In W20 in the sugar landscape, some of the most relevant trends included:

- The global sugar market is expected to shift from a deficit in 2024/25 to a modest surplus in 2025/26, driven mainly by higher Indian production despite a smaller Brazilian crop. However, analysts warn of ongoing market tightness.

- India's sugar production declined in 2024/25 due to lower cane availability and recovery rates, but is projected to rebound in 2025/26 with favorable monsoons and increased cane sowing.

- The EU will significantly reduce Ukraine's duty-free sugar export quota in Jun-25, pressuring Ukraine’s agricultural sector and prompting producers to pivot toward MENA markets, where nearly 90% of exports were directed in 2024/25.

- Mozambique extended its VAT exemption on sugar and related inputs until the end of 2025 to support local industry and purchasing power, despite an estimated USD 31 million loss in government revenue.

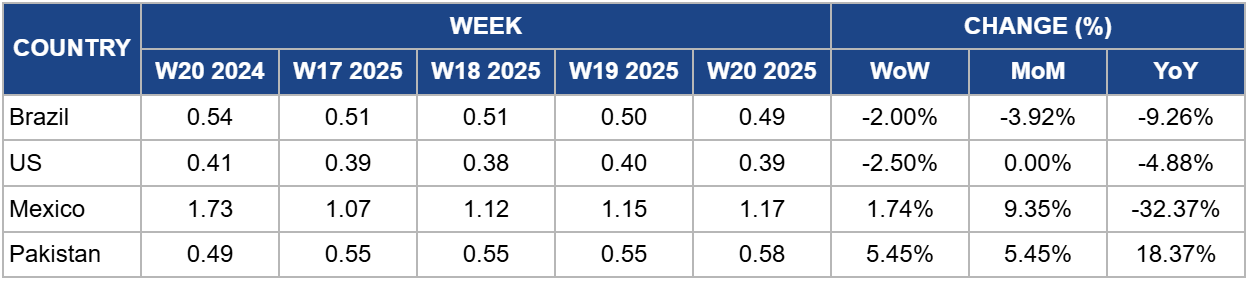

- Sugar prices in Mexico and Pakistan rose in W20, driven by localized supply constraints in Mexico and geopolitical tensions in Pakistan.

1. Weekly News

Global

Global Sugar Market to Shift from Deficit to Surplus in 2025/26

The global sugar market is expected to shift from a significant deficit of 5.2 million metric tons (mmt) in 2024/25 to a modest surplus of 400,000 metric tons (mt) in 2025/26. The increase is primarily driven by higher Indian production, projected at 30.5 mmt, offsetting a smaller Brazilian crop, estimated at 39.3 mmt. Despite the projected surplus, analysts warn of persistent market tightness and note that speculative funds remain heavily short, potentially misaligned with fundamentals.

European Union

EU to Cut Ukrainian Sugar Import Quotas Following Policy Shift Starting Jun-25

Beginning June 6, 2025, the European Union (EU) will significantly reduce duty-free access for Ukrainian agricultural products, including sugar, by replacing post-war trade privileges with transitional measures. Sugar export quotas to the EU will drop from 109,000 to 40,700 mt annually. Driven by pressure from Poland and France over falling domestic prices, this policy shift is expected to impact Ukraine's agricultural exports negatively. While a revised trade agreement is under negotiation, delays may prolong uncertainty, with the Ukrainian government warning of potential annual losses of up to USD 3.96 billion (EUR 3.5 billion).

Cuba

Cuba's 2025 Sugar Output to Hit Historic Low Below 200,000 MT as Industry Faces Severe Decline

Cuba's raw sugar production is projected to fall below 200,000 mt in 2025, marking its lowest level since the 19th century. Driven by chronic inefficiencies, input shortages, and economic challenges, this shortfall is significantly below the state-run Sugar Business Group's (AZCUBA) initial target of 265,000 mt. The decline threatens domestic supply, particularly for rum distilleries, which are required to use locally produced sugar-based alcohol. Ethanol output has also plummeted, with production of 96% sugar-based alcohol dropping 70% since 2019. With several provinces falling far short of production targets, Cuba is expected to import more sugar than it produces this year, further highlighting the deterioration of a once-dominant industry.

India

India's Sugar Production Reaches 25.74 MMT in 2024/25

According to the Indian Sugar Bio-Energy & Manufacturers Association (ISMA), India's sugar production for the 2024/25 season has reached 25.74 mmt as of May 15, 2025. The production season continues with two sugar factories still operational in Tamil Nadu. A notable trend this season is the increased diversion of sugar towards ethanol production, supporting the government’s cleaner energy initiatives. The outlook for the 2025/26 season remains positive.

India's 2024/25 Sugar Output Down 18% YoY as Stocks Remain Sufficient and Recovery Expected in 2025/26

India's sugar production for the 2024/25 season is projected at 26.11 mmt, down 18% year-on-year (YoY), due to lower sugar recovery rates and reduced cane availability, according to the National Federation of Cooperative Sugar Factories (NFCSF). Despite this decline, closing stocks are estimated at 4.8 to 5 mmt, sufficient to meet domestic demand through Oct-25 and Nov-25. Production is expected to recover in 2025/26 with favorable monsoon conditions and increased cane sowing. Ex-mill sugar prices remain stable, supported by lower output and government export approvals. The NFCSF has called for a higher Minimum Selling Price (MSP), a 5 mmt sugar diversion target for ethanol, revised ethanol procurement prices, and a continued export-friendly policy.

Mozambique

Mozambique Extends VAT Exemption on Sugar and Key Goods Through 2025 to Support Economy and Consumers

Mozambique's parliament has unanimously approved the extension of the Value Added Tax (VAT) exemption on commercial transfers of sugar, edible oils, and soaps, including raw materials and equipment used in their production, until December 31, 2025. Supported by all parliamentary groups, the measure aims to stimulate economic growth, lower production costs, and enhance purchasing power. According to Mozambique's Finance Minister, the exemption will result in over USD 31.29 million (MZN 2 billion) in foregone state revenue this year.

Ukraine

Ukrainian Sugar Producers Shift Focus to MENA Markets Due to EU Quota Limits

Ukrainian sugar producers are increasingly focusing on the Middle East and North Africa (MENA) as key export markets, amid limited access to the EU due to quota restrictions. In the 2024/25 marketing year (MY), nearly 90% of Ukraine's 500,000 mt of sugar exports were directed to this region, with major buyers including Türkiye, Libya, Lebanon, Somalia, Jordan, and Cameroon. Industry representatives expressed readiness to expand exports further and called for government support to establish trade hubs and new market channels. Ukraine currently holds a 0.2% share in global sugar trade.

2. Weekly Pricing

Weekly Sugar Pricing Important Producers (USD/kg)

Yearly Change in Sugar Pricing Important Producers (W20 2024 to W20 2025)

.png)

Brazil

Brazil's sugar prices declined to USD 0.49 per kilogram (kg) in W20, down 2% week-on-week (WoW) and 9.26% YoY from USD 0.54/kg. This downward movement reflects current supply expectations, even as production faces multiple constraints. Despite recent favorable weather, the 2025/26 harvest outlook remains uncertain due to lingering effects of drought and fire damage. According to the Brazilian Sugarcane Industry Association (Unica), Brazil's Center-South sugar production in Apr-25 fell sharply by 38.6% YoY to 1.58 mmt. Meanwhile, the cumulative output for the 2024/25 season through Mar-25 dropped 5.3% YoY to 40.169 mmt. This mismatch between falling prices and tightening supply suggests that current price softness may be temporary.

United States

In W20, the United States (US) wholesale sugar prices declined to USD 0.39/kg, a decrease of 2.50% WoW and 4.88% YoY from USD 0.41/kg. The price drop coincides with the US dollar losing momentum amid ongoing trade tensions with China and investor concerns over the US economic outlook. These uncertainties have weakened demand for US assets, contributing to softer sugar prices. On the supply side, favorable spring planting conditions in major sugar beet regions, including Idaho, Oregon, and Washington, have supported early sowing and strong yield prospects for the 2025 crop, despite a slight 2% reduction in planted acreage. This supply optimism may limit upward price pressure in the near term, but market participants should monitor geopolitical developments and crop progress closely for future price direction.

Mexico

In W20, Mexico's sugar prices rose to USD 1.17/kg, marking an increase of 1.74% WoW, despite a steep 32.27% YoY decline from USD 1.73/kg. The modest weekly increase may reflect localized supply constraints as the 2024/25 harvest concludes in regions like Morelos, where the Emiliano Zapata Sugar Mill recorded the highest national sugar yield (KARBE) at 133 kg/mt of cane. However, market conditions remain weak, with producers citing declining domestic and international prices.

According to the United States Department of Agriculture's (USDA) forecasts, Mexico's 2024/25 sugar production is projected at 4.81 mmt, slightly down from Apr-25. While domestic use is expected to increase, exports are expected to decline significantly, potentially easing supply pressure in the local market. For the 2025/26 season, production is forecast to rebound by 283,000 mt. Despite this, ending stocks are expected to remain stable, suggesting that future price recovery may be capped unless export demand improves or domestic consumption strengthens further.

Pakistan

Pakistan's sugar prices rose to USD 0.58/kg in W20, registering a 5.45% WoW and month-on-month (MoM) increase from USD 0.55/kg. The rise contributed to a 1.03% weekly increase in national inflation, with sugar identified as a key driver alongside poultry products, according to the Pakistan Bureau of Statistics (PBS). The upward price trend is further influenced by escalating military tensions with India, which have led to panic buying and hoarding in border regions. This behavior risks disrupting regional trade and supply chains. If tensions persist, supply uncertainty could support further price increases in the short term. However, sustained inflationary pressure may also reduce domestic consumption, potentially stabilizing prices.

3. Actionable Recommendations

Diversify Export Markets and Establish Strategic Trade Hubs

As the EU reduces Ukraine’s duty-free sugar access, Ukrainian exporters should accelerate efforts to strengthen their presence in alternative markets, particularly in the Middle East and MENA, which already absorb 90% of Ukrainian sugar exports. Stakeholders should collaborate with government and trade bodies to establish regional distribution hubs, enhance logistics infrastructure, and negotiate bilateral agreements with high-demand countries such as Türkiye, Libya, and Jordan. This would mitigate losses from EU market restrictions and enhance resilience against future policy shifts.

Hedge Against Market Volatility and Short Position Risk

Given the projected global shift from deficit to surplus in 2025/26 and the existing market tightness, traders and importers should actively monitor speculative fund positions, which appear misaligned with fundamentals. To manage price risk, sugar buyers should adopt a balanced hedging strategy by combining futures contracts and options to protect against unexpected price rebounds. This is particularly important as short-covering could trigger abrupt market corrections if fundamentals tighten unexpectedly.

Sources: Tridge, Grain Trade, Hellenic Shipping News, Ukr AgroConsult, Business Today, Business Standard, Reuters, Club of Mozambique, El Sol de Cuernavaca, Daily Times