In W21 in the soybean landscape, some of the most relevant trends included:

- The USDA projects global soybean production to rise by 1.41% YoY to 426.82 mmt in 2025/26, mainly driven by a 3.55% increase in Brazil. Global consumption is expected to grow by 3.40% to 424.05 mmt, fueled by higher crushing demand, particularly in China, which will import 108 mmt.

- The EU’s 25% tariff on US soybeans may shift more demand toward Brazil. Meanwhile, Argentina’s harvest faces risks due to heavy rains in Buenos Aires, potentially prompting downward revisions from the current 50 mmt forecast.

- In W21, US soybean prices rose due to planting delays and strong export demand. Brazil’s prices held steady amid plans for acreage expansion, while Argentina and Uruguay remained stable at USD 0.39/kg and USD 0.41/kg, respectively, despite weather-related and market challenges.

1. Weekly News

Global

USDA Projects 2025/26 Global Soybean Output at 426.82 MMT

The United States Department of Agriculture (USDA) forecasts global soybean production to rise by 1.41% year-on-year (YoY) to 426.82 million metric tons (mmt) in the 2025/26 season, driven mainly by a 3.55% increase in Brazil's output to 175 mmt, while declines are anticipated in Argentina and the United States (US). Global consumption will grow by 3.40% YoY to 424.05 mmt, fueled by higher crushing volumes, particularly in major consuming countries. China's soybean imports will increase by 3.70% to 108 mmt. As a result of balanced supply and demand growth, global ending stocks are estimated to rise slightly by 0.94% YoY to 124.33 mmt.

Europe

EU Retaliatory Tariffs Threaten US Soybean Competitiveness Amid Shifting Trade Dynamics

The European Union (EU), the second-largest market for US soybeans after China, has imposed a 25% retaliatory tariff on US agricultural products, including soybeans, in response to US tariffs on EU steel and aluminum. This move threatens to reduce US soybean competitiveness in the EU market, where exports had already declined from 5.3 mmt in the 2024/25 season to 5.1 mmt in the 2025/26 season, despite accounting for over 53% of total EU soybean imports. With US soybean production nearing 119 mmt and exports projected to exceed 50 mmt, the new tariffs could significantly impact trade flows and shift EU demand further toward Brazil, which supplied 5.9 mmt last season.

Argentina

Soybean Harvest at Risk as New Rains Threaten 730 Thousand Ha in Buenos Aires

Heavy rains in Buenos Aires threaten Argentina’s 2024/25 soybean harvest. Although forecasts indicate stable weather ahead, the recent storms have already raised alarm in the agricultural sector. According to the Buenos Aires Grain Exchange (BAGE), the excessive rainfall could delay harvest progress and force a downward revision of the national production forecast, currently at 50 mmt. Approximately 730 thousand hectares (ha) of soybeans remain unharvested in Buenos Aires province. This area had already suffered in Mar-25, with productivity dropping by 15% YoY. The latest weather events now pose a serious risk of further crop losses.

Brazil

Brazil’s Soybean Harvest Nearly Complete at Record 172.4 MMT

The Brazilian soybean harvest is nearly complete, with 99.7% of the crop harvested and the Northeast and South regions surpassing 99% completion. Overall yields remain excellent across most producing areas, except in Rio Grande do Sul, where productivity dropped to 39 bags/ha due to adverse weather during the season. Despite this, Brazil’s total soybean output is estimated at 172.4 mmt, marking a significant increase compared to the previous season.

China

China's Soybean Imports from Brazil Declined 22.2% Yoy in Apr-25 Amid Delays

In Apr-25, China's soybean imports from Brazil dropped 22.2% YoY to 4.6 mmt due to harvest delays, logistical issues, and prolonged customs clearance, according to the General Administration of Customs of China (GACC). Imports from the US also fell sharply by 43.7% YoY to 1.38 mmt. Despite these monthly declines, total soybean imports by China for the year to date reached 12.95 mmt, marking a 35.2% YoY increase compared to the same period in 2024.

2. Weekly Pricing

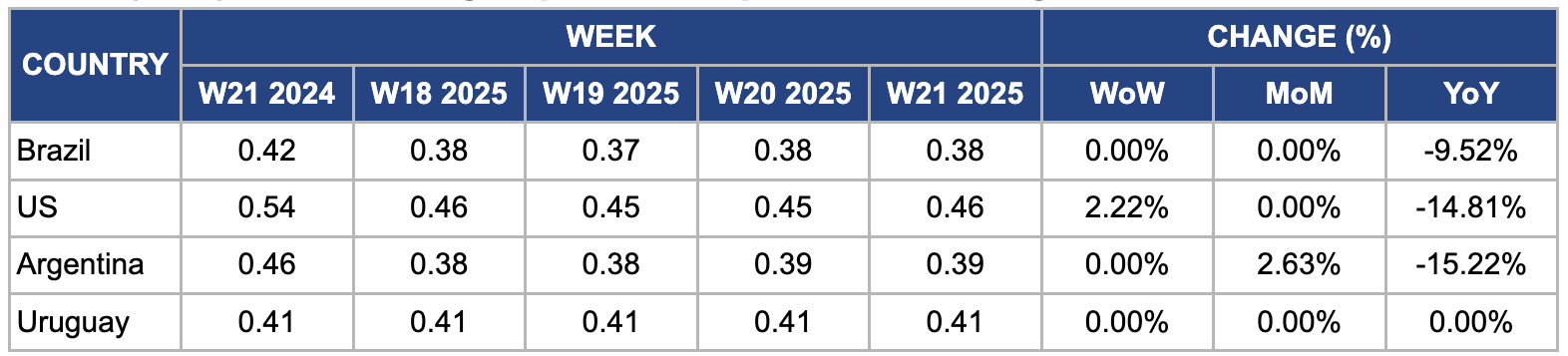

Weekly Soybean Pricing Important Exporters (USD/kg)

Yearly Change in Soybean Pricing Important Exporters (W21 2024 to W21 2025)

Brazil

In W21, Brazil’s soybean prices remained unchanged week-on-week (WoW) and month-on-month (MoM) to USD 0.38 per kilogram (kg). This is fueled by expectations that farmers will expand soybean acreage by about 500 thousand ha, in the 2025/26 season, marking the 19th consecutive year of growth. This expansion is expected mainly in the central-western and northeastern regions, which benefit from favorable growing conditions. While China remains the key market driving demand, the pace of acreage growth may slow compared to previous years due to changing market dynamics and environmental factors.

United States

In W21, US soybean prices rose 2.22% WoW, reaching USD 0.46/kg, up from USD 0.45/kg the previous week. This increase is due to weather-related planting delays in key producing states such as Iowa, Illinois, and Indiana. Persistent wet and cool conditions hampered fieldwork, raising concerns about potential reductions in planted acreage and yield prospects for the 2025/26 crop. Moreover, firm export demand, particularly from China, and tighter old-crop supplies contributed to upward price pressure. Traders responded to the uncertainty by bidding up futures, translating into higher spot prices for soybeans.

Argentina

In W21, Argentina's soybean prices remained steady WoW at USD 0.39/kg, reflecting a 2.63% MoM increase from USD 0.38/kg in Week 18. This price stability occurred despite significant challenges in the agricultural sector. The soybean harvest faced delays due to heavy rains and flooding in key regions like northern Buenos Aires province, where rainfall exceeded 260 millimeters (mm) in 24 hours, leading to severe flooding and evacuations. These conditions hampered harvesting efforts and raised concerns about potential crop losses. However, forecasts of drier weather in the coming days offered hope for resuming harvest activities and mitigating further damage.

Uruguay

In W21, Uruguay’s soybean prices remained unchanged WoW, MoM and YoY at USD 0.41/kg, reflecting a market in equilibrium. This stability was underpinned by a sharp rebound in domestic production following the devastating drought in 2023, which had slashed output to just 700 thousand metric tons (mt). In contrast, the 2024/25 harvest surged to an estimated 3.1 mmt, thanks to favorable weather and improved yields, bringing production back in line with the five-year average. However, despite this strong recovery, prices faced downward pressure from a globally oversupplied market, mainly due to record soybean harvests in Brazil, limiting Uruguay’s potential price gains.

3. Actionable Recommendations

Diversify Export Markets to Offset Tariff-Driven Losses

With the EU imposing a 25% retaliatory tariff on US soybeans, American exporters risk losing a substantial share of this historically strong market. To mitigate this impact, US traders and exporters must actively diversify their export destinations by targeting fast-growing demand centers such as Vietnam, Indonesia, Egypt, Morocco, Mexico, and Colombia. They should organize trade missions in Vietnam to establish long-term supply agreements with animal feed manufacturers and soybean crushers. They can launch digital outreach campaigns and implement tariff-friendly financing models through the USDA’s export credit programs. By tapping into new, less politically exposed regions, US exporters can reduce their dependence on the EU and China and stabilize revenues amid rising global competition.

Strengthen On-Farm Climate Resilience in Argentina

Persistent heavy rainfall in Buenos Aires province has delayed the soybean harvest and increased the risk of significant crop losses. To prevent such issues in future seasons, stakeholders must promote climate-resilient farming practices. This means investing in improved drainage systems, adopting earlier planting schedules to avoid peak rainfall, and using soybean varieties that tolerate excess moisture and heat. For example, local governments and cooperatives can partner with agricultural research institutes to distribute improved seed varieties and train farmers on effective water management techniques. By doing so, they can help farmers better withstand unpredictable weather patterns, minimize harvest disruptions, and secure national production levels.

Capitalize on Brazil’s Acreage Expansion for Forward Contracts

Brazil will expand its soybean acreage by approximately 500 thousand ha in the 2025/26 season, particularly in the Central-West and Northeast regions. To capitalize on this growth, soybean traders and cooperatives should offer forward contracts to farmers before planting. These contracts let farmers lock in favorable prices while giving processors and exporters a secure supply base. This approach reduces price risk for both parties and ensures timely delivery of volumes in a highly competitive global market, mainly as Brazil strengthens its position in world soybean trade.

Sources: Tridge, Agrolink, CanalRural