1. Weekly News

Global

Coffee Prices Surge by 40% in 2024

Coffee prices have surged nearly 40% in 2024 due to adverse weather conditions in Brazil, impacting Arabica and Robusta varieties. Despite the significant price increase, Brazil's coffee exports rose 26% year-on-year (YoY) in Jul-24, demonstrating the industry's resilience. In contrast, Argentina, which relies entirely on coffee imports, closely monitors the situation but does not expect immediate impact on local prices. Argentina's Tucumán province is making strides in local coffee cultivation, with pesticide-free plantations now harvesting their third generation of coffee cherries, signaling potential growth in domestic production.

Brazil

Brazilian Coffee Exporters Face Severe Logistical Disruptions

Due to severe overcrowding and port congestion, Brazilian coffee exporters face significant logistical challenges. In Jul-24, 60% of vessels experienced port changes or delays, with the Santos Port having the longest waiting period of up to 55 days. These disruptions led to the export failure of 1.262 million 60-kilogram (kg) bags of coffee, resulting in a loss of USD 313 million. The situation is expected to worsen in the second half of 2024 due to increased shipments of various containerized goods. Brazil's Council of Coffee Exporters (Cecafe) called for urgent dialogue and increased investment in port infrastructure to mitigate further losses.

Brazil's 2024/25 Coffee Harvest Projected to Decline YoY

Brazil's 2024/25 coffee harvest is nearing completion, with 92% of the crop harvested as of August 13, 2024, slightly surpassing the five-year average. However, adverse weather conditions have led to smaller beans and uneven ripening, resulting in a lower production estimate of 63.3 million 60-kg bags, a 4.4% YoY decrease from the previous season. Domestic demand for Arabica is expected to rise, while Robusta exports are projected to increase due to strong global demand. Despite potential demand fluctuations in the European Union (EU) and Japan caused by high prices, the international coffee market may experience a deficit for the fourth consecutive year.

Brazil’s Coffee Exports from Aug-23 to Jul-24

From Aug-23 to Jul-24, Brazil exported 48.17 million 60-kg bags of coffee, valued at USD 10.14 billion. The exports included 44.38 million 60-kg bags of green coffee, with Arabica accounting for 35.73 60-kg million bags and Robusta 8.65 million 60-kg bags. Additionally, Brazil exported 3.78 million 60-kg bags of industrial coffee during this period, comprising 3.73 million 60-kg bags of soluble coffee and 48.66 thousand 60-kg bags of roasted and ground coffee.

Peru

Peru's Coffee Crops Face Agroclimatic Risks

National meteorological agency Senamhi has issued an agroclimatic risk forecast for Peru's coffee crops from Aug-24 to Oct-24. The forecast anticipates above-normal daytime and nighttime temperatures and lower-than-expected rainfall in the northern and central jungle regions. These conditions could lead to thermal stress and water deficits, potentially affecting the bud swelling and flower bud phases in coffee plantations. The risk level is expected to range from low to high, with higher risks in Sep-24 and Oct-24 due to insufficient rainfall and elevated temperatures.

European Union

Coffee Organizations Raise Concerns over Impact of EUDR on Small Farmers

Leading coffee-focused nonprofits and trade organizations, including Fairtrade International, the Global Coffee Platform (GCP), and the European Coffee Federation (ECF), have urged European leaders to address potential issues related to the European Union Deforestation Regulation (EUDR), which is set to take effect on December 30, 2024. These groups warn that the regulation could inadvertently harm smallholder coffee farmers, who may need help with the stringent compliance and reporting requirements. They call for immediate intervention to mitigate these potential negative impacts and ensure a fair and sustainable market for all coffee producers.

2. Weekly Pricing

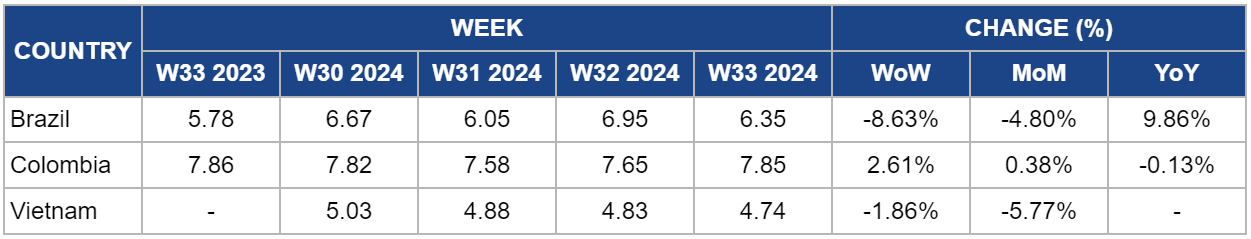

Weekly Coffee Pricing Important Exporters (USD/kg)

Yearly Change in Coffee Pricing Important Exporters (W33 2023 to W33 2024)

Brazil

Coffee prices in Brazil decreased by 8.63% week-on-week (WoW) and 4.8% month-on-month (MoM) to USD 6.35/kg in W33 compared to USD 6.95% in W32 and USD 6.67/kg in W30. However, the YoY price rose 9.96%, reflecting a long-term price increase. Brazil’s coffee exports face severe port delays due to overcrowding and congestion, significantly disrupting the export schedule and negatively affecting local prices. This situation is expected to worsen in the second half of 2024, which calls for immediate action to avoid further losses. In addition, the country’s coffee production also faces challenges from dry weather, which will continue to influence global prices.

Colombia

In W33, Colombia's coffee price rose by 2.61% WoW and 0.38% MoM to USD 7.85/kg. The YoY price declined slightly by 0.13%. Concerns about weather conditions in Brazil this week supported global coffee prices, leading to increased futures prices. Despite challenges in Brazil, Colombia's coffee production increased by 16% YoY from Jul-23 to Jul-24. The market is monitoring the weather conditions in Brazil and is expected to experience price fluctuation due to global supply dramatics.

Vietnam

Due to a global supply recovery, Vietnam's coffee prices declined by 1.86% WoW and 5.77% MoM to USD 4.73/kg in W33. During the first ten months of the 2023/24 season (Oct-23 to Jul-24), the country's coffee exports dropped 12.4% YoY to 1.3 million metric tons (mmt) due to supply constraints. Vietnam's Ministry of Industry and Trade predicts Vietnam's coffee exports will continue to decline in the remaining months of Q3-2024 due to low supply. However, the supply is expected to rebound in Oct-24 when the 2024/25 crop harvest begins.

3. Actionable Recommendations

Address Port Congestion and Logistics Challenges in Brazil

Brazilian coffee exporters should urgently engage with the government and private sector stakeholders to improve port infrastructure and streamline logistics processes. The logistics company should implement digital tracking systems and predictive analytics to help manage port congestion more effectively. Additionally, exporters should diversify their shipping routes and explore alternative ports to mitigate delays. Investing in temporary warehousing solutions near key ports could reduce bottlenecks during peak export periods.

Support Smallholder Farmers in Complying with the EUDR

Coffee industry stakeholders, particularly in producing countries, should collaborate with local governments to provide smallholder farmers with the resources and training needed to comply with EUDR. This includes developing affordable and accessible reporting tools, offering workshops on sustainable practices, and facilitating access to finance for certification costs.

Enhance Domestic Coffee Production in Argentina

Given the potential growth in domestic coffee cultivation in Argentina’s Tucumán province, the Argentinian government and private sector should invest in expanding research and development for sustainable coffee farming practices. Supporting the adoption of high-yield, climate-resilient coffee varieties and providing technical assistance to local farmers will be crucial. Additionally, coffee producers shall promote Argentine coffee locally and internationally through marketing campaigns to help build a niche market for this new production area.

Sources: Tridge, Infobae, Cecafe, AgroPeru, Portal Do Agronegócio, Noticias Agrícolas, Dailycoffeenews