1. Weekly News

Brazil

Brazil's Orange Prices Hit 30-Year High Amid Supply Shortage and Weather Challenges

Orange prices in Brazil have reached their highest levels in 30 years, reaching USD 15.73/40.8 kilogram box (BRL 85/40.8 kg box) in São Paulo. This is a record for the entire Cepea series since 1994. The price increase is attributed to greater demand for raw materials and reduced supply. The 2024/25 harvest has been affected by unfavorable weather, with below-average rainfall forecasted until mid-October. While recent rain and milder temperatures have provided some relief for citrus growers, they continue to impact fruit quality and size.

Singapore

Singapore's Orange Supply Chain Unaffected by Global Challenges

Singapore's Fruit and Vegetable Importers and Exporters Association (SFVIEA) chairman stated that the supply of local fresh oranges remained stable despite disruptions in the supply chain caused by extreme weather and the Red Sea crisis. Local oranges are primarily imported from the United States and Australia, with two main types: the Valencia Orange for juicing and the Naval Orange for direct consumption. The Red Sea crisis has led to a surge in shipping prices, with freight rates sometimes doubling.

Meanwhile, Brazil, the world's largest orange exporter, is expected to experience its lowest production levels since 1989 due to record-breaking heat waves and extreme weather. Despite these challenges, consumers in Singapore have not experienced significant changes in orange prices. Fruit vendors in areas like Toa Payoh have reported no price increases or supply shortages when purchasing from wholesalers. Overall cost increases and inflation have primarily driven the recent price hikes in fruits over the past year or two.

South Africa

Southern Africa's Orange Exports Cut by 14.5% Amid Weather Challenges and High Local Prices

The Citrus Growers' Association of Southern Africa (CGA) has revised its orange export estimates, indicating a 14.5% reduction in the number of 15 kg cartons of navel oranges expected to be exported. This marks an 11% year-over-year (YoY) decrease when South Africa packed 24.8 million cartons for export. This adjustment contributes to high local citrus juicing prices, smaller fruit sizes due to warm and dry weather, and severe winds and hail damage in certain regions. Additionally, the projected export figure for 15 kg cartons of Valencia oranges has been reduced to just over 56 million, reflecting a 4% reduction from the start of the season.

Spain

Spain's Vega del Guadalquivir Citrus Campaign Hit by Low Production and Influx of Egyptian Oranges

The Agricultural Association of Young Farmers of Córdoba (Asaja) participated in the final session of the Citrus Table of the Chamber of Commerce, concluding this year's campaign with a sharp decrease in demand due to the influx of oranges from Egypt. The 2023/24 campaign in Spain's Vega del Guadalquivir experienced low production, even exceeding initial estimates. In February, fresh and industrial orange prices dropped unexpectedly due to the entry of oranges from outside the European Union (EU), primarily from Egypt. This situation has led to increased exports from third countries without reciprocal labor and health standards from the EU.

Spanish Orange Season Ends with Low Demand and Competitive Pressure from Egyptian Imports

Spain's commercial orange season has ended, with demand significantly reduced due to low, non-competitive prices from Egyptian imports. The Union of Young Farmers of Córdoba reports that the harvest has been completed despite a significant reduction in production due to drought and irrigation issues. Producer prices of fresh and juice Spanish oranges were reasonable in the first part of the season. However, from Feb-24 onwards, prices have dropped due to the entry of oranges from third countries, mainly Egypt.

2. Weekly Pricing

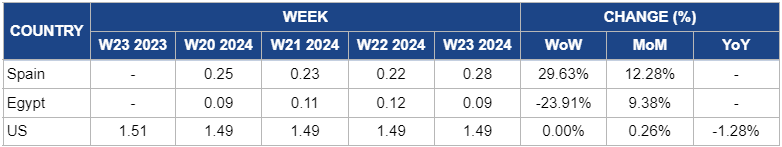

Weekly Orange Pricing Important Exporters (USD/kg)

Yearly Change in Orange Pricing Important Exporters (W23 2023 to W23 2024)

.png)

* Blank spaces on the graph signify data unavailability stemming from factors like missing data, supply unavailability, or seasonality

Spain

Spain's orange prices increased to USD 0.28/kg in W23, marking a 29.63% week-on-week (WoW) increase compared to USD 0.22/kg in W22. This increase can be attributed to low supply and the influx of Egyptian oranges in the Spanish market.

Egypt

The decrease in Egyptian orange prices to USD 0.09/kg in W23, compared to USD 0.12/kg in W22, despite the 9.38% month-on-month (MoM) increase, can be attributed to several factors. The earlier oversupply issues in European markets, caused by the Red Sea crisis and currency fluctuations, likely continued to impact prices despite ongoing improvements in demand and distribution of orange sizes. This suggests that the market was still adjusting to the previous surplus of oranges, leading to a temporary price decrease despite the overall positive trend.

United States

In W23, the price of US oranges remained at USD 0.49/kg, unchanged since W20. This stability suggests a balanced market with steady supply and demand, likely due to consistent production levels, reliable sourcing channels, and stable consumer demand.

3. Actionable Recommendations

Managing Brazil's High Orange Prices

To address the surge in orange prices, Brazil can focus on optimizing irrigation practices and investing in drought-resistant citrus varieties. Improving storage and transportation infrastructure can reduce post-harvest losses while promoting sustainable farming practices and diversifying export markets, which can stabilize prices and reduce dependency on specific regions or countries.

Addressing Challenges in South Africa's Orange Exports

The CGA can mitigate these challenges by promoting juicing-grade fruit to capitalize on local citrus juicing demand. They can also invest in weather-resistant farming techniques to improve fruit quality and size. Exploring new export markets can help diversify sales channels and reduce reliance on traditional markets.

Addressing Record High Orange Prices in Brazil

In response to record-high orange prices in Brazil, reaching USD 15.73/40.8 kg box (BRL 85/40.8 kg box) in São Paulo, several strategies can be implemented. Firstly, investing in irrigation systems is crucial, given the forecast of below-average rainfall, to mitigate the impact of unfavorable weather on fruit quality and size. Secondly, promoting sustainable farming practices can improve long-term resilience to weather challenges and ensure a consistent fruit supply. Lastly, exploring new export markets can help reduce reliance on traditional markets and stabilize prices by diversifying sales channels.

Sources: Tridge, Freshplaza,NoticiasAgricolas, Agriorbit, InfoAgro