W39 2025: Palm Oil Weekly Update

In W39 in the palm oil landscape, some of the most relevant trends included:

- Palm oil prices in Bangladesh have risen recently due to higher wholesale costs and reduced supplier commissions, despite government-enforced price controls. Retailers report selling bottled oil at a loss amid temporary supply shortages.

- Regional sustainability efforts are advancing, with the APOA, CPOPC, and Solidaridad signing a tripartite MOU to harmonize standards, promote regenerative practices, and ensure traceable, smallholder-inclusive, NDPE-compliant palm oil, particularly in India and South Asia. Initiatives include digital traceability pilots, importer dashboards, and joint working groups.

- Indonesia’s palm oil production declined slightly in 2024, while domestic consumption rose due to biodiesel mandates and food demand. Strong CPO prices are expected through 2025, with supply risks from smallholder issues and fires.

- Malaysia raised its Oct-25 CPO benchmark price and maintains a 10% export duty, with MSPO certification recognized by the EU. Supporting sustainability compliance and market confidence.

- Indonesia’s palm oil exports to the EU are expected to rise due to a new trade agreement and delays in the EUDR, improving market access and regulatory certainty.

1. Weekly News

Bangladesh

Bangladesh Sees Rising Retail Prices for Soybean and Palm Oil Despite Government Price Controls

Retail prices of soybean oil and palm oil in Bangladesh have risen in recent days despite the government rejecting a proposed USD 0.082 per liter (BDT 10/liter) increase. Loose soybean oil now trades at USD 1.40 to 1.41/liter (BDT 170 to 172/liter), while palm oil sells for USD 1.27 to 1.31/liter (BDT 155 to 160/liter), an increase from USD 1.39/liter (BDT 169/liter) and USD 1.23/liter (BDT 150/liter), respectively, in September 22. The price rise is attributed to reduced supplier commissions and higher wholesale rates, creating temporary supply shortages. Bottled oil prices remain officially fixed, but retailers report selling at a loss due to increased wholesale costs. The government continues to enforce fixed prices for both bottled and loose edible oils.

India

Producers and Consumers Sign MOU to Advance Sustainable Palm Oil in India and South Asia

The Asian Palm Oil Alliance (APOA), the Council of Palm Oil Producing Countries (CPOPC), and Solidaridad, an international non-profit organization that promotes sustainable supply chains, signed a tripartite Memorandum of Understanding (MOU) on September 25, 2025, in Mumbai to strengthen collaboration between palm oil producers and consumers and advance sustainability across the value chain, with a focus on India and South Asia. The MOU establishes a formal platform to harmonise national sustainability frameworks—including Indonesian Sustainable Palm Oil (ISPO), Malaysian Sustainable Palm Oil (MSPO), and Indian Palm Oil Sustainability (IPOS)—promote regenerative practices, and ensure traceable, smallholder-inclusive, No Deforestation, No Peat, and No Exploitation (NDPE) compliant sourcing. Initiatives include digital traceability pilots, importer-facing dashboards for Indian buyers, and a Joint Working Group to coordinate progress and advocacy. The partnership aims to enhance market stability, support smallholder livelihoods, and provide consumers with affordable, responsibly produced palm oil, while fostering transparency and alignment on sustainability standards across producing and consuming countries.

Indonesia

Rising Domestic Demand Drives Indonesia’s Palm Oil Market Despite Production Challenges

Indonesia, the world’s largest palm oil producer and consumer, saw domestic consumption of crude palm oil (CPO) rise to 23.8 mmt in 2024, nearly half of its total output, while production declined to 52.7 mmt from 54.8 million tonnes in 2023. The biodiesel mandate and increasing demand from the food industry primarily drive the increase. Exports weakened as high prices pushed global buyers toward alternatives, with shipments to India falling 28% year-on-year (YoY) in early 2025, though Indonesia remains India’s main supplier. According to the Indonesian Palm Oil Association (GAPKI) chairman, production faces challenges from land conflicts and the need to rejuvenate smallholder plantations, which account for 42% of the planted area. He projected strong CPO prices through 2025, ranging from USD 1,100 to USD 1,200/mt, with spot values potentially reaching USD 1,300 Cost, Insurance, and Freight (CIF) Rotterdam. Experts warn that prioritizing domestic supply for biodiesel and food could tighten global vegetable oil availability, adding further upward pressure on prices.

Indonesia’s Palm Oil Exports to EU Poised to Grow on Trade Deal and Regulatory Delay

Indonesia’s palm oil exports to the European Union (EU) are expected to rise to around 4 mmt in 2026, up from an estimated 3.3 mmt this year, driven by a new bilateral trade agreement and the postponement of the European Union Deforestation Regulation (EUDR). The trade deal removes 98% of barriers, while the law’s delay allows Indonesian producers more time to meet sustainability and logistical requirements. Jakarta anticipates that palm oil sales to the EU could double within five years, reflecting improved market access and regulatory certainty.

Malaysia

US Considers Tariff Exemptions to Support Malaysian Palm Oil and Cocoa Exports

The United States (US) is considering tariff exemptions for key Malaysian exports, including palm oil and cocoa, with a decision expected in Oct-25. The move aims to maintain the competitiveness of Malaysian products in the US market, where palm oil exports are valued at USD 1.16 billion (MYR 4.9 billion). The exemptions are part of broader discussions on new US tariff measures, including a 100% duty on certain pharmaceutical products. Malaysian officials hope that granting concessions for palm oil and other goods could prevent export losses and establish a precedent for other Asian exporters.

Malaysia Raises Oct-25 CPO Benchmark to Maintain 10% Export Duty

Malaysia raised its Oct-25 benchmark CPO price to USD 1,015.87/mt (MYR 4,268.68/mt), maintaining the export duty at 10%, according to the Malaysian Palm Oil Board (MPOB). The increase from Sep-25’s USD 963.15/mt (MYR 4,053.43/mt) keeps the duty within the maximum band, which applies to prices above USD 962.34 (MYR 4,050). The initial export duty is 3% for prices between USD 534.63 and 570.27/mt (MYR 2,250 and 2,400/mt). Malaysia’s MSPO certification is recognized by the EU as a credible standard to help meet new deforestation regulations.

Peru

Peruvian Delegation Strengthens Palm Oil Competitiveness at International Conference in Colombia

A delegation of Peruvian business leaders participated in the 21st International Oil Palm Conference, held from September 23 to 25 in Cartagena, Colombia, under the theme “Adapt and Grow: Toward a Sustainable Future in the Oil Palm Agroindustry.” The event gathered more than 2,600 participants and 60 international speakers to address crop management, biotechnology, processing, added value, sustainability, and global market trends. The Peruvian delegation engaged in discussions on sustainable cultivation practices, biofuels, and opportunities in international markets, while also visiting production fields and processing plants to observe best practices. According to the manager of Kampu Group, a Peruvian agribusiness company engaged in the cultivation and processing of oil palm, the conference served to update knowledge and enhance the competitiveness of Peru’s oil palm value chain.

2. Weekly Pricing

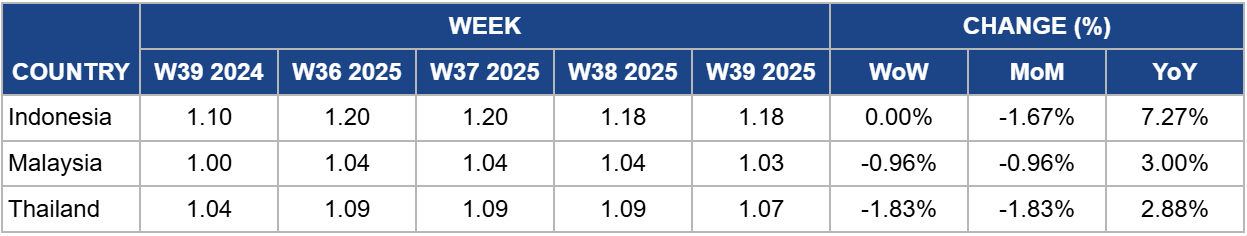

Weekly Palm Oil Pricing Important Exporters (USD/kg)

Yearly Change in Palm Oil Pricing Important Exporters (W39 2024 to W39 2025)

.png)

Indonesia

Indonesia’s palm oil prices remained stable at USD 1.18 per kilogram (kg) in W39, showing no weekly changes but rising 7.27% YoY from USD 1.10/kg. While the country is experiencing a wetter dry season with above-average rainfall, independent analyses indicate increasing forest and land fires, particularly in oil palm concessions, with 218,000 hectares (ha) burned from Jan-25 to Aug-25. Approximately 42% of these fires occurred within industrial concessions, including oil palm plantations, and many were likely anthropogenic. Despite this, official reports show a 25% decline in total fire-affected areas compared to the same period in 2023.

Fires in key regions such as West Kalimantan and Riau, along with vulnerable peatlands, could threaten future palm oil supply. While GAPKI reports no incidents among affiliates, continued monitoring is essential. Any escalation in fire activity may tighten supply and push prices higher, especially during the Sep-25 to Nov-25 transitional period.

Malaysia

In W39, Malaysia’s palm oil prices eased slightly by 0.96% week-on-week (WoW) to USD 1.03/kg, while rising 3% YoY from USD 1/kg. Dec-25 palm oil futures on the Bursa Malaysia Derivatives Exchange (BMD) gained 1.39% to USD 1,055.13/mt (MYR 4,440 ringgit/mt), supported by robust export performance, stronger soyoil prices, and the EU’s one-year delay of its anti-deforestation law. Exports for Sep-25 rose an estimated 11–13% month-on-month (MoM), reinforcing market sentiment. While weaker crude oil and a slightly softer ringgit may limit biodiesel-driven demand, the combination of export strength and regulatory relief in the EU is likely to stabilize prices and support near-term market confidence.

Thailand

In W39, Thailand’s palm oil prices fell 1.83% WoW to USD 1.07/kg, while rising 2.88% YoY from USD 1.04/kg. The decline reflects bearish regional sentiment and high inventory levels in Malaysia, which limit export opportunities and cap price movements. Despite the short-term dip, the YoY increase indicates a stronger underlying market for vegetable oils in 2025, suggesting potential support for price stability if regional demand picks up or inventories decrease.

3. Actionable Recommendations

Leverage Sustainability Initiatives to Secure Premium Markets

Producers in Indonesia and Malaysia should actively implement NDPE-compliant and traceable supply chains, capitalizing on the recent APOA–CPOPC–Solidaridad MOU. Highlighting verified sustainability practices—such as smallholder inclusion, digital traceability, and regenerative methods—will strengthen market access in India, the EU, and other environmentally conscious markets, allowing exporters to command stable or premium prices amid global supply tightness.

Optimize Export Strategies in Response to Regional Price Trends

Indonesia and Malaysia should strategically manage exports to high-demand markets such as India and the EU, balancing domestic consumption pressures with international sales. With Indonesia’s strong domestic biodiesel demand and Malaysia’s rising benchmark CPO prices, targeted volume agreements, forward contracts, and monitoring competing vegetable oils will help stabilize revenues, reduce inventory risks, and secure long-term buyer relationships.

Enhance Risk Management and Supply Chain Resilience

Producers and traders should implement proactive risk management measures to mitigate supply disruptions from fires, land conflicts, and smallholder plantation challenges. Investments in monitoring systems, insurance schemes, and smallholder support programs will safeguard production continuity, prevent abrupt price spikes, and reinforce confidence among buyers in both domestic and export markets.

Sources: Tridge, AGROPERÚ, Ukr Agroconsult