The delay has also led to the suspension of palm oil shipments from Indonesia and Malaysia. Industry representatives are urging the government to revert to the previous clearance system to prevent further price hikes and ensure timely supply during Ramadan.

Uzbekistan

Uzbekistan Enforces Mandatory Testing for Palm Oil as Imports Decline

Uzbekistan will implement mandatory laboratory testing for palm oil and products containing trans fats starting March 1, 2025, as outlined in a presidential decree issued on January 30, 2024. Sanitary-epidemiological certificates for imports will require testing in accredited laboratories, with regulatory bodies also increasing oversight of domestic food production. Despite extending import duty exemptions on palm and coconut oil for two more years to support manufacturers, Uzbekistan's palm oil imports have declined significantly, dropping 40% in volume and 46% in value over the past year.

2. Weekly Pricing

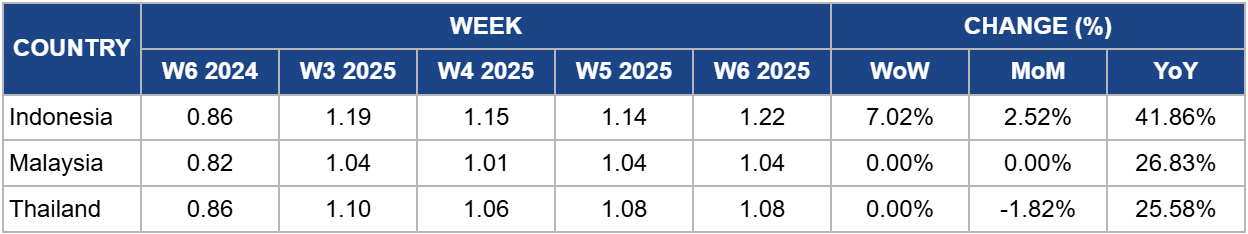

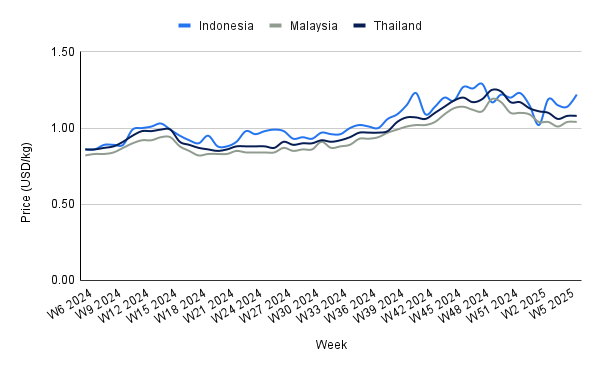

Weekly Palm Oil Pricing Important Exporters (USD/kg)

Yearly Change in Palm Oil Pricing Important Exporters (W6 2024 to W6 2025)

Indonesia

Indonesia's palm oil prices rose to USD 1.22 per kilogram (kg) in W6, up 7.02% week-on-week (WoW) and 41.86% year-on-year (YoY), driven by regulatory changes and growing biodiesel demand. The government's stricter HGU permit rules, requiring larger land allocations for smallholders, may constrain large-scale expansion, potentially limiting future supply growth. Simultaneously, Indonesia's push for higher biodiesel blending rates (B40 in 2024 and B50 in 2025) is expected to boost domestic consumption, tightening export availability. If supply constraints persist while demand remains strong, prices could continue rising, influencing global vegetable oil markets.

Malaysia

Malaysia's palm oil prices remained stable in W6 at USD 1.04/kg, reflecting a 26.83% YoY rise. Factors contributing to this increase include stronger rival soybean oil prices, a weaker Malaysian ringgit (MYR), market responses to Indonesia's potential export levy reductions, and uncertainty surrounding United States (US) tariff threats.

However, the market remains cautious due to a combination of weaker Malaysian palm oil exports, a recovery in production, and anticipated declines in Indonesian palm oil exports. Additionally, Malaysian exports are projected to have fallen by 12.3% to 20.1% month-on-month (MoM) in Jan-25. These developments suggest that while current prices have been supported by external market factors, future price stability may hinge on the resolution of export challenges and production dynamics.

Thailand

In W6, Thailand's palm oil prices remained steady at USD 1.08/kg, marking a 1.82% decrease MoM but a 25.58% increase YoY. The government is responding to industry challenges by drafting new legislation aimed at providing stability for palm oil farmers. This initiative comes in light of the planned phase-out of biodiesel price subsidies by 2026, which could significantly impact farmers' incomes and market dynamics.

The proposed Palm Oil Industry Promotion Law, which draws from the successful structure of the Cane and Sugar Act of 1984, aims to safeguard income distribution and job security while preventing economic disruptions. The law’s development, led by a newly appointed committee, seeks to stabilize the market and ensure long-term growth and sustainability for palm oil producers.

As the government works to implement this legislation, its ability to stabilize the market and mitigate the effects of subsidy removal will be crucial. Future palm oil prices in Thailand may be influenced by the success of these measures in ensuring fair income distribution and industry stability.

3. Actionable Recommendations

Capitalize on Indonesia's Biodiesel Expansion

As Indonesia aims to reach a B50 blend by 2026, companies in the palm oil and biofuel sectors should position themselves to take advantage of the growing demand for palm oil in biodiesel production. This could involve expanding production capacity, securing long-term supply contracts with Indonesian biodiesel producers, or exploring investment opportunities in biodiesel infrastructure to benefit from both the environmental push and energy self-sufficiency goals set by the government.

Leverage Sustainability and Labor Standards

With Malaysia prioritizing labor standards and sustainability certification (MSPO) for palm oil plantations, companies in the palm oil supply chain should ensure they meet or exceed MSPO requirements. This is critical to align with global sustainability trends and attract eco-conscious consumers. Additionally, ensuring compliance with labor regulations will safeguard against potential disruptions or penalties, allowing for continued market access in key regions like the European Union (EU) and the US.

Mitigate Supply Chain Disruptions in Pakistan and Uzbekistan

Given the disruptions caused by customs delays in Pakistan and Uzbekistan’s tightening import regulations, stakeholders in the palm oil market should consider diversifying supply chains or enhancing logistics operations to avoid further delays. Exploring alternative routes for palm oil imports or establishing local storage and processing hubs in these regions can help mitigate the risks of future shortages and rising costs, especially during peak consumption periods like Ramadan in Pakistan.

Sources: Tridge, UkrAgroConsult