1. Weekly News

Global

Rapid Growth in Peanut Allergy Treatment Market

The peanut allergy treatment market has grown substantially in recent years, with a market size of USD 437 million in 2022. This market is projected to expand significantly, reaching USD 1.273 billion by 2032 at a remarkable compound annual growth rate (CAGR) of 11.5% from 2023 to 2032. The increasing prevalence of peanut allergies and advancements in treatment options drive the market's growth.

United States

Peanut Growth Conditions and Harvest Progress in Southeastern US

According to the United States Department of Agriculture’s (USDA) National Agricultural Statistics Service (NASS), peanut conditions as of W34 show varied results across the Southeastern of the United States (US). In Alabama, 7% of peanuts rated as excellent, 61% as good, 29% as fair, and 3% as poor to very poor. In Florida, 6% of peanuts have been dug, compared to 13% last year and a five-year average of 6%. Additionally, 1% of peanuts have been harvested, down from 3% last year, with the five-year average at 2%. In Georgia, peanut conditions are reported as 8% excellent, 54% good, 30% fair, and 8% poor to very poor.

Turkey

Peanut Cultivation in Adana, Turkey, Increased in 2024

Turkey’s peanut cultivation area in Adana saw a 30% year-on-year (YoY) increase in 2024, driven by high profits in 2023. Producing approximately 89 thousand metric tons (mt) of peanuts annually, Adana contributes to 50% of the country’s total peanut production. The peanut harvest in this region is expected to end in Oct-24.

Myanmar

Prices Surge in Myanmar's Oil Seed Market

Myanmar's oil seed market is experiencing a price surge for peanuts, sunflower seeds, rapeseed, and sesame, fueled by strong demand from the edible oil sector. The high cost of imported edible palm oil, compounded by the appreciation of the US dollar, has led to a boost in domestic edible oil production. Despite flooding disrupting planting seasons in some regions, farmers strategically hold their inventory to take advantage of the high prices. Among the domestically produced edible oils, peanut oil is the most preferred, followed by sunflower and rapeseed oil. Sesame oil, however, is less favored due to its strong smell.

2. Weekly Pricing

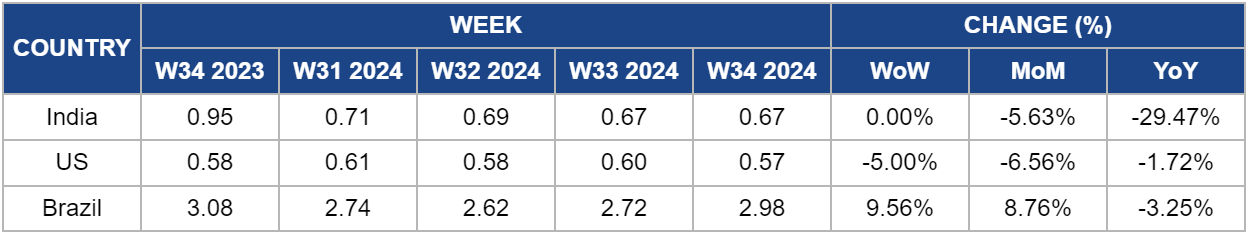

Weekly Peanut Pricing Important Exporters (USD/kg)

Yearly Change in Peanut Pricing Important Exporters (W34 2023 to W34 2024)

India

Peanut prices in India remained unchanged week-on-week (WoW) at USD 0.67 per kilogram (kg) in W34, making a 4.63% month-on-month (MoM) and a 29.47% YoY drop.The downward pressure on prices is attributed to the increased supply from the new harvest and high inventory from the 2023 crop. However, prices have stabilized following the Gujarat government’s decision to purchase 100 thousand mt of peanuts. Additionally, heavy rainfall in Uttar Pradesh has caused considerable damage to the peanut crops, leading to uncertainties in the country’s total peanut outputs.

United States

US peanut prices decreased to USD 0.57/kg in W34, marking a 5% WoW and a 6.56% MoM decrease, respectively. In addition, marketings totaled 33.2 million lbs, a significant decline of 64.9 million lbs compared to the previous week. This decrease in both prices and marketing could indicate a potential softening in demand or an oversupply in the market. Lastly, as Mississippi River levels drop, raising concerns about grain transportation and increasing freight costs, US peanut prices have demonstrated resilience. Despite these logistical challenges, the peanut market strengthens as the harvest season advances.

Brazil

In W34, Brazil’s peanut prices rose to USD 2.98/kg from USD 2.72/kg in W33, reflecting a 9.56% WoW and 8.76% MoM increase. The country’s peanut prices face a significant price rise this month due to climate challenges, high global demand, and rising production costs. Brazil’s peanut production is expected to decrease in 2024 due to severe drought, particularly in the São Paulo region, negatively impacting the yield. In addition, the heightened export demand from China and India also limits domestic supply. Moreover, the escalating fertilizer costs also contribute to the price rise.

3.Actionable Recommendations

Capitalize on the Growing Peanut Allergy Treatment Market

Pharmaceutical companies should focus on increasing investment in research and development (R&D) to innovate and improve peanut allergy treatments, as the market is projected to reach USD 1,273 million by 2032. Expanding product lines and securing partnerships with healthcare providers will enable broader market penetration. Regulatory affairs teams should work closely with government agencies to ensure new treatments are approved and accessible in key markets, mainly where peanut allergies are prevalent.

Address Climate and Supply Challenges

Peanut producers in Brazil should invest in climate-resilient farming practices, such as adopting drought-resistant peanut varieties and advanced irrigation systems, to mitigate the impact of severe weather conditions. Agricultural research institutes should focus on developing these resilient varieties and provide them to farmers in affected regions. Additionally, producers should explore expanding cultivation in less drought-affected areas to maintain overall production levels. Export companies should secure long-term contracts with international buyers, particularly in China and India, to ensure steady demand and better pricing amidst supply constraints.

Sources: Tridge, openPR, Iha, Foodmate.