1. Weekly News

Brazil

Brazilian Grape Exports Dropped by 69% in H1-24

In the first half of 2024 (H1-24), Brazilian grape exports plummeted by 69% compared to the same period in the previous year, totaling nearly 5 thousand tons. The export value dropped by 65% year-on-year (YoY), reaching just USD 14 million. This sharp decline was mainly due to a low supply and poor grape quality caused by heavy rains between Feb-24 and Apr-24 in the Vale do São Francisco region (Pernambuco and Bahia states), which affected the key exporting areas. Additionally, high domestic prices for white seedless grapes further reduced exports. In contrast, grape imports rose by 17.4% YoY, reaching 7.8 thousand tons and USD 16.4 million, as Brazil aimed to make up for the domestic shortfall, resulting in a negative trade balance in H1-24.

Peru

Peruvian Table Grape Industry Expects Strong Recovery for 2024/25 Season

Peru's table grape industry is working on recovering production levels after a challenging 2023/24 campaign, which saw exports fall to nearly 62.7 million 8.2 kilograms (kg) boxes from 71.4 million the previous season. The Peruvian Association of Table Grape Producers and Exporters (PROVID) is optimistic about rebounding for the 2024/25 season, with an estimated 78.7 million 8.2-kg boxes. This recovery, especially in northern Peru, follows a period of climate-related challenges. The industry adapted by incorporating new grape varieties and increasing yields per hectare. To maintain market trust and avoid oversaturation, PROVID focuses on quality across all markets, including Mexico, Latin America, and Asia. Major production regions include Ica, Piura, and Lambayeque. Peruvian table grapes are expected to reach over 50 global markets, with key destinations such as the United States (US), Europe, and China. PROVID will update these projections in October and December.

South Korea

Shine Muscat Grape Production Rises Ahead of Chuseok in South Korea

Shine Muscat grape production in South Korea, especially in areas like Gimcheon, Sangju, and Yeongdong, is expected to increase by up to 30% during the upcoming Chuseok holiday. Despite smaller berries caused by a recent heatwave, the grapes maintain high quality, with a sugar content of over 15 Brix. While prices have been low due to higher production, a slight rebound is possible during the holiday season as demand increases. However, the overall price outlook remains uncertain due to the impact of high temperatures and early shipments on fruit quality.

Turkey

Heavy Rains Devastate Grape Harvest in Alaşehir, Turkey

Severe weather in Alaşehir, Turkey, has heavily damaged the grape harvest. Intense rainfall and flooding hit the Tepeköy, Akkeçili, Infantry, and Türkmenköy neighborhoods, causing the Karacalar Creek to overflow and wash away grapes drying in an 80.9 hectare area in Tepeköy. Around 60% of sultana grapes were damaged. Despite efforts by local authorities such as Alaşehir Municipality teams, residents are now using potash to prevent the remaining grapes from rotting due to moisture.

Vietnam

Chinese Grapes Flood Vietnamese Market with Record-Low Prices

Chinese grapes like Peony, Queen, and Ruby flood the market in Vietnam at sharply reduced prices. Over the past five years, China has expanded its grape exports from primarily green and red seedless varieties to include mid-range and high-end types previously imported from the US, Japan, and Korea. In Aug-24, Peony grapes were sold for as low as USD 1.85/kg (VND 46,000/kg), a 30% YoY drop. Queen grapes prices stood around USD 12.06/1.2-kg box (VND 300,000/1.2-kg box), and Ruby grapes prices stood at about USD 11.26/8 kg (VND 280,000/8 kg). This price drop is due to the harvest season and large import volumes, which allow wholesalers to offer discounts. From Jan-24 to Jul-24, Vietnam imported nearly 117 tons of Chinese grapes, a 50% YoY increase. This surge is partly due to reduced local production in Ninh Thuận, which is impacted by unfavorable weather. China remains a significant fruit supplier to Vietnam, holding a 35% market share.

2. Weekly Pricing

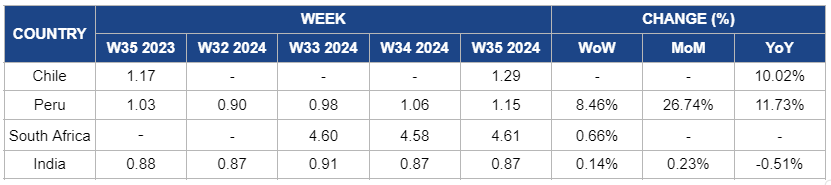

Weekly Grape Pricing Important Exporters (USD/kg)

* Varieties: Chile (Thompson Seedless), Peru (Grape Italia), and India (Green Grape)

Yearly Change in Grape Pricing Important Exporters (W35 2023 to W35 2024)

* Varieties: Chile (Thompson Seedless), Peru (Grape Italia), South Africa (White Seedless), and India (Green Grape)

* Blank spaces on the graph signify data unavailability stemming from factors like supply unavailability, missing data, or seasonality

Peru

In Peru, grape prices continue to increase, rising 8.46% week-on-week (WoW) to USD 1.15/kg in W34, compared to the previous price of USD 1.06/kg. There is also a 26.74% month-on-month (MoM) and 11.73% YoY increase. This upward trend is driven by Peru's dominant position as the world's leading grape exporter, with significant annual growth in export volumes. Despite global stagnation in the grape trade and increased competition from countries like China and India, Peru's extended growing season and strong export demand allow it to maintain and potentially raise prices. The robust export performance and high global demand have led to higher prices domestically and abroad.

South Africa

South African grapes increased slightly by 0.66% WoW to USD 4.61/kg in W34. This modest rise in price reflects improvements in vineyard management practices, particularly the innovative use of drones to disperse predatory wasps for pest control, which has significantly reduced leafroll virus and mealybug infestations. This enhanced pest management is expected to stabilize and boost grape yields and quality. These advancements' positive impact on vineyard health contributes to the price increase, offsetting some of the previous market volatility and supporting a more stable pricing trend for South African grapes.

India

In W34, India's grape prices increased by 0.14% WoW and 0.23% MoM to USD 0.87/kg. This modest price rise is due to the adverse effects of recent weather conditions, including a significant heatwave during the main growing months and insufficient post-monsoon rains in 2023. These factors have contributed to lower grape production, resulting in reduced supply. Despite rainfall being 7% above normal from Jun-24 to Aug-24, the previous weather challenges have already impacted output. As a result, while demand remains steady, the industry is maintaining relative stability with only modest price increases as production struggles to meet market needs.

3. Actionable Recommendations

Enhance Flood Mitigation Strategies for Grape Harvests

Local grape growers and authorities in Alaşehir should invest in improved flood mitigation strategies to prevent future damage from severe weather. This includes installing better drainage systems and flood barriers to protect vineyards during heavy rains. Additionally, adopting advanced weather forecasting tools will help plan timely interventions to safeguard crops. Implementing these measures will reduce the impact of extreme weather events and protect grape harvests from similar damage.

Focus on Quality and Market Expansion to Rebuild Grape Exports

PROVID should prioritize maintaining high quality across all markets to rebound from the decline in table grape exports. By focusing on quality control and expanding market reach, including enhancing exports to the US, Europe, and China, PROVID can rebuild trust and prevent market oversaturation. Additionally, PROVID should continue to incorporate new grape varieties, such as Sweet Globe, Allison, and Timpson, and refine production practices to increase yields per hectare, ensuring a successful 2024/25 season and sustained growth in global markets.

Improve Grape Quality and Diversify Export Markets

To address the significant decline in grape exports, Brazil should invest in adopting advanced farming techniques and expanding into emerging markets. The sharp drop in exports, driven by heavy rains and high domestic prices, underscores the need for improved quality control. By implementing advanced farming practices such as precision agriculture, climate-resilient grape varieties, and integrated pest management, Brazil can enhance grape quality and yield, making exports more competitive. Simultaneously, exploring emerging markets will help diversify Brazil's export base and reduce dependence on traditional markets, aiding in balancing the trade deficit. This dual approach will stabilize the export sector and strengthen Brazil's position in the global grape market.

Sources: Tridge, Sondakika, DHA, Nongmin, MXfruit, Portaldelcampo, VNExpress, Farmer.pl, CNN, Business Standard