In W16 in the avocado landscape, some of the most relevant trends included:

- The global avocado market is seeing increased competition, with key producing countries like Colombia and Kenya facing challenges from import surges and logistical disruptions, particularly affecting exports to Europe. This has prompted shifts towards value-added processing, such as avocado oil production, to mitigate export challenges.

- Australia and Mexico are investing in sustainability and long-term growth, with Australia aiming for entry into the growing Chinese avocado market and Mexico launching a net-zero sustainability initiative targeting water management, biodiversity, and carbon reduction by 2035.

- Price volatility is emerging as a key trend, with Spain experiencing significant price drops due to a surge in imports, especially from Morocco, which is putting pressure on local growers in regions like the Valencian Community.

- As demand for avocados grows, producers are diversifying their strategies, with Colombia's growing export success driven by improved agricultural practices, and Kenya increasing its avocado processing capacity in response to export constraints.

1. Weekly News

Australia

Australia Explores Entry into China’s Expanding Avocado Market

Australia is positioning itself to enter China’s expanding avocado market, with formal import negotiations expected to start once ongoing discussions on apples and blueberries are finalized. Although trade talks have been ongoing since 2013, recent progress, marked by China’s easing of restrictions on other Australian products, has renewed optimism among Australian avocado exporters. With China’s avocado imports reaching nearly 60 thousand metric tons (mt) in 2024, primarily from South America, Australia aims to tap into the growing demand from the country’s health-conscious middle class. Backed by decades of expertise, Australian producers have already established joint ventures and shared technology in regions like Yunnan, laying the groundwork for future trade. Market entry is expected to unlock substantial commercial opportunities, with existing partnerships and pre-orders valued at USD 195 million, pending final customs approval.

Colombia

Colombia Strengthens Global Position as a Leading Hass Avocado Exporter

Colombia has strengthened its role as a leading global exporter of Hass avocados. In 2024, exports reached 138 thousand tons and generated a Free On Board (FOB) value of USD 309 million, marking a 21% year-on-year (YoY) increase in volume and a 54% YoY rise in value. This growth has positioned Hass avocados as Colombia’s second most exported fruit after bananas. The industry's success is driven by improved agricultural practices, expanded planting areas, adoption of sustainable methods, and technological advancements. In addition, the effective rollout of the “Inspection at Origin” program by the Colombian Agricultural Institute (ICA) has elevated phytosanitary standards. However, challenges persist, including infrastructure gaps, labor shortages, and the ongoing need for institutional support to ensure the industry maintains its quality and competitiveness on the global stage.

Kenya

Kenyan Avocados Face Export Hurdles During Logistics Crisis but Find Growth in Processing

Kenya’s avocado industry is facing major export challenges to the European market amid ongoing logistical disruptions from the Red Sea crisis. These disruptions have extended sea freight times beyond 32 days and significantly increased airfreight costs. Although early-season avocados from Kenya are of high quality, with strong dry matter content and favorable calibers, exporters are facing stiff competition. The competition comes from lingering Moroccan and Spanish supplies, as well as early arrivals from Peru and South Africa. These pressures have led to a drop in export volumes to Europe, pushing many Kenyan exporters to pivot toward value-added processing. In response, the country has rapidly scaled up its avocado oil sector, now boasting nearly 30 processors. Despite continued challenges, Kenya remains confident in its market position, especially at the start of the season. This confidence is supported by strong product quality and adherence to international certification standards.

Mexico

Mexico Launches Sustainable Avocado Strategy Aiming for Net-Zero by 2035

Mexico’s avocado industry has launched the Path to Sustainability initiative, spearheaded by the Avocado Institute of Mexico (AIM) in collaboration with grower-exporters and import associations. The initiative aims to achieve net-zero emissions by 2035 through improved environmental stewardship. The plan targets four core areas: water, biodiversity, climate, and deforestation. By 2026, sustainable water management practices will be adopted across all production zones, expanding on current irrigation and watershed conservation efforts. Biodiversity preservation efforts include pollinator protection, pest control, and ecosystem restoration, reinforced by large-scale tree planting programs. Simultaneously, the initiative focuses on minimizing environmental impact and boosting carbon sequestration to attain a net-zero carbon footprint across the supply chain. To address deforestation, a strong forest management and reforestation strategy has been launched, featuring a baseline study and a multi-million tree planting campaign. These objectives are supported by structured action plans and regular sustainability reporting to ensure industry-wide transparency and accountability.

Spain

Valencian Avocado Prices Drop Due to Surge in Imports

In Spain’s Valencian Community, avocado prices have dropped significantly this season, with the Lamb Hass variety falling over 29% from USD 2.78 per kilogram (EUR 2.44/kg) in Mar-24 to USD 1.97/kg (EUR 1.73/kg) in Mar-25. This sharp decline is driven by a surge in imports, which rose 68% YoY in Jan-25, and by 89% when including volumes from Morocco, which alone contributed 14.1 thousand tons that month. Throughout 2024, Spain imported 262 thousand tons of avocados, marking an 8% YoY increase. Cultivating 3.9 thousand hectares (ha), or nearly 19% of the country’s total avocado area, the Valencian Community has been particularly affected, not only by import-driven price pressures but also by a rise in field thefts, leading to calls for enhanced security measures during the harvest season.

2. Weekly Pricing

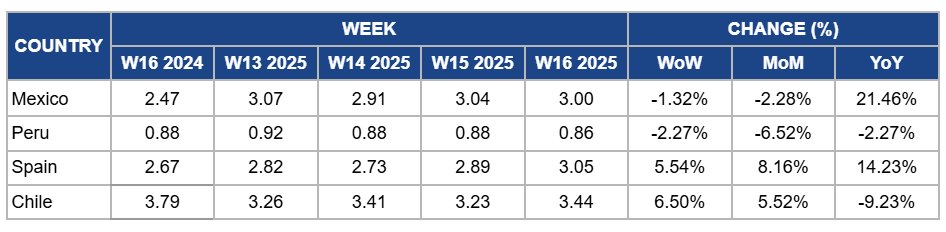

Weekly Avocado Pricing Important Exporters (USD/kg)

Yearly Change in Avocado Pricing Important Exporters (W16 2024 to W16 2025)

Mexico

Mexico's avocado prices dropped slightly by 1.32% week-on-week (WoW) to USD 3/kg in W16, with a 2.28% month-on-month (MoM) decrease due to lower demand from local markets. Additionally, the availability of a higher volume of avocados from the 2025 season and logistical improvements contributed to price stabilization. However, YoY prices surged by 21.46% due to reduced export volumes in 2024, which resulted in tighter supplies for international markets and higher demand for Hass avocados in key destinations like the US. The impact of fluctuating yields in the previous year and the strong 2025 production forecast has driven this year’s upward price correction.

Peru

In W16, Peruvian avocado prices declined by 2.27% WoW to USD 0.86/kg, reflecting a 6.52% MoM and a 2.27% YoY decrease. The price dropped due to early-season supply pressures, as shipments faced uneven ripening, leading to market concerns about quality consistency. Moreover, the overlap with Spanish and Moroccan avocado supplies has intensified competition, particularly as these regions benefit from favorable weather conditions, allowing for earlier harvests. This has increased imports into key markets like Europe, which has contributed to downward pressure on prices. In addition, logistical challenges in managing timely deliveries, along with fluctuating demand, have added further volatility to the pricing landscape despite the overall production growth forecast for Peru. As the market becomes more crowded with supply from multiple origins, Peru’s exporters may need to adjust strategies, such as diversifying export destinations or emphasizing quality differentiation, to maintain competitive pricing and secure market share.

Spain

Spain's avocado prices increased by 5.54% WoW to USD 3.05/kg in W16, reflecting an 8.16% MoM and a 14.23% YoY increase. The price increase is due to a combination of factors, including a temporary drop in local production caused by adverse weather conditions affecting the avocado-growing regions. Additionally, the rise in prices is due to a lower supply of avocados during the early part of the season and high demand locally and from export markets. These factors, along with logistical challenges and rising import costs, have contributed to the price uptick.

Chile

Avocado prices in Chile rose by 6.5% WoW to USD 3.44/kg in W16, with a 5.52% MoM increase due to reduced competition from Peru and Mexico, as their harvests began to slow down, allowing Chilean exporters to secure higher prices. Additionally, growing demand from markets like Europe, which showed signs of recovering after earlier economic concerns, provided some price support. However, YoY prices dropped by 9.23% due to the previous year's strong export volumes and higher prices, which were driven by limited availability and higher demand during the earlier stages of the harvest.

3. Actionable Recommendations

Optimize Export Routes and Leverage Value-Added Products

Kenyan avocado exporters should focus on diversifying logistics options, exploring alternative shipping routes to mitigate Red Sea disruptions, and strengthening airfreight partnerships to reduce delays. Additionally, exporters should accelerate efforts to promote and expand value-added products, particularly avocado oil, by targeting niche markets and increasing visibility in Europe. By enhancing product offerings and streamlining logistics, Kenyan exporters can better navigate the competitive landscape and maintain strong export momentum.

Enhance Security and Explore Niche Market Strategies

Avocado growers in Spain’s Valencian Community should invest in stronger security measures to prevent field theft and safeguard crops. Additionally, growers should explore niche markets by promoting the unique qualities of locally grown Lamb Hass avocados, focusing on premium segments that value sustainability and traceability. Collaborating with retailers to develop branding strategies highlighting local production and quality can help differentiate Spanish avocados and mitigate the impact of rising imports.

Sources: Tridge, Aenverde, Eldebate, Freshplaza, La Unió, myNEWS, Portalfruticola