In W30 in the palm oil landscape, some of the most relevant trends included:

- EU palm oil imports fell 20% YoY to 2.8 mmt in MY 2024/25, driven by declining demand in Spain and Italy and policy shifts removing palm-based biofuels from national quotas under RED III.

- India emerged as Malaysia's top buyer of palm oil and germinated seeds in 2024. At the same time, it is expanding domestic production under the NMEO, targeting 2.8 mmt of CPO by 2029/30 across 1 million ha.

- Indonesia's proposed B50 biodiesel mandate may increase domestic use by up to 3 mmt, supporting prices amid rising US tariffs. Meanwhile, forest fires in Riau are raising short-term supply concerns.

- Malaysia's palm oil production is projected to rise to 19.4 mmt in 2025/26, with exports up to 16 mmt. Prices increased to USD 0.99/kg in W30, supported by strong demand from India and elevated soybean oil prices.

- Nigeria launched the NaPOTS framework to improve traceability and sustainability in palm oil production. In addition, POFON committed to price stabilization and capacity growth despite rising input costs.

1. Weekly News

European Union

EU Palm Oil Imports Drop 20% in 2024/25 Amid Policy Shifts and Biofuel Restrictions

According to Germany’s Union for the Promotion of Plants and Protein (UFOP), palm oil imports into the European Union (EU) fell by 20% year-on-year (YoY) to approximately 2.8 million metric tons (mmt) in the 2024/25 marketing year (MY), driven by reduced demand from major buyers such as Spain, Italy, and Germany. Italy’s imports dropped 28% to 835,000 metric tons (mt), while Spain saw a sharper 40% decline to 289,000 mt. The Netherlands remained the largest importer, although volumes fell slightly to 959,000 mt. The decline reflects the impact of EU policy shifts, particularly the exclusion of palm oil-based biofuels from national quotas under the Renewable Energy Directive (RED III). UFOP supports further restrictions, including the proposed exclusion of biofuels derived from palm oil mill effluent and other by-products.

India

India Strengthens Palm Oil Self-Sufficiency with Surge in Malaysian Seed Imports and Strategic Collaboration

India has become the largest importer of Malaysian oil palm germinated seeds as part of its strategy to expand domestic palm oil production and reduce reliance on imports. In 2024, India also emerged as Malaysia's top palm oil market, accounting for 17.9% of total exports at 3.03 mmt. Under the National Edible Oils Mission (NMEO), India aims to expand cultivation to 1 million hectares (ha) by 2025/26 and produce 2.8 mmt of crude palm oil (CPO) by 2029/30. Malaysia is supporting this effort by supplying high-yielding seed varieties and technical expertise through enterprise-level agreements, reinforcing bilateral agricultural cooperation.

Indonesia

Indonesia's B50 Mandate and Malaysia's Export Duty Hike Poised to Support Regional Palm Oil Prices

Indonesia’s planned implementation of the B50 biodiesel mandate could raise domestic palm oil consumption by up to 3 mmt, or 6.2% of projected 2025 output. Still under government review, this policy is expected to support CPO prices in 2026 by offsetting export pressure from increased United States (US) import duties. The rollout of the B40 standard is progressing, likely boosting 2025 domestic use by 2 mmt and tightening export availability. Meanwhile, Malaysia has raised its CPO benchmark price for Aug-25 and increased its export duty to 9%, reinforcing broader price support in the region.

Tariff Reduction Poised to Solidify Indonesia's Lead in US Palm Oil Market

Indonesia is expected to strengthen its position in the US palm oil market following a reduction in its reciprocal tariff from 32% to 19%, significantly lower than Malaysia’s 25% rate. The move is expected to give Indonesia a competitive edge, especially as it already supplies 85% of US palm oil imports. While Indonesia exported 2.2 mmt to the US last year, Malaysia only shipped 191,000 mt. Ongoing negotiations between Malaysia and the US may still adjust current rates, but the widened tariff gap is likely to favor Indonesian exports in the near term.

Malaysia

Malaysia’s Palm Oil Output and Exports Set to Rise in 2025/26

Malaysia's palm oil production is projected to rise to 19.4 mmt in 2025/26, supported by normal weather conditions and expanded planted area, according to the United States Department of Agriculture (USDA). Exports are forecast to increase to 16 mmt, due to higher output, while domestic consumption remains stable. Palm oil is expected to trade at a discount amid improving global supply and heightened competition from other vegetable oils. Stocks are anticipated to reach 2.3 mmt, driven by elevated beginning inventories. Palm kernel oil (PKO) production and consumption are also set to rise, with exports increasing due to surplus supply and competitive pricing.

Nigeria

POFON Targets Price Stability and Production Growth to Strengthen Nigeria's Palm Oil Sector

The Plantation Owners Forum of Nigeria (POFON) has committed to stabilizing palm oil prices throughout the year to cushion the impact of rising living costs and reduce seasonal price fluctuations. Despite inflation and rising input costs, POFON aims to maintain affordable prices while expanding production capacity through significant investments by major producers such as Presco, Okomu, Saro Africa, and Wilmar. National CPO output has grown from around 1 mmt to 1.5 mmt annually over the past eight years, though a supply gap persists. POFON is collaborating with government agencies to develop a sustainable roadmap for both large-scale and smallholder production to meet domestic demand.

Nigeria Launches Palm Oil Traceability Framework

Nigeria has launched the National Palm Oil Traceability System (NaPOTS) Framework alongside a 16-member Inter-Agency Committee to oversee its implementation. The initiative aims to enhance product quality, sustainability, and market competitiveness through improved transparency and traceability in the palm oil sector. Aligned with the National Agricultural Technology and Innovation Policy (NATIP), NaPOTS supports climate-smart practices and responsible production, particularly among smallholder farmers who contribute over 80% of Nigeria’s output. The framework is expected to strengthen Nigeria’s position in global markets and improve standards across the food, pharmaceutical, and cosmetic industries.

2. Weekly Pricing

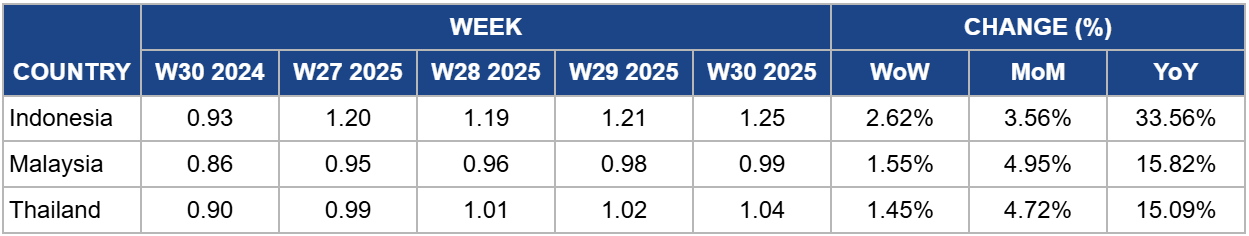

Weekly Palm Oil Pricing Important Exporters (USD/kg)

Yearly Change in Palm Oil Pricing Important Exporters (W30 2024 to W30 2025)

.png)

Indonesia

Indonesia's palm oil prices rose by 2.62% week-on-week (WoW) to USD 1.25 per kilogram (kg), reflecting a sharp 33.56% YoY increase, underpinned by supply-side concerns linked to intensifying forest and peatland fires in Riau, a major palm oil-producing region. Although plantations remain operational and major producers like the April Group report no direct impact, the declaration of a state of emergency and worsening fire conditions raise risks of short-term production disruptions during the peak harvest season. These concerns are helping to support current price levels, but analysts note that unless fires spread into core plantation zones or significantly hinder logistics, a major price spike remains unlikely. However, continued dry weather and fire-related haze could tighten near-term supply and keep prices elevated, particularly if disruptions coincide with strong festive demand from key buyers like India.

Malaysia

Malaysia’s palm oil prices rose by 1.55% WoW to USD 0.99/kg in W30, reflecting a 15.82% YoY increase from USD 0.86/kg. This upward trend aligns with robust export activity, particularly to India and Kenya, and sustained external price momentum. With Malaysian free-on-board (FOB) prices reaching USD 1,029.83/mt on July 22, the market is benefiting from strong festive-driven demand in India and elevated US soybean oil prices. However, the upside may be limited in the near term due to ample global oilseed supplies. Price stability in the range of USD 970 to 980/mt is expected, unless tighter supply or renewed demand shocks emerge.

Thailand

In W30, Thailand’s palm oil wholesale prices rose 1.45% WoW to USD 1.04/kg, up 15.09% YoY. This increase reflects steady demand and optimism around ongoing negotiations with the US to reduce a proposed 36% export tariff. A favorable agreement aligning Thailand’s tariff with regional competitors like Vietnam and Indonesia could maintain export momentum and support price stability or further gains. Conversely, delays or unfavorable outcomes may weigh on prices amid domestic economic challenges and political uncertainty.

3. Actionable Recommendations

Enhance Market Resilience Through Trade Diversification

Palm oil exporters in Malaysia and Indonesia should intensify efforts to expand into emerging markets such as Africa, the Middle East, and the Association of Southeast Asian Nations (ASEAN), reducing reliance on the EU, where demand has fallen due to policy restrictions. Strategic partnerships, preferential trade agreements, and tailored marketing in high-growth regions can help offset risks from shifting biofuel mandates and import tariffs.

Support Domestic Production and Traceability to Strengthen Supply Security

Governments and private stakeholders in countries such as Nigeria and India should scale up investment in palm oil cultivation, smallholder integration, and processing infrastructure while advancing traceability frameworks like NaPOTS. These measures will enhance food security, improve sustainability credentials, and unlock access to premium markets with stringent import standards.

Adjust Export Duty and Pricing Policies to Maintain Competitiveness

Malaysia and Indonesia should regularly review their CPO export duties to reflect global market conditions and rival tariff structures, especially given Indonesia’s improved position in the US market. Temporary duty reductions or flexible schemes during peak demand periods may help preserve market share and sustain export momentum amid rising competition and shifting trade flows.

Sources: Tridge, Ukr AgroConsult