.jpg)

In W2 in the palm oil landscape:

- EU palm oil imports declined by 16% YoY from Jul-24 to Dec-24, partly due to stricter deforestation-free supply chain requirements. Indonesia and Malaysia saw reduced exports, though Italy led imports.

- The WTO panel ruled on a trade dispute between the EU and Indonesia, supporting EU palm oil biofuel restrictions but identifying administrative shortcomings. The EU aims to increase renewable energy use by 2030 while excluding palm oil biofuel.

- Indonesia restricted exports of UCO and palm oil residues to prevent mixing with crude palm oil CPO, aiming to secure domestic supply. Exports of palm oil mill effluent and residues have outpaced CPO exports.

- The USDA forecasts a decline in Malaysia's palm oil production for 2024/25, reducing exports and contributing to higher global prices.

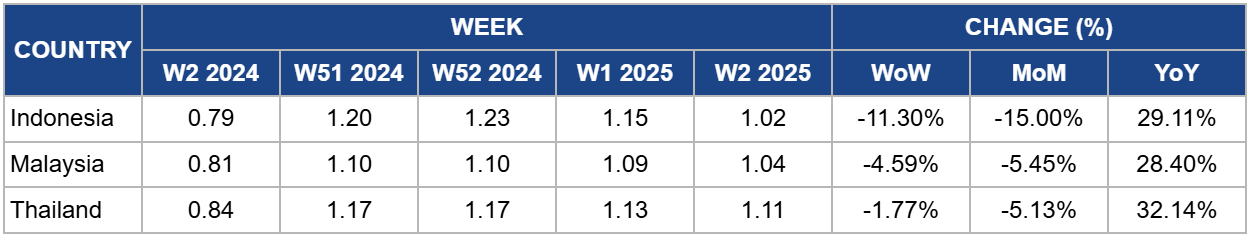

- Palm oil prices in Indonesia, Malaysia, and Thailand saw declines in W2, with Indonesia’s prices dropping 11.3% due to delays in the B40 biodiesel mandate, while Thailand's prices fell 1.77%. Despite reduced stocks and strong domestic demand, Thailand's low biodiesel blending ratio (B5) could limit future price growth.

- Palm oil prices in Indonesia, Malaysia, and Thailand saw declines in W2, with Indonesia’s prices dropping 11.30% WoW due to delays in the B40 biodiesel mandate, while Thailand's prices fell 1.77% WoW.

1. Weekly News

European Union

EU Palm Oil Imports Decline 16% Due to Stricter Deforestation-Free Requirements

The European Union’s (EU) demand for palm oil continues to decline, with imports from July 1 to December 10, 2024, totaling just under 1.4 million metric tons (mmt), a 16% drop compared to 2023, partly due to stricter deforestation-free supply chain requirements. Indonesia remained the top supplier, providing 476,000 metric tons (mt), followed by Malaysia at 286,000 mt, though both saw significant declines. Italy led EU imports with 478,000 mt, while Germany increased imports by 32% to 115,000 mt.

Indonesia

WTO Issues Mixed Ruling in EU-Indonesia Palm Oil Trade Dispute

The World Trade Organization (WTO) panel issued a mixed ruling on a trade dispute between the EU and Indonesia regarding EU restrictions on palm oil-based biofuels. While the panel largely supported the EU's stance, it identified shortcomings in the preparation, publication, and administration of the contested measures. These restrictions are part of the EU's Revised Renewable Energy Directive, "Red II", which aims to increase renewable energy use to 32% by 2030, excluding palm oil biofuel due to concerns over deforestation and environmental impact. Indonesia, the largest palm oil producer, argues that these policies are discriminatory and harm farmers' livelihoods.

The panel recommended that the EU align its measures with WTO obligations under the Technical Barriers to Trade (TBT) Agreement and the General Agreement on Tariffs and Trade 1994 (GATT 1994). Both parties retain the option to appeal, although the WTO's appellate body remains non-functional since 2019. A similar ruling in Mar-24 favored the EU in a related dispute with Malaysia, underscoring ongoing tensions between environmental goals and trade policies surrounding palm oil.

Indonesia Restricts Exports of Palm Oil Residues to Safeguard Domestic Crude Palm Oil Supply

Indonesia, the world's largest palm oil exporter, has restricted exports of used cooking oil (UCO) and palm oil residues following evidence that crude palm oil (CPO) was being mixed into these products, exceeding the estimated production capacity of 300,000 mt. Exports of palm oil mill effluent (POME) and high-acid palm oil residue (HAPOR) reached 4.87 mmt in 2023 and 3.45 mmt from Jan-24 to Oct-24, significantly surpassing CPO exports during the same periods. The regulation aims to secure CPO availability for domestic industries and avoid a potential deficit.

Malaysia

Malaysia Aims to Boost Palm Oil Production by Enhancing Smallholder Yields and Supporting Sustainability

The Malaysian government aims to increase palm oil production by boosting the yield of fresh fruit bunches (FFB) per hectare (ha) from smallholders by 40%, equating to an additional 5 to 10 mt/ha. As of W2, smallholders yield 8 to 12 mt/ha, compared to 28 to 30 mt/ha by larger corporations. The initiative focuses on enhancing productivity without expanding land use, with smallholders managing 1.5 million ha. A memorandum of collaboration (MoC) has been established between FGV Holdings Bhd (FGV), one of Malaysia's largest integrated palm oil companies, and the Malaysian Palm Oil Board (MPOB). It aims to empower smallholders through training, technology, and sustainability compliance, aiming to improve efficiency and access to premium markets. The government also supports Indonesia's biodiesel use, which helps stabilize palm oil prices globally.

USDA Forecasts Decline in Malaysia’s Palm Oil Production

The United States Department of Agriculture (USDA) forecasts a reduction in Malaysia’s palm oil production for the 2024/25 marketing year (MY), with production expected to decrease by 510,000 mt to 19.2 mmt. This decline, exacerbated by floods in late 2024, has led to higher palm oil prices, resulting in a projected decrease in exports by 772,000 mt, to 15.8 mmt. Ending stocks are expected to remain stable at 2.011 mmt. The reduced supply has also impacted global markets, pushing up soybean oil prices amid a drought in Argentina, which may further affect neighboring palm and sunflower oil markets.

2. Weekly Pricing

Weekly Palm Oil Pricing Important Exporters (USD/kg)

Yearly Change in Palm Oil Pricing Important Exporters (W2 2024 to W2 2025)

.png)

Indonesia

Indonesia's palm oil prices decreased to USD 1.02 per kilogram (kg) in W2, reflecting an 11.30% week-on-week (WoW) decline. This drop is primarily attributed to delays in implementing Indonesia’s planned B40 biodiesel mandate. The uncertainty surrounding the mandate’s rollout—due to a lack of official decrees and technical details—has created significant market volatility. Initially, expectations of reduced exports from Indonesia boosted palm oil prices, but the absence of clarity has reversed this trend. Future prices could remain susceptible to fluctuations if the mandate continues to face delays. If the B40 mandate is implemented without delays, future prices could rise as a result of the expected reduced supply.

Malaysia

In W2, Malaysia's palm oil prices fell to USD 1.04/kg, a 4.59% WoW decline, although prices remain 28.40% higher than last year. This decrease follows a period of high prices, which peaked in Nov-24. Malaysia's palm oil stocks have fallen to their lowest level since May-23, driven by a drop in production due to flooding. As of Dec-24, inventories decreased by 6.91% month-on-month (MoM) to 1.71 mmt, while production dropped 8.3% to 1.49 mmt. The reduction in stocks could support prices in the short term, but weak export performance and higher local consumption may pressure future demand. As palm oil continues to trade at a premium to other oils, the market may need to adjust prices to maintain competitiveness, particularly in price-sensitive markets.

Thailand

Thailand's palm oil prices decreased to USD 1.11/kg in W2, reflecting a 1.77% WoW decline, though prices are 32.14% higher year-on-year (YoY). The outlook for palm oil production in 2025 remains positive, supported by the maturation of new plantations established following favorable price conditions in 2022. However, the decision to maintain a low biodiesel blending ratio of B5 is expected to limit demand for palm oil in biofuel production. Additionally, a slight decline in exports to 1 mmt is anticipated. These factors, combined with stable domestic consumption, could result in modest price adjustments in 2025, as market dynamics in both biofuel demand and production influence price stability.

3. Actionable Recommendations

Adapt to Environmental Regulations and Certification Standards

Palm oil producers should enhance their sustainability efforts by aligning with environmental certifications like the Roundtable on Sustainable Palm Oil (RSPO). Given the EU's strict deforestation-free supply chain requirements and growing demand for sustainable practices, engaging with certification programs can help boost market access, particularly in European markets where demand is declining. Governments and trade organizations can support smallholders in obtaining certifications and improving traceability.

Leverage Biodiesel Policy Changes for Market Stability

To mitigate price fluctuations and volatility in Indonesia's palm oil market, stakeholders should monitor and prepare for the eventual rollout of the B40 biodiesel mandate. Companies can strategically plan for this mandate by securing domestic contracts for biofuel production, which could stabilize palm oil demand. Additionally, producers must engage in discussions with government bodies to advocate for clarity in policy implementation to minimize market uncertainty.

Increase Yield Efficiency in Malaysia's Smallholder Sector

The Malaysian government's initiative to improve smallholder productivity presents a strategic opportunity. Investors and palm oil companies can collaborate with local smallholders to adopt advanced agricultural techniques, such as precision farming, to boost yields without expanding land use. This approach could increase Malaysia's overall production capacity and strengthen its position in global markets, helping counteract production losses from recent flooding.

Sources: Tridge, Terre-net, Ukragroconsult, Grain Trade