In W21 in the strawberry landscape, some of the most relevant trends included:

- Italy’s strawberry exports declined by 10% YoY in 2025 despite a 15% rise in average export value, with southern regions facing oversupply and quality issues due to adverse weather conditions.

- Ukraine experienced a sharp drop of up to 35% in strawberry prices in W21, caused by oversupply and poor quality from adverse weather, though prices remain 45% higher than last year.

- The UK maintained strong strawberry yields in 2025 due to widespread protected cultivation methods, allowing crops to ripen 10 days earlier despite a very dry spring.

- The US saw steady progress in California’s 2025 strawberry harvest, with rising prices reflecting limited supply and increased demand, especially in the fresh and frozen segments.

1. Weekly News

Italy

Italy’s Strawberry Exports Decline Despite Higher Values and Expanded Production

Italy’s 2025 strawberry season has delivered mixed results, shaped by regional climate differences and evolving market trends. Early in the campaign, Southern regions such as Campania, Basilicata, and Sicily benefited from favorable weather, yielding high-quality fruit and strong exports to Germany, Austria, and Switzerland. However, rising temperatures and humidity from mid-Mar-25 led to oversupply, quality concerns, and falling prices. Northern regions like Veneto and Romagna experienced fewer disruptions. Still, overall exports dropped 10% year-on-year (YoY) to 10.5 thousand tons, the lowest in five years, even as the average export value rose by 15%. Imports surged by 13% to 27.5 thousand tons, surpassing exports. Italy’s strawberry cultivation area expanded by 2%, reaching 4.2 thousand hectares (ha). Over 85% of this area is now under protected cultivation. South-Central regions currently account for 66% of the country’s total output. Campania and Basilicata saw increased planting this season. In contrast, areas like Sicily and Calabria reported declines. Despite these regional challenges, Italy remains competitive in the European market, particularly against Spain, which faced weather-related production issues.

Ukraine

Strawberry Prices Drop Sharply in Ukraine Due to Oversupply and Poor Quality

Strawberry prices in Ukraine have plunged by up to 35% in W21. This sharp decline is due to a sudden increase in supply from farms in the western and southern regions, combined with poor berry quality caused by adverse weather. Prices dropped from USD 5.31-6.27 per kilogram (UAH 220-260/kg) to USD 2.9-4.59/kg (UAH 120-190/kg), especially as harvesting expanded from plastic tunnels. The main harvest is expected in early Jun-25. However, growers have reported significant early-season losses ranging from 30% to 100%. These losses were caused by severe frosts in Apr-25 and May-25 and could impact the supply dynamics. Despite the current price decline, strawberries remain about 45% more expensive than at the same time last year, highlighting underlying market volatility.

United Kingdom

UK Strawberry Yields Unaffected by Drought Due to Protected Cultivation

Strawberry production in the United Kingdom (UK) has remained resilient despite experiencing one of the driest springs in over a century. This resilience is due to the widespread use of protected cultivation methods, such as polytunnels and drip irrigation sourced from boreholes. Unlike vulnerable arable crops such as spring wheat, which have suffered from compacted soils and insufficient rainfall, strawberries have thrived under controlled conditions. They are ripening at least 10 days earlier than usual. The current strawberry harvest remains strong and stable, demonstrating the effectiveness of climate-resilient cultivation practices in mitigating the impacts of extreme weather.

United States

California Strawberry Harvest Continues in Response to Limited Supply and Higher Prices

California’s 2025 strawberry harvest is advancing steadily with average supply levels across key growing areas, as the industry prepares for peak production by late May-25. Processing volumes are expected to double, and rising prices reflect tightening supply conditions and increased demand. Conventional strawberries are priced at USD 0.68 per pound (lb) and organic at USD 0.95/lb, both above last year’s levels, while juice-grade fruit is lower, at USD 0.25/lb (conventional) and USD 0.40/lb (organic). In the frozen segment, individually quick frozen (IQF) strawberries have seen a 10% YoY price increase, with medium conventional at USD 1.10/lb and sliced IQF at USD 1.15/lb. Demand has rebounded as inventories clear and buyers return, while an early season end in Central Mexico has constrained supply further, reinforcing California’s central role in meeting current market needs.

2. Weekly Pricing

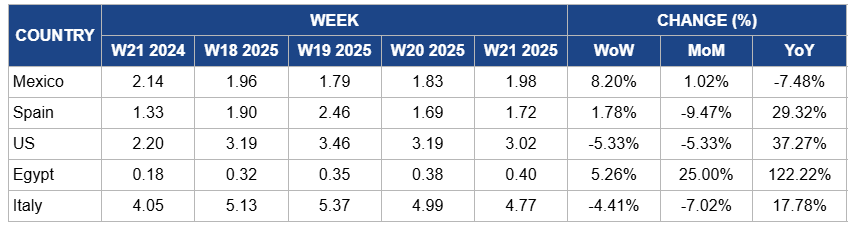

Weekly Strawberry Pricing Important Exporters (USD/kg)

Yearly Change in Strawberry Pricing Important Exporters (W21 2024 to W21 2025)

Mexico

In W21, Mexico's strawberry prices increased by 8.20% week-on-week (WoW) to USD 1.98/kg, with a slight 1.02% month-on-month (MoM) rise. This uptick is due to the early conclusion of the Central Mexico strawberry season, which ended weeks ahead of schedule, leading to reduced supply and heightened demand in the market. An industry participant noted that the premature end of the season strained availability, causing prices to rise. However, YoY prices dropped by 7.48% due to a significant increase in overall production volumes and intensified competition from other producing regions, which exerted downward pressure on prices.

Spain

Strawberry prices in Spain increased by 1.78% WoW to USD 1.72/kg in W21, marking a 29.32% YoY surge. This rise is primarily due to a significant reduction in production, especially in Huelva, Spain's main strawberry-producing region, where yields have dropped by approximately 25% because of adverse weather conditions, including heavy rainfall and water scarcity. However, prices declined by 9.47% MoM as the season progressed, leading to increased supply and a shift in consumer demand towards other seasonal fruits, thereby exerting downward pressure on prices.

United States

United States (US) strawberry prices declined by 5.33% WoW and MoM to USD 3.02/kg in W21, due to increased supply from key growing regions such as California's Santa Maria and Oxnard, where favorable weather conditions led to higher yields and improved fruit quality. This surge in availability outpaced demand, exerting downward pressure on prices. However, YoY prices surged by 37.27%, largely due to earlier disruptions in the supply chain caused by labor shortages and trade constraints, which limited imports and reduced overall availability in the preceding year. These factors contributed to higher baseline prices in 2024, making the current year's prices appear significantly elevated in comparison.

Egypt

Egypt's strawberry prices increased by 5.26% WoW to USD 0.40/kg, with a 25% MoM rise and a substantial 122.22% YoY surge. This significant price escalation is due to multiple factors, such as a 25% reduction in fresh strawberry acreage due to challenges in obtaining quality plants, escalating production costs driven by climate change impacts, currency devaluation, and compliance with stringent European phytosanitary regulations necessitating the use of more expensive pesticides. Additionally, high shipping costs and a strong demand from European, Gulf Cooperation Council (GCC), and Asian markets have further propelled prices upward. These combined elements have strained supply chains, leading to increased prices in both domestic and export markets.

Italy

Strawberry prices in Italy declined by 4.41% WoW to USD 4.77/kg in W21, reflecting a 7.02% MoM decrease. This downturn is due to a surge in supply from key producing regions such as Campania, Basilicata, and Sicily, where favorable weather conditions led to higher yields. The increased availability and the entry of Dutch strawberries into the European market intensified competition and exerted downward pressure on prices. However, YoY prices rose by 17.78% due to earlier climatic challenges that affected fruit set and quality, leading to reduced export volumes, the lowest in five years. Despite the lower volumes, revenues increased, indicating that the market absorbed higher prices due to sustained demand.

3. Actionable Recommendations

Improve Post-Harvest Handling to Stabilize Prices

Strawberry producers in Ukraine, Poland, and Egypt should strengthen post-harvest handling practices to reduce losses and maintain quality during peak supply periods. Producers can invest in shaded field packing stations, rapid pre-cooling systems, and reusable ventilated crates to minimize bruising and spoilage. For instance, Ukrainian growers facing poor berry quality due to weather can reduce deterioration by cooling berries within two hours of harvest. Similarly, Polish producers can use perforated liners and humidity control during transport to preserve freshness and extend shelf life. These measures help maintain higher prices even when supply surges.

Prioritize High-Grade Fruit for Fresh and IQF Markets

Strawberry producers in California, Mexico, and Egypt should prioritize sorting and channeling high-grade fruit toward fresh retail and IQF segments to capitalize on strong demand and higher prices. For example, US producers can direct well-formed, undamaged berries to IQF processing lines, where medium and sliced formats fetch premium prices. Mexican growers, facing an early season end, can maximize returns by focusing limited quality fruit on fresh export markets rather than juice-grade channels. Similarly, Egyptian exporters can increase profits by maintaining strict quality standards during harvest and the cold chain to meet IQF buyer requirements in Europe and the Gulf.

Sources: Tridge, BBC, CSO ITALY, Easfruit, Mintec/Expana, Ohio State News