W52 2024: Palm Oil Weekly Update

.jpg)

1. Weekly News

European Union

EU Demand for Palm Oil Declines Due to Deforestation Regulations and Increased Use of Waste Oils

The European Union's (EU) demand for palm oil continues to decline, primarily due to regulations requiring proof of deforestation-free supply chains. From Jul-24 to Dec-24, EU imports fell by 16% compared to 2023, with Indonesia and Malaysia being the largest suppliers. While Italy saw an 8% increase in imports, Spain and Sweden recorded significant declines. The rise in imports of used oils, such as waste cooking oils, has displaced palm oil in many EU states. The Oilseeds and Grains Promotion Union (UFOP) advocates for stricter controls on waste oil usage and suggests revising biofuel limits to promote domestic biomethane production.

Indonesia

Indonesia's CPO Export Duty Hike Threatens Global Competitiveness and Biodiesel Goals

The Indonesian Palm Oil Association (GAPKI) has raised concerns over the government’s plan to increase the crude palm oil (CPO) export duty from 7.5% to 10% in 2024. It warns that it could reduce Indonesia’s competitiveness in global markets compared to neighboring countries. Refined palm oil products face lower export duties of 3 to 6% as of W52.

The government justifies the increase as necessary to fund the mandatory 40% palm oil-based biodiesel (B40) program launching in Jan-25. However, industry associations fear higher duties and stagnant domestic production could lower overall CPO exports.

Meanwhile, Malaysia recently raised its CPO export duty to 9.5% for the first time in three years, further intensifying regional competition.

United States

US Palm Oil Exports Increase Following Global Production Shortfall and Price Shifts

The United States Department of Agriculture's (USDA) Dec-24 World Agricultural Supply and Demand Estimates (WASDE) report highlights increased United States (US) and Brazilian palm oil exports due to reduced global production, primarily driven by wetter conditions in Malaysia and Indonesia. This supply shortfall has pushed palm oil prices above soybean oil prices.

A key competitor to soybean oil, palm oil is integral to food production, beauty products, and biofuel industries. The expansion of the US biofuel sector has also retained more domestic soybean oil, historically sold at a premium to palm oil. Global market dynamics continue to underline the importance of tracking palm oil production and supply trends.

2. Weekly Pricing

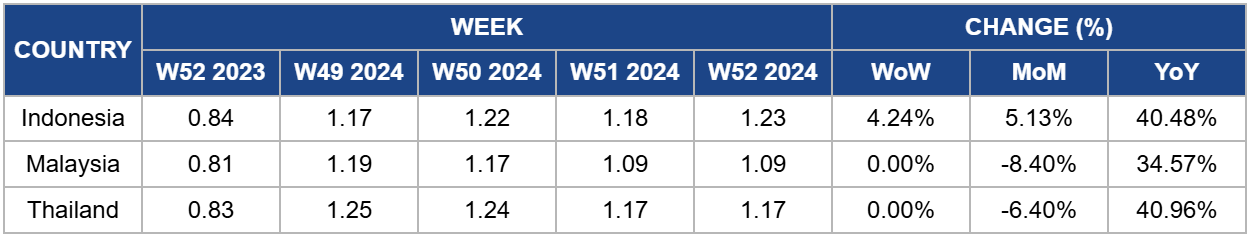

Weekly Palm Oil Pricing Important Exporters (USD/kg)

Yearly Change in Palm Oil Pricing Important Exporters (W52 2023 to W52 2024

.png)

Indonesia

Indonesia's palm oil prices increased to USD 1.23 per kilogram (kg) in W52, marking a 4.24% week-on-week (WoW) rise and a significant 40.48% year-on-year (YoY) increase. This upward trend is driven by tightening inventories despite higher production, exports, and domestic consumption. In Oct-24, palm oil production grew by 9.69% to 4.843 million metric tons (mmt), exports surged by 19.33% to 2.543 mmt, and domestic consumption rose by 4.73% to 2.083 mmt. However, ending stocks decreased by 4.61% to 2.502 mmt, reflecting ongoing supply constraints.

These factors suggest that elevated prices will likely persist in the short term due to strong demand and declining inventories. If production fails to outpace demand over the medium to long term, prices may remain high or become more volatile. Additionally, proposed policy changes, such as Indonesia's planned export levy increase, could further impact global competitiveness and exert upward pressure on domestic prices.

Malaysia

In W52, Malaysian palm oil prices remained stable at USD 1.09/kg, reflecting a 34.57% YoY increase. However, concerns about weaker Malaysian exports and competition from soybean oil have put an 8.40% month-on-month (MoM) downward pressure on prices. Exports from Malaysia fell 8.3% in the first 20 days of Dec-24, with shipments to India, the largest buyer, dropping nearly 22%. This decline is due to seasonal demand fluctuations, as palm oil solidifies in colder temperatures during winter.

Despite palm oil trading at a rare premium to soybean oil, weakening exports and waning competitiveness are dampening market sentiment. Traders have also been taking profits ahead of the holiday season. These factors suggest that while prices may remain stable in the short term, ongoing export challenges and competition from soybean oil could exert downward pressure on future prices if the export slowdown continues.

Thailand

Thailand's palm oil prices remained stable at USD 1.17/kg in W52, marking a 40.96% increase compared to the previous year. The outlook for Thai palm oil production in 2025 is positive as new oil palm plantations, encouraged by favorable prices in 2022, begin to yield crops. However, domestic palm oil consumption is expected to remain steady at 1.49 mmt. In contrast, demand for palm oil as biofuel is projected to decline due to the Ministry of Energy maintaining a low biodiesel blending ratio (B5). Palm oil exports are anticipated to decrease slightly to 1 mmt in 2025. These factors, coupled with fluctuations in biofuel demand and production levels, could influence future price stability or lead to minor price adjustments in 2025.

3. Actionable Recommendations

Diversify Palm Oil Export Destinations

To mitigate the impact of declining demand in the EU and regional competition, exporters in Indonesia, Malaysia, and Thailand should explore new and emerging markets for palm oil. This includes expanding trade relations with non-EU countries, particularly in regions such as Africa and Latin America, where demand for palm oil remains steady or is growing. By diversifying export markets, producers can reduce their reliance on the EU and better navigate fluctuating demand, ensuring more stable revenue streams despite regulatory challenges and competition from alternative oils.

Adapt to EU Sustainability Regulations

Given the EU's increasing focus on deforestation-free supply chains, palm oil producers should invest in certification programs such as the Roundtable on Sustainable Palm Oil (RSPO) to meet sustainability standards. By obtaining these certifications, producers can retain market access in the EU and potentially benefit from the rising demand for sustainably sourced oils. Additionally, engaging in direct dialogue with EU regulators to influence future policies and participating in collaborative industry initiatives can help shape a more favorable regulatory environment.

Strengthen Biodiesel and Domestic Consumption Strategies

With palm oil's growing importance in biodiesel production, especially in Indonesia and Malaysia, governments and industry players must strengthen policies promoting domestic consumption, such as biofuel blending programs. Implementing the B40 biodiesel program in Indonesia can help absorb domestic production surpluses. Similarly, governments should consider incentivizing the use of palm oil in non-biofuel sectors, including food processing and cosmetics, to stabilize demand. By securing stable domestic markets for palm oil, producers can reduce their vulnerability to export uncertainties.

Sources: Tridge, Ukragroconsult, Grain Trade, The Nation Thailand