In W6 in the tomato landscape, some of the most relevant trends included

- India’s tomato production for 2024/25 is estimated at 215.49 mmt, a 1.06% YoY increase. In Odisha, farmers were forced to sell at distressed prices of USD 0.023/kg due to oversupply, while the government introduced a Market Intervention Scheme in Madhya Pradesh to support storage and transportation.

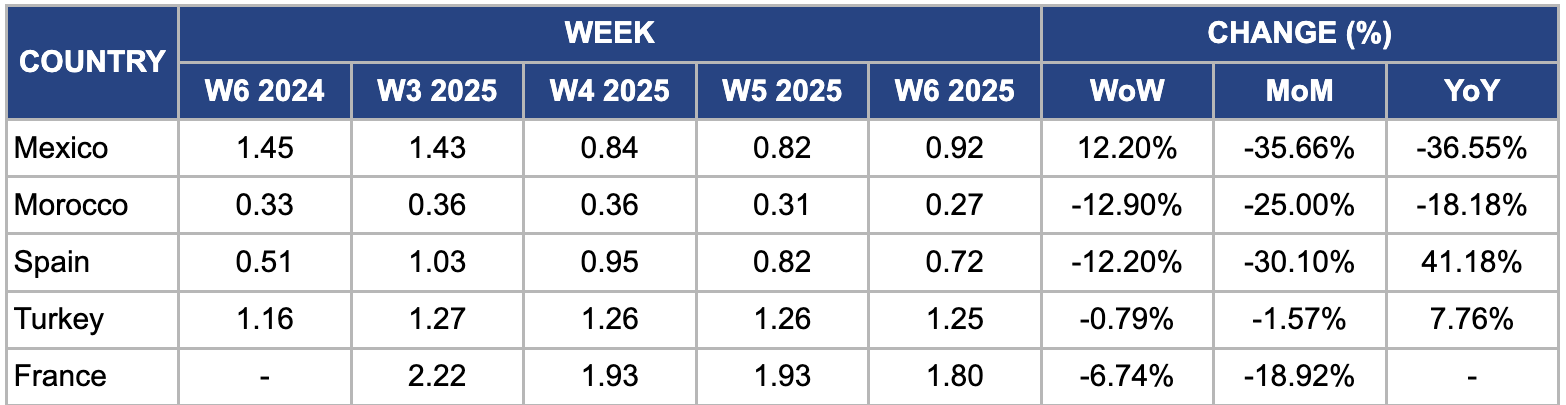

- Mexico’s tomato prices rose WoW following a 25% US tariff but remained lower MoM due to oversupply. Morocco’s prices declined WoW as the impact of Tobamovirus eased, while Spain’s prices fell both WoW and MoM due to increased domestic and imported supply.

- The Philippines recorded a 155.7% YoY surge in tomato inflation in Jan-25 due to cyclone-driven shortages. Meanwhile, Türkiye and France saw minor price declines, with France’s greenhouse tomato production dropping 9% YoY, tightening supply.

1. Weekly News

India

India’s Tomato Production to Rise Slightly in 2024/25 Crop Year

In the 2024/25 crop year (July to June), Indian tomato production is estimated to reach 215.49 million metric tons (mmt). According to the Agriculture Minister's first advance estimate, this is a 1.06% year-on-year (YoY) increase from 213.23 mmt in 2023/24.

Tomato Prices Crashed in Odisha in W6

In W6, tomato farmers in Odisha, particularly in Dhenkanal, Keonjhar, Rayagada, Koraput, and Kandhamal, faced severe losses as prices plummeted to USD 0.023 per kilogram (kg), forcing distress sales. This is significantly lower than Jul-24's USD 1.15/kg price. Farmers who invested heavily in fertilizers, pesticides, and labor struggled to recover costs. Lack of cold storage prevents them from holding stocks for better prices, pushing many to dump tomatoes on roads or sell at throwaway prices. Oversupply and weak market linkages have worsened the crisis, leaving farmers vulnerable to middlemen offering minimal rates.

India Approves Reimbursement for Tomato Storage and Transport

In response to falling tomato prices, the Indian government will reimburse storage and transportation costs for tomatoes in Madhya Pradesh under the Market Intervention Scheme (MIS). The Agriculture Minister has approved the transportation component of the MIS, and the National Cooperative Consumers' Federation (NCCF) will implement it. Under this initiative, NCCF will soon transport tomatoes from Madhya Pradesh. The scheme covers operational costs for storing and transporting TOP crops (tomato, onion, and potato) to bridge price gaps between producing and consuming states. National Agricultural Cooperative Marketing Federation of India (NAFED) and NCCF will receive reimbursements to support farmers in producing states.

Philippines

Tomato Prices in the Philippines Surged in Jan-25 Amid Supply Disruptions

In Jan-25, tomatoes saw the highest inflation rate in the Philippines, surging to 155.7% from 120.8% in Dec-24, reflecting a sharp price increase. This is primarily due to supply chain disruptions caused by six consecutive tropical cyclones between Oct-24 and Nov-24. These typhoons inflicted extensive damage on key tomato-producing regions, including Cagayan Valley, Calabarzon, and Bicol, substantially reducing supply. Consequently, retail prices in Metro Manila escalated dramatically, reaching between USD 3.46 to 6.05/kg as of January 4, 2025, a stark increase from the USD 0.69 to 1.73/kg range observed in the same period the previous year. The Department of Agriculture anticipates that prices may stabilize in the coming weeks, coinciding with the onset of the dry season and the resumption of tomato production.

2. Weekly Pricing

Weekly Tomato Pricing Important Exporters (USD/kg)

Yearly Change in Tomato Pricing Important Exporters (W6 2024 to W6 2025)

Mexico

In W6, Mexico's tomato prices rose 12.20% week-on-week (WoW) to USD 0.92/kg from USD 0.82/kg. This increase follows the 25% tariff imposed by the United States (US) on Mexican tomato imports, effective February 1, 2025. The tariff has disrupted exports, leading to an oversupply in Mexico as exporters seek alternative markets or redirect produce domestically, pushing prices upward. However, prices declined 35.66% month-on-month (MoM) and 36.55% YoY due to increased domestic supply. Major producing regions like Sinaloa and Baja California have reported higher yields due to favorable weather, further adding to market pressure.

Morocco

In W6, Morocco's tomato prices fell 12.90% WoW to USD 0.27/kg from USD 0.31/kg in W5, marking a 25% MoM decline from USD 0.36/kg in W3. This price drop is primarily due to the waning impact of the Tobamovirus (plant virus genus causing mosaic diseases in crops like tomatoes), which had previously caused severe production losses. Despite initial estimates indicating a 50% YoY production decline, recent crop conditions and output improvement have eased supply constraints, reducing prices.

Spain

Spain's tomato prices fell 12.20% WoW and 30.10% MoM to USD 0.72/kg in W6. This decline is primarily due to increased domestic production and higher import volumes. Over the past decade, Spanish tomato production has decreased by nearly 19%, leading to a greater reliance on imports from countries like Morocco and Türkiye. In recent months, favorable weather conditions have resulted in abundant harvests both domestically and in these exporting countries, leading to an oversupply in the Spanish market. This surplus has exerted downward pressure on prices. Moreover, the European Union (EU) reported lower tomato prices in Feb-25 compared to previous years, with Spain experiencing prices 43% below the five-year average, further contributing to the observed price decrease.

Türkiye

In W6, Türkiye's tomato prices experienced a slight decline of 0.79% WoW and 1.57% MoM, settling at USD 1.25/kg. This marginal decrease is primarily due to improved weather conditions in key tomato-producing regions, including Antalya, Mersin, İzmir, and Aydın. These regions benefit from a Mediterranean climate characterized by mild, wet winters and hot, dry summers, which are optimal for tomato cultivation. Earlier adverse weather, including cold temperatures and excessive rainfall, had constrained yields, but recent favorable conditions have enhanced production and supply stability. Moreover, stable export demand has contributed to maintaining price levels without significant fluctuations.

France

In W6, France's tomato prices fell 6.74% WoW and 18.92% MoM to USD 1.80/kg. Despite this decline, greenhouse tomato production dropped 9% YoY to 436,236 metric tons (mt) in 2024. While outdoor production increased by 19% YoY, it has not fully offset the overall supply reduction. The decline in greenhouse output is due to adverse weather conditions and reduced cultivated areas.

3. Actionable Recommendations

Strengthen Cold Storage and Supply Chain Infrastructure in India

To mitigate distress sales and post-harvest losses in states like Odisha, India should expand cold storage facilities, particularly in major tomato-producing regions. Public-private partnerships (PPPs) can encourage investment in storage and processing units, allowing farmers to store surplus production and sell at better prices when demand rises. Developing farm-to-market logistics hubs can streamline transportation and reduce reliance on middlemen.

Diversify Mexico’s Tomato Export Market

With the US imposing a 25% tariff on Mexican tomato imports, exporters should explore alternative markets in Canada, the EU, and Asia, particularly Japan, South Korea, Singapore, and Malaysia, which has strong demand for high-quality fresh produce. Mexico can strengthen trade agreements with these regions and promote premium-quality tomatoes for high-value segments. Moreover, fostering domestic demand through retail promotions and food processing incentives can help absorb excess supply and stabilize prices.

Enhance Climate-Resilient Tomato Farming in the Philippines

Frequent typhoons have severely impacted tomato production in the Philippines. The country should implement climate-resilient farming practices such as protected cultivation (greenhouses, net houses), improved drainage systems, and the adoption of drought- and disease-resistant tomato varieties like Roma VF, Sona, Swarna Naveen, and Arka Rakshak, which offer resistance to bacterial wilt, leaf curl virus, and late blight. These measures can help reduce weather-related yield losses. Moreover, establishing early warning systems and insurance programs can help farmers mitigate risks and ensure a stable consumer supply.

Sources: Tridge, AP News, Business Standard, Economic Times, Horti Daily, Philippines News Agency, Times Of India