1. Weekly News

Brazil

Reduced Processing Plants and Low Fruit Quality Challenge São Paulo's Orange Industry

São Paulo's orange industry faces significant challenges. The number of active processing plants has declined from ten to six as of Jan-24, raising concerns about supply sustainability beyond Feb-25. Low fruit quality due to insufficient rainfall during fruit development has resulted in a diminished brix-acid ratio and poor juice yield, affecting processing efficiency. While current raw material is expected to sustain operations until February, uncertainties about supply for March highlight vulnerabilities in Brazil's orange supply chain.

France

French Orange Market Strengthens with Diverse Supply Sources

The French orange market remains a primary outlet for Moroccan producers, supported by various origins and high consumer expectations. While Spain, Italy, and Portugal dominate the supply, Spain leads despite challenges like floods in Valencia affecting volumes. Premium varieties such as Italian Naveline Feuille and Portuguese Newhall PGI oranges are highly valued. Wholesale prices range from USD 1.05 to 1.58 per kilogram (EUR 1/kg to 1.5/kg) but are expected to stabilize as supply increases during the peak season. Despite climatic and logistical disruptions, the quality of oranges remains high, ensuring French consumers have access to fresh, top-quality produce.

India

Rising Competition from Rajasthan Threatens Nagpur's Orange Market Dominance

Nagpur, India's top orange producer and exporter, faces increasing competition from Rajasthan, where smaller, sweeter, and more vibrant oranges are gaining popularity. Rajasthan supplies 10 to 15 tons of oranges daily at prices ranging from USD 0.24 to USD 0.61/kg, challenging Nagpur's market share. Meanwhile, Amravati continues to offer 30 to 40 tons of larger, thicker-skinned oranges with a sour-sweet taste, priced at USD 0.18 to USD 0.49/kg. While competition continues to grow, wholesale prices have remained stable compared to last year. This stability, supported by the Mrigbahar crop, provides some assurance for traders and growers as the season extends into mid-Jan-25.

South Africa

South Africa's Valencia Orange Exports Struggle with Adverse Weather and Market Instability

South Africa's Valencia orange exports encountered significant hurdles this season, including adverse weather conditions, logistical disruptions, and market oversupply. Frost, heavy rains, and hurricanes delayed shipments from Port Elizabeth, causing initial shortages in European markets. However, a sudden surge in orange arrivals in Oct-24 created an oversupply, driving prices down sharply and leading to considerable losses for importers who had anticipated lower volumes. The efforts to redirect shipments to alternative markets, such as Canada, were thwarted by logistical strikes, worsening the challenges. Despite packing 48.7 million boxes, 16% below the original forecast, growers struggled to balance fresh orange supply and demand. The Citrus Growers Association (CGA) noted that fluctuating juice market dynamics added further unpredictability, as high juice prices did not translate to steady demand for fresh produce. This season underscores the complexity of navigating market trends and logistical uncertainties in global citrus exports.

Spain

Spanish Navel Oranges Face Quality Issues Upon Arrival in Brazil

The first shipment of Spanish Navel oranges for the season reached São Paulo's wholesale market in W48. However, the fruit's quality was below expectations, with noticeable signs of rotting and mold, an uncommon issue for early-season produce. These quality concerns have impacted the market, with 14-kg boxes of Class 1 oranges, sized between calibers 40 and 56, being sold at wholesale prices ranging from USD 21.56 to USD 23.22/14-kg box (BRL 130 to 140/14-kg box). This highlights an early challenge for Spanish orange exporters aiming to meet quality standards in the Brazilian market.

2. Weekly Pricing

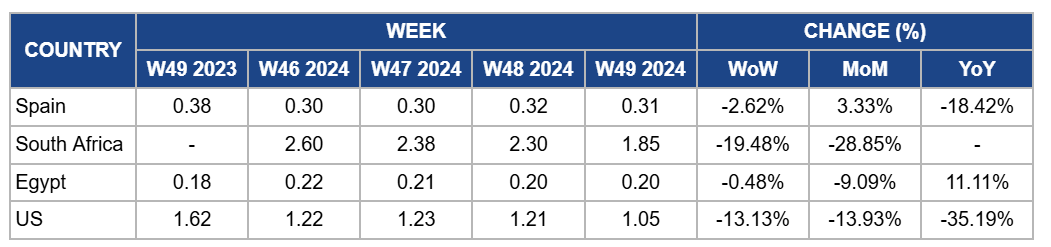

Weekly Orange Pricing Important Exporters (USD/kg)

Yearly Change in Orange Pricing Important Exporters (W49 2023 to W49 2024)

Spain

Orange prices in Spain fell by 2.62% week-on-week (WoW) to USD 0.31/kg in W49. This marked a significant year-on-year (YoY) decline of 18.42% because of the dominance of smaller-sized oranges–comprising 40 to 70% of batches–making them less appealing to retailers. Low supermarket pricing for orange nets also contributed to the decline. Increased competition from upcoming Egyptian orange supplies, which are expected to enter the market by mid-Dec-24, has also pressured prices. However, prices saw a 3.33% month-on-month (MoM) increase due to improved demand for larger-sized oranges and those sold with leaves. This trend was particularly strong in premium markets like Italy, Belgium, and France, where careful handling and strategic packaging have supported higher profitability.

South Africa

In W49, orange prices in South Africa experienced a sharp decline, dropping by 19.48% WoW to USD 1.85/kg, reflecting a 28.85% MoM decrease. This decline is due to an oversupply in primary markets, mainly Europe, following a sudden surge in orange arrivals in Oct-24 after earlier shipment delays caused by frost, heavy rains, and hurricanes. The oversupply led to intense competition and sharp price reductions, worsened by logistical strikes that hindered efforts to redirect exports to alternative markets like Canada. The reduced export forecast and unpredictable juice market dynamics further contributed to market volatility, adding downward pressure on fresh orange prices.

Egypt

Orange wholesale prices in Egypt dropped slightly by 0.48% WoW and 9.09% MoM to USD 0.20/kg in W49 due to the anticipation of the upcoming harvest season, which is expected to significantly increase supply, prompting producers to adjust prices lower to clear out remaining stock from the previous season. Strategic price adjustments ahead of the export season also contributed to the downward trend. However, there is an 11.11% YoY price increase due to strong international demand, particularly from key export markets, and tighter supply conditions compared to the previous year. Limited carryover supply and ongoing global citrus shortages have supported continued market interest in Egyptian oranges.

United States

In W49, orange prices in the United States (US) declined by 1.05% WoW to USD 1.05/kg, reflecting a 13.93% MoM drop and a 35.19% YoY decline. This is due to a continued increase in local supply following the resolution of earlier weather-related disruptions in Northern California, enabling higher harvesting and improved distribution. Additionally, elevated import volumes from major citrus-exporting regions have intensified market competition, putting downward pressure on prices. The YoY decline is due to weaker consumer demand than the previous year and a substantial production recovery in key regions like Florida, which had previously experienced significant setbacks due to citrus diseases and adverse weather conditions.

3. Actionable Recommendations

Optimize Supply Chain and Market Diversification for Valencia Oranges

Exporters and growers in South Africa's Valencia orange sector should optimize supply chain strategies and diversify market outreach. Exporters must strengthen coordination with logistics providers to mitigate oversupply risks and logistical disruptions, ensure timely shipments, and avoid port bottlenecks. Diversifying target markets beyond Europe and Canada can reduce dependency on a few regions and spread risks. Additionally, marketing efforts should emphasize the versatility and quality of Valencia oranges to tap into niche and high-demand segments in underexplored markets. These strategies should be driven by citrus exporters, in collaboration with grower associations, to stabilize operations and revenue.

Enhance Market Position through Differentiation and Branding

Nagpur orange traders and growers should focus on differentiating their produce by emphasizing their oranges' unique sour-sweet flavor and nutritional benefits. Collaborating with local marketing agencies, they should launch branding campaigns highlighting Nagpur oranges' heritage and quality. Additionally, improving packaging and targeting high-demand urban and export markets can help maintain competitive pricing and market share. This approach, led by traders and growers, will ensure Nagpur's oranges remain a preferred choice amidst rising competition from other regions.

Strengthen Supply Resilience Through Strategic Planning

São Paulo's orange processors should collaborate with growers to secure supply beyond Feb-25 by implementing advanced crop management practices such as precision irrigation, soil nutrient management, and integrated pest management (IPM) to improve fruit quality and yield. Processors must also explore diversifying sourcing regions within Brazil to reduce dependence on a single area. Establishing supply contracts and fostering partnerships with growers will ensure a steady flow of raw materials, mitigating the impact of production challenges on processing operations.

Sources: Tridge, Agrimaroc, CEPEA, Comitedecitricos, Eastfruit, Freshplaza, PunekarNews, USDA