W41 2024: Apple Weekly Update

1. Weekly News

Europe

EU Apple Production Expected to Decline by 10% YoY in 2024/25

The European Union (EU)'s apple production for the 2024/25 season is projected to drop by 10% year-on-year (YoY), reaching 10.1 million metric tons (mmt), the lowest level since 2017/2018. This decline is due to unfavorable weather in major apple-producing countries, including Poland, Germany, Italy, and France. Poland is expected to see a 20% YoY reduction, while Germany faces a 16% YoY drop. Apple production for processing is anticipated to fall by 22% YoY, reducing overall supply. Due to lower prices, fresh consumption may decline by 3% YoY despite a slight increase in per capita consumption to 13.6 kilograms (kg). The EU’s fresh apple exports are forecast to fall by 12% YoY, with imports rising by 14% YoY. Additionally, processed apple exports are also expected to fall, with imports rising due to reduced domestic availability. The ending stocks of fresh apples are expected to drop by 15% below the five-year average, reaching 300 thousand metric tons (mt).

Greece

Greek Granny Smith Apple Harvest Begins with High-Quality Fruit Despite Lower Yields

As of W41, the harvest of Greek Granny Smith apples has started in the mountainous regions of Greece, producing excellent-quality fruit in medium to large sizes. However, due to high temperatures, total yields are lower than last year. Export prices have been set at USD 0.95/kg, and the market has responded positively. Despite this, there is a potential risk of leftover stock from the previous season, which could affect overseas markets by introducing lower-quality fruit.

Kazakhstan

Kazakhstan Bans Non-EAEU Apple Imports to Protect Domestic Market

Kazakhstan's Ministry of Agriculture temporarily banned apple imports from countries outside theEurasian Economic Union (EAEU) countries until the end of 2024. Designed to protect domestic apple growers during the harvest season, this measure aims to prevent price dumping and enhance local profitability. The ban applies to imports by road but does not impact international transit through the country. This decision follows a 58% surge in apple imports, with over 107 thousand tons brought into Kazakhstan in the first seven months of 2024. Imports from China and Iran saw dramatic increases, rising 18-fold and sevenfold, respectively. The ban does not apply to EAEU countries such as Armenia, Belarus, Kyrgyzstan, and Russia.

Moldova

Moldova's Industrial Apple Prices Surged as Demand Rises in Europe

Moldova's industrial apple prices reached a record high of over USD 0.30/kg (PLN 1.20/kg), making them more attractive compared to Poland. Smaller apple harvests in Poland and Europe and growing demand from processing plants drive these price increases. Moldova's apple concentrate, priced about 12% higher than Poland's, remains competitive due to lower energy and labor costs. This season, Moldova surpassed Ukraine as the primary supplier of apple concentrate to Poland, Hungary, and Austria, driven by the ongoing conflict in Ukraine. The demand surge and reduced stocks in Europe and the United States (US) led apple concentrate prices in the EU to exceed USD 2181.12/mt (PLN 8,600/mt). While imports are rising, Moldovan concentrate doesn't significantly threaten the Polish market, though the shortage of raw materials is prompting Polish processors to consider further price hikes.

Portugal

Storm Kirk Devastates Northern Portugal Apple Crops, Reducing Yields by 30%

Storm Kirk, which struck the Iberian Peninsula on October 10, 2024, caused severe damage to apple crops in northern Portugal, particularly in Armamar and Moimenta da Beira. Forecasted initially to yield 70 thousand mt, apple production is reduced to 50 thousand mt, with over 65% of the fruit damaged, lowering their market value. The storm also uprooted some trees, resulting in financial losses. This year's revenue will fall short of last year's earnings of over USD 54.73 million from the region.

Ukraine

Ukraine's Apple Harvest Faces Challenges Leading to Record-High Prices

Ukraine's apple harvest has fallen below average, with Vinnytsia reporting yields 30% lower than usual, while regions like Bukovina and Transcarpathia saw more minor losses and even record harvests in some cases. The outcome variation is due to modern farming techniques, as better-equipped orchards performed better. However, Golden and Red Delicious apple quality was affected by late frost, leading to some being downgraded. Apple prices surged, reaching USD 0.61/kg (UAH 25/kg) for wholesale and USD 0.097/kg (UAH 40/kg) for retail, driven by high production and shipping costs. Technical apple prices also hit a record high of USD 0.33/kg (EUR 0.30/kg), though market stabilization may lead to price decreases in the coming weeks.

2. Weekly Pricing

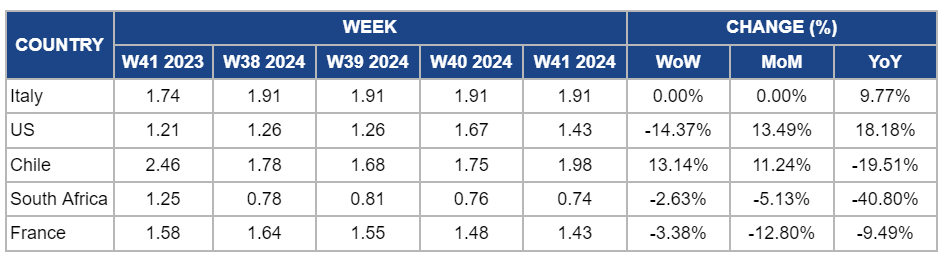

Weekly Apple Pricing Important Exporters (USD/kg)

* Varieties: US and Italy (Gala), Chile, South Africa, and France (Granny Smith)

Yearly Change in Apple Pricing Important Exporters (W41 2023 to W41 2024)

* Varieties: US and Italy (Gala), Chile, South Africa, and France (Granny Smith)

* Blank spaces on the graph signify data unavailability stemming from factors like missing data, supply unavailability, or seasonality

Italy

Apple prices in Italy remained stable at USD 1.91/kg in W41, showing no week-on-week (WoW) or month-on-month (MoM) change, but it shows a 9.77% YoY increase. This stability is due to consistent demand in the local market, supported by favorable weather conditions that maintained good fruit quality. The balance between supply and demand and strong consumer interest, particularly in premium varieties like Gala and Candine, has helped sustain the current pricing levels. Additionally, the increase in organic apple production and export growth, particularly to countries like Germany and France, has bolstered Italy's market position and supported the YoY price increase by driving higher demand for Italian apples in international markets.

United States

In the US, apple prices decreased by 14.37% WoW to USD 1.43/kg in W41. This decline is due to a temporary easing in market pressure as harvests resumed and supply normalized in primary producing regions. The return to regular picking schedules following weather disruptions in certain states, including those affected by Hurricane Milton, helped improve supply and ease pricing pressure. However, MoM and YoY prices increased by 13.49% and 18.18%, respectively. This is due to tighter supplies earlier in the season, driven by challenges in specific regions and increased demand as consumers prepare for colder months. Additionally, the growing interest in fresh, local apples, including new varieties like ZeeApple-1 in California, contributes to the upward pressure on prices as markets anticipate higher demand for premium-quality, locally-grown apples.

Chile

Chile's apple prices increased by 13.14% WoW to USD 1.98/kg in W41, with an 11.24% MoM increase. This is due to stronger domestic demand as favorable weather conditions supported ongoing harvesting and helped absorb part of the market's oversupply. The increase in local consumption provided upward price momentum. However, YoY prices decreased by 19.51% due to the high base prices from the previous year when yields were lower and export opportunities were more limited. The current oversupply and reduced export demand continued to exert downward pressure on prices compared to last year.

South Africa

In W41, apple prices in South Africa declined by 2.63% WoW to USD 0.74/kg, with a 5.13% MoM decrease and a 40.80% YoY decline. The price declines are due to ongoing oversupply in the market, as harvest levels remain high, leading to increased competition among sellers. Despite favorable weather conditions earlier, which had bolstered demand and improved fruit quality, the overall market remains saturated, putting downward pressure on prices. The substantial YoY decrease is primarily due to the rebound in production from the previous year when supply was more limited.

France

France's apple prices declined by 3.38% WoW to USD 1.43/kg in W41, with a 12.8% MoM and 9.49% YoY decline. The price drop is due to continued unfavorable weather conditions, with persistent rain affecting harvest quality and consumer demand. The poor weather led to more fruit blemishes and accelerated harvesting, which resulted in an oversupply of lower-quality apples in the market. Additionally, the high humidity and ongoing rainy conditions deterred consumer purchases, contributing to the downward pressure on prices. This combination of factors negatively impacted the market despite stable production forecasts.

3. Actionable Recommendations

Mitigate Storm Damage with Emergency Crop Protection

Apple growers in northern Portugal should immediately implement stronger protective measures for their orchards, including installing temporary weather barriers and prioritizing using resilient apple varieties. To minimize financial losses, producers should also explore rapid harvesting techniques and damage control strategies to salvage undamaged fruit. Additionally, considering the potential impact on the coming seasons, investing in tree reinforcement and long-term weather-proofing can help reduce future storm vulnerability.

Strengthen Supply Chain for Apple Concentrate Export

Moldovan apple concentrate producers should focus on expanding production capacity and improving supply chain efficiency to meet the growing demand, especially in Poland, Hungary, and Austria. They can capitalize on the competitive pricing advantages by optimizing processing facilities and ensuring reliable raw material sources. Additionally, they should collaborate with logistics partners to streamline exports and reduce costs, securing long-term contracts with European processors. This will help maintain Moldova's competitive edge while addressing potential future price hikes in the market.

Sources: Tridge, Agronews, Agrotimes, Eastfruit, Freshplaza, Kvedomosti, MXfruit, Sad24