.jpg)

In W38 in the wheat landscape, some of the most relevant trends included:

- EU wheat imports have fallen 43% YoY so far in the 2025/26 season, with Ukraine’s share declining significantly while Canada and Serbia are gaining ground.

- Australia’s northern wheat trade is active ahead of harvest, though southern prices face pressure due to subsoil moisture concerns.

- France revised its 2025 soft wheat harvest upward to 33.3 mmt, supported by strong yields and expanded sown areas.

- India has set a wheat target of 119 mmt for Rabi 2025/26, backed by strong seed stocks and farmer guidance campaigns.

- Pakistan faces domestic disruptions as Punjab’s restrictions on wheat movement trigger nationwide flour shortages and sharp price spikes, raising concerns about market destabilization and import reliance.

- The Philippines continues to rely on wheat imports, expected to reach 7.2 mmt in 2025/26, driven by food, feed, and industrial demand.

- In Russia, increased export tariffs have supported domestic wheat prices while making Black Sea wheat more attractive globally.

- Ukraine faces declining export competitiveness due to Russian competition, restrictive EU quotas, and global oversupply.

- The US benefits from strong export demand and competitive prices, highlighted by a five-year wheat supply deal with Bangladesh, though global oversupply limits further gains.

1. Weekly News

European Union

EU Wheat Import Structure Shifts Amid 2025/26 Decline

European Union (EU) wheat imports in the 2025/26 season have significantly declined, totaling 980 thousand metric tons (mt) as of September 14, down 43% year-on-year (YoY), with Ukraine’s dominance as a supplier weakening and Canada’s role expanding. Ukraine remained the largest supplier at 329 thousand mt, though volumes plunged 71.3% YoY, cutting its market share to 33.5% from 66.8%. In contrast, Canada supplied 323 thousand mt, nearly doubling its exports (+95.8% YoY) and lifting its share to 32.9% from 9.6%, while Serbia followed with 137 thousand mt, up 47.8% YoY, raising its share to 14%. This shift follows a broader trend seen in 2024/25, when total EU wheat imports fell 19% YoY to 7.44 million metric tons (mmt), with Ukraine’s share dropping from 71.2% to 60.4% and Canada’s rising from 9% to 16%.

Australia

Australia’s Wheat Trade Gains Momentum as Harvest Nears

Australia’s wheat market is seeing rising trade activity in the northern region as consumers secure supply well into 2026 and growers sell current-crop tonnage ahead of harvest. Delivered Downs wheat is trading at between USD 312/mt and USD 320/mt, with some stock feed wheat (SFW)-type wheat booked as far forward as Sep-26 at USD 327/mt. Early yields in the Maranoa and Western Downs are estimated to range from 2.5 mt per hectare (ha) to 3 mt/ha, rising to between 6mt/ha and 7mt/ha in the Golden Triangle. In contrast, southern prices remain under pressure, with Melbourne Australian standard wheat (ASW) dropping from USD 345/mt to USD 340/mt between September 11 and September 18, reflecting concerns over limited subsoil moisture and the need for finishing rain. The outlook remains uncertain, depending on rainfall forecasts, which the Bureau of Meteorology pegs at a 60% to 80% chance of above-average rain for eastern Australia this spring.

France

France Revises 2025 Soft Wheat Harvest Upward Amid Strong Yields

France’s soft wheat production for 2025 has been revised upward to 33.3 mmt, up from 33.1 mmt, reflecting favorable conditions despite recent stormy weather and a 5% increase over the five-year average. The sown area for milling wheat expanded to 4.486 million ha, with yields rising to 7.42 mt/ha, driving the overall growth in the gross harvest. Overall, France’s total grain harvest is projected at 63.15 mmt from 8.748 million ha, supported by increases in barley and durum wheat yields, indicating a strong recovery in wheat output and stable grain supplies despite mixed conditions for other crops.

India

India Sets Ambitious Wheat Target of 119 mmt for Rabi 2025/26

For the Rabi 2025/26 season, India has set an ambitious wheat production target of 119 mmt, 1.26% above last year’s record of 117.51 mmt, reflecting confidence in agricultural growth. This target is part of a broader cereals production goal of 171.14 mmt for the Rabi season, contributing to a national agricultural year target of 362.50 million tonnes, up 2.4% from 2024/25. With 25 mmt of seeds already secured, exceeding the 22.9 mmt requirement, the government is ensuring a stable start despite recent heavy rains. To support farmers, a nationwide campaign will deploy over 2,000 teams to provide guidance on improving yields, while fertilizer supply will be coordinated to meet increased demand due to expanded sown areas. Strong procurement has also boosted wheat inventories to a four-year high of 33.3 mmt as of September 1, giving the government room to stabilize prices through open market sales. These measures aim to secure domestic supply, enhance productivity, and position India for robust grain exports.

Pakistan

Punjab Wheat Restrictions Trigger Nationwide Flour Shortage and Price Surge

Punjab’s restrictions on the interprovincial movement of wheat have triggered severe flour shortages and sharp price increases in provinces dependent on Punjab supplies like Khyber Pakhtunkhwa (KP) and Sindh. Checkpoints set up to monitor unusual wheat movement have effectively limited transport, pushing KP flour prices up to USD 33.37/20 kilogram bag (PKR 2,800/20 kg bag), a 68% surge from Punjab rates. Critics argue that the measures violate constitutional rights and the deregulation policy, destabilize markets, and discourage private investment, potentially reducing domestic wheat production and increasing reliance on costly imports. Punjab authorities defend the measures as necessary to curb hoarding and ensure local food security, reporting sufficient stocks of 250 thousand mt and seizing hoarded wheat, which has already contributed to a price drop of USD 2.82 per maund, equivalent to 40 kg (PKR 800/maund). The federal government faces mounting pressure to restore free wheat movement to prevent a nationwide crisis.

Philippines

Philippines’ Wheat Reliance on Imports Grows as Consumption Patterns Shift

The United States Department of Agriculture (USDA) projects that the Philippines will import 7.2 mmt of wheat in the 2025/26 season, reversing the previous forecasted decline due to higher anticipated food, seed, and industrial consumption. As the country does not produce wheat domestically, it relies entirely on imports for both milling wheat for human consumption and feed wheat for livestock. Feed wheat is a key driver of demand, often substituting for feed corn when prices are favorable or when supply gaps occur. Philippine wheat imports have experienced several revisions this year, reflecting volatility in consumption patterns and feed substitution trends. Corn imports are projected at 1.9 mmt, slightly lower than previous estimates, supported by domestic production of 8.3 mmt, while rice imports remain steady at 4.9 mm for the current year due to the ongoing 60-day import ban. This outlook underscores the Philippines’ dependence on imported wheat and the influence of shifting feed and food consumption on import requirements.

Russia

Higher Russian Tariffs Make Black Sea Wheat More Attractive

Russian wheat export dynamics have driven recent market movements, with prices rebounding on the Paris Euronext exchange as traders react to significantly higher export duties. Russia raised its wheat export tariff 2.9 times from USD 2.01/mt (RUB 168.6/mt to USD 5.91/mt (RUB 495.9/mt), effective from September 17 to September 23. The move is expected to slow Russian exports and make Black Sea wheat more attractive globally. Domestic wheat prices in Russia have been supported by limited farmer sales of the new harvest due to low local prices.

Taiwan

Taiwan Strengthens Agricultural Trade Ties With US

Taiwan has reaffirmed its strong partnership with the United States (US) in wheat trade, as the Taiwan Flour Millers Association (TFMA) signed a letter of intent to purchase 3.6 mmt of US wheat, valued at nearly USD 1.3 billion, for delivery between 2026 and 2029. Signed with US Wheat Associates (USW), the agreement underscores Taiwan’s consistent preference for high-quality US wheat, following imports of 949 thousand mt in the 2024/25 season that placed it as the fifth-largest market. The long-standing collaboration, dating back nearly six decades and strengthened by 14 goodwill missions since 1998, highlights mutual trust and reliability. Alongside the wheat deal, Taiwan also signed purchase agreements for US soybeans and corn, further deepening agricultural trade ties.

Ukraine

Ukraine’s Wheat Exports Plunge as Russian Competition and EU Quotas Tighten Margins

Ukraine’s wheat sector in the 2025/26 season faces mounting challenges, with exports falling by 26.25% YoY to 3.99 mmt as of September 19. The drop could be attributed to subdued demand, competition from cheaper Russian wheat, and restrictive EU tariff quotas. The EU’s duty-free allowance of just 583 thousand mt renders additional sales unprofitable under the USD 111.80/mt (EUR 95/mt) tariff, threatening trader margins and potentially cutting state revenues by up to USD 329.52 million (EUR 280 million). Although Ukraine harvested 22.2 mmt of wheat for 2025/26, price competitiveness remains weak as Russian 12.5% protein wheat matches or undercuts Ukrainian 11.5% in key Middle East and North Africa (MENA) and Asian markets. Rising freight costs and declining spot basis further strain profitability, while global oversupply and hesitant importers limit recovery prospects, leaving only modest stabilization potential tied to movements in Euronext futures.

United States

US Wheat Exports Strengthen Despite Global Supply Pressure

The US wheat market is currently navigating a mixed outlook, with strong export demand offset by abundant global supply. The USDA recently raised its 2024/25 export forecast to 900 million bushels, the highest since Jun-21, supported by low US wheat prices, a relatively weaker dollar, and competitive values only USD 1/mt to USD 3/mt above Argentina and France. Wheat exports for the first quarter of 2025/26 (from Jun-25 to Aug-25) reached 6.49 mmt, the strongest first-quarter shipment since 2017/18 and well above the 10-year average of 5.68 mmt, highlighting robust international demand. A notable milestone was the departure of the first vessel carrying 55 thousand mt of US hard red winter (HRW) wheat to Bangladesh under a new five-year agreement to supply 700 thousand mt annually, ensuring both stable supplies for Bangladesh and reliable market access for US farmers. However, the upside for US wheat remains capped by large harvests in Russia, the EU, Australia, and Argentina, with Russia continuing to expand production and exports. While global supply pressure weighs on prices, recent trade agreements and favorable competitiveness suggest US exports could remain a key bullish driver in the year ahead.

2. Weekly Pricing

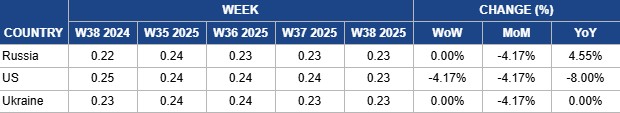

Weekly Wheat Pricing Important Exporters (USD/kg)

Yearly Change in Wheat Pricing Important Exporters (W38 2024 to W38 2025)

Russia

In W38, Russia’s wheat prices remained stable week-on-week (WoW) at USD 0.23/kg for the third consecutive week, while recording a 4.17% month-on-month (MoM) decline and a 4.55% YoY increase. The stability reflects a settling market after earlier fluctuations, while the monthly drop is linked to abundant supply and softer demand. The YoY gain suggests that prices remain higher than in 2024, supported by elevated costs and strong global demand. Russia’s outlook remains firm, with Russian consultancy firm SovEcon recently raising its 2025 wheat production forecast to 87.2 mmt, providing a solid export base but also keeping domestic prices under pressure Meanwhile, the Russian government raised the wheat export duty to USD 7.84/mt (RUB 655.6/mt) from September 24, up from USD 5.91/mt (RUB 495.9/mt) a week earlier, an almost 1.5-fold increase. This measure is expected to curb exports and enhance the global competitiveness of Black Sea wheat.

United States

In W38, US wheat export prices fell 4.17% WoW and MoM to USD 0.23/kg, marking an 8.00% YoY decline. The drop is primarily driven by intense competition from Black Sea suppliers and sluggish global demand, which continues to erode US market share. According to the USDA, while US wheat exports are expected to recover in volume terms during 2025/26, the abundance of global supplies will keep prices under pressure, with the season-average farm price revised down to USD 5.10 per bushel. Prices are also hovering near a five-year low, reflecting oversupply conditions and subdued international demand. Domestically, the ongoing corn and soybean harvest is influencing market dynamics, as some wheat is being moved into commercial channels to create space for new crop storage, particularly in hard red spring (HRS) producing areas. This has heightened logistical concerns for farmers and commercial elevators managing grain volumes ahead of the large fall harvest, compounded by weak demand from key buyers like China. Additional export capacity is available through Oct-25 to Dec-25, creating opportunities for competitive sales beyond the usual shipping window. However, as producers shift focus to other fall crops, basis levels may strengthen due to logistics and space constraints, particularly for HRS. For HRW wheat, basis adjustments may also be required to encourage grain movement and maintain market flow.

Ukraine

In W38, Ukraine’s wheat export prices held steady at USD 0.23/kg for the second consecutive week, though they declined 4.17% MoM. This recent softening reflects a combination of weaker global demand and intensifying competition from Russian wheat, with food wheat in Ukraine currently quoted at between USD 214/mt and USD 218/mt. Despite this, prices remain broadly stable compared to 2024 levels, supported by steady domestic supply and cautious buyer activity. Earlier in the season, delays in harvesting due to rains in western Ukraine temporarily lifted prices, but this also reduced the competitiveness of Ukrainian grain in key MENA and Southeast Asian markets. However, the decisive downward pressure has come from Russia’s aggressive export presence and the release of its new crop, which has weakened Ukrainian spot basis values in recent weeks. On the policy side, Ukraine’s competitiveness is further constrained by restrictive EU tariff quotas. The EU’s duty-free allowance is limited to 583 thousand mt, with any additional sales subject to a USD 111.80/mt (EUR 95/mt) tariff. This renders exports beyond the quota largely unprofitable, threatening trader margins and potentially reducing state revenues by as much as USD 329.52 million (EUR 280 million).

3. Actionable Recommendations

Optimize Australian Wheat Marketing and Forward Sales

Australian wheat growers and traders should focus on forward contracting and hedging strategies to manage price volatility across northern and southern regions. With northern yields promising strong returns and southern subsoil moisture concerns, timely pricing of forward sales and risk management using futures can protect margins and ensure stable market access for both domestic and export buyers.

Leverage India’s Wheat Surplus for Strategic Export Growth

India’s ambitious Rabi production target and high inventory levels offer an opportunity to expand wheat exports. Exporters should explore long-term trade agreements with nearby import-dependent markets, supported by government-backed logistics and procurement strategies. Promoting high-quality Indian wheat to emerging markets and offering competitive pricing will enhance India’s global market presence while stabilizing domestic prices.

Restore Market Stability in Pakistan Through Policy Alignment

The federal and provincial governments in Pakistan should coordinate to remove interprovincial trade barriers and ensure the free movement of wheat. Clear regulatory frameworks, along with enforcement against hoarding, will stabilize prices and encourage private investment. Transparent communication of stock levels and proactive procurement strategies will help avert shortages and support farmer confidence for the upcoming sowing season.

Strengthen the Philippines’ Wheat Supply Chains and Feed Flexibility

Given the Philippines’ full dependence on wheat imports and feed substitution dynamics, policymakers and importers should diversify suppliers to manage price volatility and supply gaps. Developing long-term agreements with major exporters, maintaining adequate storage, and optimizing feed wheat-corn substitution based on market prices will ensure an uninterrupted supply for both human consumption and livestock feed, enhancing resilience against global market fluctuations.

Sources: Tridge, Foodmate, Sinor, Superagronom, UkrAgroConsult