Ample pork supplies exert pressure on domestic prices in China

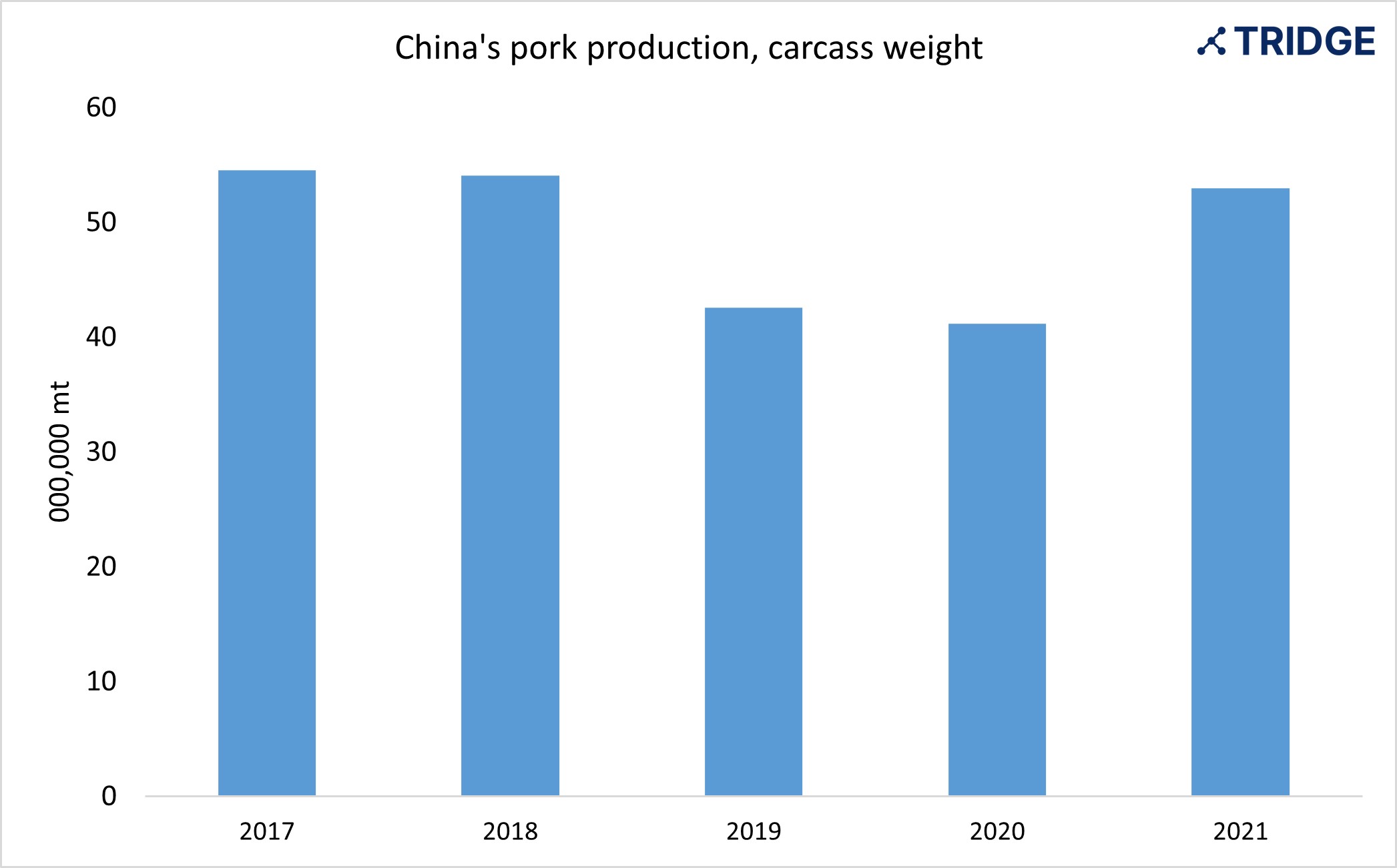

China’s hog herd and sow inventory rose rapidly in 2021, as the country recovered from a disastrous African swine fever (ASF) four years ago. A higher pig population accelerated the slaughter rate in the county. The Chinese Ministry of Agriculture’s (MAGA) data shows that the slaughter rate in the world’s biggest pork-consuming state exceeded 235.89 million pigs from January through November 2021, 66% more YoY. Recent statistics also confirmed the upward production trend as far as the pork output is concerned. According to MAGA, China produced 52.96 million mt of pork in carcass weight last year, up 28.8% from 2020 results.

Source: MAGA

The 2022 pork production in China is projected to increase further, as the sow herd inventory at the end of 2021 exceeded last year’s figure by 4%. The latter will keep a stable level of piglet production in the country. At the same time, farmers will continue to send more hogs for slaughter driven by high production costs and possible threats from another wave of ASF. Given the abovementioned circumstances, some industry agencies have raised China’s pork output forecast in 2022. A bright example comes from the USDA’s forecasts, although their production figures, in general, are lower than that of MAGA. In January’s report, USDA estimated China’s pork production at 49.5 million mt, up 8% compared to 2021.

Wholesale prices under pressure

The existing pork glut has caused wholesale prices in the domestic market to plummet since the beginning of 2021. The wholesale price offering for frozen pork shoulder and ham in Hebei, one of the country’s vital key pork production areas, stood at USD2.68/KG as of January 17, 2022, down 61% YoY. Such a tremendous value plunge harms small producers, who cannot bear high production costs and, therefore, must leave the market to minimize profit losses. Wholesale pork prices may tumble even more within the next two weeks because of increasing slaughter rates ahead of the Lunar New Year.

Source: Tridge

At the same time, the demand for pork from the local population in 2021 was weak due to COVID-19, which limited meat consumption at restaurants and social events. The rapid development of the plant-based protein industry, which offers various meat-flavored products to health-conscious consumers, also diverts some pork market share. Although this alternative market is still relatively small, its value is expected to reach USD12 billion by 2023 (read more on The global plant-based meat protein market increases rapidly). More people in China have become aware of animal production’s adverse impact on the environment. This attitude is gradually shifting consumers’ preferences towards plant-based products.

China’s pork import decreases

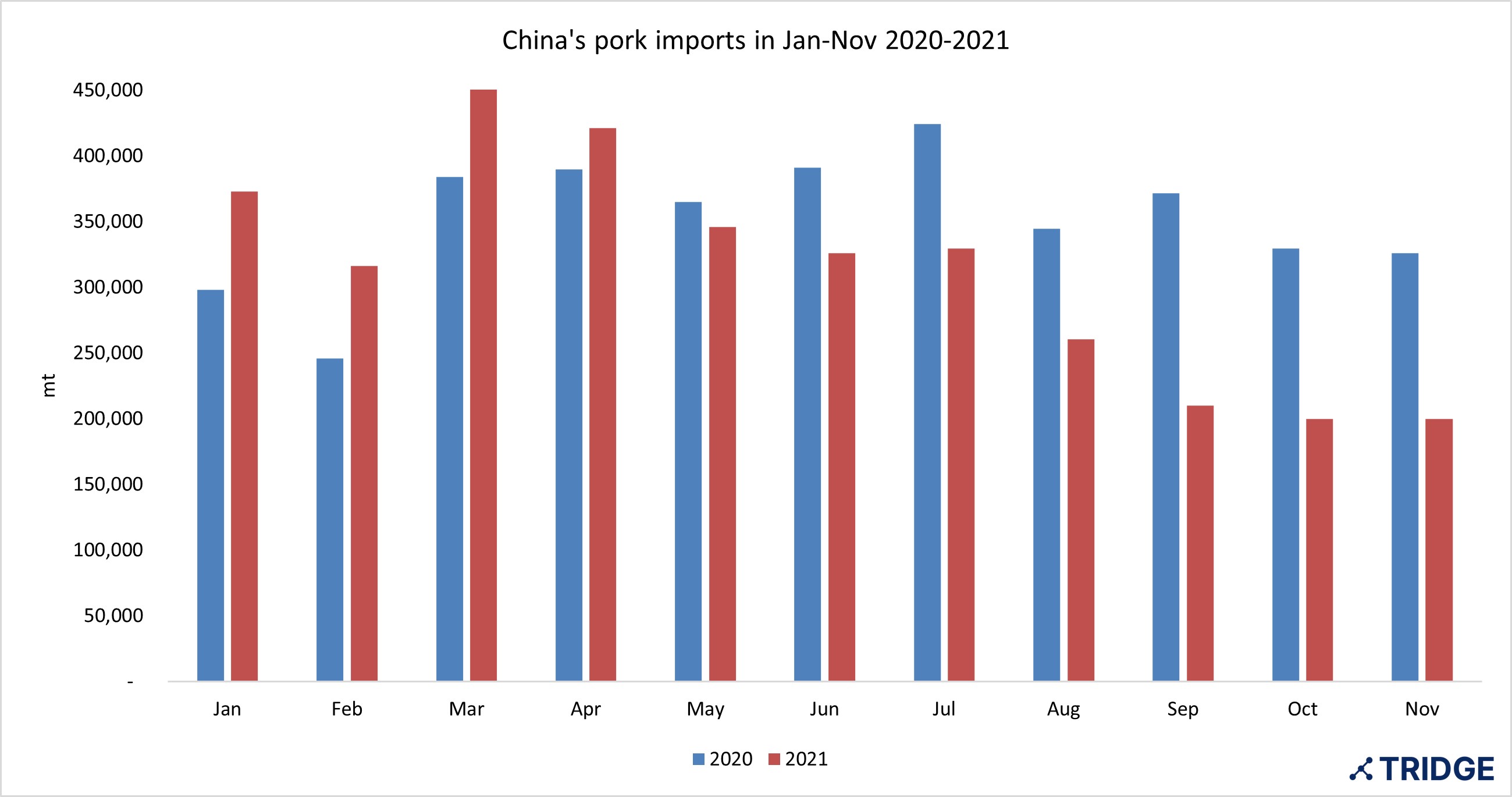

The existing pork oversupply also affected the country’s meat trade flow in 2021. In the first 11 months of last year, China’s pork imports equaled 3.43 million mt, 11.3% less than in the same period of 2020. The most significant imports drop was in August-November 2021 when substantial volumes of domestic pork meat loomed into the market.

Source: ITC Trade Map, China Business Industry Research Institute

China’s pork imports are forecast to decrease further in 2022, as the government has taken tariff measures to balance the unfavorable price situation. On 15 December, China’s Finance Ministry announced a rise in import duties for frozen pork products (HS codes: 030222, 030229) from 8% in 2020 to 12%, effective from January 1, 2022. In its January report, USDA forecast Chinese pork imports at 4.2 million mt in 2022, down 6.7% YoY.

Sources:

Tridge.com. Price charts

Rabobank. Pork Quarterly Q4 2021: New Pressures Expected to Curb Growth

Reuters. China's sow herd at end-Nov rises 4.7% from year earlier -ag ministry

Pig Progress. China’s sow herd rose 4.7% in November 2021

National Bureau of Statistics of China. National Economy Continued to Recover with Expected Development Targets Well Achieved in 2021

CGTN. China's pork oversupply may cause huge losses for producers, warns minister

FAS USDA. Livestock and Poultry: World Markets and Trade

Reuters. China to levy higher tariffs on pork imports in 2022 amid supply glut

QQ.com. Statistical analysis of China's pork import data from January to November 2021