1. Weekly News

India

Gujarat's Peanut Cultivation Expected to Rise by 20% YoY in 2024/25 Season

India's peanut cultivation in Gujarat is forecasted to increase by 20% year-on-year (YoY) in the 2024/25 season due to favorable weather conditions and shifting agricultural patterns. Discouraged by low soybean prices over the past three years and the current low prices for cotton, farmers turned to peanut cultivation as a replacement for cotton and soybean. However, the market faces challenges with substantial old stocks and fluctuating prices influenced by export demand and regional production variances.

Australia

Uncertainty for Queensland Peanut Growers Amid Bega Group's Strategic Review

Based in Kingaroy, Australia, leading Australian dairy and food company Bega Group announced a strategic review to investigate various alternatives for its peanut company in Australia. This announcement has brought uncertainties to peanut growers in Queensland, who are now anxiously awaiting the review's outcome to understand its implications for their crop. Some farmers have indicated they will shift to soy or mung beans if they cannot continue growing peanuts

2. Weekly Pricing

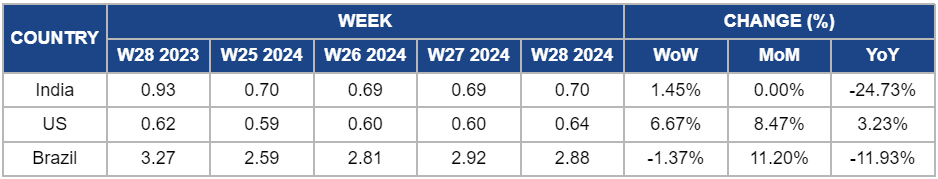

Weekly Peanut Pricing Important Exporters (USD/kg)

Yearly Change in Peanut Pricing Important Exporters (W28 2023 to W28 2024)

.png)

India

Peanut prices in India increased by 1.45% week-on-week (WoW) to USD 0.7 per kilogram (kg) in W28 due to high inventory levels and low demand from China. Insufficient rain and heat have disrupted India’s peanut harvest, damaging crops and increasing storage and logistic fees. Despite these challenges, India’s peanut cultivation in Gujarat is expected to grow in the 2024/25 season due to the pressed soybean and cotton margin. Given the current high stock level, peanut prices will largely depend on export demand.

United States

Peanut prices in the United States (US) stood at USD 0.64/kg in W28, an increase of 6.67% WoW compared to USD 0.60/kg in W27. The United States Department of Agriculture (USDA) forecasts a return to average levels for peanut production in 2024. This anticipated rebound is predicted to stabilize or lower peanut prices.

Brazil

Brazil's peanut prices decreased by 1.37% WoW to USD 2.88/kg in W28, after a significant WoW increase in W27. The surge in peanut consumption in Jun-24 due to Festa Junina has slowed down, leading to decreased prices. Despite this recent decrease, peanut prices are expected to remain strong in the short term due to stable global and local demand.

3.Actionable Recommendations

Capitalize on Increased Peanut Cultivation in Gujarat

India's anticipated 20% YoY increase in Gujarat's peanut cultivation presents a significant opportunity. India should support farmers with advanced agricultural techniques, high-quality seeds, and efficient irrigation systems to capitalize on this growth. However, addressing the challenges of old stock and price fluctuations is equally essential. This will require better storage facilities and market strategies to enhance export demand.

Mitigate Uncertainty for Queensland Peanut Growers

The strategic review by Bega Group has created uncertainty for Queensland's peanut growers. To mitigate this, farmers should diversify their crop portfolios by considering alternatives like soy or mung beans. Engaging in dialogue with Bega Group and exploring potential partnerships or support programs can provide stability. The Australian government should support farmers through financial assistance and advisory services that can help them navigate this transitional period and maintain their livelihoods.

Leverage Stable Demand for Market Growth

Despite the recent price decrease, Brazil can leverage the stable demand for peanuts to foster market growth. Promoting peanut-based products and value-added processing can increase domestic and international demand. Investing in storage infrastructure and logistics will ensure the quality of peanuts during off-peak seasons. Engaging in marketing campaigns and strengthening trade relationships can further enhance Brazil's position in the global peanut market.

Sources: Queenslandcountrylife, CMB News