.jpg)

1. Weekly News

Europe

EU Wheat Production to Decline in 2024/25 MY Due to Reduced Sowing Area

According to the United States Department of Agriculture's (USDA) Foreign Agricultural Service (FAS), grain production in the European Union (EU) for the 2024/25 marketing year (MY) is projected to decrease due to a reduced sowing area and lower yields. Specifically, the EU wheat harvest is expected to decline to 127.4 million metric tons (mmt), down from 130 mmt in the Jul-24 USDA report and 134.9 mmt in 2023/24 MY. This reduction is mainly due to a significant drop in wheat production in France, Germany, Hungary, Poland, and Romania, which cannot be offset by increased production in Spain. Weather conditions varied across European countries, with Bulgaria benefiting from sufficient rainfall during winter and spring, creating optimal growing conditions. In contrast, Romania faced above-average spring temperatures, leading to an earlier harvest by two to three weeks, while similar conditions affected Hungary.

France

France's 2024 Soft Wheat Production Expected to Hit 40-Year Low

France's agriculture ministry anticipates soft wheat production in 2024 will reach its lowest level in 40 years, falling 25% year-on-year (YoY). This decline is due to a significant reduction in sowing area, which has decreased by 10.8% YoY to 4.2 million hectares (ha), coupled with unfavorable weather conditions, including prolonged wet weather since autumn. These factors have delayed sowing, harmed plant development, and increased disease incidence. Overall, total grain production in France is forecasted to drop to 54.8 mmt in 2024, 10 mmt less than the previous year's output.

Indonesia

Indonesia's Wheat Imports Set to Reach Record 12.6 MMT in 2023/24 Amid Increased Demand

Indonesian wheat imports are projected to reach a record 12.6 mmt in the 2023/24 MY, up 33% YoY, driven by increased demand from feed mills, higher consumption of flour-based foods, and a shift towards cheaper alternatives to rice. Wheat consumption for food and feed is forecasted at 11.3 mmt and 11.7 mmt, respectively. However, imports may decrease in 2024/25 due to reduced demand following recent elections and weakened exchange rates.

Russia

Russia's Wheat Exports Exceed Five-Year Average in Jul-24

In Jul-24, the first month of the 2024/2025 agricultural season, Russia exported approximately 3.6 mmt of wheat, surpassing the five-year average of 3.1 mmt. This increase occurred despite solid competition from Eastern Europe and Ukraine. Egypt remained the top buyer with 0.5 mmt, followed by Morocco with 0.34 mmt and Bangladesh with 0.25 mmt. Saudi Arabia and Kenya imported 0.19 mmt and 0.18 mmt, respectively. Despite Turkey's import ban, Russia delivered over 100 thousand metric tons (mt) of wheat to Turkish ports for re-export.

Russia's Wheat Reserves Hit Record 20.3 MMT

As of July 1, 2024, Russia's wheat reserves reached 20.3 mmt, setting a new record with a 21% YoY increase, driven by an early harvest prompted by recent weather anomalies. By early Jul-24, Russia had harvested approximately 6.9 mmt of wheat, a significant rise from 0.2 mmt the previous year. However, excluding the new harvest, wheat reserves were lower at 13.4 mmt, down from 16.6 mmt in 2023. SovEcon projects wheat production for the new season at 84.7 mmt, lower than the previous year's 92.8 mmt.

2. Weekly Pricing

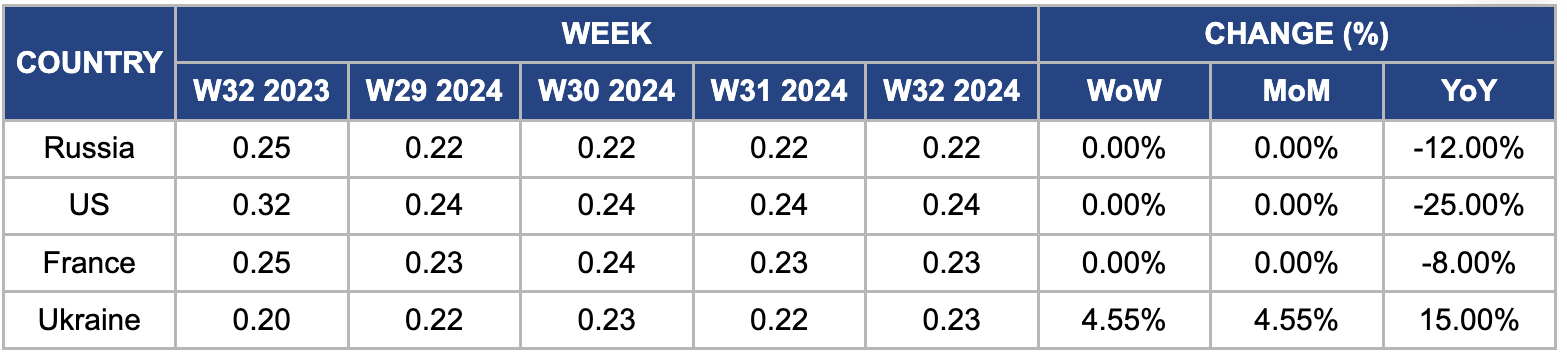

Weekly Wheat Pricing Important Exporters (USD/kg)

Yearly Change in Wheat Pricing Important Exporters (W32 2023 to W32 2024)

Russia

In W32, Russian wheat prices held steady at USD 0.22 per kilogram (kg), though they fell 12% YoY due to unfavorable global market conditions and a more assertive Russian ruble. The new wheat harvest is advancing well, with seasonal increases in supply as the peak harvest season nears. Russia's share of global wheat exports has risen significantly. Additionally, as of July 1, 2024, wheat reserves in Russia reached a record 20.3 mmt, up 21% from the previous year, thanks to an early harvest and favorable weather conditions.

United States

United States (US) wheat prices remained stable at USD 0.24/kg in W32 but fell 25% YoY from USD 0.32/kg in W32 2023. This decline is due to the positive outlook for US wheat production, spurred by dry conditions that have advanced the harvest. US wheat exports have significantly increased since the start of the agricultural season, with contracts for 8.5 mmt established between June 1 and August 1, a 33% YoY rise. So far, 3.4 mmt have been shipped, primarily to Mexico and other Asian and Oceania countries. The USDA projects total wheat exports for the season to reach 22.5 mmt, a 17% increase from the previous season but slightly below the five-year average.

France

In W32, French wheat prices remained stable at USD 0.23/kg over the past two weeks. This stability contrasts with France's severe wheat harvest issues, facing one of the worst in 40 years due to rainy weather conditions. Production is forecasted to drop by 25% to 26.3 mmt, making France, the EU's largest soft wheat producer, and exporter, one of the most affected countries. Despite potential impacts on bread prices, bakeries are likely to absorb the increased costs since wheat and flour constitute only a tiny fraction of the total cost of French bread. Farmers are seeking financial aid from the government, which has offered concessions following protests and blockades by agricultural unions.

Ukraine

In W32, Ukrainian FOB wheat prices increased by 4.55% week-on-week (WoW) and 4.55% month-on-month (MoM) to USD 0.23/kg. This rise is due to limited grain offers and strong demand. The market experienced price support due to farmers' restraint of sales, which led to a constrained supply, while active buyer demand bolstered prices.

3. Actionable Recommendations

Diversify Export Markets for Russian Wheat

Russia has seen a significant increase in wheat reserves and production, with a record harvest contributing to its global export share. To maximize this opportunity, Russia should focus on diversifying its export markets and establishing long-term trade agreements with emerging markets. For instance, expanding exports to Vietnam could be a strategic move. Vietnam has shown increasing demand for wheat, driven by its growing food processing and bakery industries. Establishing a trade agreement with Vietnam could give Russian wheat producers a stable export market and reduce dependency on traditional markets. Additionally, South Korea presents another promising export market. With a substantial demand for wheat for its food industry and feed production, South Korea could offer a significant growth opportunity for Russian wheat exports. Investing in market research and expanding trade partnerships can mitigate risks associated with market volatility and trade restrictions. This approach will benefit Russian wheat producers by securing stable export opportunities and enhancing their competitive position in the global wheat market.

Enhance Wheat Storage and Distribution in Ukraine

Ukrainian wheat prices have risen due to limited grain offers and strong demand. To capitalize on these conditions and address future market fluctuations, Ukraine should invest in advanced storage facilities and optimize distribution networks. Expanding storage capacity will allow farmers to manage supply more effectively and stabilize prices. Improving distribution channels will enhance market access and reduce logistical bottlenecks. These measures will support Ukrainian wheat farmers by providing greater flexibility in managing supply and demand dynamics, ultimately benefiting domestic and international markets.

Strengthen Indonesian Wheat Supply Chain

To ensure a stable wheat supply and manage potential decreases in imports for the 2024/25 marketing year, Indonesia should diversify its wheat supply sources by establishing long-term contracts with key exporting countries such as Russia, the US, and Canada. Additionally, investing in modern domestic storage facilities and improving logistical infrastructure will help mitigate supply chain disruptions and manage inventory more effectively. These measures will benefit Indonesian consumers and feed mills by maintaining a steady wheat supply and moderating price fluctuations.

Sources: UkrAgroConsult, Zol, Oilworld, Sinor, Agrobusiness, Elevatorist, Akhbarelyom