W2 2025: Banana Weekly Update

In W2 in the banana landscape, some of the most relevant trends included:

- Adverse weather and diseases (e.g., bacterial wilt, TR4) disrupted yields in Ecuador, Cambodia, and Guatemala, affecting export volumes.

- Fluctuating prices were observed globally due to supply disruptions, oversupply, and seasonal variations, with Ecuador and Guatemala experiencing notable YoY impacts.

- Countries like India and Uganda are increasing focus on exports, with India targeting Russia and Uganda emphasizing value-added products to boost competitiveness.

- Efforts to develop disease-resistant varieties and promote sustainability are key in Ecuador, while Uganda aims to industrialize banana production for global markets.

- Cameroon saw export growth due to contributions from emerging players like CDBM, indicating a diversification of global suppliers.

1. Weekly News

Cambodia

Cambodia's Banana Exports Decline Due to Price and Weather Challenges

Cambodia's fresh banana exports declined 11.2% year-on-year (YoY) in the first 11 months of 2024, generating USD 138.71 million compared to USD 156.2 million in the same period of 2023. This decrease was primarily due to adverse weather conditions, which negatively impacted crop yields and quality, leading to reduced export volumes. The decline in banana prices, which dropped 10% YoY with carton rates falling from USD 10 to 11 to USD 8 to 9, can be due to broader market factors, such as increased competition from other banana-exporting countries and global supply-demand imbalances. While adverse weather conditions affected the quality and quantity of Cambodia’s bananas, the overall price drop was likely driven by competitive pressures and weaker demand in certain markets.

Despite these challenges, demand for Cambodia's green bananas has remained steady. To strengthen resilience and support future export growth, efforts are underway to transition from family-based farming to industrial-scale production in key provinces such as Ratanakiri, Kratie, and Kampot.

Cameroon

Cameroon's Banana Exports Rise in 2024 as Production Dynamics Shift

Cameroon exported 210.6 thousand tons of bananas in 2024, marking a 1.8% YoY increase driven by the entry of Compagnie des Bananes de Mondoni (CDBM). A subsidiary of France's Compagnie fruitière de Marseille, this new producer contributed 14.05 thousand tons to the total, achieving an impressive 351% growth and securing its position as the country’s third-largest producer. Plantations du Haut Penja (PHP) retained its leadership in the industry, despite a 5.5% YoY decline in exports to 153.2 thousand tons. Meanwhile, the Cameroon Development Corporation (CDC) increased its exports to 31,643 tons, despite facing challenges related to an ongoing socio-political crisis. However, Boh Plantations Plc dropped to fourth place with 11.7 thousand tons.

Bananas remain a crucial non-oil export for Cameroon, primarily destined for the European Union (EU). They are also integral to the country’s ambition of reaching 500 thousand tons of annual production by 2030, as outlined in its National Development Strategy.

India

India Targets USD 1 Billion in Banana Exports to Russia via Sea Routes

India, the world’s largest banana producer, is intensifying its efforts to boost banana exports to Russia, to reach USD 1 billion in the coming years. In 2023/24, India exported USD 300 million worth of bananas, a significant increase from USD 176 million the previous year. This growth reflects the country's expanding share in global banana markets, rising from just 0.21% in 2013 to 1.74% in 2023. To reduce its reliance on air freight and address challenges such as ripening variability, India is working to develop sea export protocols through the Agricultural and Processed Food Products Export Development Authority (APEDA). These initiatives aim to improve cost efficiency and scalability, enhancing India's access to global markets. With ongoing improvements in farming practices, infrastructure, and financial support for farmers, India is positioning itself as a key player in the global banana trade, with Russia emerging as a critical strategic market.

Ecuador

Ecuador's Banana Industry Shows Growth and Focuses on Sustainability and Challenges

Ecuador's banana industry grew 1.39% in 2024, exporting 330.90 million boxes, up from 326.37 million in 2023. Favorable climatic conditions in the first half of 2024 helped increase production, although the industry continues to face challenges, including bacterial wilt and the threat of Fusarium Tropical Race 4 (TR4). Supported by approximately 200 thousand hectares (ha) of plantations and 5.4 thousand producers, the industry works closely with government agencies on biosecurity and production monitoring initiatives, including the 'Safe Banana' project. Rising production costs prompted price adjustments, with efforts now focused on market adaptation and promoting sustainability. In response to additional pressures from certifications and European market green policies, the industry’s plans for 2025 include developing disease-resistant banana varieties, advocating for fair compensation for producers, and emphasizing sustainability efforts to attract consumer support.

Uganda

Uganda's Banana Industry Targets Growth Through Value Addition and Increased Production

Uganda's Presidential Initiative on Banana Industrial Development (PIBID) is marking two decades of progress in advancing the banana subsector through value addition and farmer empowerment. Currently, PIBID produces 1.4 tons of dry bananas daily, with plans to expand this output to 10 to 14 tons daily, contingent on securing a proposed budget of USD 13.5 million (UGX 50 billion) in the upcoming fiscal year. In collaboration with Ishara Industrial Technology Park, PIBID aims to enhance production capacity, unlock export potential, and support import substitution, positioning bananas as a primary driver of Uganda's economic growth. Despite these ambitious goals, challenges such as insufficient funding continue to impede progress.

2. Weekly Pricing

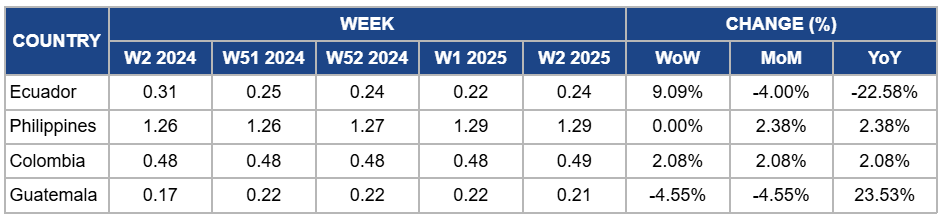

Weekly Banana Pricing Important Exporters (USD/kg)

Yearly Change in Banana Pricing Important Exporters (W2 2024 to W2 202

5)

Ecuador

Banana prices in Ecuador increased by 9.09% week-on-week (WoW) to USD 0.24 per kilogram (kg) in W2 due to a temporary reduction in local supply as harvests slowed down, allowing for some market stabilization. However, banana prices dropped by 4% month-on-month (MoM) and 22.58% YoY due to continued oversupply from previous seasons, with the effects of last season's drought and disease outbreaks still being felt. Additionally, intensified competition from other banana-exporting countries, offering more competitive pricing, put downward pressure on prices. Logistical challenges and global market conditions, particularly in primary markets like Europe, the United States (US), and Asia, have further constrained price recovery, leading to a significant YoY decline.

Philippines

In the Philippines, banana prices remained steady at USD 1.29/kg in W2, reflecting a 2.38% MoM and YoY increase. This price stability is due to a balanced supply and demand situation, with weather conditions, mostly cloudy and cold, helping maintain consistent yields. Despite some fluctuations earlier in the year due to adverse weather and diseases, the improved production and easing of previous disruptions allowed for steady prices. Additionally, the consistent demand, particularly in export markets, continued to support the price level, keeping it stable as production remained solid.

Colombia

In W2, Colombia's banana prices fell by 2.08% WoW MoM and YoY due to a slight easing in export demand following the seasonal holiday consumption peak. While the market had previously benefitted from higher demand from key export markets like the US and Europe, this surge has subsided, leading to a temporary price dip. Additionally, while production remains steady and weather conditions favorable, some market pressures from competing banana-exporting countries and broader logistical challenges contributed to the price declines. Despite this, the overall stability in supply and demand dynamics helped cushion the impact of these price fluctuations.

Guatemala

Banana prices in Guatemala decreased by 4.55% WoW and MoM to USD 0.21/kg in W2 due to higher supply levels during the low production season, which led to lower price levels despite stable demand. This increased supply during the season resulted in a slight reduction in pricing. However, prices increased by 23.53% YoY due to reduced production levels compared to the previous year, influenced by scattered showers and rainy weather early in the month. These weather conditions constrained harvesting and logistical operations, leading to tighter supply and supporting higher YoY price levels.

3. Actionable Recommendations

Enhance Banana Export Strategy for Market Stability

Colombian banana exporters should proactively strengthen relationships with key markets like the US and Europe to avoid price volatility. By adjusting shipment schedules to align with off-peak demand periods, they can better stabilize prices during seasonal fluctuations. Additionally, exporters should collaborate with logistics partners to address supply chain challenges, ensuring consistent supply despite competition from other banana-exporting countries. Promoting Colombia's unique banana quality and leveraging established export networks can help maintain steady demand throughout the year.

Strengthen Export Strategy Amid Declining Banana Shipments

Cambodian banana exporters should diversify their export markets beyond China to reduce dependence on a single market and mitigate price fluctuations. Focus on expanding shipments to regions such as Japan, South Korea, and Vietnam, leveraging Cambodia's unique green banana variety to attract premium pricing. To boost production and enhance competitiveness, exporters should continue transitioning to industrial-scale farming while adopting modern farming techniques. Collaborating with international buyers to secure long-term contracts and promoting Cambodia's bananas in new markets can help stabilize exports and support future growth.

Sources: Tridge, Agrospectrumindia, Businessincameroon, Freshfruitportal, Freshplaza, MXfruit, NilePost, The Phnom Penh Post