December 2023 Outlook Report: Fruits & Vegs

Bojan Mijatovic, Juan Carlos

게시됨 2023년 12월 1일

PDF 파일 미리보기

Key Indicators: In Nov-23, global freight prices increased by 10% month-on-month (MoM), marking the first rise in three months, while year-on-year (YoY) prices remained significantly lower by 62%, with the slowest decline pace since Sep-22. The Food and Agriculture Organization of the United Nations Food Price Index, or the FFPI, continued the bearish trend in Oct-23, down 0.5% MoM and 11% YoY. However, certain FFPI products showed slight increases in Nov-23, signaling a potential shift in the overall trend. The World Bank's fertilizer index reached its highest level since Feb-23, rising 2.7% MoM to 161.7, slightly exceeding seasonal expectations.

Apples: In November, China and the United States (US) markets saw mixed price changes for fresh apples. The US is coping with increased supply, pressuring prices down, which forced the United States Department of Agriculture (USDA) to reach the preventive purchase of USD 100 million. Conversely, China Fuji apple volumes have been diminishing, especially the high-quality ones, disrupted by adverse weather and decreased acreage from previous seasons. On the other hand, India and Italy saw stable price trends, and while there are still concerns regarding the demand in Europe, India seems lucrative for apple traders. The December outlook will bring higher prices for the US and China, while India and Italy will face difficulties maintaining current levels.

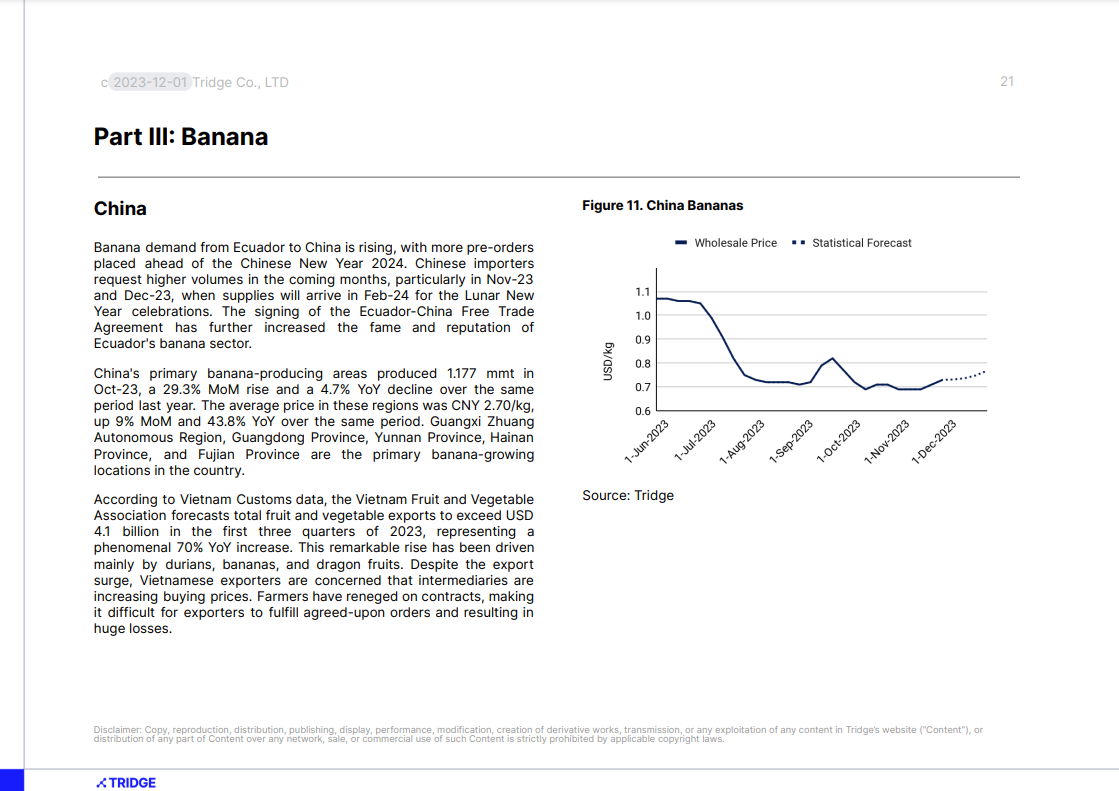

Bananas: In Ecuador, the government plans to set a minimum export price of USD 6.85 per box of bananas starting January 1, 2024, leading to disagreement from the El Oro Banana Producers Association. Ecuadorian banana exports reached USD 2.84 billion globally between Jan-23 and Sept-23, showing a 17.4% YoY increase. Drought-related issues in the Panama Canal affect shipping and the banana industry on South America's west coast. In the US, tropical fruit imports, especially bananas from Ecuador, are increasing. In Europe, the Canary Islands experienced a 30% YoY rise in banana supply, with Tridge expecting stable prices in December. In China, demand for Ecuadorian bananas is growing for Chinese New Year 2024, and despite a slight November increase, prices are predicted to rise in December.

Peppers: Due to low quantities and poor quality induced by the high heat in July and August, greenhouse vegetable prices in Spain have fluctuated. Spain, a significant supplier of peppers and lettuce to Germany, saw wholesale prices rise 9.27% week-on-week (WoW) in November. Peruvian capsicum exports have expanded dramatically, primarily to Mexico. China's fresh bell pepper export volume and value increased YoY, whereas Turkey's pepper shipments to Germany fell.

Durian: Thailand, a significant supplier of fresh durians to China, faces competition from Vietnam, Malaysia, and Indonesia due to increased demand. Thailand's durian exports are projected to be around 700,000 metric tons (mt) valued at almost USD 3 billion to China this year. Overall, the price of durian in these markets is likely to increase in December, driven by upcoming festivities in China.

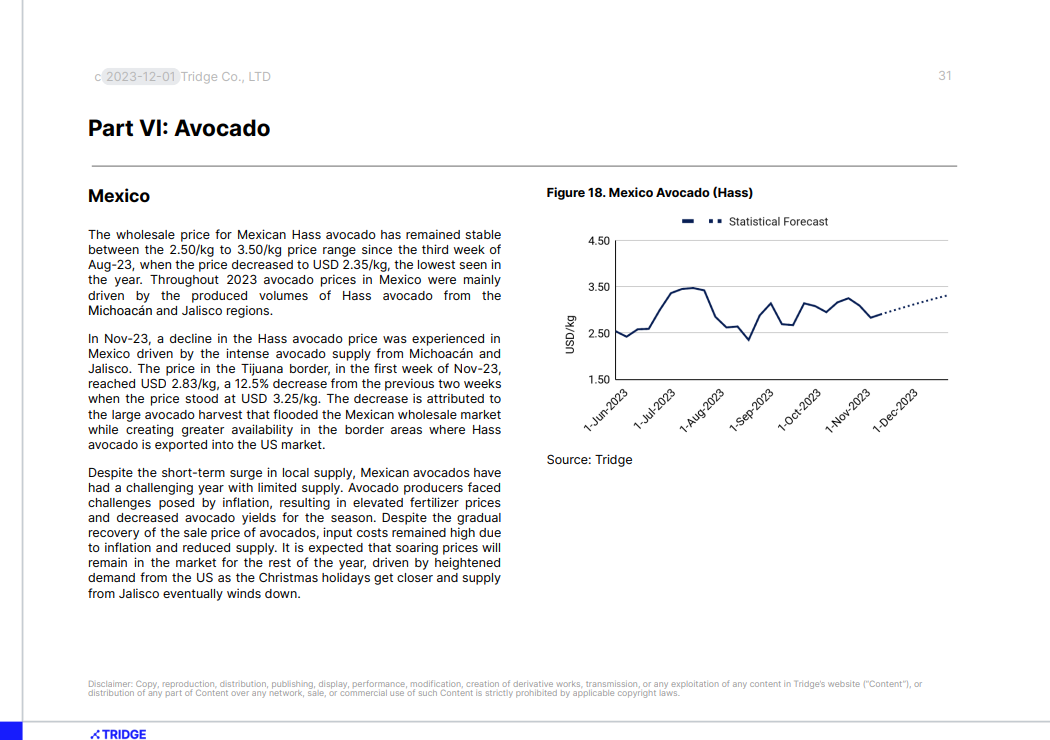

Avocado: In Mexico, prices dipped to USD 2.83 per kilogram (kg) at the Tijuana border due to a supply surplus. Despite challenges, prices are expected to rise gradually in December, fueled by increased demand from the US during the holiday season and reduced supply from local and international sources. In South Africa, as the season is ending, avocado prices are rising, reaching USD 2.25/kg, marking a significant recovery from earlier price drops.

Mango: Mango prices are exhibiting diverse trends in Brazil and Spain. In Brazil, Tommy Atkins mango prices initially increased due to reduced volumes but are now declining with an expanding harvest. Conversely, in Spain, Tommy Atkins mango prices surged as the season concluded, influenced by harvest reductions due to drought. Increased European mango consumption is prompting imports, particularly from Peru. These contrasting price dynamics are anticipated to persist through December.

Onion: Onion markets display divergent patterns across regions. In Mexico, red onion prices have surged since September, driven by a global supply shortage and economic inflation. Conversely, prices have significantly decreased in the US after reaching record highs, attributed to delayed harvests, reduced Peruvian supply, and heightened customer demand. Peruvian red onion prices have also receded from historic peaks, influenced by various market factors.

Apples: In November, China and the United States (US) markets saw mixed price changes for fresh apples. The US is coping with increased supply, pressuring prices down, which forced the United States Department of Agriculture (USDA) to reach the preventive purchase of USD 100 million. Conversely, China Fuji apple volumes have been diminishing, especially the high-quality ones, disrupted by adverse weather and decreased acreage from previous seasons. On the other hand, India and Italy saw stable price trends, and while there are still concerns regarding the demand in Europe, India seems lucrative for apple traders. The December outlook will bring higher prices for the US and China, while India and Italy will face difficulties maintaining current levels.

Bananas: In Ecuador, the government plans to set a minimum export price of USD 6.85 per box of bananas starting January 1, 2024, leading to disagreement from the El Oro Banana Producers Association. Ecuadorian banana exports reached USD 2.84 billion globally between Jan-23 and Sept-23, showing a 17.4% YoY increase. Drought-related issues in the Panama Canal affect shipping and the banana industry on South America's west coast. In the US, tropical fruit imports, especially bananas from Ecuador, are increasing. In Europe, the Canary Islands experienced a 30% YoY rise in banana supply, with Tridge expecting stable prices in December. In China, demand for Ecuadorian bananas is growing for Chinese New Year 2024, and despite a slight November increase, prices are predicted to rise in December.

Peppers: Due to low quantities and poor quality induced by the high heat in July and August, greenhouse vegetable prices in Spain have fluctuated. Spain, a significant supplier of peppers and lettuce to Germany, saw wholesale prices rise 9.27% week-on-week (WoW) in November. Peruvian capsicum exports have expanded dramatically, primarily to Mexico. China's fresh bell pepper export volume and value increased YoY, whereas Turkey's pepper shipments to Germany fell.

Durian: Thailand, a significant supplier of fresh durians to China, faces competition from Vietnam, Malaysia, and Indonesia due to increased demand. Thailand's durian exports are projected to be around 700,000 metric tons (mt) valued at almost USD 3 billion to China this year. Overall, the price of durian in these markets is likely to increase in December, driven by upcoming festivities in China.

Avocado: In Mexico, prices dipped to USD 2.83 per kilogram (kg) at the Tijuana border due to a supply surplus. Despite challenges, prices are expected to rise gradually in December, fueled by increased demand from the US during the holiday season and reduced supply from local and international sources. In South Africa, as the season is ending, avocado prices are rising, reaching USD 2.25/kg, marking a significant recovery from earlier price drops.

Mango: Mango prices are exhibiting diverse trends in Brazil and Spain. In Brazil, Tommy Atkins mango prices initially increased due to reduced volumes but are now declining with an expanding harvest. Conversely, in Spain, Tommy Atkins mango prices surged as the season concluded, influenced by harvest reductions due to drought. Increased European mango consumption is prompting imports, particularly from Peru. These contrasting price dynamics are anticipated to persist through December.

Onion: Onion markets display divergent patterns across regions. In Mexico, red onion prices have surged since September, driven by a global supply shortage and economic inflation. Conversely, prices have significantly decreased in the US after reaching record highs, attributed to delayed harvests, reduced Peruvian supply, and heightened customer demand. Peruvian red onion prices have also receded from historic peaks, influenced by various market factors.

목차

Key Takeaways

Part I: Key Indicators

Freight

Food Price Index

Fertilizer

Part II: Apples

United States

China

Italy

India

Part III: Banana

Ecuador

United States

Europe

China

Part IV: Peppers

Spain

Peru

China

Türkiye

Part V: Durian

Thailand

China

Part VI: Avocado

Mexico

South Africa

Part VII: Mango

Brazil

Spain

Part VIII: Onions

Mexico

United States

Peru

South Africa

관련 시장 데이터

관련 콘텐츠 더 보기

'쿠키 허용'을 클릭하면 통계 및 개인 선호도 산출을 위한 쿠키 제공에 동의하게 됩니다.

개인정보 보호정책에서 쿠키에 대한 자세한 내용을 확인할 수 있습니다.