.jpg)

1. Weekly News

Bangladesh

Onion Prices in Dhaka Surged 33% MoM in Jul-24

Onion prices in Dhaka, Bangladesh, surged by 33% month-on-month (MoM) in Jul-24, climbing from USD 0.68 to 0.76 per kilogram (kg) to USD 0.93 to 1.02/kg. This rise coincides with India imposing a 40% duty on onion exports and experiencing price increases. Prices of other commodities, such as rice, potatoes, and vegetables, also remained high, while dry spice prices have eased slightly. Industry insiders blame recent floods and continuous rains for disruptions in vegetable production. Wholesalers in markets like Shyambazar and Karwan Bazar sold domestic onions at USD 0.93/kg and Indian onions at USD 0.85/kg, expecting these high prices to persist.

India

Indian Government Boosts Onion Procurement to Stabilize Prices Amid Production Shortfall

The Indian government has initiated a substantial procurement drive to acquire 500 thousand metric tons (mt) of onions, aiming to stabilize market prices during times of need. So far, approximately 71 thousand mthave been procured. This initiative follows a 20% year-on-year (YoY) reduction in onion production in 2024 due to inadequate rainfall in major agricultural regions. Despite these challenges, the market has shown signs of stabilization, and the government expects a large harvest supported by favorable monsoon forecasts. The government eased export restrictions in May -24 in response to market conditions. Still, it maintained a 40% export duty and a minimum export price (MEP) of USD 550/mt to balance local and international market interests.

Italy

Italian Fruit and Vegetable Prices Decline; Onion Prices Show Significant Drop

According to the Italian Telematic Commodity Exchange (Bmti) surveys, fruit and vegetable prices continue to fall in W28. After about a year of high prices due to production difficulties, Italian onion prices have recently dropped. This price decline is due to the new campaign bringing ample supply to the markets, affecting the round red, white, and golden onion varieties. However, the prices of Tropea onions remained stable, with regular demand and supply.

New Zealand

New Zealand and Indonesia Sign New Export Deals for Onions and Pineapples

New Zealand and Indonesia have signed new export deals and a broader cooperation arrangement to enhance two-way trade. The agreements include committing to electronic certification and export plans for New Zealand onions and Indonesian pineapples. The new deal allows New Zealand growers to export onions to Indonesia without fumigation. The Trade and Agriculture Minister, the Indonesia Quarantine Authority (IQA) chairman, signed the updated cooperation arrangement in Auckland on July 9. This arrangement is expected to bolster the USD 1.81 billion trade relationship between the two countries and enhance food safety and animal health cooperation.

2. Weekly Pricing

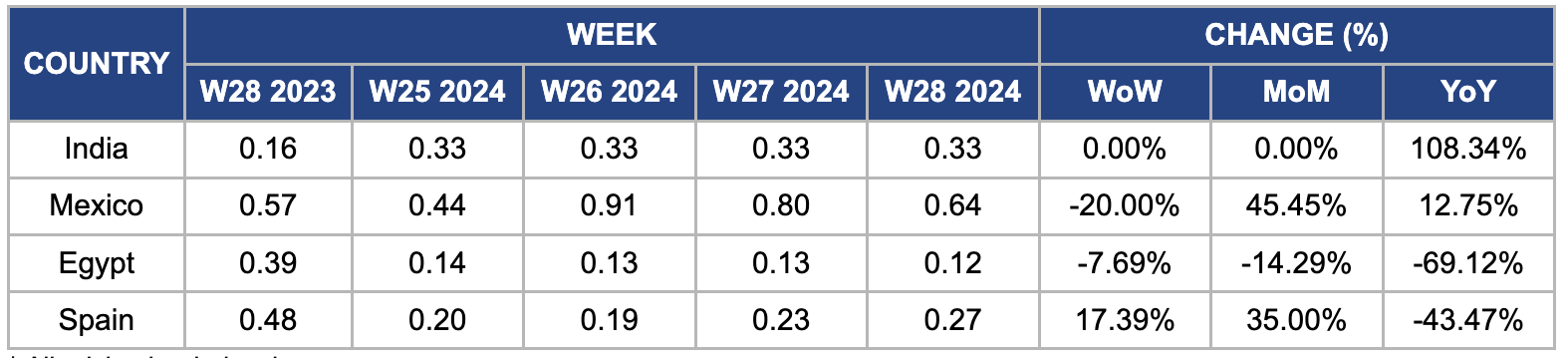

Weekly Onion Pricing Important Exporters (USD/kg)

* Varieties: Netherlands (yellow onion), Mexico (white onion), and India, Egypt and Spain (overall average)

Yearly Change in Onion Pricing Important Exporters (W28 2023 to W28 2024)

* Varieties: Netherlands (yellow onion), Mexico (white onion), and India, Egypt and Spain (overall average)

* Blank spaces on the graph signify data unavailability stemming from factors like missing data, supply unavailability, or seasonality

India

In W28, onion prices in India remained stable at USD 0.33/kg for four consecutive weeks due to an increased supply of Rabi onions and the onset of monsoon rains. The government expects prices to moderate further as supply from major onion-producing regions like Nasik increases. The Agriculture Ministry, in collaboration with state governments, aims to sow onions on 360 thousand hectares (ha) during the Kharif season, up from 280 thousand ha in 2023. Karnataka, a leading producer, has planted 30% of its targeted 150 thousand ha, with good progress also seen in Maharashtra and Andhra Pradesh. Bihar and Odisha plan to increase their onion cultivation areas due to favorable climatic conditions.

Mexico

Mexican onion prices decreased by 20% week-on-week (WoW), falling from USD 0.80/kg to USD 0.64/kg. This decline is due to the start of Mexican onion production, which has helped alleviate supply constraints. Despite this, there remains a tight supply of all onion varieties, mainly white and red onions. However, further relief is anticipated with the imminent start of Texas production for yellow onions, which is expected to begin next week.

Egypt

In W28, Egypt's wholesale onion prices decreased by 7.69% WoW and 14.29% MoM, falling to USD 0.12/kg. Prices have dropped significantly by 69.12% YoY. This decline is due to high stock levels and the suspension of export permits to Saudi Arabia. Despite an adequate supply of Egyptian red onions, prices remain low due to limited competition. In Western Europe, particularly England, there is a strong demand for Egyptian red onions. However, Eastern Europe's preference for lower-priced yellow onions from the Netherlands poses a competitive challenge for Egyptian exports this season.

Spain

In W28, Spain's wholesale onion prices surged by 17.39% WoW, reaching USD 0.27/kg, up from USD 0.23/kg in W27. This price increase is driven by a significant shortage in the market caused by a reduced supply both nationally and globally. Spanish late onion production has decreased by 45 to 50% YoY this season compared to previous years, with the area dedicated to this crop falling by nearly 30% YoY due to poor results in prior campaigns.

3. Actionable Recommendations

Strengthen Procurement and Storage Initiatives in India

India should expand its onion procurement and storage initiatives to manage price volatility effectively. Increasing the procurement target and investing in additional cold storage facilities can help stabilize market prices during production shortfalls. Optimizing the distribution network to ensure timely and efficient delivery of onions to various markets can alleviate regional price disparities and enhance overall market stability. Countries importing Indian onions, such as Bangladesh and Nepal, would benefit from a more consistent supply and potentially lower prices if India’s production stabilizes.

Facilitate Trade Agreements and Export Opportunities in New Zealand and Indonesia

New Zealand and Indonesia should continue to leverage their trade agreements to expand onion export opportunities, focusing on enhancing food safety and animal health cooperation. Developing joint marketing strategies and exploring new market opportunities are also crucial. New Zealand would benefit from increased market access for onions in Indonesia and other Southeast Asian markets. Indonesia would gain access to high-quality New Zealand onions. Both countries could also benefit from strengthened trade relations and enhanced market opportunities.

Support Agricultural Innovation and Climate Adaptation in Egypt

Egypt should invest in agricultural innovation and climate adaptation strategies, such as improving onion varieties and investing in climate-resilient farming practices. Enhancing partnerships with international buyers and exploring alternative export markets are also crucial. Stabilizing domestic prices and improving its competitive position in global markets would benefit Egypt. Importing Western European countries, such as the UK and Germany, would benefit from a more reliable supply of Egyptian onions.

Sources: Agrimaroc, Terraevita, FruitNet, The Business Standard, Fresh Market