1. Weekly News

Austria

Red Onion Prices in Austria in W33

In Austria, the average wholesale price of red onions remained unchanged in the W33 despite sluggish summer demand and a weaker-than-usual crop. The average wholesale price for red onions ranged between USD 22.29 to 25.63 per 100 kilograms (kg), notably lower than 2023's prices and even below the levels observed two years ago. Sales of winter onions are performing well, while summer onions have also entered the market. However, due to poor yields, the supply of summer onions needs to be increased to cause a rapid drop in prices. Demand in the domestic market remains modest, and exports have not increased significantly, although there has been growing interest in Austrian onions.

Netherlands

Dutch Onion Exports Surged in W30, Ivory Coast Leads in Purchases

Dutch onion exports rose to 19,287 metric tons (mt) in W30, according to preliminary figures from the Quality Control Bureau (KCB). Ivory Coast emerged as the primary buyer, purchasing over 4,400 mt. Sales to this West African country are progressing significantly faster than in 2023, with Ivory Coast having already bought around 9,600 mt of onions from the Netherlands in the first month of the 2024 season, which is 4 thousand mt more than the same period in 2023 when higher prices made sales more challenging. However, exports to Great Britain have decreased by more than a quarter compared to last year, particularly during the season's first two weeks. In W30, British purchases picked up, reaching nearly 3,600 mt. Overall, W30 saw a higher export volume than the same week in 2023. Notably, sales to Senegal, which started early with large quantities in 2023, are beginning later this year.

Peru

Peru Exported 76 mt of Red Onions to Chile

The Peruvian government announced that producers from the district of Inclán in Tacna have successfully exported 76 mt of red onions to Chile. Agromercado, the commercial arm of the Ministry of Agrarian Development and Irrigation (Midagri), facilitated this direct export. The export agreement includes 250 mt of red onion, shipped in seven additional weekly batches of 25 mt each until Oct-24. This export milestone is particularly noteworthy as it involves family agriculture producers collaborating to consolidate a supply of up to 600 mt of red onions. These onions were cultivated on 105 hectares (ha), achieving an average yield of 35.5 mt/ha.

Ukraine

Ukraine's Onion Prices Continue to Drop Amid Surplus and Low Demand

In mid-Aug-24 24, Ukrainian onion prices continued to decline, falling below 2023's levels. As of August 15, Ukrainian farmers sold onions at USD 0.12 to 0.22/kg, marking an average 17% week-on-week (WoW) decrease. This drop is primarily attributed to a rapid increase in supply as nearly all Ukrainian farms have begun harvesting onions. However, demand remains low, and the price reduction has yet to boost sales. Due to weather conditions this season, farmers are actively selling substandard onions, resulting in a need for more high-quality onions suitable for storage. This has led to higher percentages of losses and an increased share of substandard products on the market. Despite the current situation, some market participants expect prices to rise by Sept-24 as onion stocks diminish.

2. Weekly Pricing

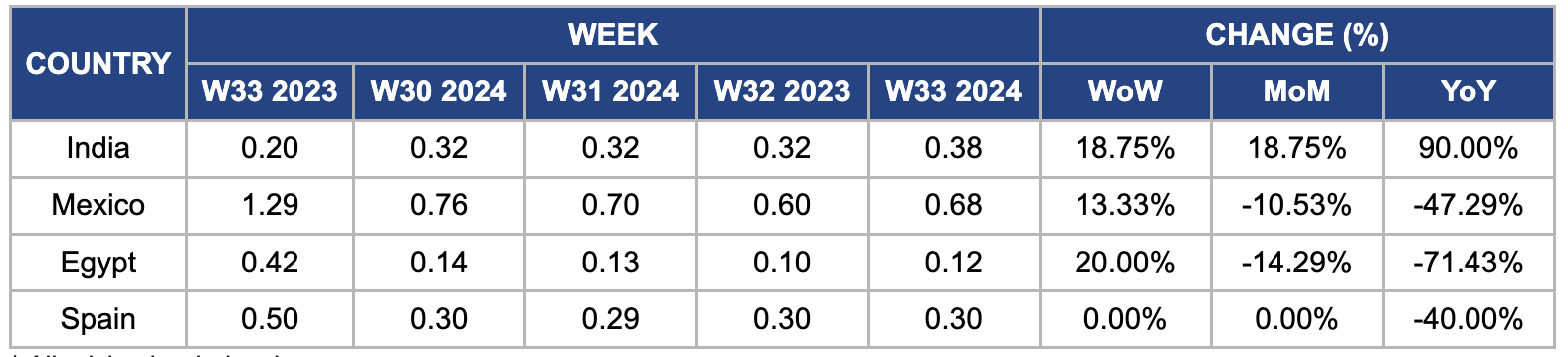

Weekly Onion Pricing Important Exporters (USD/kg)

* Varieties: Netherlands (yellow onion), Mexico (white onion), and India, Egypt, and Spain (overall average

Yearly Change in Onion Pricing Important Exporters (W33 2023 to W33 2024)

* Varieties: Netherlands (yellow onion), Mexico (white onion), and India, Egypt, and Spain (overall average)

* Blank spaces on the graph signify data unavailability stemming from factors like missing data, supply unavailability, or seasonality

India

In W33, onion prices in India surged by 18.75% WoW, 18.75% month-on-month (MoM) and 90% year-on-year (YoY) to USD 0.38/kg, driven by a significant reduction in rabi onion acreage and lower-than-usual kharif sowing. The rabi crop, which accounts for over 72 to 75% of the country's total onion consumption, saw a sharp drop in sown area, with only 756 thousand ha planted compared to 1.23 million ha in 2023. Although recent rainfall in critical regions like Nashik is expected to improve kharif sowing, the reduced supply from the rabi season has tightened the market, keeping prices elevated despite declining exports. Consequently, onions are sold at USD 0.42 to 0.54/kg in most retail markets, with limited options for the government to lower prices immediately.

Mexico

Mexican wholesale onion prices surged by 13.33% WoW to USD 0.68/kg, although they experienced declines of 10.53% MoM and 47.29% YoY. The price increase is primarily due to a seasonal decrease in onion harvests. This situation was increased by cold weather and frost, which hindered crop development and harvesting in key producing states such as Chihuahua, Guanajuato, and Zacatecas, according to the Agri-Food and Fisheries Information Service (SIAP) of the Ministry of Agriculture and Livestock (SADER). Additionally, inflation in Mexico has increased for five consecutive months in Aug-24, further contributing to price pressures. Despite these challenges, the market has seen a price decline over the longer term due to the recovery from severe weather disruptions, including Hurricane Hilary in late Aug-23, which initially reduced local supply but was later mitigated by increased imports, helping stabilize the market.

Egypt

In W33, Egypt's wholesale onion prices surged by 20% WoW to USD 0.12/kg, though this remains lower compared to India and Mexico. Despite the recent increase, prices are still significantly below the peak of USD 0.42/kg recorded in the same week of 2023. YoY, the price has dropped sharply by 71%, primarily due to the severe devaluation of the Egyptian pound (EGP), raising foreign exchange imbalances. In Sept-23, prices tripled to USD 0.74/kg, prompting Egyptian officials to temporarily halt onion exports, blaming traders for the price spike. However, onion growers attributed the price rise to a heat wave that reduced the harvest and increased production costs.

Spain

In W33, Spain's wholesale onion prices remained stable WoW at USD 0.30/kg, though there was a significant % YoY decline of 40%. This substantial decrease is primarily due to a surge in onion imports from third countries, particularly China, which has exerted considerable downward pressure on the market despite domestic solid production. Representatives from the Agrarian Association of Young Farmers (ASAJA) in Bolaños de Campos reported that the downward trend began several months ago with the increase in imports and has worsened in recent weeks. This decline is further exacerbated by rising production costs and a critical shortage of qualified labor for harvesting, complicating the already challenging market conditions.

3. Actionable Recommendations

Enhance Market Strategies and Address Supply Chain Challenges

In Austria, where the average wholesale price of red onions remains stable despite sluggish summer demand and a weaker-than-usual crop, the focus should be on enhancing market strategies and addressing supply chain challenges. To balance prices effectively, Austria needs to manage the supply of summer onions by investing in improved storage and transportation infrastructure, which will help stabilize supply and reduce price volatility. Additionally, Austria should explore new export markets to diversify its trading partners and boost demand. For example, targeting markets such as South Korea, with growing interest in European vegetables, could offer significant opportunities. Establishing trade agreements and promoting Austrian onions through international food fairs and targeted marketing campaigns in South Korea will help increase exports and strengthen Austria's position in the global onion market. By addressing these factors, Austria can better support its onion market and enhance domestic and international trade performance.

Utilize Low Prices for Strategic Export Growth

Egypt should capitalize on its low onion prices by targeting markets with high consumption rates, such as South Asia. Conducting market research to understand demand patterns and forming trade agreements with importers in India, Bangladesh, and Sri Lanka will open new export opportunities. Egypt can also invest in logistics to streamline exports and promote its onions through targeted marketing campaigns. This strategy will help absorb surplus production, mitigate domestic price declines, and generate foreign currency revenue while providing stable supplies to importers.

Invest in Storage Infrastructure and Quality Management

Ukraine should invest in modern storage infrastructure and quality management to address the decline in onion prices and substandard products in Ukraine. Developing state-of-the-art, energy-efficient storage facilities, such as refrigerated warehouses with climate control systems, will help manage supply better and reduce spoilage. Training programs for farmers and storage operators on best storage practices, including proper handling, ventilation, and pest control, will improve product quality. Upgrading existing equipment through subsidy programs can enhance storage conditions, while collaboration with international partners for technology transfer will introduce advanced solutions and best practices. Establishing stringent quality control standards for exports will ensure consistent, high-quality onions, enhance Ukraine’s reputation in international markets, and stabilize domestic prices.

Sources: Tridge, Agrobusiness, Nieuwe Oogst, Agro Peru, Indian Express, DW News, Bloomberg Linea, ADN 40