W6 2025: Avocado Weekly Update

In W6 in the avocado landscape, some of the most relevant trends included:

- Rising avocado production worldwide is strengthening supply, with New Zealand, California, and Spain boosting production through improved cultivation and orchard investments.

- Expanding market access and improving logistics are reshaping trade flows, as Peru dominates China’s imports, Tanzania boosts exports with direct cargo flights, and Spain competes with Moroccan avocados in Europe.

- Security concerns in Michoacán and adverse weather in Spain affect availability and pricing.

- Changing consumer demand in key markets influences trade, with rising health-conscious consumption in Europe and Asia shaping supplier strategies.

1. Weekly News

Mexico

Mexican Avocado Exports for Super Bowl 2025 Decline Due to Multiple Challenges

Mexico, the leading supplier of avocados to the United States (US), shipped 137.5 thousand tons for the 2025 Super Bowl, a decrease of 20 thousand tons from 2024. While it remains the dominant source, factors such as ongoing security challenges in key producing regions like Michoacán may have disrupted supply chains, affecting harvesting and transportation. Additionally, growing competition from Peru and Colombia and potential shifts in US demand may have contributed to the decline. Despite this, Mexico continues to be the primary supplier for the Super Bowl surge, underscoring its strong position in the US avocado market.

New Zealand

New Zealand's Avocado Production Rises, with Strong Export Potential

New Zealand's avocado production is expected to reach 7 million trays this 2024/25 season, a significant increase from the 5 million trays harvested last year. Despite challenges from Cyclones Dovi and Gabrielle in previous seasons, the industry has been resilient and optimistic. Approximately half of the harvest is exported, with Australia as the primary market, while growing demand from Japan, South Korea, and Thailand is driving expansion in Asia. New Zealand’s reputation for high-quality, sustainably grown avocados strengthens, supporting domestic sales and international market growth.

Peru

Peru Becomes China’s Leading Avocado Supplier

Peru's Hass avocado exports to China soared by 40% year-on-year (YoY) in 2024, reaching a record 50 thousand metric tons (mt). This positions Peru as China’s top supplier ahead of Chile and Kenya. This growth is driven by Peru’s favorable climate, year-round production, and coordinated efforts between the government, exporters, and growers to meet China’s strict market standards. As China’s avocado imports have risen by 112% over the past five years, Peru has effectively capitalized on this expanding demand, particularly amid Mexico’s supply decline. Globally, Peru exported 539 thousand mt of Hass avocados, valued at USD 1.129 billion, with key production hubs in Lima, La Libertad, and Ica.

Declining Prices and Rising Competition Challenge Peru’s Hass Avocado Market in Europe

Despite growing competition from Colombia and South Africa, Peru remains a primary supplier of Hass avocados to Europe, though prices have declined due to weaker demand and increased exports. Spain is expanding its production but faces rising competition from Morocco, while Italy's avocado market continues to grow, driven by shifting consumer preferences toward healthier diets. As the European market evolves, Peru’s ability to navigate fluctuating demand and intensifying competition will be essential in sustaining its strong market position.

Spain

Spain’s Hass Avocado Season Sees Higher Volumes but Faces Market Challenges

Spain’s Hass avocado season is progressing in the Valencian Community with expectations of higher volumes, though smaller fruit sizes in some areas have slowed sales. Many growers delayed harvesting to achieve better sizes and prices, but competition from Moroccan avocados, which dominate European supermarkets, has limited Spain’s market share. The Lamb Hass variety, known for its strong production potential, often serves as a gap filler before Peruvian Hass arrives but struggles with market recognition. Despite its high yield and quality, stronger promotional efforts and domestic marketing strategies are needed to enhance the value of Spanish avocados and secure a more competitive position in the European market.

Tanzania

Tanzania Expands Avocado Exports with New Direct Cargo Flight to China

Tanzania’s avocado industry is expected to benefit from a new direct cargo flight from Dar es Salaam to Guangzhou, cutting shipping time from 22 days by sea to just 12 hours by air. This new logistics option, introduced by Air Tanzania’s Boeing 767 freighter with a 54-mt capacity, improves market access for Tanzanian avocados, which gained entry to China in 2022. The development supports Tanzania’s goal of increasing horticultural export value to USD 2 billion annually by 2030. The faster shipping ensures Tanzanian avocados reach Chinese consumers in peak condition, providing a competitive edge for exporters and expanding opportunities in the growing Chinese market.

United States

California Avocado Production Expected to Reach Record Growth in 2025

California’s avocado production is expected to reach 375 million pounds (lbs) in the 2025 season, the largest crop since 2020. This growth is driven by a decade of strategic investments in new plantings and high-density orchards. Between 2013 and 2023, growers planted approximately 3 million new trees, replacing older or damaged ones to boost yields. Although strong winds posed early-season challenges, optimism remains high, with peak supply anticipated between spring and summer, reinforcing California’s role as a key player in the global avocado market.

2. Weekly Pricing

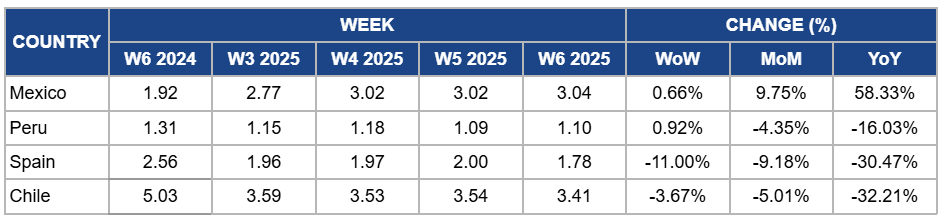

Weekly Avocado Pricing Important Exporters (USD/kg)

Yearly Change in Avocado Pricing Important Exporters (W6 2024 to W6 2025)

Mexico

In Mexico, avocado prices in W6 rose slightly by 0.66% week-on-week (WoW) to USD 2.04 per kilogram (kg), showing a 9.75% month-on-month (MoM) increase and a 58.33% YoY surge. The price increase was primarily driven by supply constraints, including lower shipment volumes ahead of the Super Bowl and heightened security concerns in Michoacán disrupting supply chains. However, rising competition from Peru and Colombia continues to add downward pressure on prices, influencing overall market dynamics.

Peru

Peru's avocado prices increased by 0.92% WoW to USD 1.10/kg in W6 due to strong demand from China, where Peru has solidified its position as the leading supplier, and other international importers. However, MoM and YoY prices dropped by 4.35% and 16.03%, respectively, due to intensified competition from Colombia and South Africa, and increasing production from Spain and Morocco is adding to supply pressure, contributing to lower prices.

Spain

Avocado prices in W6 dropped by 11% WoW to USD 1.78/kg, marking a 9.18% MoM decrease and a 30.47% YoY decline due to increased supply from Spain's ongoing Hass avocado season in the Valencian Community. While overall production volumes are higher, smaller fruit sizes in some areas have slowed sales, contributing to downward price pressure. Additionally, competition from Moroccan avocados, which dominate European supermarkets, has further limited Spain’s market share, reducing pricing power. The presence of alternative varieties, such as Lamb Hass, has not significantly mitigated the decline, as market recognition remains weak.

Chile

Chilean avocado prices fell by 3.67% WoW to USD 3.41/kg in W6, marking a 5.01% MoM decrease and a 32.21% YoY drop due to increased harvest volumes leading to higher supply in local and export markets. Additionally, competitive pressure from Peru and Mexico, along with shifting demand dynamics in key markets, contributed to the price decline. The significant YoY drop reflects the normalization of supply conditions compared to last year’s shortages, which had previously driven higher prices.

3. Actionable Recommendations

Maximize Market Reach for California Avocados

California avocado growers should leverage the strong 2025 crop by expanding distribution channels and targeting peak demand periods in primary markets. Strengthening partnerships with retailers, promoting direct-to-consumer sales, and emphasizing premium quality can enhance profitability and market positioning.

Strengthen Mexico’s Avocado Supply Chain

Mexican avocado exporters should reinforce supply chain security and explore logistics optimizations to maintain steady shipments to the US market. Strengthening partnerships with buyers and addressing competition from Peru and Colombia through strategic pricing and quality differentiation will help sustain Mexico’s market dominance.

Enhance Market Position for Spanish Avocados

Spanish avocado growers should strengthen marketing efforts for Lamb Hass by highlighting its high yield, quality, and unique selling points. Expanding domestic promotions and securing stronger retail partnerships can improve consumer recognition and boost competitiveness against Moroccan and Peruvian imports.

Sources: Tridge, Agro Safor, Freshplaza, Fruitnet, Portalfruticola, Produce report, Sportjudge