W26 2024: Beef Weekly Update

.jpg)

1. Weekly News

Denmark

Denmark is Set to Implement the Tax on Greenhouse Gas Emissions

Denmark is set to become the first country to enforce a tax on methane emissions from its cows and pigs, starting in 2030. This pioneering measure underscores Denmark's commitment to environmental sustainability and its efforts to combat significant sources of greenhouse gasses, particularly methane, which has a potent impact on global warming. The initiative is part of Denmark's ambitious goal to reduce greenhouse gas emissions by 70% from 1990 levels by 2030.

Under this plan, Danish farmers will initially pay USD 43.2 (DKK 300) per metric ton (mt) of carbon dioxide equivalent in 2030. This tax will increase to USD 107.99 (DKK 750) by 2035. However, after accounting for a 60% income tax deduction, the actual cost per mt will start at USD 17.28 (DKK 120) and rise to USD 43.20 (DKK 300) by 2035.

South Korea

South Korean Farmers Call for Urgent Stabilization of Hanwoo Prices

With a deepening deficit among Hanwoo farmers due to auction prices falling below production costs, urgent short-term measures are needed to stabilize prices. Farmers are calling for immediate actions such as swift market isolation and the military meal services expansion. Their demands include the enactment of the Hanwoo Act, guaranteeing minimum production costs, promoting consumption, supporting feed cost differences, and reducing feed prices and slaughter fees. The Ministry of Agriculture, Food and Rural Affairs (MAFRA) has proposed measures like extending feed purchase fund repayment and revising the Livestock Act, but these are seen as insufficient for immediate relief. With each fattening cattle shipped incurring a USD 1,440.19 (KRW 2 million) deficit primarily due to rising feed prices, fundamental solutions such as a feed price stabilization fund and support for direct transaction businesses are crucial. Immediate government purchases, expansion of meal programs, and large-scale consumption promotion are essential to prevent further financial strain on farmers.

United States

USDA’s Proposal to Boost Fairness and Competition in the Livestock and Poultry Markets

On June 25, the United States Department of Agriculture (USDA) proposed the Fair and Competitive Livestock and Poultry Markets rule to advance the Biden-Harris administration's goal of creating a fairer, more competitive, and resilient meat and poultry supply chain. This rule aims to clarify the interpretation of "unfair" practices under the Packers and Stockyards Act, enabling better enforcement and transparency. The agricultural secretary emphasized that the rule would help lower consumer prices and ensure fair practices for producers.

However, the Meat Institute criticized the rule, arguing that it would introduce market uncertainty, disrupt demand signals, and lead to trivial lawsuits. The Meat Institute contended that these changes would harm producers, packers, and consumers, particularly during periods of low cattle supply. Despite record-high cattle prices in 2023 and a bullish outlook for 2024, the Meat Institute warned that the rule could undermine the benefits of increased beef demand and fail to stand up in court, as similar past attempts have failed.

2. Weekly Pricing

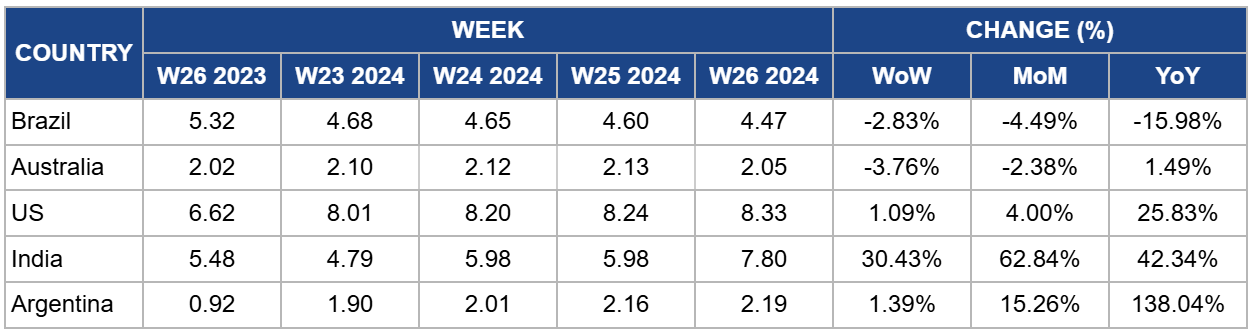

Weekly Beef Pricing Important Exporters (USD/kg)

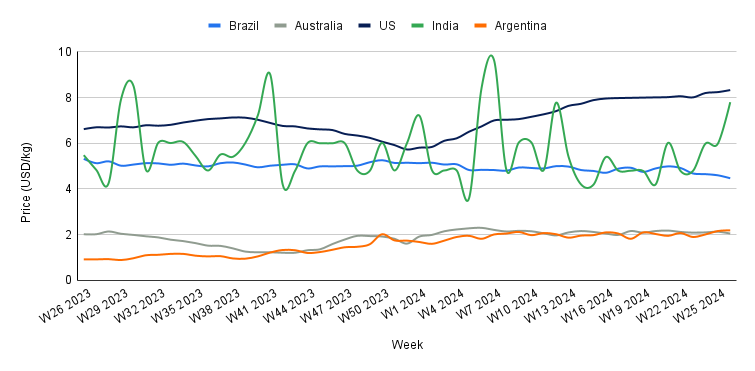

Yearly Change in Beef Pricing Important Exporters (W26 2023 to W26 2024)

Brazil

The wholesale price of boneless rear beef in Brazil averaged USD 4.47 per kilogram (kg) in W26. This represents a 2.83% week-on-week (WoW) drop, a 4.49% month-on-month (MoM) decrease, and a 15.98% year-on-year (YoY) decline. Despite these changes in USD, the price in Brazilian real (BRL) remained steady at BRL 25.00/kg for the fourth consecutive week. This stability suggests that the WoW drops in USD are due to the devaluation of the real against the US dollar. However, the significant YoY decline is primarily attributed to a high beef supply in the Brazilian market, resulting from increased production. According to the USDA, Brazil’s beef production is projected to rise by 2% YoY to 11.2 million metric tons (mmt) in 2024, driven by strong export demand and low cattle prices that are encouraging higher slaughters.

Australia

Australia's national young cattle indicator averaged USD 2.05/kg in W26, a 3.76% WoW drop, and a 2.38% MoM decline. This price drop could be attributed to variations in supply at different saleyards. According to Meat and Livestock Australia (MLA), yardings in Queensland saw a significant increase to approximately 18.59 thousand heads, even as other states experienced decreases. MLA also reported that the Queensland indicator price in W26 was the lowest so far in 2024. While market results in Roma were positive, other saleyards in the state largely remained below the national price.

United States

In W26, the average price of lean beef (92% to 94%) in the United States (US) stood at USD 8.33/kg, a 1.09% WoW increase and a substantial 25.83% YoY rise. These price hikes are attributed to a reduced beef supply in the market, driven by a decrease in US beef production due to prolonged droughts. According to researchers from the University of Missouri have reported a 13% YoY decrease in US cow slaughters so far in 2024. This market outlook highlights the significant impact of the drought on US cattle herds, with no imminent signs of recovery.

India

In W26, the average price of beef (cow) in India was USD 7.80/kg, marking a 30.43% WoW rise, a 62.84% MoM increase, and a 42.34% YoY uplift. These significant price hikes underscore the volatility of the Indian beef market, which has been notably pronounced over the past year. This volatility is primarily driven by both domestic and international regulations, as well as fluctuations in the supply within the Indian market.

Argentina

The average price of beef (steer) in Argentina reached USD 2.19/kg in W26, marking a 1.39% WoW increase, and a 15.26% MoM rise. A rebound in demand due to the holidays likely drove these price hikes. Argentines observed four public holidays in June and are approaching Independence Day on July 9, 2024. Despite this recent surge in demand, beef consumption has remained low in recent months due to the challenging economic environment, leading many consumers to choose more cost-effective options like poultry. The Chamber of Industry and Commerce of Meats and Derivatives of the Argentine Republic (CICCRA) reports that purchasing power dropped by approximately 13% YoY in the first half of 2024, negatively impacting access to various basic basket products, including beef.

3. Actionable Recommendations

Strategies for Sustainable Farming and Financial Resilience

As Denmark prepares to enforce a groundbreaking tax on methane emissions in 2030, Danish farmers and agricultural stakeholders should proactively adapt to mitigate financial impacts and capitalize on potential benefits. Farmers should invest in methane-reducing technologies and sustainable farming practices to lower emissions and consequently reduce their tax burden. Exploring alternative livestock management techniques, such as feed additives that inhibit methane production or breeding programs for low-emission animals, will be critical. Additionally, forming cooperatives can help small and medium-sized farms pool resources to implement these changes more efficiently.

Strategic Measures for Price and Cost Stability

To address the urgent crisis faced by Hanwoo farmers due to auction prices falling below production costs, the government should expedite market isolation measures and expand military meal services to absorb excess supply. Implementing the Hanwoo Act to guarantee minimum production costs will provide long-term stability. Meanwhile, short-term solutions like direct government purchases and large-scale consumption promotion campaigns can alleviate immediate financial pressures. Establishing a feed price stabilization fund and providing subsidies to offset feed costs will address the core issues driving the deficit. Also, collaboration with financial institutions to extend repayment terms for feed purchase funds will offer temporary relief.

Navigating Regulatory Changes and Ensuring Compliance

To navigate the implications of the USDA's proposed Fair and Competitive Livestock and Poultry Markets rule, stakeholders across the supply chain should engage in constructive dialogue with regulators to ensure balanced implementation. Producers and packers should assess and potentially adjust their operational practices to align with new transparency and fairness requirements. Legal teams should prepare for possible litigation and seek clarity on ambiguous aspects of the rule to minimize disruptions. Also, collaboration with industry associations to advocate for practical adjustments that mitigate unintended consequences will be crucial.

Additionally, investing in technology to enhance traceability and compliance can provide a competitive edge. Educating consumers on the benefits of the rule in promoting fair practices could help mitigate any negative perceptions and bolster demand. Monitoring market responses and being agile in operational strategies will help businesses adapt to the evolving regulatory landscape without significant detriment.

Sources: Agromeat, Korea Farmers and Fishermen Newspaper, USDA, MLA, Brownfield