1. Weekly Pricing

Global

Sugar Futures Increased in W38 Amidst Declined Sugar Yield in Brazil

In W38, global sugar futures prices rose due to dry and hot weather in Brazil’s key sugar-producing regions, São Paulo and Mato Grosso, expected to see reduced sugarcane yields. In Aug-24, severe fires, driven by the heat, damaged up to 5 million metric tons (mmt) of sugarcane in São Paulo. In addition, the strengthening of the Brazilian real against the United States (US) dollar, reaching a four-week high, has further supported sugar prices while making Brazil’s sugar exports less competitive on the global market.

Argentina

Argentina Completes 2023/24 Raw Sugar Export Quota to the US

Argentina fulfilled its raw sugar export quota to the US for the 2023/24 season, ending September 30, 2024. Despite facing challenges such as drought impacting sugarcane production in 2023, the country's national exporters managed to meet the quota. As a result of this achievement, Argentina received an additional 14.9 thousand mt of quota, bringing the total exports quota to 53.04 thousand mt in the 2024/25 season, 133% of the regular annual quota. Notably, the US allocated 44.19 thousand mt of raw sugar export quota to Argentina during the 2023/24 period.

Brazil

Fire Disrupted Brazil's Sugarcane Production

Brazil's sugarcane fires in Aug-24 have led to severe losses for producers and disrupted global sugar supplies. In São Paulo, around 60 thousand hectares (ha) of sugarcane were destroyed, significantly damaging roots and reducing production prospects for the 2025 crop. In addition, Raizen SA reported losses of 1.8 mmt, while Sao Martinho reported losses of 20 thousand ha.These fires and declining global production due to adverse weather conditions in key producers such as India and Thailand drive global sugar prices up. The price rise pushes some food manufacturers to pass increased costs onto consumers, while interest in alternative sweeteners is growing as a potential solution to mitigate the impact.

Germany

Germany’s Sugar Prices Increased MoM in Aug-24 Despite Declining Energy Costs

According to the Federal Statistical Office of Germany, sugar prices in Germany rose by 21% in Aug-24 compared to the previous month. This increase occurred despite a 9.2% month-on-month (MoM) decrease in electricity costs and a 12.3% MoM decline in natural gas prices. The increased food and service costs due to the war in Ukraine contributed to the country’s inflation since this spring.

Ukraine

Ukraine's Sugar Prices Decline Amid Strong Harvest and Export Restrictions

Ukraine's sugar prices are declining due to increased harvesting, positive harvest prospects, and restrictions on sugar exports to the European Union (EU). The EU sugar export quota for Ukraine in 2024 was fully used by May-24, with the next quota becoming available in Jan-25. From Sep-23 to Jul-24, Ukraine exported 700 thousand metric tons (mt) of sugar, with 307 thousand mt going to the EU. Since Sep-24, sugar prices have dropped by 5% to 10%, ranging from USD 400/mt to USD 450/mt, compared to USD 600/mt to USD 700/mt a year ago.

2. Weekly Pricing

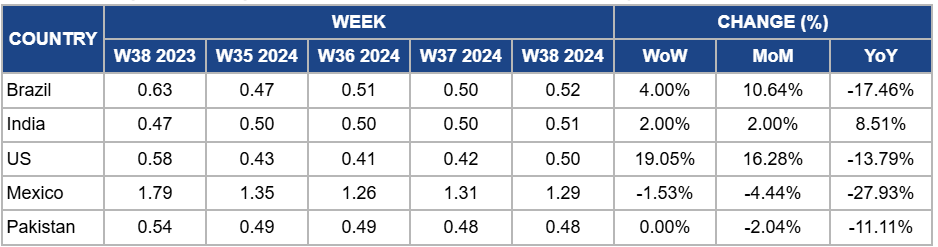

Weekly Sugar Pricing Important to Producers (USD/kg)

Yearly Change in Sugar Pricing Important Producers (W38 2023 to W38 2024)

Brazil

In W38, Brazil's sugar prices increased by 4% week-on-week (WoW) to USD 0.52 per kilogram (kg), marking a 10.64% MoM rise. The WoW and MoM price increases are mainly due to continued adverse weather conditions, arid and hot weather in key regions like São Paulo and Mato Grosso, which have reduced sugarcane yields. In addition, the fires in São Paulo in Aug-24 damaged around 60 thousand ha of sugarcane, impacting short- and long-term production. However, prices remain 17.46% lower year-on-year (YoY), reflecting weaker global demand and increased sugar supply from other regions.

India

India's sugar prices rose by 2% WoW and MoM to USD 0.51/kg in W38, continuing a steady upward trend. This rise is influenced by India's ongoing restrictions on sugar exports to prioritize domestic ethanol production, especially as ethanol prices are expected to increase. The YoY price rise of 8.51% reflects global supply constraints, with India's reduced export availability affecting international markets. Other countries' restrictions and production challenges will likely keep prices high.

United States

In W38, US sugar prices increased by 19.05% WoW to USD 0.50/kg, reflecting a solid recovery from previous weeks and a 16.28% MoM increase. The rise is due to concerns over global sugar supply, mainly due to Brazil's production setbacks from drought and fires. However, despite this recent price surge, YoY prices remain 13.79% lower due to increased domestic production and higher stock levels from previous years. The United States Department of Agriculture (USDA) anticipates an increase in sugar stocks in the 2024/25 season, further stabilizing prices.

Mexico

Mexico's sugar prices decreased by 1.53% WoW to USD 1.29/kg in W38, resulting in a 4.44% MoM and a 27.93% YoY drop. The YoY decline is attributed to a significant increase in domestic sugar production. In addition, the weakening of the Mexican peso against the US dollar also contributed to this price reduction in international markets. However, given the current production challenges in Brazil and Thailand, Mexico's price will likely recover in the short term.

Pakistan

Pakistan's sugar prices remained stable at USD 0.48/kg in W38, with no WoW change, but a 2.04% MoM and an 11.11% YoY drop, largely due to an oversupply in the domestic market and the country’s previous export ban. Continuous surplus production has led to a sugar glut, putting downward pressure on prices. Pakistan’s inability to export a significant portion of this surplus has exacerbated the issue, leaving local sugar mills struggling with excess stock. Despite recent export authorizations, the domestic sugar surplus continues to weigh heavily on prices.

3.Actionable Recommendations

Strengthen Fire Prevention and Climate Adaptation Strategies

Sugarcane producers in Brazil should invest in enhanced fire prevention measures and climate adaptation strategies to mitigate future losses. Installing early detection systems and conducting routine risk assessments can reduce the impact of wildfires on sugarcane fields. Additionally, agricultural cooperatives should promote the adoption of drought-resistant sugarcane varieties and irrigation systems to maintain stable yields amid adverse weather.

Increase Exports to Alleviate Surplus

Pakistan’s sugar industry should ramp up exports to reduce domestic surplus and ease downward pressure on prices. Partnering with international buyers through government-negotiated trade deals can help alleviate the surplus. In addition, domestic producers should explore local ethanol production to absorb excess sugar stocks, which could create new revenue streams and stabilize prices.

Diversify Sugar Export Markets

As India continues to prioritize ethanol production, sugar producers should seek to diversify their export markets, mainly focusing on regions less affected by global supply shortages. Exploring opportunities in regions such as Southeast Asia and Africa, where demand for sugar remains robust, will help offset the impact of limited sugar availability in traditional markets. Producers should also invest in upgrading processing facilities to improve sugar quality, allowing them to command higher prices in international markets.

Sources: Agrobusiness, GrainTrade, Dairyreporter, Agroindustria, Vinanet