1. Weekly News

Global

Global Table Grape Exports Hit Four-Year Low But Expected To Rebound in 2024/25 Season

A recent report from Rabobank, a global leader in food and agriculture financing, reveals that the global table grape exports dropped to a four-year low of 4.2 million metric tons (mmt) due to adverse weather in Europe and the United States (US). Despite this, a rebound is expected in the 2024/25 season, with signs of recovery in weather-affected regions. The US saw a significant decline in export share, decreasing from 45% to 36% over the past decade, with US growers particularly impacted by Storm Hilary. Europe faced extreme weather and market stagnation, while China and India emerged as major exporters. Although premium pricing for new grape varieties softened, their expansion will drive future growth.

Cyprus

Cyprus Grape Production Severely Impacted by Drought and Extreme Weather in 2024

Grape production in Cyprus, both for wine and table varieties, faced severe challenges due to an unusual drought and extreme weather conditions. Grape vineyards covering around 7 thousand hectares (ha) experienced low rainfall and unprecedented high temperatures throughout May, June, and July. These conditions have particularly affected the wine-producing regions in the Troodos Mountains and areas around Limassol and Paphos, leading to lower-than-anticipated yields. The table grape sector has also suffered, with common varieties like green and burgundy grapes notably absent from the market. Moreover, hailstorms damaged vineyards in regions such as Paphos, Pitsilia, and the western parts of Limassol. With 2024 being one of the most challenging years for Cyprus' grape industry, ongoing evaluations aim to quantify the full extent of the losses.

Greece

Greek Grape Production Drops by 30% YoY Due to Extreme Weather Conditions

Greece's grape production declined substantially this season, with overall volumes estimated to decrease by 30% year-on-year (YoY). This drop is primarily due to two consecutive mild winters and an exceptionally hot and dry summer. Crimson grapes have been particularly affected, with production expected to fall by 50% YoY. In contrast, newer grape varieties have shown greater resilience. Despite the reduced availability, Greek exporters maintain their export levels to primary markets, including the United Kingdom (UK) and other overseas destinations. To address future risks, they are prioritizing the introduction of more resilient grape varieties that can better withstand extreme weather and require less labor. While production may decrease, grape quality remains high, particularly for popular varieties like Cotton Candy and Sweet Globe.

Russia

Dagestan Anticipates Increased Grape Production in 2024

The Dagestan region of Russia is projected to see higher grape yields in 2024, with over 110 thousand tons already harvested, primarily for processing. Vineyard expansion is underway, with 980 ha planted in spring 2024 and plans for an additional 264 ha in the fall. The region aims to harvest approximately 300 thousand tons in 2024, exceeding last year's 280 thousand tons by 14 thousand tons. So far, Dagestan has processed 90 thousand tons of the current harvest, producing 2.8 million decaliter (dal) of alcoholic beverages. Furthermore, a new quality standard is being developed for wine produced in the Derbent district.

Spain

Spain's 2024 Grape Harvest Expected to Increase Amid Challenges from Drought and Diseases

Spain's grape harvest is progressing, with the southern regions nearing completion while the central and northern areas continue their campaigns. The national forecast predicts production between 38 to 40 million hectolitres (hL), an increase from last year's 32 million hL, which was significantly affected by drought. However, the harvest remains inconsistent across different regions. In Andalusia, the Jerez area experienced a 25% increase in grape yield, while Montilla-Moriles has reported lower-than-expected output. Castilla-La Mancha, Spain's largest grape-producing region, is currently 45% complete with its harvest and anticipates a 33% YoY increase. In contrast, Catalonia and La Rioja are facing difficulties, with a 40% YoY reduction in grape production in Catalonia due to drought and the emergence of mildew and other diseases in both regions. Despite these challenges, the overall quality of the grapes remains high.

2. Weekly Pricing

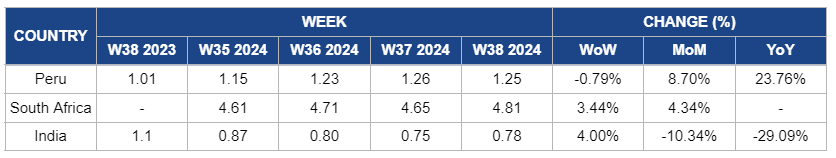

Weekly Grape Pricing Important Exporters (USD/kg)

* Varieties: Chile (Thompson Seedless), Peru (Grape Italia), and India (Green Grape)

Yearly Change in Grape Pricing Important Exporters (W38 2023 to W38 2024)

* Varieties: Chile (Thompson Seedless), Peru (Grape Italia), South Africa (White Seedless), and India (Green Grape)

* Blank spaces on the graph signify data unavailability stemming from factors like supply unavailability, missing data, or seasonality

Peru

In Peru, grape prices decreased slightly by 0.79% week-on-week (WoW) to USD 1.25 per kilogram (kg) in W38. This decline is due to cloudy weather conditions that have affected harvesting and delayed some shipments. Additionally, currency exchange rate fluctuations may contribute to this minor price drop, as a stronger local currency could increase prices in the international market. Moreover, there is an 8.70% month-on-month (MoM) increase and a 23.76% YoY surge due to Peru's ongoing strong position as the leading grape exporter, bolstered by high global demand and the benefits of an extended growing season. These factors continue to support overall price levels despite the recent dip.

South Africa

South Africa's grape prices in W38 increased slightly by 3.44% WoW to USD 4.81/kg, reflecting a 4.34% MoM increase. This is due to renewed demand as consumers respond positively to recent quality improvements from enhanced vineyard management practices. Additionally, the stabilization of supply levels after the temporary easing in demand in the previous week has contributed to this price uptick. The continued investment in advanced technologies has ensured that quality remains high, further supporting price resilience in the market.

India

In India, there is a 4% WoW increase in grape prices during W38 due to a slight improvement in demand as consumers begin to respond to the favorable pricing environment. Despite this short-term uptick, looking at MoM and YoY prices, the prices declined by 10.34% MoM and 29.09% YoY. The overall decline remains influenced by a high supply in the market stemming from increased cultivation efforts. While production quality has been affected by heatwaves and insufficient rainfall, the robust supply continues to exert downward pressure on prices, resulting in significant YoY reductions.

3. Actionable Recommendations

Introduce Resilient Grape Varieties for Future Sustainability

Grape producers in Greece should prioritize the cultivation of resilient grape varieties, such as Cotton Candy and Sweet Globe, which can better withstand extreme weather conditions and require less labor. By investing in these varieties, producers can mitigate the impacts of climate change and ensure more stable yields. Implementing advanced irrigation systems will also further support grape health during drought, helping maintain export levels and overall quality despite adverse environmental conditions.

Adapt to Changing Export Dynamics with Strategic Crop Management

Table grape producers in the US and EU should focus on diversifying their export markets and adjusting crop management practices in response to recent global export declines. Specifically, they should explore new market opportunities in regions like China and India while investing in premium grape varieties, such as Cotton Candy, Sweet Globe, and Midnight Beauty, to capitalize on evolving consumer preferences. As adaptive strategies, improved weather monitoring and soil management will enhance resilience against adverse weather conditions and ensure consistent quality and supply for the upcoming season.

Enhance Vineyard Management for Sustained Price Stability

Grape producers in South Africa should continue investing in advanced vineyard management practices to maintain and enhance grape quality. This includes implementing precision agriculture technologies and regular monitoring of soil health and crop conditions. By ensuring high-quality produce, growers can respond effectively to increased consumer demand, ultimately stabilizing prices in the market. Producers should also focus on marketing strategies such as highlighting quality improvements through social media campaigns, collaborating with retailers for in-store promotions, and participating in trade shows to showcase their premium products. These efforts will help attract more buyers and strengthen brand recognition.

Sources: Tridge, TASS, Efeagro, Freshplaza, Kvedomosti, Fruitnet, MXfruit