1. Weekly News

Azerbaijan

Azerbaijan's Corn Imports Drop 2.1% YoY in Volume

From Jan-24 to Sep-24, Azerbaijan imported 63,946 metric tons (mt) of corn, reflecting a 2.1% decrease compared to the same period in 2023, as the State Customs Committee (SCC) reported. Despite the reduction in volume, the value of corn imports rose by 2.8% to reach USD 19.76 million. Corn imports accounted for 0.13% of Azerbaijan’s total import expenditures during this period, slightly down from 0.15% in the previous year.

Brazil

Brazil's Oct-24 Corn Exports Declined 30.1% YoY

As of October 29, Brazil's Foreign Trade Secretariat (SECEX) reported that unmilled corn exports for the month reached 5.34 million metric tons (mmt), about 63.2% of the volume exported in Oct-23. The daily shipment average of 281,042 mt reflects a 30.1% year-on-year (YoY) decrease compared to Oct-23's average of 402,307 mt. Given the reduced supply and intensified competition from United States (US) corn, this year's lower export volumes align with expectations. Despite the decline in exports, domestic demand has been strong, diverting corn away from export markets and stabilizing prices domestically. Brazil generated USD 1.069 billion in revenue from corn exports in Oct-24, a daily average of USD 56.264 million, down 37.9% from Oct-23's USD 90.602 million per day. Additionally, the average price per ton of Brazilian corn dropped by 11.1% YoY, from USD 225.20 in Oct-23 to USD 200.20 in Oct-24.

United States

US Corn Harvest Reached 81% Completion as of W43

According to the United States Department of Agriculture's (USDA) W43 report, US corn harvest progress was at 81%, up from 65% the previous week. This pace surpasses both 2023's level of 68% and the five-year average of 64% for the same period. The updated progress aligns closely with market expectations.

US Corn Export Reached Record Highs Amid Uncertain Chinese Demand

US corn exports surged to record levels, even excluding significant purchases from China. In W42, US exporters delivered 4.18 mmt of corn, exceeding previous estimates. Historically, similar export volumes were driven by large Chinese purchases, particularly in early 2021, when weekly sales to China exceeded 3 mmt. However, these figures included only a minimal 10 thousand mt to China, indicating China's limited engagement in the US corn market for the 2024/25 season. The surge in US exports largely stems from abundant corn supplies and low prices, positioning the US to retain its leading exporter status this year despite competition from Brazil, which began exporting corn to China in 2022. China's import demand, expected to range between 13 and 19 mmt for 2024/25, is substantially reduced from the nearly 30 mmt it imported last season, reflecting both shifting trade patterns and increased competition in the global corn.

Ukraine

Ukraine's Corn Production Forecasted at 23.3 MMT for 2024/25

According to the USDA forecast, Ukraine's 2024/25 season corn production will significantly decline to 23.3 mmt, down from 31.04 mmt in the 2023/24 season. However, the area allocated for corn cultivation is expected to increase to 4.05 million hectares (ha), slightly exceeding the 3.98 million ha harvested in the previous season. Furthermore, Ukraine's corn exports for the 2023/24 season are anticipated to total 17.8 mmt, marking a considerable decrease from the 28.55 mmt exported in the prior season.

2. Weekly Pricing

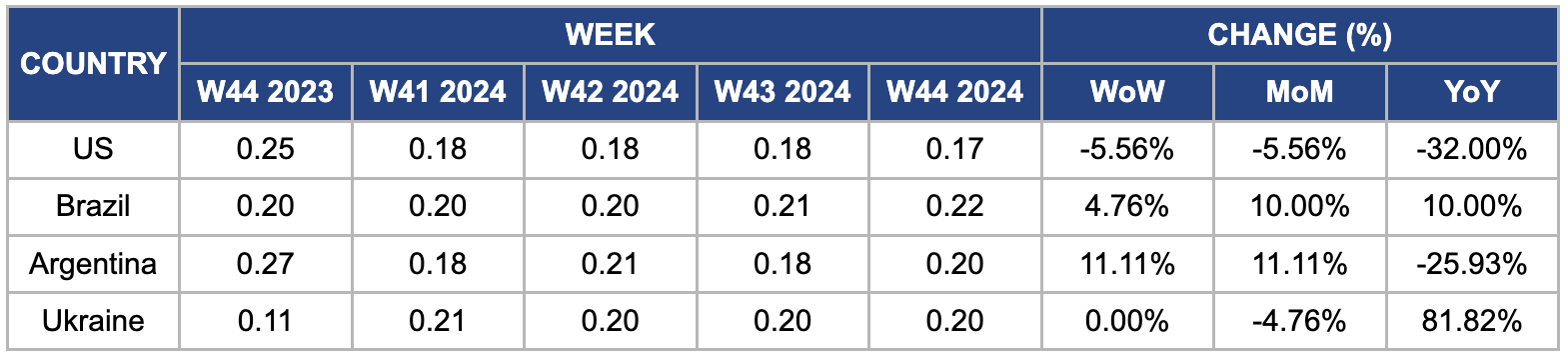

Weekly Maize Pricing Important Exporters (USD/kg)

Yearly Change in Maize Pricing Important Exporters (W44 2023 to W44 2024)

US

In W44, wholesale maize prices in the US experienced a decline of 5.56% week-on-week (WoW) and month-on-month (MoM), as well as a significant 32% YoY drop, reaching USD 0.17 per kilogram (kg). This price decrease coincides with notable progress in the US corn harvest, which advanced to 81%, up from 65% the previous week. This pace exceeds last year's level of 68% and surpasses the five-year average of 64% for this time of year, aligning closely with market expectations and contributing to increased supply. Additionally, the USDA has revised its corn production forecast for 2024 upward, estimating 15.186 billion bushels with an average yield of 183.6 bushels per acre. This improved production outlook has alleviated supply pressures, significantly influencing the YoY price reduction in maize.

Brazil

In W44, wholesale maize prices in Brazil increased by 4.76% WoW, 10% MoM, and 10% YoY, reaching USD 0.22 per kilogram (kg). This price rise is due to delays in corn planting caused by adverse weather conditions, which have significantly reduced supply. Farmers are facing interruptions in planting due to drought, resulting in variable productivity that depends on rainfall levels. The total acreage for the first corn crop is estimated at 9.26 million acres, reflecting a 6% YoY decrease, which leads to a production estimate of 23 mmt, down 2% YoY. Conversely, the safrinha (second crop) corn acreage is expected to cover 39.19 million acres, a 2% decrease, with production projected at 100 mmt, marking a 10% increase. Brazil's corn production for the 2024/25 season is estimated at 125 mmt, indicating a slight increase of 2.5 mmt from 2023.

Argentina

In W44, the wholesale price of Argentine corn price increased by 11.11% WoW and MoM, reaching USD 0.20/kg. This increase is due to a severe corn leafhopper outbreak during the 2023/24 season, which reduced corn acreage for the upcoming season. Farmers have reduced their planting by approximately 30% in the first phase of the current season despite the improved weather conditions. While the number of traps with no insects has increased, particularly in areas outside of northeastern Argentina, the exact impact on late-planted corn acreage and crop rotation choices is yet to be determined.

Ukraine

Ukrainian wholesale maize prices held steady WoW at USD 0.20/kg in W44, reflecting a substantial 81.82% YoY increase from USD 0.11/kg in 2023. The Ukrainian Agrarian Council (UAC) revised the USDA's forecast for Ukraine's corn harvest downward by 1 mmt to 26.2 mmt due to dry weather conditions, contributing to the price surge. Moreover, challenges continue as the country's reliance on deep-sea ports has resulted in a 13% YoY decline in the once-significant export route through Constanta.

3. Actionable Recommendations

Strengthen Supply Chain Resilience

Azerbaijan should focus on enhancing its supply chain resilience to address the recent decline in corn imports. Given the slight decrease in import volume alongside a rise in value, the country needs to strengthen logistics and infrastructure related to corn transportation and storage. This can be achieved through partnerships with logistics companies to optimize distribution routes and reduce delays, especially during peak demand periods. By investing in better infrastructure and technology, Azerbaijan can ensure a more reliable supply of corn from international markets, stabilize prices, and minimize the impact of supply chain disruptions that could arise from political or economic factors.

Diversify Agricultural Practices

Brazil should implement diversification strategies in its agricultural practices to mitigate risks associated with weather disruptions, such as the drought conditions currently impacting corn planting. Farmers should be encouraged to adopt drought-resistant corn varieties like Pioneer® P0457AM and P0636AM, which maintain productivity under limited moisture. By doing this, Brazil can buffer its agricultural sector against poor yields in any season, protect farmer incomes from market fluctuations, and promote overall agrarian sustainability in the face of climate challenges.

Adopt Precision Agriculture Technologies

Ukraine should prioritize adopting precision agriculture technologies to improve its corn production efficiency amid climate variability and pest outbreaks. By investing in tools like soil sensors, drone monitoring, and advanced data analytics, Ukrainian farmers can optimize their input usage, such as water, fertilizers, and pesticides, based on real-time conditions. Providing training and resources to facilitate the adoption of these technologies will enable farmers to respond more effectively to environmental challenges, ultimately leading to enhanced crop yields and reduced production costs. Implementing precision agriculture can significantly increase the sustainability and productivity of Ukraine's corn sector, helping to stabilize its economy and food security in the face of ongoing difficulties.

Sources: NoticiasAgricolas, Ukr AgroConsult, Epochtimes, Portal Do Agronegócio