In W17 in the orange landscape, some of the most relevant trends included:

- Orange producers and exporters in Brazil and Mexico are facing production and export disruptions due to drought and adverse weather, which have reduced fruit availability, especially for processing and fresh market sales, leading to lower harvest volumes and declining export figures.

- Traders and supply chain operators in Mexico and Brazil are experiencing slowed commercial activity and higher price volatility as seasonal harvests end and demand weakens in key markets like Europe and the US, particularly affecting orange juice exports and sour orange trade.

- The University of Florida is actively developing disease-tolerant orange varieties and resilient rootstocks to combat threats like citrus greening and support long-term recovery in affected production regions like Florida.

1. Weekly News

Brazil

Brazil’s Fruit Exports Rise in Q1-25 but Orange Shipments Drop Sharply

Brazil's fruit export industry saw a 26% increase in the first quarter of 2025 (Q1-25), with a total of 301 thousand tons of fruit exported, generating USD 311 million in revenue. Key exporting states included Rio Grande do Norte, Ceará, São Paulo, and Pernambuco, with major importers being the Netherlands, the United Kingdom (UK), and Spain. However, orange exports faced a significant decline, with a 52% decrease in the first three months of 2025 compared to the same period in 2024. The drop in orange exports is due to reduced demand in Europe and the United States (US). In addition, a lower supply for processing, resulting from challenging growing conditions in Brazil's citrus belt, has contributed to the decline. Meanwhile, other fruits like bananas, watermelons, and papayas saw substantial export growth.

Mexico

End of Valencia Orange Harvest Slows Activity in Veracruz, Mexico

The harvest of Valencia oranges, locally known as Tardía, ended in northern Veracruz, Mexico. This has significantly slowed operations at the Estero del Ídolo collection center, the country's largest citrus hub. Since the Easter holiday, truck deliveries have halted, and traders in the La Báscula area report a noticeable drop in fruit availability. Only limited quantities of Mayera and northern orange varieties remain on the market, with reduced demand further dampening activity. Top-quality Mayera oranges prices range from USD 664.61 to 715.73 per ton (MXN 13,000 to 14,000 per ton), while northern oranges fetch slightly higher prices at USD 817.98 to 869.10 per ton (MXN 16,000 to 17,000 per ton). With limited commercial activity expected, the market now looks ahead to the next harvest cycle, which begins in September and continues through spring.

Drought Triggers Sour Orange Shortage and Price Hikes in Mexico

A severe drought in Mexico has sharply reduced the availability of citrus fruits, particularly sour oranges, impacting producers, vendors, and consumers. Harvest volumes have declined compared to previous years, driving up prices to between USD 0.31 to 0.51 per piece (MXN 6 and 10 per piece), with sellers cautioning that further increases are likely as the fruit remains out of season. Lemon prices are currently holding steady at USD 1.79 to 2.04 per kilogram (MXN 35 to 40/kg), but continued lack of rainfall could soon push those prices higher as well.

United States

US Develops HLB-Tolerant Orange Varieties to Support Florida Citrus Industry

The University of Florida developed six new Huanglongbing (HLB)-tolerant citrus varieties to address the devastating impact of citrus greening disease on Florida’s orange production since 2005. These include improved sweet oranges and hybrid mandarins with higher brix levels, better color, and superior juice quality, making them well-suited for not-from-concentrate (NFC) orange juice. Additionally, the rootstock Orange 14 has demonstrated strong resilience to HLB and other disease pressures. Supported by several Florida citrus organizations, these new varieties are intended to boost the state’s citrus industry by enhancing disease resistance while maintaining fruit yield and quality.

Florida's Orange Industry Faces Challenges but Shows Signs of Recovery

Florida's orange industry remains under pressure from the combined impacts of hurricanes and citrus greening, but recent signs point to a slow recovery. While Hurricane Milton caused notable damage to orange groves, improved tree health and a favorable bloom in some areas have raised cautious optimism. The United States Department of Agriculture’s (USDA) latest forecast holds orange production steady at 11.6 million 90-pound (lbs) boxes, consistent with Mar-25 projections. Although overall production for the 2024/25 season is expected to remain below historical levels due to persistent challenges, gains in grapefruit and mandarin yields and ongoing recovery efforts offer hope for the industry’s gradual rebound.

2. Weekly Pricing

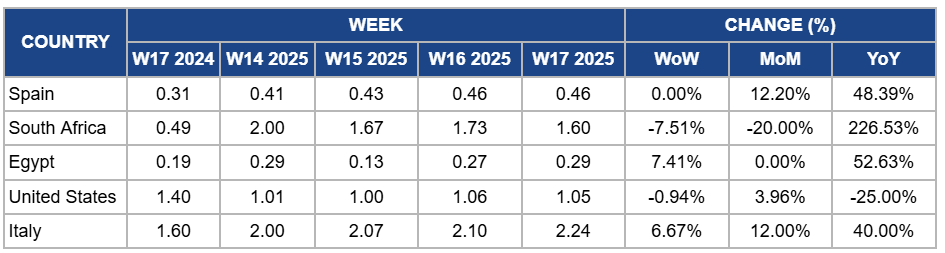

Weekly Orange Pricing Important Exporters (USD/kg)

Yearly Change in Orange Pricing Important Exporters (W17 2024 to W17 2025)

Spain

In W17, orange prices in Spain remained steady at USD 0.46/kg, reflecting a 12.20% month-on-month (MoM) and a 48.39% year-on-year (YoY) increase. This stability is due to a 19% YoY increase in Andalusia's 2024/25 citrus production, totaling 2.26 million tons, driven by improved irrigation from consistent spring and fall rainfall. Despite challenges such as adverse weather conditions earlier in the season, these favorable climatic factors have bolstered production, contributing to the observed price stability.

South Africa

South Africa's orange prices dropped by 7.51% WoW to USD 1.60/kg in W17, with a 20% MoM decrease due to a short-term surge in supply as growers rushed to export remaining volumes before the end of the peak harvest season, which typically runs from April to June. This increase in available volumes, particularly of late-season fruit that may be of lower quality, led to downward pressure on prices. Additionally, softer demand in key export markets and increased competition from other citrus-exporting countries, such as Egypt and Morocco, likely contributed to the price decline. However, prices increased by 226.53% YoY due to significantly reduced production in the previous season caused by drought and irregular rainfall, which had sharply limited supply and raised baseline prices.

Egypt

Orange prices in Egypt increased by 7.41% WoW to USD 0.29/kg in W17, with no MoM change and a dramatic 52.63% YoY increase. The price surge is mainly due to a lower-than-expected harvest in key producing regions, particularly in Egypt's primary citrus-growing areas like the Nile Delta, where unfavorable weather conditions, including fluctuating temperatures and dry spells, have affected yields. Additionally, the global demand for Egyptian oranges, especially in the European Union (EU) and the Middle East, has remained strong, further driving up prices. The YoY increase is reflective of a significant supply gap compared to the previous season, when higher volumes were available, resulting in limited availability and upward pressure on prices.

United States

In the US, orange prices dropped by 0.94% to USD 1.05/kg in W17, with a 25% YoY drop but still increased by 3.96% MoM. The price drop is due to the continued oversupply from previous harvests, which were larger than expected, leading to an excess of oranges in the market. This surplus and lower demand for fresh oranges, as consumer preferences shifted and juice processors faced lower-than-usual demand, contributed to the price decline. Despite the recent increase in supply from less affected regions, the overall volume from Florida remains below historical levels, resulting in a mixed pricing trend.

Italy

In W17, orange prices in Italy rose by 6.67% WoW to USD 2.24/kg, reflecting a 12% MoM increase and a significant 40% YoY increase. The price surge is due to reduced supply from key producing regions in Italy, particularly from Sicily, where weather challenges such as irregular rainfall and unseasonably warm temperatures have affected yields. Additionally, stronger export demand, especially from European markets and the Middle East, has pushed prices higher. However, the sustainability of these price increases is uncertain. As the harvest season nears its end in late spring and early summer, supply is expected to decrease, which could put downward pressure on prices. Furthermore, the upcoming harvests from competing countries like Spain may lead to more competition, further affecting the price levels.

3. Actionable Recommendations

Diversify Sourcing Channels to Stabilize Supply

Brazilian and Mexican orange exporters should secure alternative sourcing from less-affected regions or partner with growers in emerging production zones to maintain supply continuity. For example, collaborating with producers in northeastern Brazil or early-harvest regions in Veracruz can help offset shortfalls. Additionally, exporters can work with juice processors to adjust sourcing schedules and prioritize stable supply for key markets like Europe and the US, reducing exposure to price swings and delivery delays.

Optimize Inventory Management and Forecasting

Traders and exporters should closely monitor inventory levels at collection centers and adjust pricing strategies to align with the current demand slump. By forecasting demand shifts ahead of the next harvest cycle, traders can build stockpiles of remaining high-quality varieties, like Mayera oranges, to meet market needs. For example, they can focus on early sales or leverage contract agreements to secure better deals before the market enters the next peak season.

Sources: Tridge, Datamar News, Elmomentoveracruz, Freshplaza, Portalfruticola, Solyucatan, Wric