W37 2025: Palm Oil Weekly Update

.jpg)

In W37 in the palm oil landscape, some of the most relevant trends included:

- Indonesia is restructuring its palm oil sector by consolidating 1.5 million ha of seized illegal plantations under the state-owned firm Agrinas, creating the world's largest producer by land size. This move signals a strategic shift toward greater state control over domestic supply of palm oil, potentially altering long-term export dynamics.

- Indonesia continues to pursue improved market access, actively leveraging its position as a key palm oil supplier in negotiations to reduce the 19% reciprocal import tariff from the US. This diplomatic effort underscores the strategic importance of the US market and the role of trade policy in shaping future export profitability for Indonesian producers.

- Malaysia has secured a significant advantage in accessing the European market after its MSPO certification was recognized as compliant with the EU's new deforestation regulation. In contrast, a new study revealed that independent smallholders in Indonesia are largely excluded from certified supply chains, highlighting a critical gap in achieving an inclusive and sustainable market.

- Regional palm oil prices are facing downward pressure after Malaysia’s official data confirmed inventories have risen for the sixth consecutive month to a two-year high. The combination of rising production, weakening exports, and high stockpiles has stabilized prices at lower levels and created a bearish outlook for the near term.

1. Weekly News

Indonesia

Major Consumer Brands Form Alliance to Combat Deforestation in Indonesia's Aceh Province

A coalition of leading global consumer brands, including Nestlé, PepsiCo, and Unilever, has partnered with major palm oil companies like Musim Mas and Golden Agri-Resources to establish the Aceh Sustainable Palm Oil Working Group (ASPOWG). This first-of-its-kind provincial initiative in Indonesia, coordinated by the non-profit organization IDH, aims to promote the production of deforestation-free palm oil in a region critical for its biodiversity, including the Leuser Ecosystem. The collaboration directly addresses a recent surge in deforestation rates in Aceh, which threatens to exclude the province's producers, particularly its smallholders who account for 52% of output, from international markets as regulations like the European Union Deforestation Regulation (EUDR) take effect. The working group will focus on accelerating the implementation of a 2024 provincial government roadmap for sustainability. Key objectives include improving smallholder productivity, protecting high-conservation-value forests, restoring degraded lands, and preparing producers for EUDR compliance. This strategic partnership signals a significant commitment from major supply chain actors to align Aceh’s palm oil sector with global sustainability standards, thereby safeguarding both market access and vital ecosystems.

Indonesian Independent Farmers Face Exclusion from Certified Palm Oil Market

A recent study has revealed that independent smallholder farmers in Indonesia are unintentionally being excluded from sustainable palm oil supply chains, creating a significant barrier to market equity. Research conducted in Kalimantan and Sumatra, major production hubs, found that mills certified by the Roundtable on Sustainable Palm Oil (RSPO) sourced only 7% of their fruit from independent farmers, despite this group producing an estimated 34% of the total volume. In contrast, certified mills sourced a disproportionately high volume from contract smallholders who have formal agreements. This phenomenon, described as "passive exclusion," prevents a large segment of producers from accessing the benefits of the certified market, such as price transparency and secure offtake. The findings are particularly relevant as new regulations, including the EUDR, risk further marginalizing small-scale producers. The study’s authors recommend that sustainability organizations and major traders take a more proactive approach, urging for increased engagement and collaborative efforts between governments and the private sector to resolve foundational issues like land legality, thereby better integrating independent farmers into global sustainable markets.

Indonesia Creates World's Largest Palm Oil Firm by Consolidating Seized Plantations

The Indonesian government has consolidated vast areas of seized palm oil plantations under the state-owned firm Agrinas Palma Nusantara, establishing it as the world's largest palm oil company by land size. Following a recent handover of 674,178 hectares, Agrinas now controls 1.5 million hectares, with an additional 1.8 million hectares seized from illegal operators pending verification for future transfer. This action is part of a nationwide crackdown on illegal land use in forest areas, with operators of the seized lands also facing substantial fines for illegal profits. With this consolidation, Agrinas holds a potential annual production capacity of 5.7 million metric tons (mmt) of crude palm oil (CPO). The company plans a significant expansion of its processing capabilities, intending to add dozens of new mills to its existing 17 to meet this potential. In the short term, the output will be used to support the government's subsidized domestic cooking oil program, with a long-term focus on supplying the bioenergy sector. This strategic move signals a major shift towards state control over a significant portion of Indonesia's palm oil production and land resources.

Indonesia Leverages Palm Oil in Negotiations for Lower US Import Tariffs

Indonesia is actively negotiating with the United States (US) to secure a further reduction of the current 19% reciprocal import tariff, positioning palm oil as a key commodity in the discussions. According to Indonesia's Ambassador to the US, the strategy involves offering to boost exports of products not produced domestically in the US, arguing that a lower tariff on essential imports like palm oil would be mutually beneficial. This approach is part of a broader diplomatic push to improve market access and ultimately achieve a zero-tariff arrangement for certain Indonesian goods. The negotiations are set against the backdrop of a significant trade imbalance, with Indonesia recording a USD 16 billion surplus with the US in 2024. While the US seeks a more balanced trade relationship, Indonesia is leveraging its status as a critical supplier to lobby for greater concessions. The current 19% tariff level, which was already reduced from an initial 32%, indicates progress in the talks. Alongside palm oil, Indonesia is also proposing lower tariffs for other key exports, including shrimp, timber, and copper, to strengthen its economic partnership with the US.

Malaysia

EU Recognizes Malaysian Sustainable Palm Oil (MSPO) Certification Ahead of New Deforestation Regulation

The European Union (EU) has officially acknowledged Malaysia's national palm oil certification, MSPO, as a credible standard for complying with its forthcoming deforestation regulation, which is set to take effect in Dec-25. This recognition validates the MSPO framework, which became mandatory for all Malaysian producers in January 2020, as a reliable system for ensuring that palm oil is legally sourced and deforestation-free. The move is a significant win for Malaysia, the world's second-largest palm oil exporter, as it positions the country's certified products to maintain access to the critical EU market. According to Malaysia's Plantation and Commodities Minister, the EU’s acknowledgment affirms the nation's leadership in sustainable production and ensures that its more than 500,000 smallholders remain integrated into the global sustainability agenda. The MSPO system, supported by third-party audits and a digital tracking system for full supply chain visibility, provides international buyers with the confidence that Malaysian palm oil meets stringent environmental and legal standards. This development is expected to strengthen trust among global stakeholders and reinforce the competitiveness of MSPO-certified palm oil in an increasingly regulated global market.

Malaysian Palm Oil Stocks Hit Two-Year High as Production Rises and Exports Weaken

According to official data from the Malaysian Palm Oil Board (MPOB), Malaysia’s palm oil inventories rose for the sixth consecutive month in Aug-25, exerting significant downward pressure on prices. End-of-month stockpiles increased by 4.2% from Jul-25 to reach 2.2 mmt, a two-year high. The inventory build was driven by a simultaneous rise in production and a fall in exports. Crude palm oil output grew by 2.35% month-on-month (MoM) to 1.855 mmt in Aug-25, while exports edged down by 0.3% MoM to 1.324 mmt. This growing supply surplus has already impacted the market, with October futures on the Bursa Malaysia exchange falling almost 1.5% following the report's release. Further bearish sentiment is expected in the coming months, as the pressure from high palm oil stocks is expected to be compounded by seasonally increasing supplies of rival vegetable oils, including soybean, sunflower, and rapeseed.

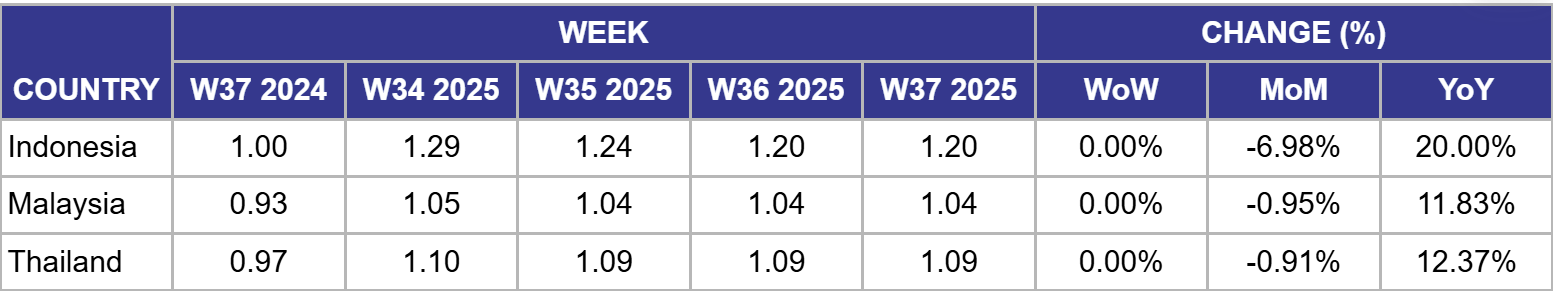

2. Weekly Pricing

Weekly Palm Oil Pricing Important Exporters (USD/kg)

* Varieties: Malaysia and Indonesia (crude palm oil), Thailand (refined, bleached, and dried or RBD palm oil)

Yearly Change in Palm Oil Pricing Important Exporters (W37 2024 to W37 2025)

* Varieties: Malaysia and Indonesia (CPO), Thailand (RBD palm oil)

* Blank spaces on the graph signify data unavailability stemming from factors like missing data, supply unavailability, or seasonality

Indonesia

In Indonesia, the price of palm oil was USD 1.20/kg in W37, unchanged week-on-week (WoW), down 6.98% MoM, and up 20.00% year-on-year (YoY). The government's consolidation of 1.5 million hectares under the state firm Agrinas Palma Nusantara, creating the world's largest producer by land size, has introduced uncertainty. While the firm's focus on domestic cooking oil could limit near-term exports, its massive long-term production potential of 5.7 mmt is a bearish factor. The sharp MoM decline aligns with regional trends of rising inventories. The strong YoY gain, however, is supported by fundamentally firm global demand and Indonesia's ongoing efforts to secure lower US tariffs, signaling a long-term strategy to enhance export value and maintain a higher price floor compared to the previous year.

Malaysia

In Malaysia, the price of palm oil held steady at USD 1.04/kg in W37, unchanged WoW, down 0.95% MoM, and up 11.83% YoY. The price stability reflects a balance between bearish supply data and positive regulatory news. The primary downward pressure stems from the MPOB report confirming that national stockpiles hit a two-year high of 2.2 mmt amid rising production and weakening exports. However, this was counteracted by the significant news that the EU has recognized the Malaysian Sustainable Palm Oil (MSPO) certification as compliant with its new deforestation regulation. This EU acknowledgment secures long-term access to a premium market, providing a crucial supportive factor that prevented prices from falling further. The slight MoM decline is a direct result of the recent inventory build, while the strong YoY increase reflects sustained global demand.

Thailand

In Thailand, the price of palm oil was USD 1.09/kg in W37, unchanged WoW, down 0.91% MoM, and up 12.37% YoY. Prices in Thailand remained stable but are heavily influenced by the bearish sentiment across the region. The primary driver for this stagnation is the high inventory level reported in neighboring Malaysia, which acts as a cap on regional price movements and limits export opportunities for Thai producers. Thai prices mirrored the trend in Malaysia, suggesting the market has fully priced in the current high supply levels for now. The slight MoM decline is consistent with this regional supply pressure. The robust YoY gain, however, highlights the stronger fundamental pricing environment for all vegetable oils in 2025 compared to the previous year.

3. Actionable Recommendations

Capitalize on MSPO Recognition to Secure Premium EU Contracts

For Malaysian producers and exporters, the EU's official recognition of the MSPO certification is a powerful competitive advantage that must be acted upon immediately. Exporters should proactively engage with European buyers, emphasizing their verified compliance with the EU's upcoming deforestation regulation. This is a critical opportunity to negotiate long-term contracts and secure premium pricing over origins that lack this level of regulatory assurance. Marketing strategies should be updated to prominently feature this EU acknowledgment, highlighting the traceability and sustainability guarantees it provides. In the current market, which is weighed down by high inventories and bearish sentiment, securing stable, high-value contracts is the most effective way to mitigate exposure to short-term price volatility and protect profit margins. This proactive approach will solidify Malaysia’s position as a preferred and reliable supplier to one of the world’s most demanding markets.

Launch Targeted Initiatives to Integrate Independent Smallholders

For sustainability organizations and large traders operating in Indonesia, the new research highlighting the exclusion of independent smallholders from certified supply chains is a direct call to action. These organizations should design and fund targeted initiatives to bridge this gap, particularly with regulations like the EUDR set to raise the stakes on traceability. Programs should focus on resolving the root causes of exclusion, such as assisting with land legality documentation, and providing the necessary training and resources for farmers to meet certification standards. The new multi-stakeholder partnership in Aceh serves as an effective model. By proactively integrating this group—which produces over a third of Indonesia’s palm fruit—companies can significantly increase the volume of certified sustainable palm oil, de-risk their future supply chains, and strengthen their environmental, social, and governance (ESG) credentials in the global market.

Sources: Tridge, UkrAgroConsult, Reuters, Vietnam Plus, University of Hawaii, OFI