W22 2024: Strawberry Weekly Update

1. Weekly News

Russia

Russian Strawberry Prices See Steady Decline Since May-24 Despite Yearly Retail Price Increase

Since May-24, strawberry prices in Russia have been declining, with wholesale prices reaching USD 2.44 per kilogram (RUB 216.9/kg) as of May 28, 2024. Despite a nearly 20% average retail price increase of strawberries in Russia over the year due to frosts, the Russian Minister of Agriculture announced that strawberry prices in the country would be adjusted in Jun-24, indicating that frosts did not significantly impact the Russian strawberry harvest.

Economic and Geopolitical Factors Drive 20% YoY Increase in Strawberry Prices in Russia

Strawberry prices in Russia increased by 20% year-over-year (YoY) in the 2024 season. Fresh and canned fruits like strawberries, cherries, apricots, and peaches now cost USD 6.69/kg (EUR 6.15/kg). Experts predict that berry prices could rise by 30% this 2024 season due to higher production costs, falling ruble value, and supply chain disruptions. Geopolitical issues and sanctions also impact strawberry prices more than weather conditions. A significant portion of berries and fruit in Russian markets is imported, with strawberries mainly coming from Turkey, Morocco, and Egypt. Domestic berry farming faces substantial challenges, as industrial-scale farming heavily relies on fertilizers, often from abroad. Establishing a berry farm requires significant investment, and berry harvesting is labor-intensive and must be done by hand. Despite mechanization, only a few farms invest in crops like blackcurrants and cherries, and bank financing is nearly impossible to secure.

Switzerland

Early Start and Promising Harvest for Switzerland's 2024 Strawberry Season

The 2024 strawberry season in Switzerland began early in Mar-24 due to favorable weather conditions. Fruit-Union Switzerland estimates a good harvest of around 7.6 thousand metric tons (mt) with excellent quality. The harvest commenced about a week earlier than anticipated, spurred by unusually high temperatures in Mar-24, and is projected to peak between May 20 and June 9. The country's strawberry cultivation spans approximately 491 hectares (ha), with national production ranging from 7 thousand to 7.7 thousand mt annually.

United States

Extreme Rainfall Severely Impacts Ohio's Strawberry Production

The extreme rainfall in Ohio dealt a severe blow to strawberry production at Bloom and Berries Farm in Loveland, causing them to lose nearly half of their 125 thousand plants. The lack of sunlight has impeded sugar development and flavor enhancement, leading to less flavorful berries. The region's strawberry crops have also been affected by winter freezes, further reducing their availability and necessitating sourcing from locations three to six hours away.

2. Weekly Pricing

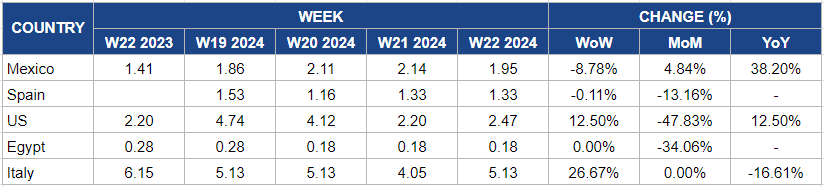

Weekly Strawberry Pricing Important Exporters (USD/kg)

Yearly Change in Strawberry Pricing Important Exporters (W21 2023 to W21 2024)

.png)

* Blank spaces on the graph signify data unavailability stemming from factors like missing data, supply unavailability, or seasonality

Mexico

Strawberry prices in Mexico decreased by 8.78% week-over-week (WoW) during W22 to USD 1.95/kg, compared to USD 2.14/kg in W21. However, prices increased by 4.84% month-on-month (MoM) and a 38.20% YoY rise. This price surge is due to decreased cultivation, export volume contraction, and a 30% rise in production costs, reducing supply and affecting consumer prices.

Spain

In W22, strawberry prices in Spain remain unchanged at USD 1.33/kg since W21. However, there is a 13.16% MoM increase. The price stability is influenced by several factors, including weather conditions such as extreme temperatures, frost, hail, and excessive rainfall, which affect crop yields and quality, as well as demand-supply dynamics and transportation costs. Additionally, while strawberries are available year-round, about 80% of the harvest occurs between February and May, making this period crucial for supply and price fluctuations.

United States

United States (US) strawberry prices increased by 12.5% WoW in W22 to USD 2.47/kg compared to USD 2.20/kg in W21. However, there is a significant 47.83% MoM decrease. The WoW increase can be attributed to a slight correction following the previous week's sharp decline caused by oversupply in other major strawberry-producing regions. Despite this, the overall price remains lower due to the ongoing impact of the increased supply from these regions.

Egypt

In W22, strawberry prices in Egypt remained unchanged at USD 0.18/kg for three consecutive weeks. However, there is a notable 34.06% MoM decrease. Despite June being the off-season for strawberries in Egypt, the industry has shown resilience in facing challenges such as inflation, currency devaluation, and the Red Sea crisis. Rising demand and expansion into new markets, particularly for frozen strawberries, have helped maintain stable prices.

Italy

Despite June being the off-season for strawberries in Italy, the price of strawberries in Italy increased by 26.67% WoW to USD 5.13/kg in W22, compared to the previous price of USD 4.05/kg. This increase comes after a significant decrease in W20, where prices dropped by 21.05% WoW. The market experienced a 37.5% MoM decrease in W20, primarily due to increased production from Northern Italy and lower-quality goods from Basilicata. However, in W22, the price rebounded, potentially indicating a shift in market dynamics or seasonal factors.

3. Actionable Recommendations

Stabilizing Strawberry Prices in Russia Amid Market Fluctuations

A multifaceted strategy is recommended to address the recent decline in strawberry prices in Russia and ensure market stability. The Ministry of Agriculture should enhance support for domestic strawberry producers through subsidies and investment in frost-resistant crop varieties to mitigate weather-related impacts. Strengthening import regulations and tariffs for strawberries from primary suppliers like Türkiye, Azerbaijan, Serbia, and Moldova can help protect local farmers from excessive price drops. Additionally, launching promotional campaigns to boost domestic consumption and exploring export opportunities can balance supply and demand, stabilize prices, and support the Russian strawberry market.

Enhancing Resilience in Strawberry Production Amid Extreme Weather in Ohio

It is crucial to adopt resilient agricultural practices to mitigate the impact of extreme rainfall and winter freezes on strawberry production. The experience at Bloom and Berries Farm in Loveland is a pertinent example highlighting the importance of such measures. Investing in advanced drainage systems and raised bed planting can help prevent waterlogging and root damage. Implementing greenhouse or high tunnel structures can protect crops from adverse weather, extend the growing season, and improve sugar development and flavor enhancement. Additionally, diversifying sourcing partnerships with nearby regions and investing in crop insurance can provide financial stability and reduce dependency on distant suppliers, ensuring a consistent supply of strawberries despite local climate challenges.

Sources: Tridge, Freshplaza, Fructidor, Kvedomosti