In W20 in the potato landscape, some of the most relevant trends included:

- European potato export markets have cooled due to ample supplies from Egypt.

- Meanwhile, regional weather disparities in the UK are impacting crop emergence and market activity, with dryness limiting growth in some areas.

- Ireland’s planting and early harvesting are progressing well despite dry conditions.

- Uzbekistan is collaborating with Hungary to improve its potato sector through technology and expertise.

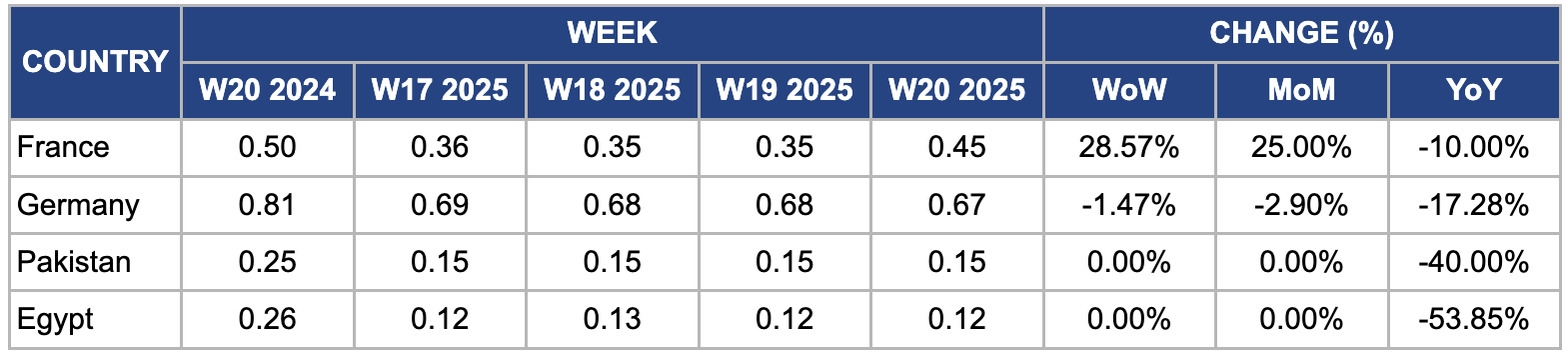

- Potato prices vary significantly by country in W20. Prices surged sharply WoW in France due to supply tightness and strong demand, while German prices declined WoW because of increased supply and subdued demand. In Pakistan and Egypt, prices remained stable WoW but were much lower YoY due to abundant harvests and reduced export demand.

1. Weekly News

Europe

European Potato Export Market Cools as Egyptian Supply Satisfies Demand

Export markets across Europe have cooled notably, driven by ample supplies of new crop potatoes from Egypt that have met importer needs and reduced sourcing pressures. In the United Kingdom (UK), regional disparities in weather are shaping the season. There are rising moisture levels in some areas contrasting with severe dryness in the east, where growers report receiving just 16 to 20 millimeters (mm) of rain since early Feb-25. This dryness is delaying crop emergence on heavier soils, potentially hindering growth if rain remains scarce. Market activity in these drier regions is subdued and limited to existing contract commitments rather than spot sales. Despite these challenges, the outlook remains cautiously optimistic, with rainfall playing a critical role in determining yield and market trends as the season advances across Europe.

Ireland

Ireland's 2025 Potato Season Advances Smoothly

Potato planting for Ireland’s 2025 season has concluded smoothly, marking a notable improvement from 2024’s weather-related delays. According to the Irish Farmers Association (IFA), crop development is progressing well under current dry conditions, though concerns remain over low rainfall in some areas. Early harvesting is underway, with growers in the southeast beginning to lift Home Guard potatoes this week, and Early Queen varieties are expected within three weeks if dry conditions continue. Meanwhile, Ireland’s recent warm, dry spell has shifted consumer habits, reducing demand for potatoes, particularly larger pack sizes, as shoppers opt for lighter salad options.

Kyrgyzstan

Kyrgyzstan Expands Potato and Melon Cultivation as Spring Fieldwork Nears Completion

As of May-25, Kyrgyzstan is nearing the completion of its spring fieldwork, with sowing and plowing conducted on 598,400 hectares (ha), representing 85.8% of the planned area, according to the Ministry of Water Resources, Agriculture and Processing Industry. The country has expanded its potato cultivation, with 49.2 thousand ha planted, up by 4.7 thousand ha compared to May-25. The 2025 plan aims to plant potatoes on 66.4 thousand ha nationwide.

Uzbekistan

Uzbekistan-Hungary Potato Partnership Deepens in W20

In W20, a delegation from Uzbekistan visited Budapest as part of the Uzbek President’s official trip to Hungary to strengthen the country’s potato farming sector, according to the Ministry of Agriculture. The Agriculture Minister led the delegation and initiated discussions to expand agricultural cooperation, including a key meeting with a Professor of the Hungarian University of Agriculture and Life Sciences, a renowned potato cultivation expert. Both sides agreed to leverage Hungarian technologies and expertise to enhance the efficiency and stability of Uzbekistan’s potato industry.

2. Weekly Pricing

Weekly Potato Pricing Important Exporters (USD/kg)

Yearly Change in Potato Pricing Important Exporters (W20 2024 to W20 2025)

France

In W20, potato prices in France surged 28.57% week-on-week (WoW) and 25% month-on-month (MoM), reaching USD 0.45 per kilogram (kg). This is driven primarily by a tightening supply caused by delays in the new season harvest due to cooler-than-average spring temperatures. The 2025 production forecast projects a slight decrease of about 3% year-on-year (YoY) from 6.8 million metric tons (mmt) in 2024 to approximately 6.6 mmt, further limiting available stocks. Furthermore, strong domestic demand from retail and processing industries, along with reduced imports due to higher tariffs and logistical constraints, intensified upward price pressure during this period.

Germany

In W20, Germany’s wholesale potato prices declined 1.47% WoW and 2.90% MoM to USD 0.67/kg, mainly due to increased supply from the 2025 harvest, which expanded market availability by approximately 5 to 8% compared to Apr-25. The 2025 production forecast for Germany’s potato crop is around 11.2 mmt, slightly higher than the 2024 output of 10.9 mmt, supporting greater supply pressure. Furthermore, subdued demand from food processing sectors amid seasonal shifts and competitive imports from neighboring countries like the Netherlands and Poland, where prices averaged USD 0.63 to 0.65/kg, further contributed to the price decline.

Pakistan

In W20, potato prices in Pakistan remained stable WoW and MoM at USD 0.15/kg but dropped 40% YoY due to active harvesting in Punjab flooding the market with fresh supplies. Many farmers expanded planting areas in 2025, estimated at a 10 to 12% increase, driven by strong returns from the previous season, while favorable weather conditions improved yields by around 8 to 10% YoY. Stable input costs for fertilizers and fuel helped maintain farm profitability despite lower prices. On the demand side, reduced export interest kept more potatoes within the domestic market, and enhanced internal distribution systems facilitated efficient movement to key consumption areas, supporting balanced market conditions despite the significant annual price drop.

Egypt

In W20, Egypt’s potato prices held steady WoW and MoM at USD 0.12/kg but dropped sharply by 53.85% YoY due to abundant supply from the 2025 harvest. Favorable weather in key growing areas like the Nile Delta and Upper Egypt boosted yields, pushing production up 8% YoY to an estimated 3.5 mmt. The increased volume of fresh potatoes flooding the domestic market has exerted downward pressure on prices. Furthermore, reduced export demand from traditional buyers in the Gulf and Europe has lowered external sales, keeping more stock at home and further suppressing prices.

3. Actionable Recommendations

Enhance Irrigation Infrastructure and Water Management in Drought-Prone Regions of Europe

The notable dryness in eastern parts of the UK and some other European potato-growing regions is delaying crop emergence and reducing early growth potential, especially on heavier soils. Governments and agricultural cooperatives should prioritize investment in irrigation infrastructure and efficient water management systems. This includes expanding access to localized irrigation technologies such as drip or sprinkler systems and encouraging water-conserving practices like mulching and soil moisture monitoring. Moreover, establishing drought contingency plans and early warning systems will help farmers respond proactively to water shortages. Improving irrigation capacity will reduce yield variability caused by unpredictable rainfall patterns, ensure consistent market supplies, and help maintain farmers’ livelihoods amid increasingly erratic climate conditions.

Strengthen Market Diversification and Value Addition Strategies to Offset Price Volatility

Price fluctuations across key potato markets, such as the sharp YoY price drop in Egypt due to oversupply, contrasted with tight supply-driven price surges in France, highlight the need for growers and industry stakeholders to pursue diversified market and product strategies. In oversupplied regions, investing in value-added processing (e.g., frozen, chips, dehydrated potatoes) can help absorb excess production and stabilize income streams. Concurrently, expanding access to export markets with unmet demand, particularly in regions less affected by supply gluts, can balance local surpluses. Governments and industry groups should support these initiatives through export facilitation services, quality certification schemes, and market intelligence dissemination. This approach reduces vulnerability to local price crashes, encourages sustainable production planning, and improves overall sector resilience.

Facilitate Technology Transfer and Capacity Building for Potato Sector Modernization in Central Asia

Uzbekistan’s collaboration with Hungary on advancing potato farming through elite variety cultivation, seed improvement, and breeding system modernization is a promising model. Uzbekistan and similar countries like Kyrgyzstan should institutionalize ongoing knowledge exchange programs with established potato-producing nations. This can include training workshops for local agronomists and farmers on best practices in disease management, post-harvest handling, and mechanization. Further, establishing pilot farms and demonstration plots will allow practical testing and showcasing of new technologies. International donor agencies and development banks could support these efforts financially and technically. Such capacity building will increase production efficiency, improve seed quality, reduce losses, and position the potato sector for sustainable growth with enhanced export potential.

Sources: Tridge, Akchabar, Fresh Plaza, Potato News Today,