W39 2025: Beef Weekly Update

In W39 in the beef landscape, some of the most relevant trends included:

- Brazilian beef exports continue to expand strongly, with China as the leading buyer, the US remaining a key market despite tariff setbacks, and growing diversification into markets like Mexico, Indonesia, and Russia.

- Sustainability advances, particularly FTAI, are enhancing productivity while cutting emissions by nearly half, reinforcing Brazil’s role as a global livestock leader.

- Domestic cattle prices in Brazil remain firm, supported by exports and limited supply. However, short-term declines reflect adequate slaughter schedules and forward contracting.

- Regional markets show mixed dynamics, with Paraguay posting record slaughter and exports, Argentina recording rising prices amid recovering consumption, and Kazakhstan enforcing supply controls to stabilize food inflation.

- Internationally, beef prices are firm across key producers. Australia sustains strong prices despite easing yardings, the US faces record-high lean beef costs due to tight inventories, and Europe records historic carcass price highs driven by supply shortages.

1. Weekly News

Brazil

Brazilian Beef Exports Surge 19% in 2025, Led by China and Supported by Strong Global Demand

In Aug-25, Brazilian beef exports reached 359,400 metric tons (mt), an increase of 19% year-on-year (YoY), generating USD 1.66 billion, a 49% increase and the second-best monthly result of the year. Despite this growth, shipments of fresh and processed beef to the United States (US) fell 46% due to additional tariffs, though total exports, including by-products, maintained the US as the second-largest market at USD 136.4 million.

From Jan-25 to Aug-25, Brazil exported 2.41 million metric tons (mmt) of beef, earning USD 10.8 billion, up 19% and 34% YoY, respectively. China remained the leading buyer with USD 4.96 billion in purchases, followed by the US at USD 1.6 billion. Other significant markets included Chile, Mexico, where shipments nearly tripled, and Russia. Overall, 132 countries increased their Brazilian beef imports during this period, reflecting strong global demand and support for continued price stability.

FTAI Cuts Beef Emissions by Half and Boosts Productivity in Brazil

A study by the University of São Paulo (USP), in partnership with GlobalGen and the Brazilian Agricultural Research Corporation (Embrapa), shows that fixed-time artificial insemination (FTAI) can halve the carbon footprint of Brazilian beef production while increasing productivity. Covering over four million beef cows, the research highlights improvements in reproductive efficiency, earlier calving, and higher weaning rates, which shorten the production cycle. These advances translate into a 49% reduction in beef cattle emissions, equivalent to removing 850,000 cars from circulation, while delivering economic returns of USD 0.75 to 1.12 (BRL 4 to 6) for every USD 0.19 (BRL 1) invested. By optimizing calf production, FTAI increases beef output by 27% and enhances genetic quality, combining sustainability with profitability and reinforcing Brazil’s position as a global leader in livestock farming.

Goiás Beef Prices Remain High in Aug-25 Amid Strong Exports and Diversified International Demand

In Aug-25, Goiás fat cattle prices averaged USD 57.53 per arroba, equal to 15 kilograms (BRL 307.25/15kg), up 2.4% from Jul-26, remaining high compared to the past two years due to strong exports, limited slaughter schedules, and constrained supply. Calf prices, which had risen since Oct-24, reached USD 534.43 per head (BRL 2,854.04/head), highlighting the need for strategic cost management and careful acquisition of replacement animals. Internationally, Jul-25 beef exports from Goiás set a monthly record, despite a 33.9% decline in shipments to China, as reduced Chinese demand was offset by increased purchases from Mexico, the US, Russia, and Italy, reinforcing Goiás’ position as Brazil’s third-largest beef exporter.

Indonesia

Indonesia Opens Market for Brazilian Beef, Strengthening Trade and Investment Ties

Following the authorization of Brazilian beef exports, Indonesia has opened a new market for Brazil, reinforcing its role as a strategic food supplier. A delegation visited Mato Grosso, highlighting opportunities for trade partnerships, joint ventures, and direct investments in agribusiness. Indonesian officials emphasized Brazil’s potential to support food security amid rising domestic demand, while local authorities underscored Mato Grosso’s capacity to supply quality, sustainable beef. The visit marks the start of enhanced trade relations between the two countries in the beef sector.

Kazakhstan

Beef Drives Food Inflation in Kazakhstan Despite Government Measures Stabilizing Prices

Kazakhstan’s food price growth has slowed significantly, with food inflation at 0.5% in Aug-25 and the gap with non-food inflation narrowing to 2.9% points. Among key items, beef, particularly chuck roast, remains the main driver of food inflation, rising 23.6% year-to-date (YTD) and contributing nearly 2% points to overall food inflation. As of W39, beef prices average USD 8.62/kg (KZT 4,715/kg), remaining lower than regional peers. Government measures, including banning live cattle exports, imposing export quotas, promoting agricultural fairs, and cracking down on price markups, have helped stabilize the market. Despite rising demand and regional export pressures, Kazakhstan maintains one of the most affordable food baskets in the Eurasian Economic Union.

Paraguay

Paraguay’s Cattle Slaughter Nears 15-Year High Driven by Strong Exports and Market Competitiveness

From Jan-25 to Aug-25, Paraguay’s cattle slaughter reached the second-highest level in 15 years, rising 6% YoY to around 1.56 million heads. Meatpacking plants showed varied capacity utilization, fostering a more competitive market and allowing producers access to fairer prices. Despite a slight supply dip in Aug-25, confinement systems and supplemental pasture indicate greater availability in the coming months. Record exports reflect Paraguay’s focus on product quality, competitive pricing, and compliance with international health standards, positioning the country as a reliable beef supplier and supporting expectations of strong prices and potential herd expansion toward 2027.

Spain

Spain’s Beef Prices Reach Record Highs Driven by Tight Supply and Strong Export Demand

European beef markets, including Spain, Italy, Portugal, and France, are experiencing record-high carcass prices, driven by a limited supply and strong demand. At the Salamanca Agricultural Market, yearling prices rose by up to USD 0.18/kg (EUR 0.15/kg), with cows also reaching all-time highs. Exports to Morocco and Lebanon further tighten supply. Despite growing cattle numbers, discrepancies in animal weights and high replacement costs are creating challenges for farmers and retailers. Market sources expect prices to continue rising in Oct-25, reflecting persistent supply constraints and strong European demand.

2. Weekly Pricing

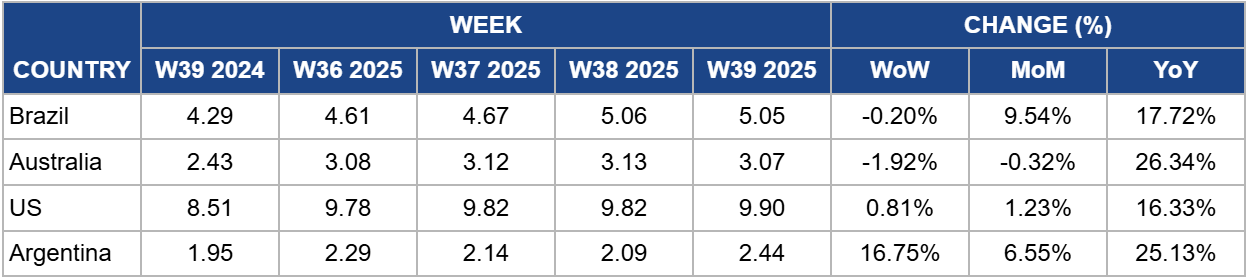

Weekly Beef Pricing Important Exporters (USD/kg)

Yearly Change in Beef Pricing Important Exporters (W39 2024 to W39 2025)

.png)

Brazil

In W39, Brazil’s boneless rear beef prices slightly declined by 0.20% week-on-week (WoW) to USD 5.05/kg, though they remain 17.72% higher than last year, reflecting continued strong market support. Most domestic cattle markets also recorded small declines per arroba (15 kg), with São Paulo at USD 56.21 (-1.64%), Goiás and Minas Gerais at USD 53.40 (-1.72%), and Mato Grosso at USD 55.27 (-1.67%), while Mato Grosso do Sul saw a modest increase to USD 60.89 (+0.62%). Wholesale cuts followed this trend, with rear quarters falling 3.11% to USD 4.37/kg (BRL 23.35/kg) and forequarters down 2.78% to USD 3.28/kg (BRL 17.50/kg).

The softening reflects adequate slaughter schedules and active forward contracts that supply animals, which help maintain supply stability. Exports continue to underpin the market, with Sep-25 shipments totaling 209,645 mt and generating USD 1.179 billion—up 16.6% in volume and 45.4% in daily export value YoY. The strong export performance supports domestic prices, suggesting limited downside risk despite short-term weekly declines. If export demand persists, Brazil’s beef prices are likely to maintain a firm trajectory, although competition from poultry may continue to moderate wholesale and retail price growth.

Australia

In W39, Australia’s beef prices declined slightly by 1.92% WoW to USD 3.07/kg but remain 26.34% higher YoY, reflecting continued strong market support. Cattle yardings eased by 5.33 thousand heads to 68.61 thousand, with sharp declines in Queensland offset by modest increases in New South Wales. Strong demand for heavy cows pushed processor cow prices to record levels, while leaner cows under 520 kg also saw gains at Wagga Wagga. Feeder steer prices softened amid focus on secondary cattle, though lot feeders sustained price support in NSW and Queensland. Overall, limited supply and robust domestic demand suggest that Australian beef prices are likely to remain firm in the near term, with potential upward pressure if heavy cow demand continues.

United States

US lean beef (92–94%) prices rose 0.81% WoW to USD 9.90/kg in W39, an increase of 16.33% YoY, driven by tight cattle inventories and strong domestic demand. The US cattle herd totaled 94.2 million heads as of July 1, with feedlot inventories declining for the eighth consecutive month to 10.92 million heads, the lowest since Oct-17. Reduced placements and marketing over the past six months have tightened the fed cattle supply, limiting beef output. External factors, including a 50% tariff on Brazilian beef and border disruptions with Mexico, have further constrained imports. While elevated prices support market strength, persistent high costs are starting to dampen retail demand, suggesting potential moderation in consumption and pressure on future price growth.

Argentina

In W39, Argentina’s beef prices rose 6.55% WoW to USD 2.44/kg, a rise of 25.13% YoY, reflecting strong structural demand and a recovering domestic market. Per capita consumption reached 49.8 kg in Aug-25, up 4.2% YoY, supported by improved household purchasing power and slower inflation, which fell to 34.6%, the lowest since Dec-20. Between Jan-25 and Aug-25, apparent beef consumption increased 7.7% YoY to 1.56 mmt, while retail beef price gains remained moderate at 1.0% month-on-month (MoM). The combination of resilient demand and contained retail inflation supports continued price stability, with potential for further moderate increases if consumption growth persists.

3. Actionable Recommendations

Diversify Market Access Beyond the US

Brazilian exporters should mitigate the impact of US tariffs by deepening trade ties with emerging buyers such as Mexico, Indonesia, and Russia, while consolidating demand in established markets like China and Chile. Establishing joint ventures, leveraging government-to-government agreements, and tailoring product portfolios to local preferences will reduce reliance on tariff-sensitive destinations and support continued export growth.

Integrate FTAI to Boost Productivity and Sustainability

Producers should adopt FTAI technology at scale to enhance reproductive efficiency, reduce the carbon footprint, and increase beef output. By improving genetics and shortening production cycles, producers can achieve up to 27% higher beef supply, positioning Brazil as a leader in sustainable livestock production. This approach will improve international competitiveness, particularly in Europe and Asia, where sustainability certifications are becoming key to market access.

Optimize Price Stability Through Cost Management and Strategic Procurement

With high calf prices and strong fat cattle valuations in regions like Goiás, producers should adopt more efficient procurement strategies, including forward contracts, pasture supplementation, and integration with feedlot systems. These measures will lower input cost risks, stabilize production cycles, and sustain profitability. By aligning herd management with export demand, producers can balance domestic price pressures while securing long-term supply commitments in premium international markets.

Sources: Tridge, Canal Rural, Agropopular, Agromeat, Agrolink