In W19 in the banana landscape, some of the most relevant trends included:

- Global banana prices are increasing due to climate change, disease threats, and rising logistics costs, pressuring production and trade sustainability worldwide.

- India and the Philippines are expanding banana export markets and improving farmer incomes by adopting high-yield, disease-resistant varieties and community trading initiatives supported by government programs.

- Panama and Spain face severe production and supply challenges caused by labor strikes and adverse weather conditions, leading to significant export losses and sharp price hikes.

- Despite rising prices in Spain and global supply issues, strong local demand and consumer preference for domestic bananas help sustain markets, although competition from cheaper imports threatens future stability.

1. Weekly News

Global

Global Banana Prices Rise Due to Climate and Disease Threats

Banana prices are rising globally as extreme weather, higher shipping costs, and growing threats from climate change and a destructive crop fungus strain the industry. While bananas are still relatively affordable in many places, global averages conceal sharp price differences between countries, with some facing unexpectedly high costs per kilogram (kg). As environmental pressures intensify and the risk of disease outbreaks persists, the long-standing era of cheap bananas may be nearing its end, raising serious concerns for the future of global banana production and trade.

India

India’s Kalahandi District Taps into Banana Export Market with G9 Variety

India’s Kalahandi district in Odisha is emerging as a promising hub for banana exports, particularly the G9 (Grand Naine) variety, which is now being exported to Dubai. G9 banana plants yield dense bunches, each bunch containing 200–220 bananas, weighing a total of 25–35 kg. They have a firm texture for long-distance transport, sweet flavor, long shelf life, and resistance to Panama wilt, making them marketable and sustainable. This initiative is supported by government bodies like the National Bank for Agriculture and Rural Development (NABARD) and Odisha’s Department of Horticulture. It opens up international market access for local farmers, provides better income opportunities, and enhances the region’s reputation in high-quality banana production.

Panama

Panama’s Banana Exports at Risk Following Halted Farm Work

A loss of 450 thousand boxes of bananas occurred in Panama due to a week-long work stoppage at farms, significantly affecting the country’s leading agricultural export. If the strikes persist, the resulting damage to plantations could become irreversible, potentially bringing all banana exports to a standstill. Bananas make up 17.6% of Panama’s total exports in early 2025 and support over 6 thousand jobs, especially in the Bocas del Toro region. While the workers’ political choices are acknowledged and respected, a return to work is urged to protect the banana industry, a vital component of Panama’s economy.

Philippines

Philippine Banana Farmers Gain Higher Income Through Community Trading Initiative

Banana farmers in Dimataling, Zamboanga del Sur, have seen improved incomes. This is due to a community-based trading enterprise launched with support from the Department of Agriculture–Philippine Rural Development Project (DA-PRDP). Since Dec-23, the Dimataling Kalipi Federated Association (DIMKAFA) has operated the Fresh Banana Trading and Consolidation enterprise with up to 410 women. They buy Cardaba bananas from local farmers at USD 0.22/kg (PHP 12/kg), up from the previous USD 0.14 to 0.16/kg (PHP 8 to 9/kg). The bananas are sold at USD 0.27/kg (PHP 15/kg) in Pagadian City. This initiative has already generated nearly USD 1,794 (PHP 100,000) in net income for the association. It has also increased competition among local buyers, leading to better farmgate prices. The project has significantly boosted farmers’ livelihoods and strengthened the local banana economy.

Spain

Weather and Supply Challenges Drive Up Canary Island Banana Prices in Spain

The price of Canary Island bananas has surged sharply due to a significant supply shortage. This shortage was due to adverse weather conditions, including cold temperatures and strong winds since Dec-24. These conditions damaged plantations and greenhouses, delaying growth and reducing quality. At the same time, production declines in Central America and West Africa have strengthened the Canary banana’s market position, pushing prices by late Apr-25 to 179.2% above the five-year average. Despite these higher prices, local demand remains strong, driven by consumer loyalty and preference for domestic bananas, although lower-cost imports are steadily gaining market share. The supply shortfall is expected to persist into summer, raising concerns about long-term market stability and the Canary banana’s competitiveness amid ongoing high production and marketing costs throughout the supply chain.

2. Weekly Pricing

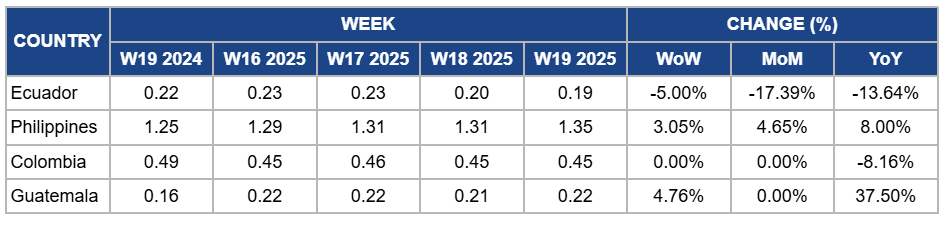

Weekly Banana Pricing Important Exporters (USD/kg)

Yearly Change in Banana Pricing Important Exporters (W19 2024 to W19 2025)

Ecuador

In W19, banana prices in Ecuador declined by 5% week-on-week (WoW) to USD 0.19/kg, continuing a downward trend driven by persistent oversupply as producers adjusted shipments to compensate for lost markets like Algeria. The redirection of exports to alternative regions intensified competition, putting further pressure on prices. Additionally, ongoing logistical bottlenecks, including port congestion and transportation delays, hampered timely deliveries, exacerbating market imbalances. Seasonal harvest peaks also contributed to elevated volumes in the market, limiting price recovery despite steady export volumes. These combined factors led to a 17.39% month-on-month (MoM) and 13.64% year-on-year (YoY) price decline.

Philippines

Banana prices in the Philippines increased by 3.05% WoW to USD 1.35/kg in W19, reflecting a 4.65% MoM increase and an 8% YoY rise due to shrinking supplies caused by adverse weather conditions in key producing regions, which limited harvest volumes. Additionally, ongoing export demand from major markets such as China and Japan remained strong, supporting higher prices. Infrastructure improvements and better logistics have also helped maintain steady export flows despite seasonal challenges, while domestic consumption growth added further upward pressure on prices.

Colombia

In Colombia, banana prices remained steady at USD 0.45/kg in W19, with no WoW or MoM change due to a balanced market where steady production levels matched consistent export demand, helping maintain price stability. However, YoY prices dropped by 8.16% due to increased competition from other Latin American exporters and a slight expansion in overall supply, which put downward pressure on prices over the longer term. Additionally, fluctuations in currency exchange rates and shifts in global demand patterns contributed to the YoY decline.

Guatemala

Guatemala's banana prices rose by 4.76% WoW to USD 0.22/kg in W19, with a significant 37.50% YoY surge and no MoM change due to strong international demand, particularly from the United States (US) and European markets, and supply challenges caused by adverse weather conditions affecting key production areas. Additionally, logistical challenges such as port congestion and higher transportation costs have limited export volumes, further tightening market supply and supporting higher prices.

3. Actionable Recommendations

Invest in Disease-Resistant Varieties and Climate-Smart Practices

Banana producers must adopt disease-resistant varieties like the ‘FHIA’ hybrids against destructive crop fungus and implement climate-smart practices to safeguard yields and control costs. For example, integrating resistant cultivars against Panama disease and Black Sigatoka, combined with improved irrigation and soil management, helps reduce crop losses from fungus and extreme weather. Producers in Latin America, Africa, and Southeast Asia can diversify planting schedules and use shade nets or windbreaks to protect crops from climate extremes. These steps are essential to maintain stable production and mitigate rising input and shipping costs.

Strengthen Supply Resilience with Diversified Production and Marketing

Banana producers should diversify growing regions and invest in climate-resilient infrastructure like windbreaks and protective greenhouses to reduce weather-related crop damage. Producers in the Canary Islands, Central America, and West Africa can stagger planting cycles and improve post-harvest handling to maintain a steady supply despite adverse conditions. Marketing teams should also emphasize quality and origin to reinforce consumer loyalty against cheaper imports, using campaigns that highlight local taste and sustainability certifications. This combined approach helps stabilize supply and supports premium pricing in competitive markets.

Sources: Tridge, Displafruit, Freshplaza, Fruit today, Metrolibre, Msn, Odishatv, PIA