.jpg)

1. Weekly News

Brazil

Brazilian Government Initiates Program to Boost Rice Production

The Brazilian government plans to support rice production by facilitating a public options contract program to boost the harvest by 1 million metric tons (mmt). The Agriculture Minister announced this initiative as part of efforts to ensure ample domestic supply. The decision follows the cancellation of an auction for imported rice due to suspected irregularities, noting that current market prices have stabilized. The options contract program, estimated to cost approximately USD 310 million (BRL 1.7 billion), allows the government to commit funds only if producers exercise their right to sell to the state, stimulating domestic production without immediate financial outlay.

China

USDA Forecasts Stable Rice Production and Higher Stockpiles in China for 2024/25

According to the United States Department of Agriculture's (USDA) Grain Report, China's rice production for the 2024/25 marketing year (MY) is forecasted at 145 mmt, a slight increase from the previous season, supported by a slightly expanded harvested area of 29 million hectares (ha). Milled rice imports are projected to decline to 1.5 mmt, while exports are expected to decrease to the same volume, 1.5 mmt, compared to the previous period. Domestic consumption is anticipated to decrease to 140 mmt, with domestic stocks forecasted to rise to 111.12 mmt, indicating stable production levels and higher stockpiles for the upcoming season.

India

Impact of Export Restrictions on India's Rice Trade

Indian rice exports from Apr-23 to Jun-24 of the 2023/24 financial year (FY) decreased by nearly 34% year-on-year (YoY) to 3.2 mmt due to export bans on non-basmati white rice and broken rice and a 20% tariff on parboiled rice. Specifically, non-basmati white rice exports plummeted 78% YoY to 300 thousand metric tons (mt), broken rice fell 8% to 300 thousand mt, and parboiled rice dropped 11% to 1.5 mt. The government banned broken rice exports in Sept-22 to ensure sufficient supplies for animal feed. The non-basmati white rice ban was announced last Jul-23 to secure domestic food security and stabilize prices amid reduced crop output from El Niño-related disruptions. Despite these restrictions, basmati rice exports increased by 16% YoY to 1.1 mmt. In the 2024 FY, India exported 15.7 mmt of rice, down from 21.8 mmt in the 2023 FY, with notable declines in non-basmati white rice and broken rice exports. India, the world's second-largest rice producer and leading exporter, previously contributed significantly to the global rice trade before the imposition of export curbs.

Vietnam

Vietnam Sees Increased Rice Harvest and Exports in H1 2024, Import Prices Remain Competitive

In the first half of 2024, Vietnam's rice harvested area increased by 0.5% YoY to 3.48 million ha, with an average yield of 6.71 mt/ha, resulting in a total yield of 23.3 mmt, up 1.6% YoY. Vietnam's rice exports reached 4.65 mmt, a 10.4% increase YoY, earning USD 2.98 billion, a 32% rise. Despite being the second-largest rice exporter, Vietnam imported USD 670 million rice worth in the first half of the year, primarily from Cambodia and India, for feed production and processing. In W26, the export price for Vietnamese rice with a 5% broken rate was USD 575 to 580/mt, slightly higher than the previous week but still USD 18 lower than Thai rice. Rice prices rose due to reduced import taxes by the Philippines but are not expected to surge significantly due to the ongoing harvest season and abundant supply.

2. Weekly Pricing

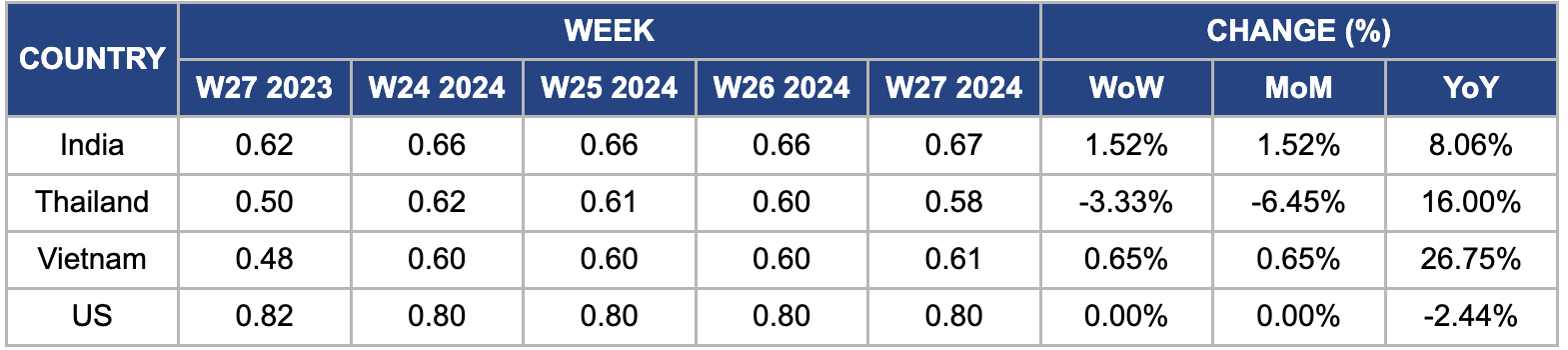

Weekly Rice Pricing Important Exporters (USD/kg)

Yearly Change in Rice Pricing Important Exporters (W27 2023 to W27 2024)

India

In W27, wholesale rice prices in India increased by 1.52% week-on-week (WoW) to USD 0.67 per kilogram (kg) after three weeks of stability. India's rice export prices reached a nearly three-month high this week due to rising demand and the government's 5.4% increase in the paddy procurement price for the new season, setting it at USD 27/100 kg (INR 2,300/100 kg). Despite this hike, Indian rice remains competitively priced compared to other sources.

Thailand

In W27, wholesale rice prices in Thailand declined by 3.33% WoW, dropping from USD 0.60/kg to USD 0.58/kg. According to a trader based in Bangkok, there is a slowdown in rice exports due to the Philippines considering changes to its import policy, including potentially lowering import taxes. Moreover, new rice supplies are anticipated to enter the market in Jul-24, which could contribute to further price decreases in the upcoming weeks.

Vietnam

In W27, Vietnamese regular rice prices slightly increased by 0.65% WoW to USD 0.61/kg, marking a significant 26.75% YoY increase. This rise is due to a projected 1.4% YoY decrease in Vietnam's rice output for the 2023/24 crop year, totaling 27.8 mmt. Despite challenges expected for Southeast Asian rice exporters in 2024, Vietnam saw increased harvests and yields in the first six months of 2024, leading to higher exports in both volume and value due to elevated prices. Vietnam's Ministry of Agriculture and Rural Development reported harvesting crops on 3.48 million ha of paddy fields, a 0.5% YoY growth, with an average yield of 67.1 mt/ha, up 0.7 mt/ha.

United States

In the United States (US), the wholesale price of milled white long rice remained stable at USD 0.80/kg in W27, reflecting a modest 2.44% YoY decrease. Several factors are influencing rice prices and production this year. The El Niño weather pattern has caused issues for rice growers globally but has had minimal impact in Arkansas so far. India's moratorium on rice exports reduces competition for US growers in export markets, and the US export market has remained strong and is expected to continue through 2024. Additionally, lower worldwide rice stocks from companies involved in the rice industry are a positive indicator for the US rice market. However, potential bearish factors include the possibility of larger crops leading to lower yields, the strong US dollar impacting agricultural commodities, the lifting of India's export ban, and the unpredictable weather affecting production.

3. Actionable Recommendations

Public Options Contract Program to Boost Rice Production

The Brazilian government's initiative to implement a public options contract program aims to boost rice production by 1 mmt. This program, costing around USD 310 million, incentivizes increased production by committing funds only when producers opt to sell to the state. To optimize the program's impact, Brazil should prioritize transparency and efficiency in implementation to foster trust among producers. Moreover, investing in infrastructure upgrades such as irrigation systems and storage facilities will support expanded rice production capabilities. Promoting the adoption of high-yield and climate-resilient rice varieties will further enhance productivity, ensuring sustainability amid climate variability challenges.

Risk Management and Market Diversification Strategies in the US Rice Market

The US rice market dynamics are influenced by factors such as El Niño weather patterns, India's export policies, and the strength of the US dollar. The US should closely monitor weather patterns and implement adaptive strategies to mitigate potential impacts on rice production. Leveraging the strong export market requires competitive pricing and ensuring high-quality rice production standards. Exploring opportunities to expand rice markets and diversify crop production will help mitigate risks associated with price fluctuations in the global market.

Technology Adoption for Yield Enhancement

Accelerate adoption of precision agriculture technologies and sustainable farming practices to optimize rice yields and improve resilience to climate change. Promote digital tools for precision irrigation, soil health monitoring, and pest management. Invest in farmer education and extension services to facilitate technology uptake and knowledge transfer. By enhancing productivity sustainably, Vietnam can meet the growing global demand for high-quality rice and strengthen its export competitiveness.

Sources: Foodmate, Agrinet, UkrAgroConsult, NoticiasAgricolas, Portal Do Agronegócio, Manilatimes