.jpg)

1. Weekly News

Brazil

Rio Grande do Sul Projects 5.3% YoY Increase in Rice Planting Area for 2024/2025 Harvest

On August 26, the Rio Grande do Sul Rice Institute (IRGA) announced its projections for the 2024/2025 rice harvest. The state plans to increase its planted rice area to 948,356 hectares (ha), marking a 5.3% year-on-year (YoY) rise from the 900,203 ha cultivated in the previous harvest. This expansion will primarily result from growth in the Internal Coastal Plain, which will see an 8.2% increase (10,907 ha), and the South Zone, which is set to grow by 7.5% (11,668 ha). The Outer Coastal Plain will be the only region to see a reduction, with a 600 ha decrease (0.6%). Meanwhile, the Campanha region will expand by 785 ha (0.6%), the Western Frontier by 17,640 ha (6.7%), and the Central region by 7,753 ha (6.5%).

Ghana

Ghana Imposes Rice Export Ban to Address Local Shortages

The Ghanaian government, through the Ministry of Food and Agriculture (MOFA), banned the export of maize, rice, and soybeans on August 26 to stabilize the local market. The ban is in response to the shortfall in local grain production caused by dry spells affecting key cultivation regions. The minister stated that the export ban would immediately take effect and remain in place until the situation improves.

Japan

Japan Faces Rice Shortage Amid Surge in Demand and Earthquake Fears

Concerns about a rice shortage are escalating in Japan, with supermarket shelves growing increasingly bare due to surging demand. The situation worsened following the recent earthquake warning for the Nankai Trench, prompting consumers to stockpile rice. Japan is in a transitional phase as new rice supplies are released, and the Ministry of Agriculture, Forestry, and Fisheries (MAFF) has urged the public to stay calm and assured that the shortage will soon be resolved. The restaurant industry is feeling the strain, with high rice prices driving operational costs. In Jul-24, rice prices surged 18% YoY, marking the most significant increase in two decades. This spike is partly due to heightened demand from foreign visitors, with annual tourist numbers expected to hit a record 35 million by 2024.

South Korea

South Korea's Rice Paddy Area Hits Record Low in 2024 Amid Declining Consumption

According to Statistics Korea, South Korea's rice paddy area hit a record low in 2024, dropping by 1.5% YoY. The total area for rice paddies was 687,416 ha in 2024, down from 697,714 ha in 2023. This reduction is part of a broader trend, with the area declining from over 1 million ha in 2004 to 815,506 ha in 2014. The government's efforts to balance rice supply and demand, including subsidies for farmers growing strategic crops like wheat and legumes, have influenced this trend. Additionally, consumption has steadily decreased, reaching an all-time low of 56.7 kilograms (kg) per capita in 2022, despite rice being a staple in Korea.

Vietnam

Vietnam's Rice Exports Surged in Jul-24

According to the Vietnam Grain Association, Vietnam's rice exports totaled 5.3 million metric tons (mmt) in Jul-24, generating USD 3.34 billion in revenue, marking increases of 8.3% YoY in volume and 27.7% YoY in value compared to the previous year. The Ministry of Agriculture and Rural Development (MARD) anticipates a growing demand for rice imports from various countries, predicting an active export market for the remainder of the year. For 2024, the ministry projects Vietnam's rice exports to reach between 7.4 and 8 mmt, with export revenues estimated at USD 5 billion.

2. Weekly Pricing

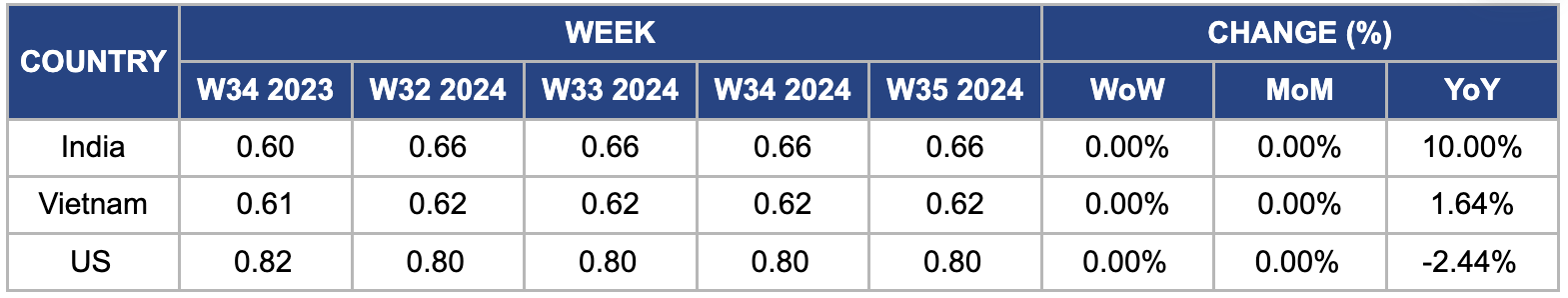

Weekly Rice Pricing Important Exporters (USD/kg)

Yearly Change in Rice Pricing Important Exporters (W35 2023 to W35 2024)

India

In W35, wholesale rice prices in India remained stable week-on-week (WoW) at USD 0.66/kg but saw a 10% YoY increase from USD 0.60/kg. This price rise is due to ongoing food inflation in India, which has hovered around 8% YoY since Nov-23. The inflation is due to supply-side factors, including adverse weather conditions affecting crop yields. Despite the early arrival of monsoon rains and forecasts of above-normal rainfall, food inflation has persisted, contributing to the overall consumer price basket. As food accounts for nearly half of this basket, the elevated prices have kept headline inflation above the central bank's 4% target, hindering any potential interest rate cuts.

Vietnam

In W35, wholesale prices for Vietnamese regular rice remained stable WoW and month-on-month (MoM) but saw a 1.64% YoY increase to USD 0.62/kg, up from USD 0.61/kg in W35, 2023. The significantly rising prices have positioned Vietnamese rice among the most expensive globally. Despite this, Vietnam anticipates record-high rice exports in volume and value, driven by increased demand from traditional trading partners. This trend contrasts with price movements in countries like Thailand and Pakistan. The elevated export prices for Vietnamese rice are due to its unique quality and specific varieties, which are unavailable from other major producers. With strong demand, Vietnamese rice exports are expected to surpass 8 mmt, generating over USD 5 billion, setting a new record for the industry.

United States

In W35, the wholesale price of US-milled white long rice in Arkansas remained stable at USD 0.80/kg, marking a 2.44% YoY decrease. The United States Department of Agriculture (USDA) reports that 23% of the rice in Arkansas was harvested as of W35 ahead of the previous year. Moreover, the US milled rice market has been resilient despite challenges such as banking issues in Iraq and the crisis in Haiti during the summer. Favorable harvest conditions have been pivotal in maintaining market stability. Iraq has resumed purchasing US rice following uncertainties caused by American financial restrictions. Current efforts are focused on strengthening export markets and improving internal relations to sustain this stability.

3. Actionable Recommendations

Increase Rice Production in Rio Grande do Sul

Rio Grande do Sul should focus on expanding its rice production area while improving agricultural practices to enhance yield and sustainability. The state can maximize output/ha by adopting precision farming techniques and optimizing water management. Investing in research and development to introduce high-yield rice varieties tailored to the region's specific conditions will further boost productivity. Strengthening infrastructure, such as irrigation systems, and providing farmers with the necessary resources and training will ensure that the expansion in rice acreage translates into consistent and sustainable production growth.

Address Japan's Rice Shortage with Strategic Supply Management

Japan should address the current rice shortage and prevent future disruptions by strategically managing its rice supply. Increasing the release of new rice stocks into the market and improving distribution channels will help alleviate the immediate shortage. To ensure long-term stability, Japan should invest in expanding domestic production capacity, particularly in regions less susceptible to natural disasters. Developing and promoting the cultivation of high-yield, resilient rice varieties will also be vital to meeting the growing demand. Additionally, the government should enhance communication efforts to prevent panic buying and maintain consumer confidence during supply fluctuations.

Capitalize on Vietnam's Rice Export Growth with Quality and Market Expansion

Vietnam should capitalize on the robust growth in its rice exports by focusing on quality enhancement and market expansion. Vietnam can maintain its competitive edge by continuing to invest in developing premium rice varieties that meet the specific demands of international markets. Expanding into new markets, particularly in regions with rising demand for high-quality rice, will diversify export destinations and reduce reliance on traditional buyers. Strengthening the logistics and supply chain infrastructure will further support the efficient and timely delivery of rice exports, ensuring Vietnam remains a leading global exporter.

Sources: Voh, Modernghana, Foodmate, Portal Do Agronegócio, Almalnews