W36 2025: Palm Oil Weekly Update

In W36 in the palm oil landscape, some of the most relevant trends included:

- Indonesia’s policy shifts, including higher export duties to fund the B40 biodiesel mandate, are tightening global supply, raising import costs for buyers like Bangladesh, and supporting elevated international palm oil prices.

- India’s rising imports from Colombia and Guatemala at discounted rates are reshaping trade flows, challenging the dominance of Indonesia and Malaysia, and adding competitive pressure from Latin American and African producers.

- Supported by higher volumes and prices, strong Indonesian exports reinforce palm oil’s role in sustaining trade surpluses. Meanwhile, ongoing WTO disputes and EU regulatory challenges highlight friction in key markets.

- Sustainability remains a central issue, with Indonesia cracking down on illegal plantations and pushing Global South-driven standards as alternatives to the EU’s Deforestation Regulation, though enforcement for smallholders remains a challenge.

- Malaysia faces a growing inventory buildup despite firm demand. Rising stockpiles are tempering price momentum, while Thailand contends with surplus-driven downside risks from weak exports to China and India.

1. Weekly News

Bangladesh

Indonesia’s Higher Palm Oil Export Duties Drive Price Surge in Bangladesh’s Edible Oil Market

Indonesia’s decision to raise palm oil export duties from Sep-25, aimed at supporting its B40 biodiesel mandate in 2025, is driving edible oil price hikes in Bangladesh. Wholesale palm oil prices in Khatunganj have risen by USD 0.58 to 0.82 per maund, equal to 37.32 kilograms (BDT 70 to 100/37.32kg) over the past month, with further increases expected as global prices climbed 5.4% year-on-year (YoY) to above USD 1,000 metric tons (mt) in Jul-25. Bangladesh, which imports 80% of its palm oil from Indonesia and relies on the commodity for 65% of its edible oil demand, is particularly vulnerable to Jakarta’s policy shift. Traders warn that higher booking costs are already eroding margins, while upcoming biofuel-driven supply constraints could intensify pressure on local markets.

India

India Turns to Discounted Latin American Palm Oil, Adding Pressure on Malaysian Futures

India’s growing purchases of discounted Colombian and Guatemalan palm oil are reshaping trade flows, challenging Malaysia and Indonesia, traditionally India’s top suppliers, with imports of up to 9 million metric tons (mmt) in 2023/24. South American exporters, offering crude palm oil at around USD 1,165/mt Cost, Insurance, and Freight (CIF) for Oct-25 delivery—over USD 10/mt cheaper than Southeast Asian supplies—have gained a foothold despite longer shipping times. This trend, driven by India’s festival-season demand and lack of emphasis on sustainability certifications, threatens to pressure Malaysian palm oil futures and highlights rising competition from Latin America, with equatorial African producers expected to add further supply-side pressure in the future.

Indonesia

Indonesia’s Palm Oil Exports Surge to USD 14 Billion, Driven by Strong Global Demand and Rising Prices

Indonesia’s palm oil exports reached USD 14.02 billion as of Jul-25, up 32.9% YoY, driven by both crude and processed shipments. Export volumes rose 10.95% to 13.64 mmt, while average prices climbed 20.7% to USD 1,042.72/mt. Palm oil remains a key contributor to Indonesia’s trade surplus, supporting the country’s positive non-oil and gas export streak for 63 consecutive months. India continues to be a major buyer, accounting for USD 2.2 billion of exports in the animal and vegetable fat and oil segment. Despite regulatory challenges from the European Union’s (EU) upcoming anti-deforestation rules, Indonesia maintains strong global demand, with part of its palm oil also directed to biodiesel production, recently supported by a favorable WTO ruling on EU import duties.

Indonesia Presses EU to Lift Biodiesel Duties After WTO Ruling Backs Palm Oil Exporter

Indonesia has urged the EU to lift countervailing duties on its biodiesel exports after a World Trade Organization (WTO) panel ruled on August 22 that the levies violate trade rules. The panel found that Indonesia’s palm oil export levy was not a subsidy, that the EU failed to prove actual injury to its biodiesel industry, and that transparency obligations were breached during the investigation. The EU had imposed duties of 8–18% since 2019, sharply reducing Indonesia’s biodiesel exports. With the Indonesia-EU free trade agreement (FTA) nearing conclusion and zero tariffs on palm oil pledged, Jakarta is pressing Brussels to comply with the ruling. The EU has until October 22 to appeal.

Indonesia Cracks Down on Illegal Palm Oil Plantations Amidst Global Sustainability Push

Indonesia has launched a major crackdown on illegal palm oil plantations, targeting 3.7 million hectares (ha) and dismantling operations in areas like Tesso Nilo National Park. The initiative aims to reclaim forests lost to unchecked expansion, protect ecosystems, and stabilize rural communities. Global demand, particularly from China, India, the United States (US), and the EU, drives much of this expansion, with China accounting for around 15% of Indonesia’s exports. While Europe and the US prioritize certified sustainable palm oil, China is increasingly advancing sustainability efforts. The success of Indonesia’s enforcement depends on responsible sourcing by major buyers, financial incentives for certified producers, and consumer awareness, highlighting the need for global cooperation to align trade, environmental stewardship, and sustainable development.

Indonesia Leads Global South Initiative to Set Alternative Palm Oil Sustainability Standards

Indonesia is spearheading efforts to establish palm oil sustainability standards through Global South platforms such as the Brazil, Russia, India, China, South Africa (BRICS), Council of Palm Oil Producing Countries (CPAPC), and the Food and Agriculture Organization (FAO), aiming to provide alternatives to the European Union Deforestation Regulation (EUDR), which is set to take effect at the end of 2025. The initiative seeks to prioritize the needs of developing countries and smallholder farmers, reflecting a strategic shift from reacting to global rules to shaping them. Both Indonesia and Malaysia have implemented mandatory certification schemes — Indonesian Sustainable Palm Oil (ISPO) and Malaysian Sustainable Palm Oil (MSPO), respectively — to improve environmental and social sustainability. However, enforcement challenges remain, particularly for smallholders. The new push highlights the need for international recognition of existing sustainability efforts, balancing deforestation prevention with economic and development realities, and may influence global standards for responsible palm oil production.

Malaysia

Malaysia’s Palm Oil Stocks Reach Nine-Month High as Output Rises

Malaysia’s palm oil inventories are projected to rise for a sixth consecutive month in Aug-25, reaching 2.2 mmt, the highest since Dec-23, as production continues to outpace exports. Crude palm oil output is estimated at 1.86 mmt, up 2.5% from Jul-25, though growth remains limited by aging trees and slow replanting. Exports are expected to rise 10.7% to 1.45 mmt, a nine-month high, with stronger demand supported by palm oil’s discount to soyoil, particularly boosting Indian purchases ahead of the festival season. The Malaysian Palm Oil Board (MPOB) will release official data on September 10.

United States

EU–US Trade Deal Sparks Palm Oil Sector Concerns Over EUDR Fairness

Concerns are mounting in the palm oil sector over the newly struck EU–US trade framework, which could allow American exporters exemptions from the EUDR. Industry observers argue that if the US secures relief from strict geolocation and monitoring requirements, producing nations such as Indonesia and Malaysia should receive similar treatment, given their reliance on palm oil exports. The potential preferential treatment risks undermining the credibility of the EUDR, raising questions of fairness under WTO rules, and intensifying pressure from global supply chain actors for further delays or adjustments to the regulation.

2. Weekly Pricing

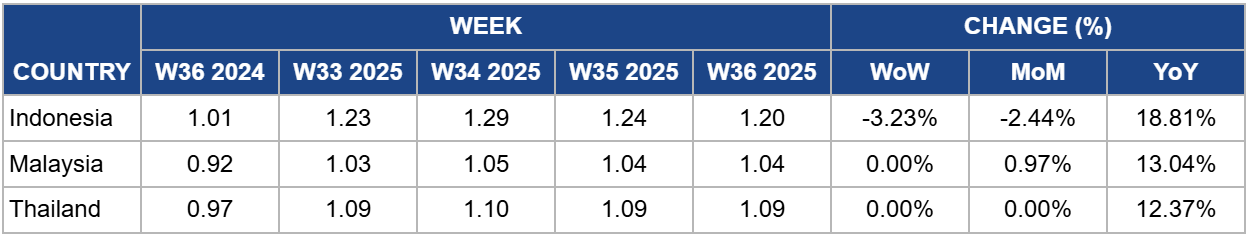

Weekly Palm Oil Pricing Important Exporters (USD/kg)

Yearly Change in Palm Oil Pricing Important Exporters (W36 2024 to W36 2025)

.png)

Indonesia

Indonesia’s palm oil prices declined by 3.23% week-on-week (WoW) to USD 1.20/kg in W36, though they remain 18.81% higher YoY from USD 1.01/kg. The short-term decline reflects volatility linked to seasonal supply recovery and market adjustments, but sustained YoY gains highlight strong global demand. Export performance reinforces this trend, with palm oil shipments reaching USD 14.02 billion by Jul-25, up 32.9% YoY, supported by both higher volumes (+10.95%) and firmer average prices (+20.7% to USD 1,042.72/mt). India’s continued role as a top buyer underpins market resilience, while biodiesel-driven domestic use adds structural support. Looking ahead, EU regulatory challenges may create headwinds, yet Indonesia’s trade surplus and diversified demand base suggest that prices, despite short-term corrections, are likely to remain elevated relative to 2024 levels.

Malaysia

In W36, Malaysia’s palm oil prices held steady at USD 1.04/kg, unchanged WoW but higher 13.04% YoY from USD 0.92/kg. Futures on the Bursa Malaysia Derivatives Exchange (MDEX) gained 0.86% to USD 1065.15/mt (MYR 4,480/mt), supported by expectations of strong Sep-25 export demand, though inventories are forecast to rise for a sixth consecutive month as production outpaces shipments. This suggests near-term price stability, with possible downside risk if stock levels continue building. However, support comes from firm demand in key destinations and movements in rival edible oils, with soyoil futures in both the Dalian Commodity Exchange (DCE) and Chicago Mercantile Exchange (CME) edging higher. A weaker ringgit also enhances Malaysia’s export competitiveness. The balance between export momentum and production trends will be decisive, while weaker crude oil prices may temper biodiesel-linked demand, potentially capping future price gains.

Thailand

Thailand’s palm oil prices held steady at USD 1.09/kg, showing no WoW and month-on-month (MoM) change but rising 12.37% YoY from USD 0.97/kg in W36 2024. However, the market is under pressure from a sharp inventory buildup, with crude palm oil (CPO) stocks more than doubling since Jan-25 to 170,000 mt. Weak export demand—intensified by cancellations from key buyers China and India—and the decline in Malaysian futures to a 17-month low are limiting price momentum. Without government measures to stabilize farmer incomes or stimulate demand, the combination of elevated stocks and sluggish exports signals further downside risks, suggesting Thai palm oil prices may soften in the coming weeks.

3. Actionable Recommendations

Expand Market Diversification and Flexible Pricing to Counter Trade Shifts

Indonesia and Malaysia should deepen engagement with emerging markets in South Asia, Sub-Saharan Africa, and the Middle East to offset potential volume losses from traditional buyers such as India and the EU. Offering competitive pricing, particularly for long-haul shipments, and tailoring contracts to seasonal demand fluctuations can help maintain market share against low-cost Latin American palm oil and anticipated African supply.

Strengthen Sustainability Compliance and Traceability to Secure Premium Markets

Producers should accelerate the adoption of ISPO and MSPO certification while promoting global recognition of these standards to navigate EUDR constraints and support biodiesel mandates. Investments in traceability, smallholder integration, and responsible sourcing will improve credibility with international buyers, safeguard export revenue, and enhance access to markets with stringent environmental requirements.

Leverage Policy and Trade Instruments to Support Export Competitiveness

Southeast Asian exporters should proactively engage in trade negotiations and utilize WTO rulings to secure tariff exemptions or zero-duty access, particularly under the upcoming EU-Indonesia FTA. Coordinating export duty adjustments with domestic biodiesel mandates can stabilize local supply, maintain margins amid rising global prices, and reinforce the structural resilience of palm oil markets.

Sources: Tridge, Ukr Agroconsult, Hellenic Shipping News