.jpg)

In W1 in the rice landscape, Bangladesh began importing rice from India, receiving 27,000 mt as part of a broader agreement to secure 200 thousand mt of parboiled rice. Meanwhile, Brazil's Santa Catarina rice industry expressed optimism for the 2024/25 harvest, anticipating a bumper crop of 1.2 mmt despite declining rice prices due to the expected high-quality yield. Indonesia's rice production in 2024 remained steady at 31 mmt, nearly the same as 2023’s output, despite challenges from El Niño. India saw a notable 8% YoY increase in agricultural exports, with rice exports growing by 13%, driven by the government’s removal of export restrictions and a bumper harvest of 120 mmt. Regarding pricing, India's wholesale rice prices dropped WoW, pressured by abundant domestic inventories. In contrast, Vietnam's rice prices rose MoM and YoY, bolstered by growing export demand from countries like the Philippines and Indonesia and global market fluctuations.

1. Weekly News

Bangladesh

Bangladesh Boost Rice Imports from India and Myanmar Amid Flood Concerns

Bangladesh's interim government has initiated rice imports from India, with the first consignment of 27 thousand metric tons (mt) arriving at Chittagong Port as part of an agreement to purchase 200 thousand mt of parboiled rice. In response to recent severe floods and to mitigate future shortages, Bangladesh plans to import an additional 100 thousand mt of rice through tenders and further quantities through government-to-government (Gt2G) arrangements with India. Additionally, private importers have secured permission to import 1.6 million metric tons (mmt) of Indian rice under a zero-duty policy to stabilize prices. Bangladesh has also signed a GtoG agreement with Myanmar to import 100 thousand mt of rice.

Brazil

Santa Catarina’s 2024 Rice Harvest Poised to Reach 1.2 MMT

Brazil's Santa Catarina Rice Industry Union (SindArroz-SC) is optimistic about the 2024/25 harvest, with the region's rice planting now complete. According to the Santa Catarina Agricultural Research and Rural Extension Company (EPAGRI), the harvest,set to begin in late Jan-25, is expected to yield 1.2 mmt. Rice prices have already started to decline due to the anticipated bumper harvest. With ample sunlight and sufficient water, favorable weather conditions are expected to produce a high-quality crop.

Indonesia

Indonesia’s 2024 Rice Production Remained Stable Despite El Niño Drought

According to the Agriculture Minister, Indonesia maintained its rice production levels near those of the previous year despite months of drought caused by the El Niño phenomenon. The country’s rice production in 2024 reached almost 31 mmt, just 500 thousand mt less than 2023's figure of 31.5 mmt. Indonesia faced La Niña and El Niño, resulting in prolonged droughts and floods in key rice-producing areas. Despite these challenges, rice production remains strong, ensuring stability for the staple food of Indonesia's 280 million population.

India

India's Rice Exports Hit USD 7.31 Billion, Driving Agricultural Trade Boom

India's agricultural and processed food exports rose by over 8% year-on-year (YoY) to USD 14.01 billion from Apr-24 to Nov-24. This is driven mainly by a 13% spike in rice exports, which reached USD 7.31 billion compared to USD 6.44 billion in the same period in 2023. This growth follows the government’s removal of restrictions on rice exports in Sep-24, including the minimum export price and export duties for basmati and non-basmati varieties. Exporters anticipate a further 10% rise in rice exports this year, supported by robust global demand despite challenges in critical markets like Iran. With a target of 5 mmt for 2025, India has cemented its dominance in global rice exports. It significantly outpaced competitors like Pakistan, which exports less than 1 mmt annually.

Russia

Russia Achieved Record Rice Harvest of 1.2 MMT in 2024

According to preliminary data from the Russian Ministry of Agriculture, Russia's rice harvest in 2024 reached a record 1.2 mmt, a 17% YoY increase. The total rice cultivation area spans 207 thousand hectares (ha). Nearly two-thirds of the production was concentrated in the Krasnodar Territory, which produced 829 thousand mt. Other significant producing regions include the Republic of Dagestan, the Rostov Region, the Chechen Republic, and the Primorsky Territory. The Ministry aims to increase rice production to 2 mmt by 2030, ensuring domestic self-sufficiency and enabling export opportunities

2. Weekly Pricing

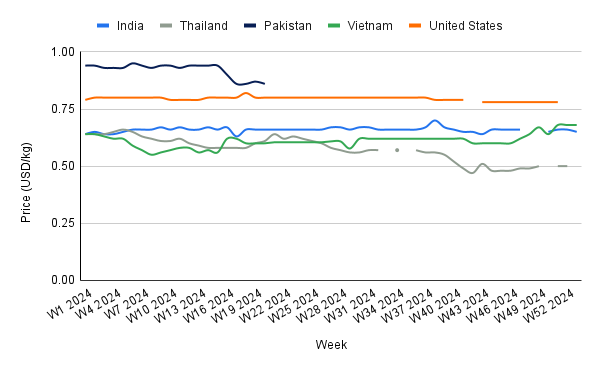

Weekly Rice Pricing Important Exporters (USD/kg)

Yearly Change in Rice Pricing Important Exporters (W1 2024 to W1 2025)

India

In W1, India's wholesale rice prices decreased by 1.52% week-on-week (WoW), reaching USD 0.65 per kilogram (kg). This decline is due to the nation's record-breaking rice production, which reached 120 mmt during the summer, accounting for approximately 85% of total rice output. The bumper harvest has increased rice inventories, with state granaries holding 44.1 mmt of rice reserves at the beginning of Dec-24, exceeding the government's target by more than five times. This surplus has exerted downward pressure on domestic rice prices, decreasing the observed price.

Vietnam

In W1, Vietnamese rice prices remained stable WoW but increased by 6.25% month-on-month (MoM) and 6.25% YoY to USD 0.66/kg. Vietnam's rice export prices have risen, with 25% broken rice reaching USD 539/mt, surpassing Thailand and Pakistan's. This surge is due to increased imports from traditional partners, including the Philippines and Indonesia, which have ramped up their rice import volumes. Moreover, the global rice market has experienced price fluctuations due to various factors, including India's removal of export restrictions, leading to increased competition and influencing Vietnamese rice prices.

3. Actionable Recommendations

Strengthen Indonesia's Resilience to Climate Variability

Indonesia should adopt advanced climate adaptation measures to mitigate the impacts of El Niño and La Niña events on rice production, focusing on drought-tolerant rice varieties like IR64-Sub1, Sahbhagi Dhan, Ciherang-Sub1, and Salibego, which are suited for water-scarce conditions. Expanding irrigation infrastructure, including drip irrigation and community-managed reservoirs, can enhance water use efficiency, while government-backed insurance schemes will protect farmers from climate-related losses. Moreover, improving real-time weather forecasting and farmer advisory systems using satellite technology and mobile platforms will help optimize planting schedules and water management, ensuring resilience and stability in Indonesia’s rice production.

Promote Value-Added Export Opportunities for Brazilian Rice

As Santa Catarina anticipates a bumper rice harvest of 1.2 mmt, Brazil should focus on developing value-added rice products, such as fortified or organic rice, on catering to niche international markets. Enhancing branding and quality certifications for Santa Catarina rice could help access premium markets in Europe, North America, and the Middle East. Furthermore, investing in modern post-harvest technologies to maintain grain quality during storage and transport would enhance competitiveness and support Brazil's goal of increasing rice exports.

Enhance Rice Supply Security Through Strategic Reserves and Diversified Imports

Bangladesh should leverage its current agreements with India and Myanmar to ensure a steady rice supply while exploring additional partnerships with other major exporters like Vietnam and Thailand. These diversified agreements will reduce dependency on specific sources and mitigate risks from potential supply disruptions. Long-term procurement plans through GtoG arrangements and private import channels can stabilize domestic rice prices, ensure food security during adverse events, and foster stronger ties with global suppliers.

Sources: Tridge, Astroawani, Canal Rural, Kvedomosti, UkrAgroConsult