1. Weekly News

India

Indian Apple Farmers Shift to Stone Fruits Due to Rising Challenges

Indian apple farmers increasingly shift to stone fruits like almonds, plums, apricots, cherries, and persimmons as erratic weather and rising input costs strain traditional apple cultivation. Milder winters and reduced chilling hours have made apple farming less viable in key regions, while financial pressures, including higher costs and lower post-Covid profitability, are driving diversification. Stone fruits require fewer resources and offer better climate resilience. They are a sustainable and profitable alternative for growers facing these challenges.

Poland

Poland Showcases Apple Industry

As Europe's top apple producer and the fourth-largest globally, Poland highlighted its apple industry during its European Union (EU) presidency by distributing apples at official events. With around 4 million tons of apples produced annually, Poland exported 817 thousand tons in 2023. Within the EU, the primary export destinations include Germany, Romania, Spain, and Sweden. Other destinations include Egypt, Saudi Arabia, and India. Combining centuries-old cultivation traditions with modern innovations, Poland has cemented its position as a global leader in apple production, highlighting this fruit's cultural and economic importance.

Thailand

Thailand Reopens Market for South African Apples

Thailand's decision to lift its 2008 ban on South African apple exporters creates a valuable opportunity for South African exporters to strengthen their presence in the Asian market. Following years of negotiations and inspections of orchards, packhouses, and cold storage facilities, the renewed trade relationship is projected to generate over USD 20 million annually. Currently a key destination for more than one-third of South Africa's apple exports, Asia continues to drive demand. South African Industry group Hortgro is set to launch a campaign in Thailand to promote the South African apples' unique flavors and quality, highlighting advancements in technology and new cultivars.

United States

Steady Supply and Strong Demand for Pennsylvania Apples

Despite a smaller 2024/25 United States (US) apple crop and strong demand, Pennsylvania's apple supply is more stable this year. Gala apples in the East Coast are in tighter supply, particularly in larger sizes, while Golden varieties are expected to run out earlier than usual. Popular types like Honeycrisp and Evercrisp maintain excellent quality and high demand, driving a successful domestic season. However, export challenges persist, worsened by an October port strike that permanently shifted some markets to European apples. Despite the challenges, domestic prices for most varieties have risen, driven by strong demand and well-managed supply levels.

Uzbekistan

Uzbekistan Balances Apple Exports and Imports in 2024

From Jan-24 to Nov-24, Uzbekistan exported apples worth USD 14.4 million. Kazakhstan was the largest buyer, with 34.3 thousand tons, followed by Russia and Kyrgyzstan. Smaller shipments were sent to Tajikistan, Mongolia, and other markets. During the same period, Uzbekistan imported 92.1 thousand tons of apples valued at USD 26.8 million, primarily sourced from Iran with 58.6 thousand tons, along with additional supplies from Kyrgyzstan, Poland, China, and Ukraine. This dual role as exporter and importer underscores Uzbekistan’s growing significance in the global apple market.

2. Weekly Pricing

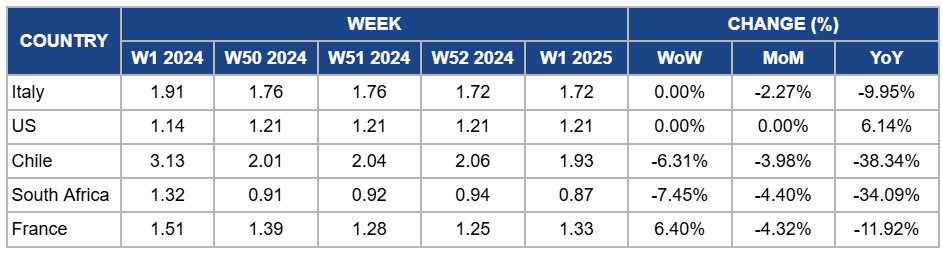

Weekly Apple Pricing Important Exporters (USD/kg)

Yearly Change in Apple Pricing Important Exporters (W1 2024 to W1 2025)

Italy

In W1, Italy's apple prices remained steady week-on-week (WoW) at USD 1.72 per kilogram (kg), but it reflected a 2.27% month-on-month (MoM) drop and a 9.95% year-on-year (YoY) decrease due to continued high market availability following the extended harvest season, which has maintained elevated supply levels. Additionally, persistent competition from other European apple producers has exerted downward pressure on prices, offsetting any potential seasonal demand recovery during the post-holiday period.

United States

In the US, apple prices held steady at USD 1.21/kg in W1, with no WoW and MoM change, but reflecting a 6.14% YoY increase due to stronger demand for fresh apples this season and tighter supply conditions for premium varieties such as Honeycrisp and Evercrisp. These varieties have maintained excellent quality and high demand, supported by well-managed inventory levels despite a slightly smaller national crop. Limited international availability and persistent export challenges have further constrained supply. Market shifts to European apples following an October port strike have also contributed, driving domestic price stability and YoY growth.

Chile

Chile's apple prices dropped by 6.31% WoW to USD 1.93/kg in W1, with a 3.98% MoM decline and a 38.34% YoY decrease. The price decline is due to easing demand following the holiday season and stabilizing supply levels that have alleviated inventory pressures. Additionally, the sharp YoY decrease reflects a correction from the exceptionally high prices seen in 2023, which were driven by significant supply shortages and heightened demand. The current pricing indicates a return to more balanced market conditions as exports and domestic consumption align with typical seasonal trends.

South Africa

Apple prices in South Africa fell by 7.45% WoW to USD 0.87/kg in W1, with a 4.40% MoM drop and a more significant decline of 34.09% YoY. The price drop is due to a seasonal post-holiday slowdown in demand, leading to a slight oversupply in the market. Additionally, the YoY decline reflects a correction from last year's higher base prices, which were driven by a smaller harvest and logistical challenges. As harvests normalize and the export market stabilizes, particularly with the resumption of exports to Thailand, prices are adjusting to more typical market conditions.

France

In France, apple prices increased by 6.40% WoW to USD 1.33/kg in W1 due to a local seasonal uptick in demand following the holiday period and a temporary stabilization in supply levels. However, MoM and YoY prices dropped by 4.32% and 11.92%, respectively. This is due to the off-season in January, which typically leads to lower apple availability and demand. The YoY price decline is also a result of the higher prices in 2023, caused by supply challenges that are no longer impacting the market.

3. Actionable Recommendations

Leverage Thailand's Market Reopening

South African apple exporters should prioritize marketing and distribution efforts in Thailand following the lifting of the 2008 import ban. Collaborate with industry group Hortgro to implement promotional campaigns emphasizing South African apples' superior quality and unique flavors. Focus on leveraging advanced technology and new cultivars to meet the growing demand in the Asian market, strengthening South Africa's position as a key supplier.

Optimize Apple Trade Balance

Apple exporters in Uzbekistan should diversify their export markets beyond Kazakhstan, Russia, and Kyrgyzstan to reduce over-reliance on a few key buyers. Concurrently, importers should explore cost-efficient sourcing options from a wider range of suppliers, such as Poland and Ukraine, to balance domestic supply needs while supporting the country's growing role in the global apple market.

Enhance Export Resilience

Pennsylvania apple exporters should focus on rebuilding market share in regions affected by the port strike by strengthening direct relationships with international buyers and leveraging alternative shipping routes. Simultaneously, growers should prioritize domestic marketing efforts for in-demand varieties like Honeycrisp and Evercrisp to capitalize on strong local demand and rising prices.

Sources: Tridge, AgroPolska, EastFruit, Freshplaza, The Tribune, TVP World, Daryo