In W20 in the banana landscape, some of the most relevant trends included:

- Cameroon exported 16.83 thousand tons of bananas in Apr-25, a 0.4% YoY decline, mainly due to reduced shipments from Plantations du Haut Penja, while Europe remained the top market.

- Colombia expects a 5% YoY growth in banana production by end-2025, supported by improved weather in Urabá and enhanced disease control, although rising costs and labor shortages pose challenges.

- Costa Rica anticipates lower banana exports in 2025 due to climate impacts, but steady US demand and tariff dynamics suggest its position in the global market will remain resilient.

- India’s Burhanpur region saw a strong export boost in 2024/25 due to favorable weather and growing exporter interest.

- Kyrgyzstan increased banana imports to nearly 6 thousand tons in 2025, with Ecuador supplying over 90%, while imports from China, Russia, and Turkey declined. India emerged as a new supplier.

- Panama faced a major disruption in its banana sector as Chiquita permanently closed farms in Bocas del Toro amid a prolonged strike, threatening Q1-25 export revenue of USD 324.4 million.

1. Weekly News

Cameroon

Cameroon’s Banana Exports Remain Resilient with Strong Demand from Europe and G7 Markets

Cameroon exported 16.83 thousand tons of bananas in Apr-25, marking a slight 0.4% year-on-year (YoY) decline. This total was driven by four producers, with state-owned Cameroon Development Corporation (CDC) increasing its exports by 30% to 3.30 thousand tons and Mondoni Banana Company rising by 42% to 1.71 thousand tons. However, the overall volume was weighed down by a 10.6% YoY export decrease from Plantations du Haut Penja, the country’s largest exporter, which exported 11.04 thousand tons, along with a slight decline from Boh Plantations. Europe remains the main destination for Cameroonian bananas, with the United Kingdom (UK) accounting for 13% of exports and generating nearly USD 11.33 million (EUR 10 million) annually. In 2023, Cameroon’s banana exports to G7 countries, including Canada, France, Germany, Italy, Japan, the UK, and the United States (US), were valued at USD 70.3 million (CFA francs 42.9 billion), underscoring the industry’s continued importance to foreign trade.

Colombia

Colombia’s Banana Industry Projects 5% Production Growth Despite Ongoing Challenges

Colombia’s banana industry anticipates a 5% year-on-year (YoY) production increase by the end of 2025 compared to 2024. This growth is due to a favorable first-quarter weather, particularly unexpected rainfall in the Urabá region. Additionally, improved agronomic practices, such as better soil analysis and more effective disease control against Black Sigatoka, a leaf-spot disease affecting banana plants, have also contributed to the expected increase. These advancements have raised productivity to over 2 thousand boxes per hectare (ha), contributing to local economic growth through job creation and increased farmer income. However, rising operational costs from disease management and adopting bio-inputs under a regenerative agriculture approach pose financial challenges. The industry also remains alert to the ongoing US tariff dispute, as the US accounts for nearly 24% of Colombia’s banana exports, over 15 million boxes annually, and supports around 7.8 thousand direct jobs across 7.8 thousand ha. While tariffs on major competitors help maintain a balanced international trade environment, a critical labor shortage driven by a lack of generational renewal threatens harvest schedules and product quality, both crucial for meeting export demands.

Costa Rica

Costa Rica’s Banana Exports Remain Resilient Despite Climate and Tariff Challenges

By 2025, Costa Rica anticipates a decline in banana export volumes, mainly due to climate-related challenges. This decline is not due to competition from other countries or fruits, as Costa Rica exports nearly all of its banana production. Although a recent report from Argentina’s National University forecasted an 18% drop in US imports of Costa Rican bananas due to reciprocal tariffs, Costa Rica’s National Banana Corporation disputes this, highlighting the price inelasticity of banana demand and steady consumption across all income levels in the US, the world’s largest per capita banana consumer. The 10% reciprocal tariff also affects key exporters like Ecuador, limiting the potential for substitution. Moreover, the additional tariff cost is typically absorbed by importers, resulting in only minor price increases for consumers. Bananas continue to be the most affordable fruit in the US fresh produce market, with prices largely unchanged for over two decades despite inflation. This strong demand and stable market positioning suggest Costa Rican bananas will retain their export resilience amid external pressures.

India

Banana Exports Rise in India’s Burhanpur Region Due to Favorable Weather

Banana exports from Burhanpur, which account for around 15% of India’s total production, are projected to rise in 2025 due to favorable summer rainfall that improved growing conditions. In the 2024/25 financial year, Burhanpur exported approximately 70 thousand metric tons (mt), while overall production exceeded 1.7 million metric tons (mmt). With about 140 truckloads arriving daily, the region is experiencing a strong supply to meet increasing demand from local markets, particularly Gujarat and Punjab, and international buyers. The combination of favorable weather and high-quality yields has sparked greater interest from exporters and motivated more local farmers to engage directly in export activities. Key transit hubs for banana shipments from Madhya Pradesh include Burhanpur, Khandwa, Dhar, and Barwani.

Kyrgyzstan

Kyrgyzstan’s Banana Imports Increase Significantly in 2025

In 2025, Kyrgyzstan’s banana imports rose to nearly 6 thousand tons, up from 5.8 thousand tons in 2024. Ecuador maintained its dominant position by supplying over 90% of the total, 5.39 thousand tons in early 2025, compared to 5.03 thousand tons the previous year. India entered the market as a new exporter with 41.8 tons, while Turkey, which had shipped 73.5 tons in 2024, stopped exports entirely. At the same time, imports from China and Russia declined notably, with volumes dropping from 362.4 to 163.8 tons and from 430.2 to 391.2 tons, respectively, signaling a shift in Kyrgyzstan’s sourcing preferences toward more consistent or competitively priced suppliers.

Panama

Chiquita Panama Permanently Suspends Banana Production Due to Prolonged Strike

In Panama, Chiquita has permanently halted operations on one banana farm in Bocas del Toro. It has also stopped operations on additional land equivalent to two more farms due to a prolonged union strike, now in its third week, protesting a proposed social security reform. The disruption has already caused over USD 10 million in losses and jeopardizes the country’s leading agricultural export, with Chiquita managing 26 farms across nearly 7 thousand ha and producing about 90% of Panama’s bananas. The strike threatens job security for 6 thousand direct and 24 thousand indirect workers, while international buyers begin shifting to other sources. Despite government assurances that the reform does not affect banana workers’ benefits, unions remain on strike in solidarity with public industry teachers, deepening the impact on the agricultural industry. Bananas continue to be Panama’s top export, representing 17.5% of foreign sales in Q1-25 and generating USD 324.4 million, the highest quarterly value in 15 years, now at risk amid ongoing disruptions.

Peru

Peruvian Banana Exports Dropped in Apr-25

Peru exported 13.7 thousand tons of fresh bananas worth USD 11.05 million in Apr-25, marking a 9% YoY drop in volume and a 12% YoY decline in value, with the average price falling 3.1% YoY to USD 0.80 per kilogram (kg). The Netherlands remained the top destination, importing 4,965 tons valued at USD 4.1 million despite a 12% YoY decrease in volume, supported by a 6% YoY rise in average price to USD 0.83/kg. The US followed, but saw a sharper 14% YoY drop in volume and a 38% YoY fall in value, as prices declined significantly by 28% to USD 0.71/kg. In contrast, Panama was the only growing market, with shipments up 27% to 1.77 thousand tons and value increasing 43% YoY, driven by a 13% YoY price rise to USD 0.79/kg. Euroandinos Port Terminals handled 99% of all banana exports. Leading exporters included Pronatur SAC, Agronegocios Los Ángeles SAC, and Cooperativa Agraria Agroexportadora del Norte, each targeting key markets such as the Netherlands, Panama, the US, the UK, and Sweden.

South Africa

South Africa and Tanzania Maintain Cooperative Banana Trade Relations Despite Import Ban Rumors

South Africa has clarified that there has never been a ban on Tanzanian banana imports, countering recent media claims and reaffirming its strong agricultural trade ties with Tanzania. The South African Department of Agriculture highlighted ongoing collaboration between the two countries, including successful market access for Tanzanian avocados over the past four years. In Feb-25, Tanzania formally requested access to the South African market for bananas, prompting a scientific Pest Risk Analysis (PRA) by South Africa’s National Plant Protection Organization to assess potential biosecurity risks, particularly from the Fusarium Tropical Race 4 (Foc Tr4) fungus. This analysis, aligned with international phytosanitary standards, is still underway to determine safe import conditions. South Africa has not received any official ban notice from Tanzania, and both nations remain committed to transparent, science-based trade as they await the PRA’s conclusion to move forward with banana import protocols.

2. Weekly Pricing

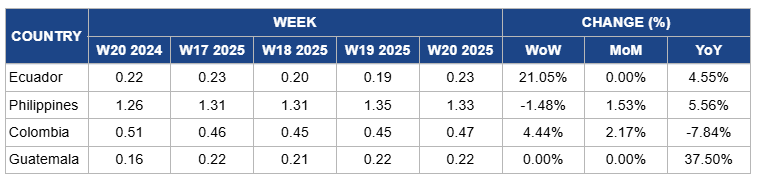

Weekly Banana Pricing Important Exporters (USD/kg)

Yearly Change in Banana Pricing Important Exporters (W20 2024 to W20 2025)

Ecuador

In W20, banana prices in Ecuador surged by 21.05% week-on-week (WoW) to USD 0.23/kg, with no month-on-month (MoM) change and a 4.55% YoY increase. This price rise is due to strong demand in key export markets, particularly Europe, the US, and Russia, which have absorbed much of Ecuador's supply. Additionally, logistical challenges, including rising freight costs and container shortages, have constrained export volumes, tightened supply, and pushed prices upward. The Ecuadorian government's increase in the minimum support price for bananas to USD 7.25 per box in 2025 has also contributed to higher market prices. Furthermore, adverse weather conditions in competing banana-producing countries have reduced their output, leading importers to rely more heavily on Ecuadorian bananas, thereby increasing demand and supporting higher prices.

Philippines

In W20, banana prices in the Philippines dropped by 1.48% WoW to USD 1.33/kg, due to increased supply from domestic production and intensified competition from neighboring countries like Vietnam and Cambodia. These countries have expanded their banana exports, offering more competitively priced products, which has led to a softening of demand for Philippine bananas in key markets such as China. Additionally, geopolitical tensions between the Philippines and China have further impacted export volumes, as Chinese importers diversify their sources. However, there is a 1.53% MoM rise and a 5.56% YoY increase in prices, reflecting a gradual recovery from previous production challenges caused by Panama disease (Fusarium wilt) and adverse weather conditions. Improved farming practices and government support have contributed to stabilizing production levels, allowing for better pricing compared to the same period last year.

Colombia

Colombia's banana prices increased by 4.44% WoW to USD 0.47/kg in W20, with a 2.17% MoM increase, reflecting ongoing recovery efforts from previous production challenges, including weather disruptions and logistical delays earlier in the year. Improved harvesting conditions and gradual normalization of shipments contributed to the recent price uptick. Despite this, YoY prices have dropped by 7.84%, influenced by heightened competition from other Latin American exporters such as Ecuador and Guatemala, as well as fluctuating demand in key markets like the European Union (EU) and the Middle East, where supply contracts and price pressures remain volatile.

Guatemala

In Guatemala, banana prices remained steady WoW and MoM at USD 0.22/kg in W22, while experiencing a 37.50% YoY increase. This YoY surge is due to heightened demand from key export markets, notably the US, which continues to be the primary destination for Guatemalan bananas, accounting for a significant share of exports. Additionally, the imposition of a 10% reciprocal tariff by the US in Apr-25 has introduced cost pressures, potentially influencing export dynamics and pricing. Despite these factors, the stability in weekly prices suggests that Guatemala's banana industry has effectively managed supply and demand, maintaining consistent pricing in the short term.

3. Actionable Recommendations

Strengthen Biosecurity Protocols to Unlock New Markets

Banana producers should proactively implement and document robust biosecurity measures to accelerate market access and ease pest risk concerns during trade evaluations. This includes adopting Foc TR4 monitoring systems, maintaining clean planting material, and certifying farms through internationally recognized phytosanitary standards. Producers exporting to new regions, such as South Africa or Asia, can support access by providing traceability records, soil test results, and pest management plans upfront to reduce delays in PRA and build importer confidence.

Optimize Logistics and Direct Export Engagement

Banana producers should strengthen their logistics coordination and engage directly with exporters to maximize market reach and capitalize on rising demand. This includes organizing efficient truck scheduling, improving cold chain management at key transit hubs, and training farmers on export-quality standards. For example, producers can collaborate with freight companies to ensure timely shipments to priority markets like Gujarat, Punjab, and other international buyers, while investing in post-harvest handling to maintain banana quality during transport.

Invest in Labor Training and Sustainable Disease Management

Banana producers in Colombia and similar markets should invest in training programs to attract and retain younger workers, addressing labor shortages that threaten harvest quality and schedules. Simultaneously, they must adopt integrated disease management practices, such as regular soil testing and use of bio-inputs, to control Black Sigatoka while managing costs. For example, implementing targeted spraying schedules combined with organic soil amendments can improve plant health sustainably. Producers can also explore mechanization, where feasible, to reduce labor dependency without compromising fruit quality.

Sources: Tridge, Agronegocios, Akchabar, Business in Cameroon, Forbescentroamerica, Fresh Fruit, Revista Summa, South African Government, Times of India