1. Weekly News

Azerbaijan

Azerbaijan's Strawberry Exports Increased by 12% YoY from Jan-24 to Jul-24

From Jan-24 to Jul-24, Azerbaijan exported 19.7 thousand tons of strawberries, with an export value of USD 25.212 million. This represents a 12% year-on-year (YoY) increase in volume and a 5% YoY rise. In 2023, the country exported 17.5 thousand tons worth USD 24.9 million. However, according to the State Statistics Committee, the average export price dropped by 6.7% YoY in 2024, from USD 1.37 per kilogram (kg) to USD 1.25/kg (AZN 2.33/kg to AZN 2.12/kg).

Brazil

High Strawberry Production in Brazil Leads to Price Drops Amid Pest Issues

Despite several challenges, strawberry production in Rio Grande do Sul, Brazil, remains strong. High supplies in regions like Caxias do Sul and Bom Princípio have caused prices to drop, ranging from USD 2.21 to 5.53/kg (BRL 12 to 30/kg), depending on quality. While plant quality is generally high, low humidity has led to pest problems, including aphids and powdery mildew. Harvest delays due to weather and pest control efforts are required in some areas. Meanwhile, regions like Pelotas are dealing with high humidity and bird attacks, which have lowered crop quality, while Santa Rosa reports better yields.

Egypt

Climate Challenges and High Production Costs Impacted Strawberry Production in Egypt in 2024

Strawberry growers in Egypt are facing significant challenges due to climate change and rising production costs. Increasing temperatures impact crop health and phytosanitary conditions, making it challenging to maintain yields compared to previous seasons. In 2024, the cost of cultivating strawberries reached approximately USD 9 thousand per acre, resulting in initial prices exceeding USD 8/kg. Additionally, rising costs for labor, transportation, and seedlings, coupled with the Egyptian pound's devaluation, further strain producers' margins and complicate their ability to operate profitably in the current market.

Kyrgyzstan

Increased Berry Imports from Kyrgyzstan to Tyumen Oblast

In Sep-24, the Tyumen Oblast experienced a significant rise in the import of fresh berries from Kyrgyzstan, with a 49% YoY increase in volume. Since the beginning of the month, over 20 tons of raspberries, strawberries, and other berry varieties have been delivered to the region. These imports were subject to phytosanitary inspections by the Federal Service for Veterinary and Phytosanitary Supervision of Russia, which confirmed that the shipments were free from quarantine pests.

Turkmenistan

Year-Round Strawberry Production Thrives in Turkmenistan

In Turkmenistan, strawberry farmers grow crops multiple times yearly, even during the cooler autumn and winter months. The most popular is the Albion variety, prized for its large size and sweetness. Greenhouses near Ashgabat help maintain stable temperatures, ensuring consistent quality. Despite summer ending, fresh strawberries are still available in local markets at around USD 5.58/kg (EUR 5/kg). Over a ton is harvested daily, supplying local demand and exports to Russia, Kazakhstan, and Uzbekistan.

2. Weekly Pricing

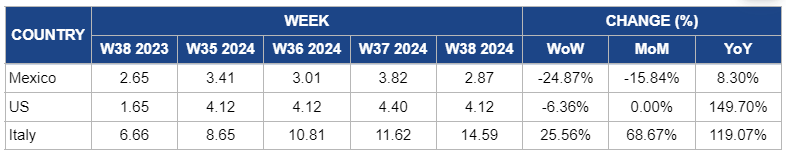

Weekly Strawberry Pricing Important Exporters (USD/kg)

Yearly Change in Strawberry Pricing Important Exporters (W38 2023 to W38 2024)

* Blank spaces on the graph signify data unavailability stemming from factors like missing data, supply unavailability, or seasonality

Mexico

Strawberry prices in Mexico decreased dramatically by 24.87% week-on-week (WoW) to USD 2.87/kg in W38, reflecting a 15.84% month-on-month (MoM) decline. This is due to an unexpected short-term increase in supply as growers accelerated harvesting to meet previous market demand surges. Improved weather conditions also supported a temporary boost in production. However, despite this price drop, ongoing concerns about long-term production challenges, such as drought and unseasonal rainfall, may cause further volatility in the coming weeks.

United States

In the United States (US), strawberry prices declined by 6.36% WoW in W38 to USD 4.12/kg due to slightly improved supply levels, as weather conditions stabilized following the earlier heatwaves and drought. However, ongoing coastal flood warnings in key strawberry-growing regions continue to pose production risks. Moreover, MoM prices remained stable, while there was a substantial 149.70% YoY increase, reflecting the lingering impact of last year's weather-related disruptions, severely reducing supply and driving up prices.

Italy

In W38, strawberry prices surged by 25.56% WoW to USD 14.59/kg due to ongoing adverse weather conditions, particularly heavy rainfall warnings in key strawberry-growing regions. This further disrupted supply chains and limited availability. Moreover, there is a significant 68.67% MoM increase, driven by persistent supply shortages, and a notable 119.07% YoY surge, reflecting the compounded effects of extreme weather challenges over the past year, severely impacting production and contributing to the substantial price hikes.

3. Actionable Recommendations

Invest in Climate-Resilient Practices and Operational Efficiency

Strawberry growers in Egypt should adopt climate-resilient farming methods by planting heat-tolerant varieties like Albion and San Andreas and implementing advanced drip irrigation systems to maintain yields under rising temperatures. Optimizing labor management through better workforce scheduling and task automation, along with using cost-effective transportation solutions like consolidating shipments, will also help reduce overhead costs. These strategies will enable producers to stabilize profitability and navigate the challenges posed by climate change and rising operational expenses.

Implement Integrated Pest Management and Quality Control Practices

Strawberry producers in Rio Grande do Sul should adopt integrated pest management (IPM) strategies to combat issues like aphids and powdery mildew. This includes regularly monitoring pests through field inspections and pheromone traps, applying biological controls such as introducing beneficial insects like ladybugs to control aphid populations and using pest-resistant strawberry plant varieties like Albion and San Andreas. Producers should also focus on quality control practices during harvest to mitigate the effects of environmental challenges like humidity and bird attacks, ensuring better yields and stable prices.

Strengthen Weather-Resilient Supply Chains

Strawberry producers should strengthen weather-resilient supply chains by improving drainage systems in growing regions to mitigate the impact of heavy rainfall and investing in protective infrastructure like greenhouses. These actions will help minimize supply disruptions and stabilize production, ensuring more consistent availability and helping to manage future price volatility.

Sources: Tridge, ABC.AZ, Portal Do Agronegocio, 24 KG, mir24.tv, Msn, Freshplaza, Eastfruit