In W38 in the palm oil landscape, some of the most relevant trends included:

- India’s palm oil imports surged 15.76% YoY in Aug-25 to 990,528 mt, driven by competitive pricing versus soybean oil and seasonal festive demand. Increased Indian buying is expected to reduce stockpiles in Indonesia and Malaysia while supporting Malaysian palm oil futures.

- Indonesia faces trade challenges from the EU’s upcoming EUDR, effective December 30, 2025, which requires costly geolocation verification for smallholders. Compliance burdens may shift buyers to Malaysia, though the EU-Indonesia CEPA offers limited mitigation.

- The EU formally recognized MSPO certification for EUDR compliance, reinforcing Malaysia’s position as the second-largest global exporter and supporting sustainable, traceable supply chains, including over half a million smallholders.

- Malaysia has advanced sustainable palm oil adoption, with nearly 90% of plantations MSPO-certified and 27% RSPO-certified. Smallholders managing 27% of plantations remain vulnerable due to compliance costs and limited resources, highlighting the need for technical, financial, and market support.

1. Weekly News

India

India’s Palm Oil Imports Soar 15.76% YoY in Aug-25

India’s palm oil imports surged 15.76% year-on-year (YoY) in Aug-25 to 990,528 metric tons (mt), the highest level since Jul-24, driven by competitive pricing against soyoil and rising festive season demand. As the world’s largest vegetable oil importer, India’s increased buying is expected to ease stockpiles in top producers Indonesia and Malaysia while providing support to Malaysian palm oil futures.

Indonesia

Indonesia Raises Concerns Over EU Deforestation Rules Ahead of CEPA

Indonesia has raised concerns over the European Union’s (EU) upcoming anti-deforestation regulation, the European Union Deforestation Regulation (EUDR), which takes effect on December 30, 2025, citing the compliance burden on its nearly eight million smallholder farmers who supply crops such as palm oil. The rules require geolocation data to verify products are deforestation-free, imposing high costs that could disproportionately affect smallholders. Indonesian officials are engaging EU authorities for implementation support, while some buyers are already shifting palm oil sourcing to Malaysia, potentially impacting Indonesia’s exports. The upcoming EU-Indonesia Comprehensive Economic Partnership Agreement (CEPA), set for September 23, 2025, offers no concessions on the EUDR, though Jakarta hopes it will help mitigate trade challenges.

Malaysia

EU Recognises Malaysia’s MSPO Certification as a Credible Standard for Upcoming Deforestation Regulation

The EU has formally recognised Malaysia’s Sustainable Palm Oil (MSPO) certification as a credible standard to meet the upcoming EUDR, effective Dec-25. The MSPO, mandatory since 2020 and verified by independent audits, ensures palm oil is legally sourced, deforestation-free, and fully traceable through its digital tracking system. This recognition reinforces Malaysia’s position as the world’s second-largest palm oil exporter, assuring global buyers while integrating over half a million smallholders into sustainable supply chains and strengthening confidence in responsible sourcing practices.

Malaysia’s Smallholders Face Challenges Despite Progress in Sustainable Palm Oil Certification

Malaysia has made significant strides in sustainable palm oil, with nearly 90% of its plantation area MSPO-certified and over a quarter attaining RSPO certification. However, independent smallholders—managing 27% of the nation’s plantations—remain vulnerable to exclusion due to limited resources, low income, and reliance on informal knowledge transfer. While most have obtained MSPO certification, many struggle with compliance costs and accessing financial or market benefits. The Permodalan Nasional Berhad Research Institute (PNBRI) report emphasizes the need for targeted support, including technical training, bulk input procurement, financial literacy, and stronger integration into the sustainable supply chain to ensure smallholders are not left behind.

2. Weekly Pricing

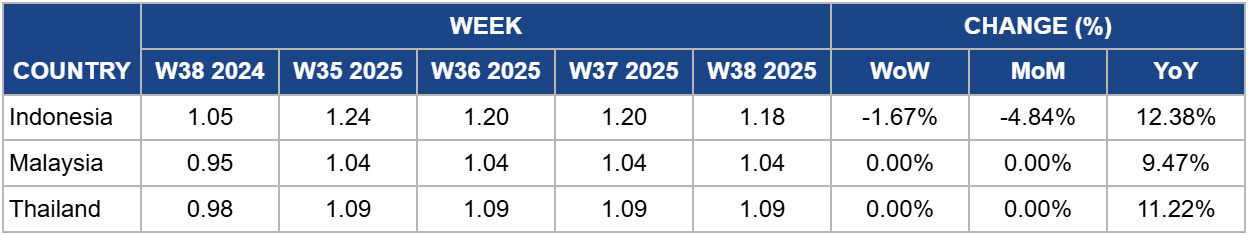

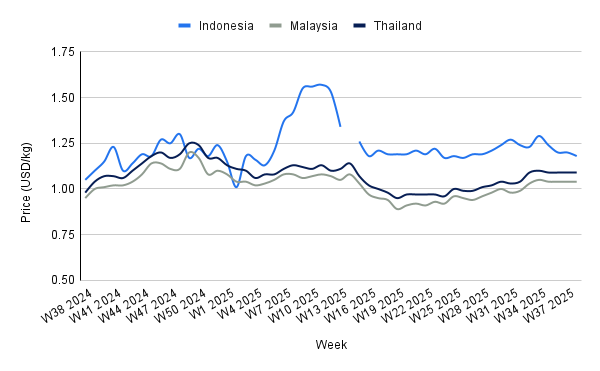

Weekly Palm Oil Pricing Important Exporters (USD/kg)

Yearly Change in Palm Oil Pricing Important Exporters (W38 2024 to W38 2025)

Indonesia

In W38, Indonesia’s palm oil prices declined 1.67% week-on-week (WoW) to USD 1.18 per kilogram (kg), marking a 4.84% month-on-month (MoM) decrease, reflecting short-term pressure from competitive edible oils. The EU’s decision to postpone its anti-deforestation law to 2026 provides relief for Indonesian exporters, particularly smallholders, and supports projected exports to the EU of around 4 million metric tons (mmt) in 2026, up from 3.3 mmt in 2025. Exports to India are expected to rise to 5 mmt in 2025. However, future shipments will remain sensitive to price dynamics versus competing oils such as soybean oil, especially following Argentina’s temporary removal of export duties. While near-term prices face downward pressure, the EU trade pact and anticipated seasonal and structural demand support longer-term market stability.

Malaysia

In W38, Malaysia’s palm oil prices remained stable at USD 1.04/kg, showing no weekly change but rising 9.47% YoY from USD 0.95/kg. Despite this stability, short-term pressures persist as rising stockpiles and weaker competitiveness against soybean oil weigh on prices. Year-to-date (YTD) CPO prices have averaged USD 1032.44/mt (MYR 4,344/mt), with forecasts ranging between USD 962.57 to 1021.98/mt (MYR 4,050 to 4,300/mt) through 2026. While near-term prices may remain subdued due to elevated output and slower exports, longer-term prospects are supported by policy measures, seasonal demand, and the EU’s recognition of Malaysian Sustainable Palm Oil (MSPO) certification, which reinforces market confidence and may enhance future price stability.

Thailand

Thailand’s palm oil prices remained stable at USD 1.09/kg in W38, unchanged WoW and MoM, while rising 11.22% YoY from USD 0.98/kg. Price stability reflects bearish regional sentiment driven by high inventory levels in Malaysia, which constrain export opportunities and cap regional price movements. The stagnation suggests that Thailand's prices have fully accounted for current supply pressures. Nonetheless, the YoY increase underscores a stronger fundamental pricing environment for vegetable oils in 2025, indicating potential support for future price stability if regional demand strengthens or inventories ease.

3. Actionable Recommendations

Capitalize on Rising Indian Demand to Optimize Exports

Producers in Indonesia and Malaysia should actively target the Indian market, leveraging the 15.76% YoY surge in imports. Exporters can negotiate volume contracts during peak festive seasons to reduce regional stockpiles, stabilize local prices, and secure market share amid competition from soybean oil. Monitoring price trends in competing oils, such as Argentine soybean oil, will be critical to maintain competitiveness.

Strengthen Compliance and Market Position through MSPO Certification

Malaysian exporters should fully leverage the EU’s recognition of MSPO certification to secure premium contracts and long-term buyers in Europe. Highlighting verified traceability, deforestation-free sourcing, and smallholder integration will enhance market confidence and mitigate risks from short-term price volatility caused by rising stockpiles and regional supply pressures.

Support Smallholder Integration to Safeguard Sustainable Supply Chains

Both Malaysia and Indonesia should implement targeted programs to assist smallholders in meeting certification and traceability requirements. Measures may include technical training, financial literacy programs, bulk input procurement, and better access to markets. This will increase the volume of certified sustainable palm oil, reduce exclusion risks, and strengthen resilience against regulatory challenges such as the EUDR.

Sources: Tridge, Ukr Agroconsult, MSN