.jpg)

In W21 in the onion landscape, some of the most relevant trends included:

- Unseasonal rains in India caused severe losses for onion farmers, damaging both standing and harvested crops. However, current compensation policies only cover standing crops, leaving many farmers without aid and sparking calls for policy revision.

- Tanzania invested in onion market infrastructure and farmer support programs to improve productivity and access.

- Onion prices showed mixed trends globally in W21. Sharp price increases occurred in Mexico and Spain due to supply constraints and weather impacts. Meanwhile, prices declined in Ukraine, Egypt, and India due to quality issues, strong harvests, and weak export demand.

1. Weekly News

India

Unseasonal May-25 Rains Devastate Nashik Onion Crops

Unseasonal rains since May 6 have caused major losses to onion farmers in Nashik, damaging crops across approximately 6,500 hectares (ha), with nearly 3 thousand ha of onions affected. This includes standing and harvested crops stored in fields. Farmers typically harvest summer onions in May-25 and store them under tarpaulins or barns. However, 2025’s unexpected rains soaked the standing crop and the harvested stock. According to National Disaster Response Fund (NDRF) guidelines, compensation is only provided for standing crops, leaving many farmers without aid despite heavy losses. Agriculture officials are currently assessing the damage, with early reports indicating that over half of the affected onions were harvested and thus ineligible for compensation. A local official noted that such May-25 rains are rare and caught farmers unprepared, resulting in ruined crops without government support under current rules. Farmers demanded that the government revise its compensation norms to include harvested onions to help prevent a severe financial crisis for Nashik’s onion growers.

Heavy Rainfall Halts Onion Trading at Lasalgaon APMC, Driving Prices Up 20%

Intense rainfall disrupted onion trading at Lasalgaon Agricultural Produce Market Committee (APMC), India’s largest wholesale onion market in Nashik, on May 21, suspending the morning session at 10:30 am. The disruption, caused by heavy downpours, also triggered a 20% surge in wholesale onion prices, which rose from USD 13.47 per quintal on May 18 to USD 16.10 on May 28 due to rainfall-induced supply shortages. Despite the interruption, trading resumed at 3:30 pm after the weather improved. Farmers had already brought in around 4,900 quintals of onions on 240 tractors and pick-ups, and auctioning occurred during the first hour before the rain halted operations.

Tanzania

Tanzania to Build Onion Markets and Enforce Packaging Rules to Support Farmers

Tanzania's Minister for Agriculture announced that the government would begin constructing onion markets in the Singida Region and other parts of Tanzania during the 2025/26 financial year, alongside introducing regulations to curb oversized and unregulated packaging. The government supports onion farmers by providing subsidized fertilizers, training on good agricultural practices, and equipping extension officers with tools like motorcycles and soil testing kits to enhance advisory services and boost productivity. Moreover, the ongoing construction of irrigation schemes across 7,300 ha in the onion-growing wards of Msange, Masimba, and Msingi will benefit 52,000 farmers in 19 villages upon completion.

Ukraine

Ukrainian Onion Prices Declined 12% WoW in W21 Due to Quality Concerns and Weak Demand

As of W21, Ukrainian farmers are offering onions at USD 0.39 to 0.63 per kilogram (kg), down from a minimum of USD 0.43/kg in W20, reflecting a 12% average decline in wholesale prices within a week. Farmers were forced to lower prices due to stricter quality demands from wholesale buyers, who rejected substandard produce. Many producers delayed sales until late Apr-25, expecting better prices, which led to a surplus of lower-quality onions on the market. Consequently, prices are now 12% lower year-on-year (YoY), and market sentiment remains pessimistic due to deteriorating storage quality and persistently weak demand.

2. Weekly Pricing

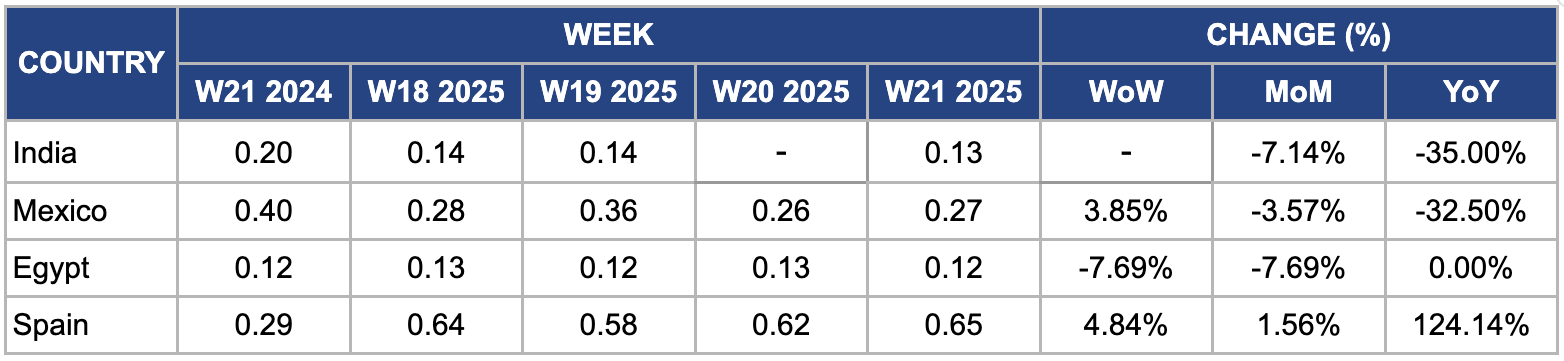

Weekly Onion Pricing Important Exporters (USD/kg)

Yearly Change in Onion Pricing Important Exporters (W21 2024 to W21 2025)

India

Onion prices in India reached USD 0.13/kg in W21, a drop of 7.14% month-on-month (MoM) and 35% YoY. This decline is primarily due to a strong harvest season, with 2024/25 onion production estimated at around 23 million metric tons (mmt), up nearly 10% YoY, driven by favorable weather conditions and expanded planting areas in key growing states such as Karnataka. Moreover, improved storage and distribution infrastructure helped reduce post-harvest losses, increasing market availability. Weak export demand, partly due to higher global onion supplies from countries like Egypt and the Netherlands, further pressured domestic prices. Lastly, sustained government intervention in the form of buffer stock releases and import duty adjustments contributed to easing prices in the domestic market.

Mexico

In Mexico, onion prices increased by 3.85% week-on-week (WoW) to USD 0.27/kg in W21 from USD 0.26/kg in W20, driven by short-term tightening in local markets due to temporary logistical disruptions and slightly reduced daily market arrivals. However, prices declined 3.57% MoM and 32.50% YoY. The sharp monthly and annual drop is primarily due to an abundant local supply, as the 2025 harvest yielded higher-than-expected volumes, saturating the market and exerting downward pressure on prices. Moreover, erratic demand from key export markets, particularly the United States (US), caused by fluctuations in import patterns and occasional trade restrictions, disrupted trade flows and contributed to price weakness.

Egypt

In W21, onion prices in Egypt decreased WoW and MoM by 7.69% to USD 0.12/kg. This decline was primarily driven by increased harvest volumes as the peak harvesting period progressed, resulting in higher local supply and market availability. Furthermore, favorable weather conditions in major producing regions like Beheira and Menoufia helped improve crop yields, easing previous supply constraints. Weakening export demand and competition from other regional suppliers further contributed to downward price pressure during this period.

Spain

Spain’s onion prices rose by 4.84% WoW to USD 0.65/kg in W21, with a 1.56% MoM increase and a sharp 124.14% YoY surge. The dramatic YoY resulted from a significant drop in onion production in 2024 due to adverse weather conditions like droughts, which lowered yields and tightened supply. The current WoW and MoM increase reflect ongoing supply constraints amid steady demand in local and export markets. Although onion acreage expanded for the 2024/25 season, the market still feels the impact of previous shortages, keeping prices elevated. Moreover, rising input costs and logistical challenges have further pushed prices upward.

3. Actionable Recommendations

Expand Compensation Coverage in India to Include Harvested Onions

The NDRF in India excludes harvested onions stored in fields or under tarpaulins from receiving financial aid, even though unseasonal rains cause significant losses. By revising the compensation norms to cover harvested onions, the government can provide critical financial relief to affected farmers, helping them recover and sustain their livelihoods. This policy change would reduce the risk of a deepening financial crisis among onion growers, encourage continued production, and ensure farmers have the resources to replant or maintain operations after such unpredictable weather events.

Accelerate Irrigation and Market Infrastructure Development in Tanzania

Tanzania’s initiative to construct new onion markets in regions like Singida, alongside the development of irrigation infrastructure spanning thousands of ha, represents a significant opportunity to boost the resilience of local onion farmers. Accelerating these projects will help stabilize onion production by reducing dependency on erratic rainfall and mitigating the impact of drought or floods. The introduction of regulated packaging standards will also improve product quality and marketability, enhancing farmer incomes and consumer confidence. Furthermore, equipping extension officers with tools and training ensures better advisory services for farmers, leading to the adoption of good agricultural practices.

Improve Post-Harvest Handling and Storage to Maintain Quality in Ukraine

Ukraine farmers should invest in improved post-harvest infrastructure, such as modern cold storage facilities, which can help preserve onion quality and extend shelf life, allowing farmers to better time their sales to market demand. Moreover, training programs focused on grading standards and quality control would help producers meet the stricter requirements of wholesale buyers and export markets. These steps can reduce produce rejection, stabilize prices, and increase the competitiveness of Ukrainian onions domestically and internationally, ultimately supporting farmer incomes and market sustainability.

Sources: Tridge, Daily News, East Fruit, Lokmat Times, Pune Pulse, Times of India